Financial aid •

March 2, 2022

Grants vs. loans: a complete guide for students

Grants and loans are both types of financial aid, but there are significant differences between them. Find out all about student loans vs. grants inside.

College costs an arm and a leg these days! With the average cost of college now exceeding $35,000 per year, most students now need to come up with a combination of ways to pay for college.

Fortunately, financial aid is available to many students. Financial aid can help make college more affordable for students—but there’s a lot of confusion around how it all works.

A common point of confusion is the difference between grants and loans. Both are considered “financial aid,” but they’re pretty different from one another.

This article will take a deep dive into the subject, comparing grants vs. loans from a student’s perspective. Let’s get started!

What is a grant?

A grant is a form of financial aid that helps students pay for college. Grants don’t need to be paid back, unlike loans.

Essentially, a grant is free money for college!

Grants are available from the federal government, state and local governments, and schools themselves.

Federal grants are among the most common. Each year, 41% of undergraduate students receive an average of $5,179 in federal grants.

Most grants are awarded based on financial need. That means a student from a lower-income household is more likely to receive a grant award than a high-income student.

So unlike something like a merit scholarship, a grant is awarded based more on a student’s financial situation than based on their academic performance.

You apply for most grants automatically by filling out the Free Application for Federal Student Aid (FAFSA).

In general, you can only use grants to pay for direct education expenses, such as tuition or fees, not books or rent. So many grants are sent directly to the school you’re attending.

The pros and cons of grants

Pros:

You don’t need to pay back grants

Available from a variety of sources

Most can be applied for using a single form (the FAFSA)

You may be able to qualify for more than one grant

The application is straightforward

Cons:

Most are restricted to students with substantial financial need (primarily from low- to moderate-income households)

Many grants have limited available funds and may use a first-come, first-served model

What is a student loan?

A student loan is another type of financial aid that helps you pay for school, but it’s not “free money,” students must pay back loans eventually.

Student loans can be either federally backed or private. Federal student loans are considered a form of financial aid and are applied for via the FAFSA. Private student loans aren’t technically financial aid, but they serve a similar purpose.

Students can take out federal student loans even if they have poor credit or a limited credit history. Certain types of federal loans are available to almost any student.

Unlike grants, which tend to be restrictive, student loans can be used for anything. Many students pay for their tuition, books, fees, and general living expenses using their student loans.

However, loans must be repaid—with interest along the way. Currently, interest rates on federal loans range from 3.73% to 6.28%, depending on the loan type.

The interest on student loans means that you’ll end up paying a lot more than you initially borrowed.

Fortunately, for federal loans, students don’t need to make payments while they’re in school. You typically have until 6 months after leaving school before you must start making monthly payments.

Private loans function similarly but are better suited to borrowers with excellent credit. Private loans have more variability in their terms and details. Some private student loans have complicated terms where the interest rate can fluctuate wildly over time. So students should carefully evaluate their private loan options before agreeing to one.

The pros and cons of student loans

Pros:

Available to most students

Not competitive, unlike grants

Enables students to pay for college without much money upfront

Can help build your credit history

More flexible in how you can use them (books, living expenses, etc.)

Cons:

Must be paid back over time (even if you declare personal bankruptcy, it’s hard to get student loans discharged)

