Student loans •

How is a student loan different from a scholarship?

Student loans and scholarships are 2 of the most popular financial aid types. Learn the pros and cons of each and how they fit into your aid package.

All things considered, the average cost of college is just over $35,000 per year. That’s probably why the vast majority of students rely on some form of financial aid.

But all the aid available can blend together and be confusing, with so many kinds available.

2 of the most common aid types are student loans and scholarships. Both help you pay for college, but neither works much like the other.

This article will explain how each aid type works, along with its pros and cons, then compare how they stack up against each other.

What are student loans?

Student loans are one of the most common types of financial aid. Since they’re loans, you eventually have to pay them back. That means they put you into debt.

However, they are generally the easiest form of aid to get since they’re based on need. Nearly 43 million borrowers have some level of student loan debt.

Types of student loans: Federal vs. private loans

There are 2 broad types of student loans: federal and private.

Federal loans, as you’d expect, come from the federal government. The government gives the money to your college who then hands it on to you to use on your education expenses.

On the other hand, private loans come from banks, credit unions, online lenders, and other financial institutions. More lenders mean more options, but they don’t come with the special features associated with federal loans.

Let’s look at each loan type in more detail.

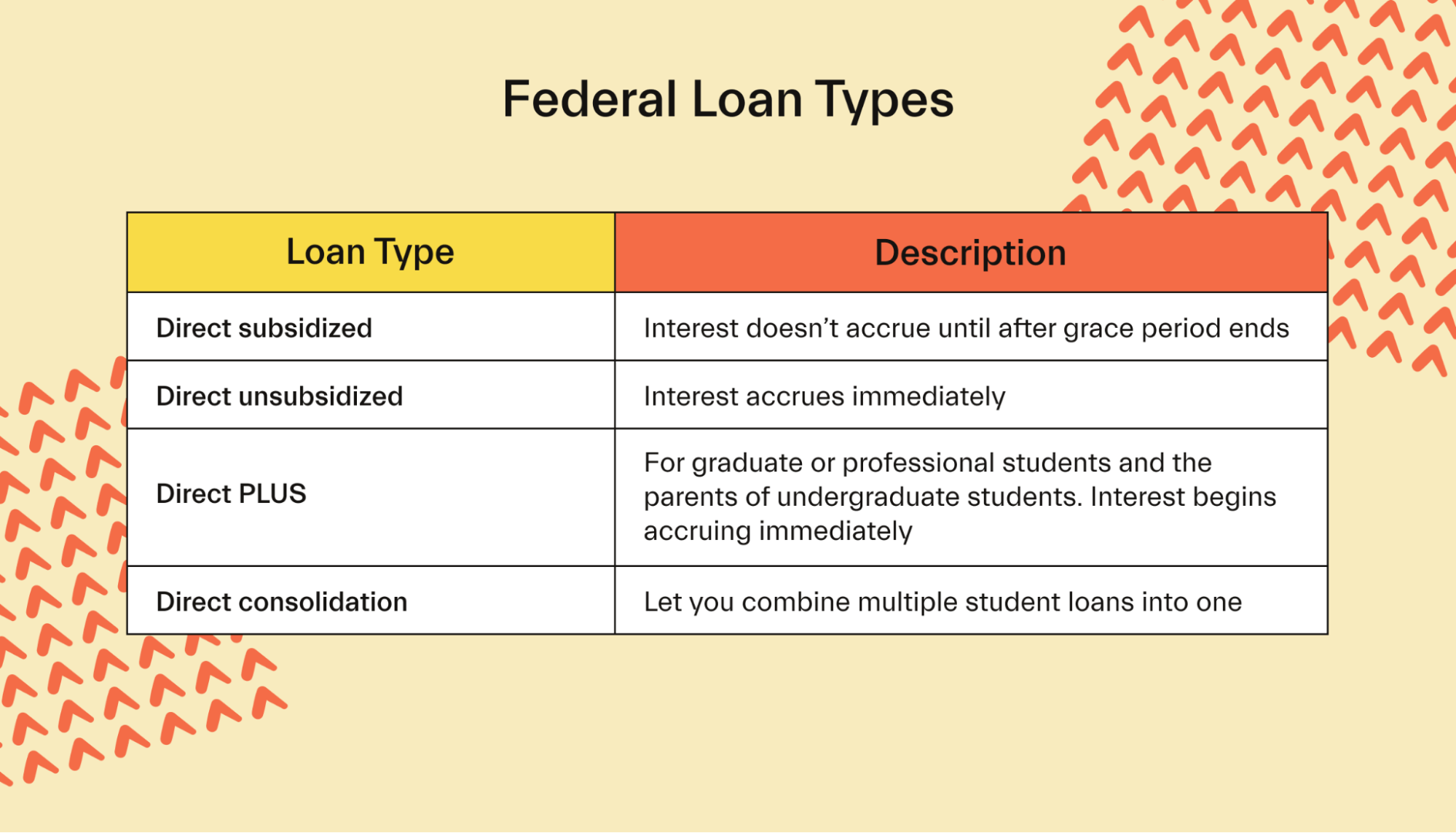

Federal student loan types

The most common type of federal student loan is the Stafford loan. This is the loan most people are talking about when they discuss federal student loans.

It got its name when former Vermont Senator Robert Stafford passed legislation that changed the Higher Education Act of 1965 in 1988.

There are 2 types of Stafford Loans:

Direct subsidized: Payments aren’t required until 6 months after you graduate or leave school. Interest doesn’t accrue until after that 6-month grace period ends, either.

Direct unsubsidized: Interest accrues immediately. However, payments aren’t required until after the 6-month grace period.

The federal government offers a couple of other loan types as well:

Direct PLUS loans: For graduate or professional students and the parents of undergraduate students. Interest begins accruing immediately.

Direct consolidation loans: These let you combine multiple student loans into one.

How to get a federal student loan

You can get a federal student loan by filing the Free Application for Federal Student Aid or FAFSA.

The FAFSA is free to file, and you can knock it out in an hour or 2 by gathering all the necessary documents ahead of time.

You’ll then create an FSA ID for your FAFSA login, plug in all your info in the right spots, then sign and submit the FAFSA.

After submitting, you’ll receive a Student Aid Report detailing your eligibility for loans and other federal financial aid sources.

Finally, you choose the loan amount you need, and it’ll be disbursed to your school to pay for college expenses.

How to get a private student loan

Private student loans are available through most established financial institutions that lend money, like banks and credit unions.

To get one, you’ll have to shop around to find the best rates. Then, you’ll need to apply by providing personal and financial information.

Now, private lenders will want to see a credit history and decent score. As a student, you might not be there quite yet.

Lenders know this and will let you apply with a co-signer—a trusted individual with a good score, such as a parent or relative.