They charge interest

Students may graduate with significant debt

Defaulting or missing payments on student loans can damage your credit

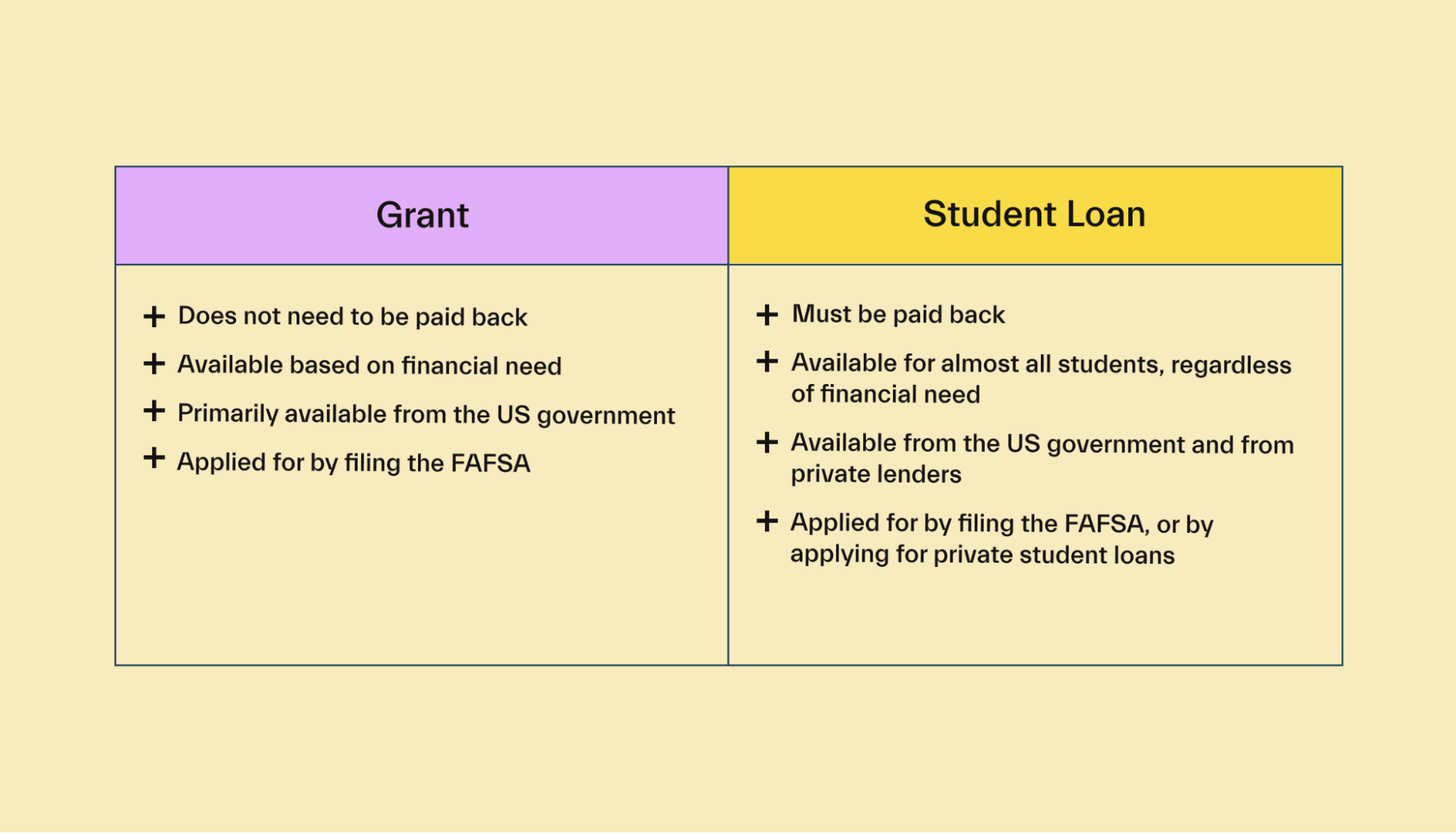

Grant vs. loan

Now, let’s compare grants vs. loans side by side.

Repayment

Repayment terms are the biggest difference between a grant and a loan.

Simply put, grants don’t need to be repaid, while you must repay student loans (plus interest).

Grant repayment

You can think of a grant like a gift but with a few strings attached. Grants are awarded to students to help pay for school. The grant doesn’t need to be repaid as long as it is used for qualifying educational expenses and the student doesn’t drop out. But if you drop out, many grants require at least partial repayment. For example, with the federal Pell Grant, if you drop out before the 60% mark of a semester, you have to repay part of the funds you received. But after the 60% mark, you won’t have to repay anything.

There are a few specific situations where grants may need to be repaid even if you don’t drop out, but this is rare. For example, suppose a student receives a grant and later receives additional grants or scholarships. In that case, they may no longer qualify for the original grant (because they no longer have the financial need). In this case, you may need to return the funds.