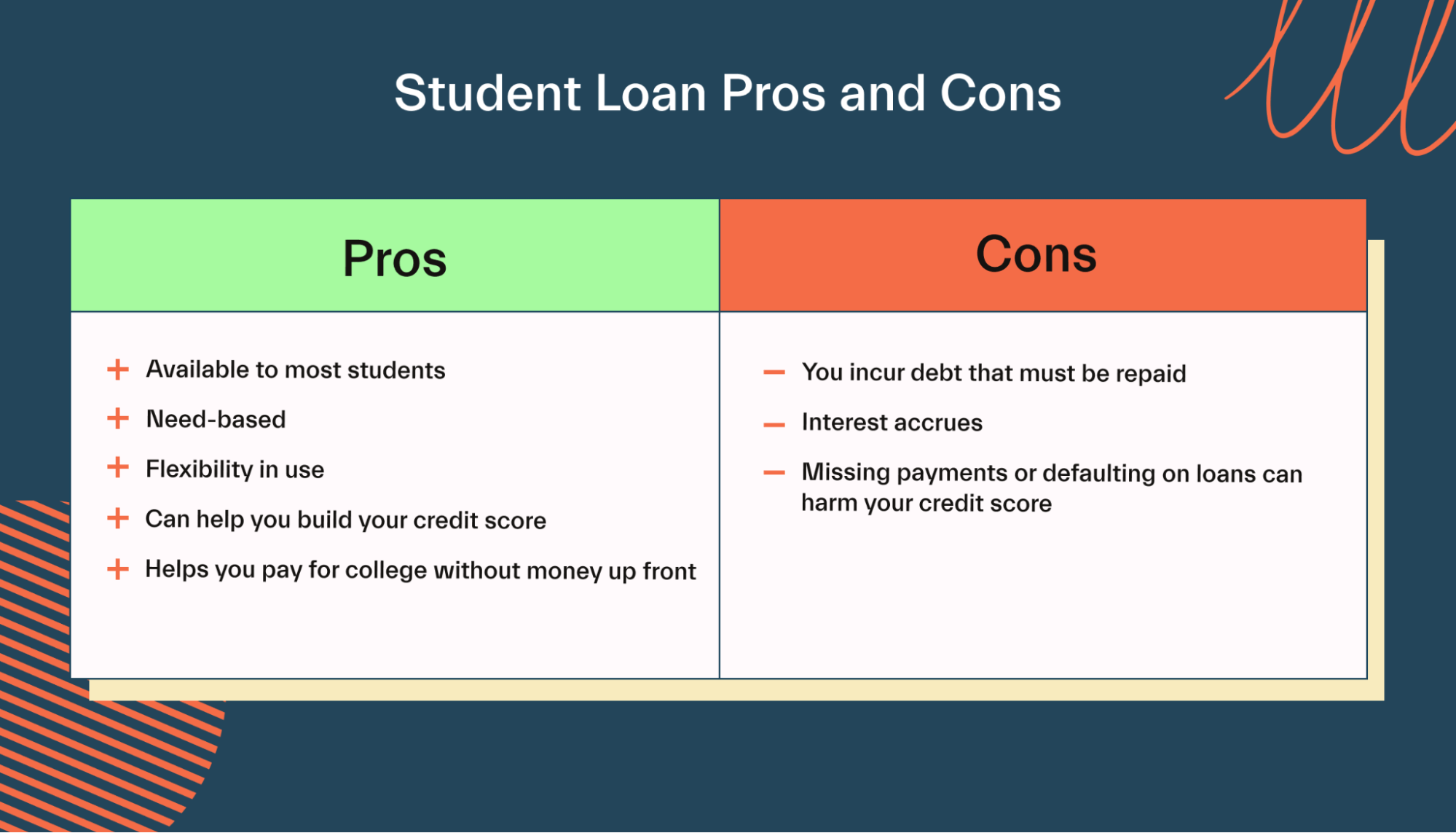

Pros and cons of student loans

Unfortunately, student loans make you go into debt.

But many students in need of financial aid will pay a good chunk of their college costs with student loans. After all, the Education Data Initiative found that student borrowers borrow an average of $32,880 to get a bachelor’s degree.

With that in mind, here are some student loan pros and cons:

Pros

Available to most students

Need-based

Flexibility in use

It can help you build your credit score

Helps you pay for college without money upfront

Cons

You incur debt that must be repaid

Interest accrues

Missing payments or defaulting on loans can harm your credit score

What are scholarships?

Scholarships are a form of financial aid you don’t have to pay back. As a result, they help you pay for college without loans. This gets you through college with less debt, putting you on better financial footing afterward.

Many scholarships are merit-based. This means you’re judged on the quality of your application. However, some scholarships may be need-based.

Types of scholarships

There are tons of scholarships for all sorts of people that require a range of effort.

For example, there are fairly easy scholarships to apply for like the Courage to Grow Scholarship. Most of these just ask for some basic info about you and maybe a few quick questions. Easy means more competition, but you can apply to more in less time.

On the other end are rigorous, exclusive scholarships like the Ron Brown Scholarship. These ask a lot more of you (usually including an essay), but the winnings can cover a big chunk of college costs.

There is a nearly endless number of niche scholarships out there for people based on sports, hobbies, majors, religious or ethnic backgrounds, and more.

The Ron Brown Scholarship is a good example — it’s designed for high-achieving Black students.

How to get a scholarship

Scholarships vary in their application processes and award criteria. However, the general steps are similar across most.

Start by looking around for scholarships. You can contact your financial aid office, browse online, or use a service like Mos to get matched to scholarships.

From there, you’ll fill out the application and attach any documents they need. You’ll also complete the essay, video, or other requirements before submitting it. Follow any other instructions to complete the application.

You’ll eventually hear back from the organization offering the scholarships about whether you won or not. How long this takes varies by organization.