Student loan repayment

Loans, on the other hand, are more like a business transaction. Loans are issued by either the government or private businesses—but either way, the funds must be paid back.

Student loans also charge interest. Not only must you pay back the amount you borrowed, but you also need to pay interest to the loan issuer.

For example, a $10,000 student loan at 4% interest, paid off over 10 years, would cost a total of $12,149.

If you’re unable to pay back student loans, there can be significant consequences. It can hurt your credit, cost you extra in fees, and more. Some states even go so far as to suspend drivers’ licenses for students who fail to repay their loans!

Eligibility

Eligibility requirements are another big difference between grants vs. loans.

Grant eligibility

Grant eligibility is primarily based on financial need. This means that if you come from a low-income household, you’re more likely to qualify for many grant programs.

For instance, the Pell Grant, a common federal grant program, is available to undergraduate students who have exceptional financial need.

In most cases, “financial need” is calculated based on the Expected Family Contribution (EFC), which is based on the income and assets of a student’s parents.

If a student or their family is over a certain income limit, they may not qualify for any grants.

Other types of grants may have non-financial eligibility requirements, but these are rare. For instance, some grants are only available for students pursuing particular subjects or from specific backgrounds.

Student loan eligibility

Federal student loans are available to almost all students. There are a few different reasons why you could be denied a student loan, but in most cases, you’ll qualify as long as you file the FAFSA.

For the most part, it doesn’t matter what your income is, what your credit score is, or even how wealthy your parents are. The vast majority of students will qualify for federal loans regardless of these factors.

With that said, borrowers with greater financial need are more likely to qualify for loans with lower interest rates.

There are different types of student loans, and some are subsidized by the federal government. These subsidized loans have lower interest rates and other favorable terms and are mostly reserved for students with greater financial need.

Private student loan eligibility

Private student loans are a bit different.

To qualify for a private loan, the student must go through a loan application process. The lender will assess the student’s credit history, income level, and assets, and use this information to decide whether or not to issue a loan.

For private loans, students with higher incomes and better credit will qualify for much better rates and terms.

Low-income students, or students with limited credit history, may not qualify at all.

The good news here is that for these students, federal loans (often with better terms) will likely be available.

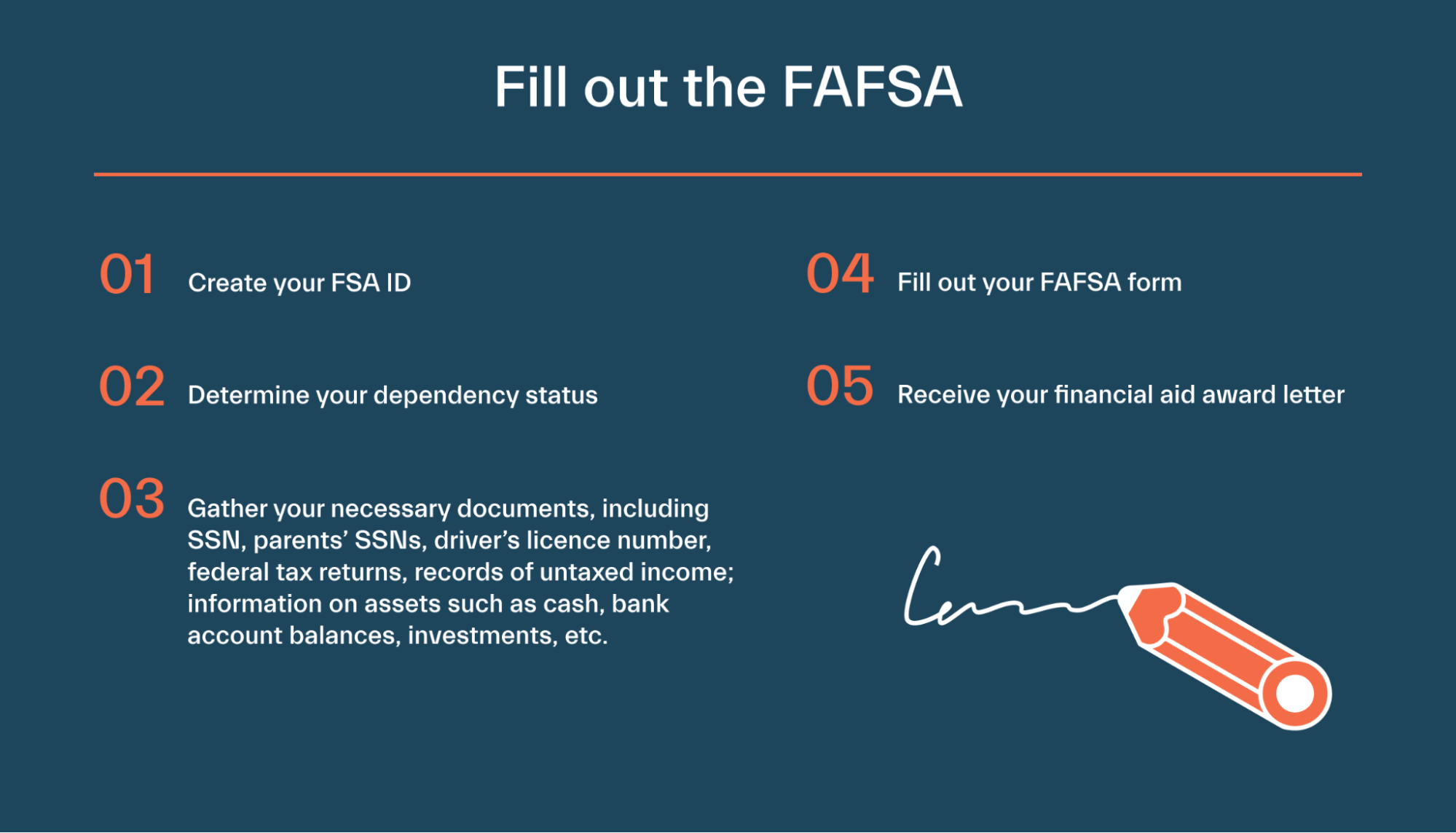

How to apply for grants and student loans

The process for applying for most grants and student loans is actually the same: It starts with submitting the Free Application for Federal Student Aid (FAFSA).

This form is your main gateway to all federal financial aid programs, including federal grants, loans, and even some scholarships.

Fortunately, it only takes around an hour to complete the FAFSA. You can submit the FAFSA online here. You can also mail it in, but this is a much slower process. The FAFSA is due by June 30th, and it must be submitted every year that you’re an active student.

Before you start your application, you’ll want to gather some information:

Your personal information (social security number, tax documents like W2s, driver’s license number, etc.)

Information about your assets (bank accounts, investments, etc.)

Your parents’ financial information (if you’re a dependent student)

A list of the school(s) you plan to apply for (you can add several schools to FAFSA if you’re not sure where you’re going)

When you have all the necessary information, fill out the FAFSA application and submit it. Your information will be reviewed, and you’ll receive a financial aid award letter explaining what types of financial aid you qualify for.