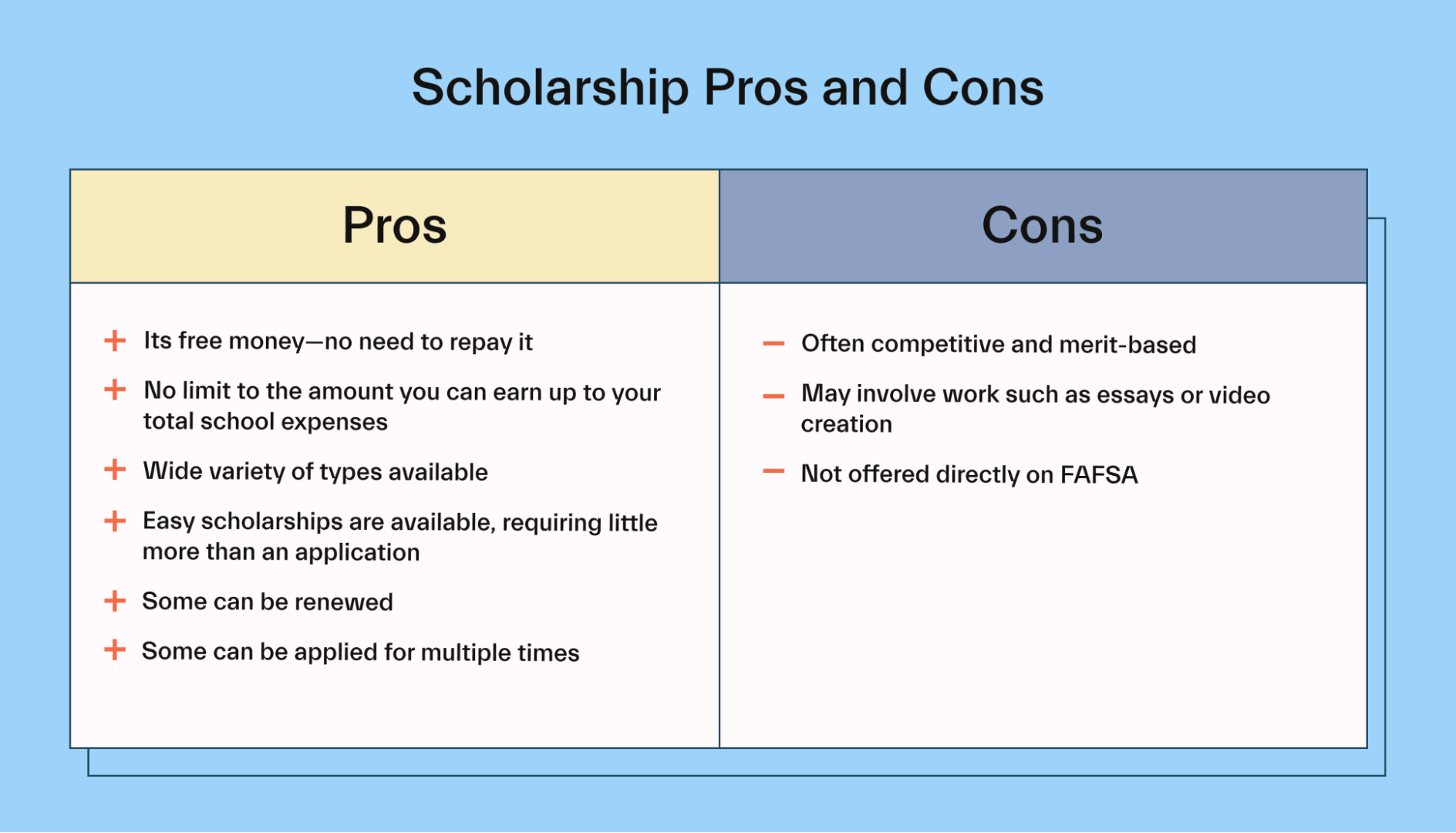

Pros and cons of scholarships

Unless you score a full-ride scholarship, this form of aid won’t necessarily pay for most of your education.

Still, scholarships are an essential piece of your financial aid package. Here are some pros and cons of this aid type:

Pros

It’s free money—no need to repay it

No limit to the amount you can earn up to your total school expenses

Wide variety of types available

Easy scholarships are available, requiring little more than an application

Some can be renewed

Some can be applied for multiple times

Cons

Often competitive and merit-based

May involve work such as essays or video creation

Not offered directly on FAFSA

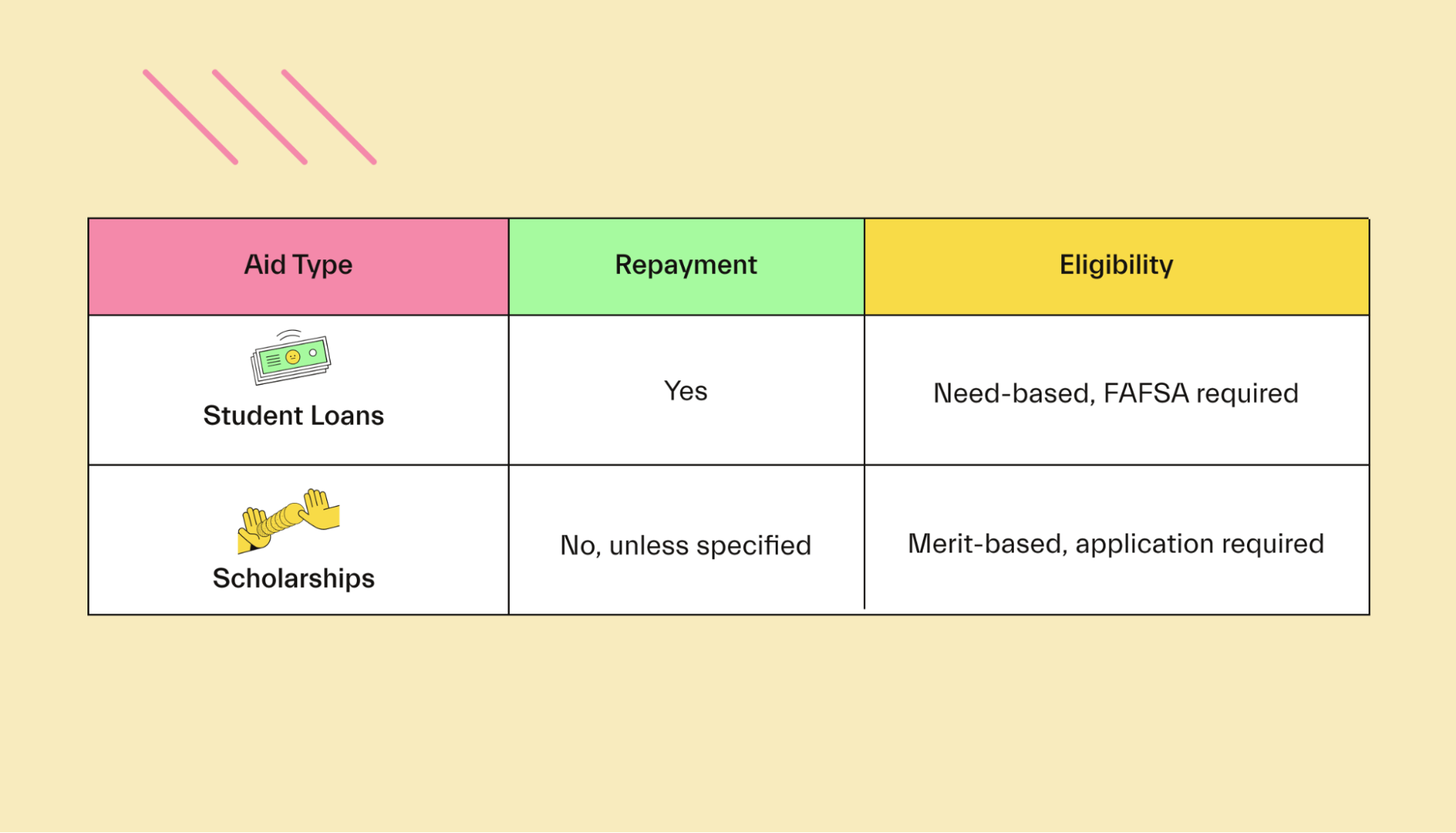

Student loans vs. scholarships

Now let’s dive in and compare the 2 different forms of aid head-to-head:

Repayment

Perhaps the biggest difference between student loans and scholarships is the repayment requirements.