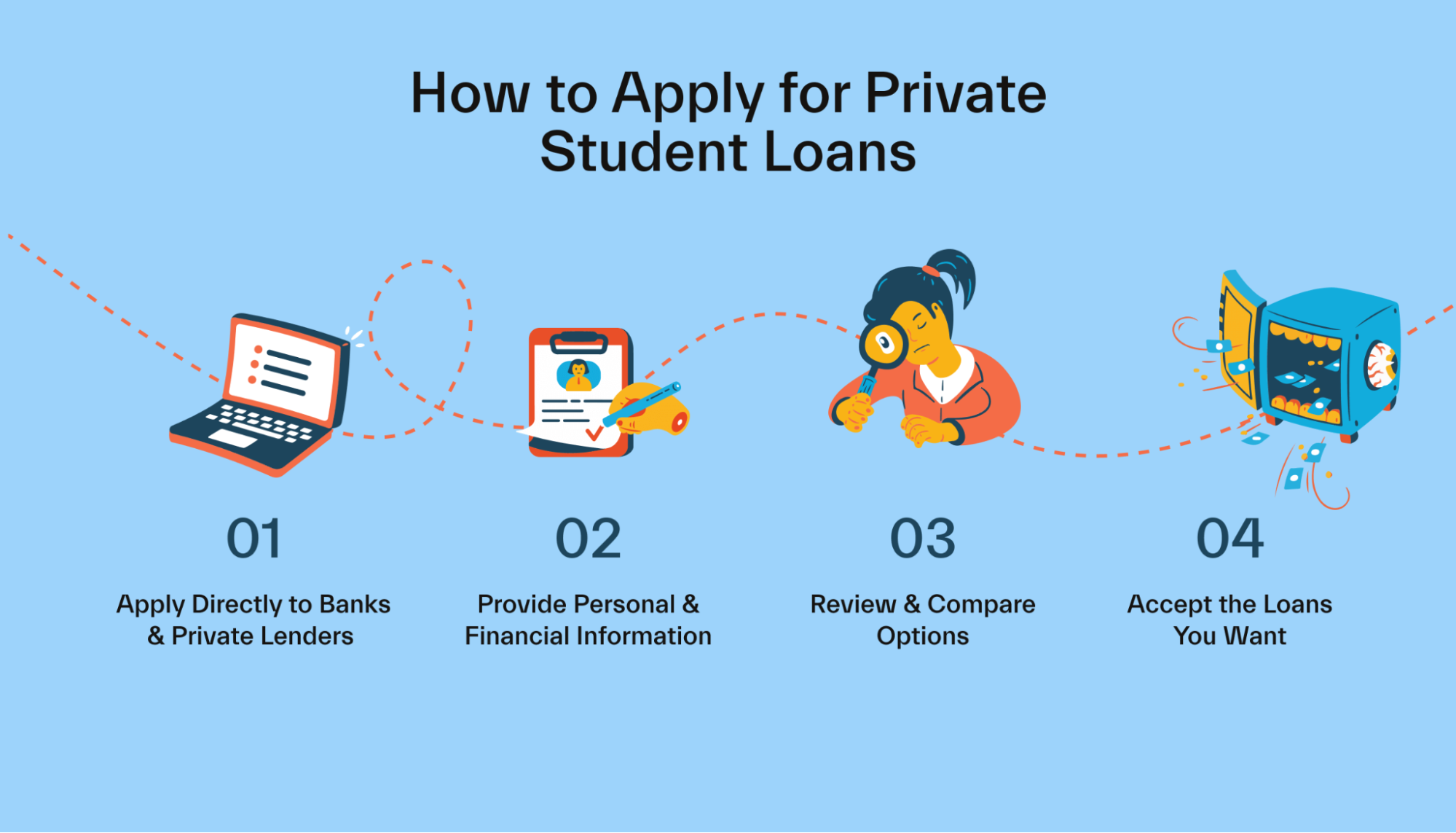

Applying for private student loans

Private student loans are different from federal loans. Filing the FAFSA is strictly for federal programs. If you plan to apply for private student loans, this process is handled separately.

Applying for private loans must be done with the specific lender you wish to take out a loan from. For example, you’ll need to apply directly with Discover to get a loan from them or with Bank of America for their student loans.

Each lender will have its own application process and specific requirements. But you’ll always be asked for:

Your name, address, and social security number

Your income and asset information

The income information of any co-signers on the loan

Applying for a private loan is generally more involved and can take substantially longer than the federal loan process.

Conclusion

The biggest difference between grants and loans is that grants don’t need to be repaid, while loans do. There are other important differences, as well, but the repayment factor will have the biggest impact on your future finances.

To learn more about different funding sources for your education, read our complete guide on how to pay for college.

And if you’re heading off to college soon, check out Mos, an app that lets you apply for the largest scholarship pool in America with a few clicks. You can even get 1-on-1 guidance on your applications from a real (yes, human) financial advisor!

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you