Let’s look at each aid type:

Student loan repayment

In general, all student loans must be repaid. The schedule can differ depending on the loan type.

For example, direct federal subsidized and unsubsidized loans don’t require repayment until 6 months after you graduate the school or drop below half-time enrollment. This is called a grace period, and it gives you time to find a job before repayment.

Direct PLUS loans usually require repayment immediately, with the first payment due 60 days after disbursement. However, the borrower can request to defer the loans all the way until the end of that grace period.

Private loans are also due immediately. Lenders may allow deferment and forbearance, but this varies by lender.

Now, you may not have to pay back all of your federal loans if you qualify for a loan forgiveness program. For example, workers in public service roles can have their loans canceled through the Public Service Loan Forgiveness Program after making enough payments.

Private loans are rarely forgivable, but it’s possible.

Scholarship repayment

Scholarships don’t usually require repayment. Once you win the money, it’s yours to keep. This is why they’re such an excellent tool for keeping down the amount of debt you graduate with.

There are exceptions, though.

For example, some scholarships are given every year as long as you maintain certain grades and are enrolled in enough credits. Fail to meet those, and you could lose your scholarship. In some cases, you might have to repay some of it. It depends on the contract you sign.

Misusing the money—like using it for your spring break trip instead of tuition—could lead to the awarding organization demanding the money back.

Of course, lying, falsifying information, or plagiarizing work on a scholarship application is grounds to have your award yanked—among other consequences. Academic dishonesty is not worth it.

Eligibility

Student loans and scholarships serve different roles in a financial aid package. So the qualification criteria and process for getting them will differ.

Student loan eligibility

Student loans are need-based. The government and private lenders will give them to you based on your and your family’s financial information and your estimated college costs.

There’s no need to compete with others for student loans, and the funds don’t run out. You simply apply for the FAFSA each year or through a private lender for private loans to see what you qualify for.

Scholarship eligibility

Some scholarships are need-based, but most of them are merit-based. This means you compete with other students for the money. The best or most suitable students win.

How you apply varies by scholarship. Some may ask for transcripts and a list of extracurriculars. Others may want to see essays or videos on a topic.

And some scholarships want all of the above.

All that said, some scholarships may take finances into account as a prerequisite for applying. For example, some scholarships are designed for students from low-income backgrounds.

These are need-based in that you must be below a certain money threshold to qualify. But the program itself may still make you compete with other applicants by submitting transcripts, extracurriculars, and essays.

Other sources of “free money” financial aid

Want more free money? If scholarships aren’t getting you enough, you have a few other options.

Try these forms of free money financial aid:

Grants

Like scholarships, grants are a form of aid that doesn’t make you repay it unless certain uncommon criteria are met.

The Pell Grant, offered through the FAFSA, is the most prominent, offering up to $6,895 for the 2022-2023 academic year.

The federal government provides a few other grants as well. If those aren’t enough, you can hunt for grants through your state. For instance, New York State resident students that file the FAFSA can get additional aid through the NYS Tuition Assistance Program grant.

Many private organizations offer grants, too. You have plenty of options out there, so don’t give up if one board says no.

Work-study

Work-study is FAFSA federal aid that lets you work up to 20 hours per week to earn money for your college expenses. These earnings don’t count toward your FAFSA income limit, so loan eligibility isn’t affected.

Your school will try to put you in a job related to your major or “civic education.”

For example, if you’re a psychology major, work-study may give you an administrative assistant job in the psychology department. Now, you get help paying for school and a resume booster.

These jobs take your class schedule into account, too. They make sure work and school clash as little as possible.

Free money vs. borrowed money

Scholarships are free money, but most are merit-based, so there’s no guarantee you’ll win any. Meanwhile, federal student loans are easier to get, but they put you into debt.

The best way for most students is to exhaust all scholarship (and grant) options first to maximize their free money. Then, use federal student loans to fill the gap. Only after exhausting these options should you consider private loans.

Have more questions about getting financial aid and the kinds available to you? Go check out our financial aid FAQs to get your questions answered.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you