Student loans •

December 20, 2021

Are student loan payments tax deductible?

How do student loans affect your taxes? Find out how to maximize your tax savings in this complete guide for students.

Student loans and taxes may be two of the worst topics to bring up at parties.

Despite their certified no-fun status, the interaction between taxes and student loans is important for students to understand.

About 1 in 8 Americans have student loan debt—a total of 42.9 million people, to be precise. The average borrower is on the hook for a whopping $37,693 of student loan debt!

Tuition, books, and living expenses all add up fast. The last thing students need is a hefty tax bill come April.

So, can your student loans help out with your taxes? Can you deduct your student loans to lower your tax bill, or get a larger refund?

This guide will explain how student loans affect personal income taxes, and what steps students can take to maximize available tax benefits.

Are student loan payments tax deductible?

Let’s start with the short answer: No, student loan payments are not tax deductible.

But don’t stop reading just yet!

That doesn’t mean that you can’t deduct a portion of your student loan payments (the interest) or that there aren’t other tax benefits to being a student (more on this below).

It just means that you can’t deduct your total student loan payments from your income for tax purposes.

Students have certainly tried a variety of workarounds and tax loopholes to try to make their loan payments tax deductible. Some have taken out other types of loans that do have tax benefits (such as certain types of business loans), and used them to pay off student loans.

However, these workarounds are illegal and unethical—not to mention overly complex.

Rather than trying to game the system, students are better off focusing on the tax benefits that are legitimately available to them.

Let’s walk you through them.

Is student loan interest deductible?

Your student loan payments are not deductible—but the interest on student loan repayment may be.

When you file your federal income taxes each year, you may be able to take the Student Loan Interest Deduction. This tax benefit applies to interest paid on most student debt, covering both private student loans and federal student loans.

This perk allows you to take a tax deduction for each dollar you paid in student loan interest in a given year, up to a total of $2,500 per year. The credit applies to interest paid, not interest accumulated.

Fortunately, this is an “above-the-line” deduction, rather than an itemized deduction. This means that you can claim the deduction even if you take the standard deduction on your tax return.

In case you don’t know: The standard deduction is a flat amount you can subtract from your taxable income instead of listing out and providing proof of all of your tax deductible expenses.

Of course, the amount you’ll actually pay in interest depends on your interest rate and the size of the loans you have taken out.

To envision what this means, let’s look at an example using nationwide averages.

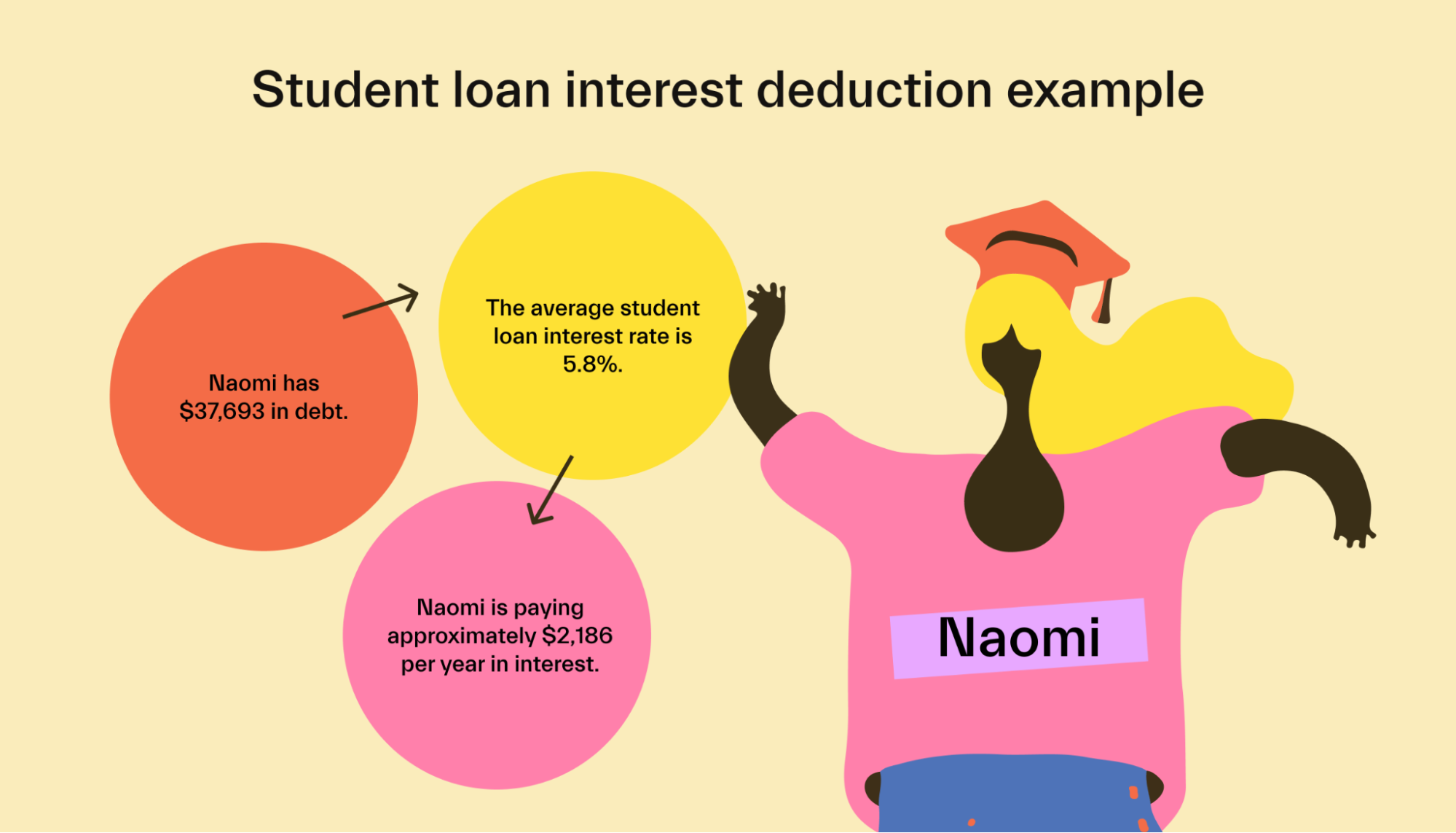

According to a recent report based on 2020 data, the average student loan holder—let's call her Naomi—has $37,693 in debt, and the average student loan interest rate is 5.8%.

This means that Naomi is paying approximately $2,186 per year in interest.

(This simplified calculation ignores the effects of compounding interest and changing balances due to loan payments, but it’s still useful for our purposes here. Sorry, math majors!)

In this example, Naomi would be able to take a $2,186 deduction when she files her taxes in April.

Okay, so what does that actually mean in terms of savings?

A $2,186 deduction means that Naomi can reduce her taxable income by $2,186. This does not mean that she will save $2,186 on her tax bill.

If Naomi earns $20,000 per year, this deduction may save her around $215 on her income tax bill.

If Naomi has graduated and earns $75,000 per year, this tax deduction may save her around $470 on her tax bill, due to her higher tax rate.

(This simplified calculation ignores the complexity of the tax code and provides a very rough estimate of tax implications. Sorry, accounting majors!)

If Naomi is earning $150,000 per year, this deduction will not be available to her and will save her $0 on her tax bill.

Eligibility requirements & income limits

Not everyone can claim the student loan interest deduction. To qualify for the tax deduction, you must meet all of these requirements:

Your tax filing status is not married filing separately (any other filing status works).

You are not claimed as a dependent by anyone else.

You are legally obligated to pay interest on a qualified student loan.

You paid interest on a qualified student loan in the given tax year.

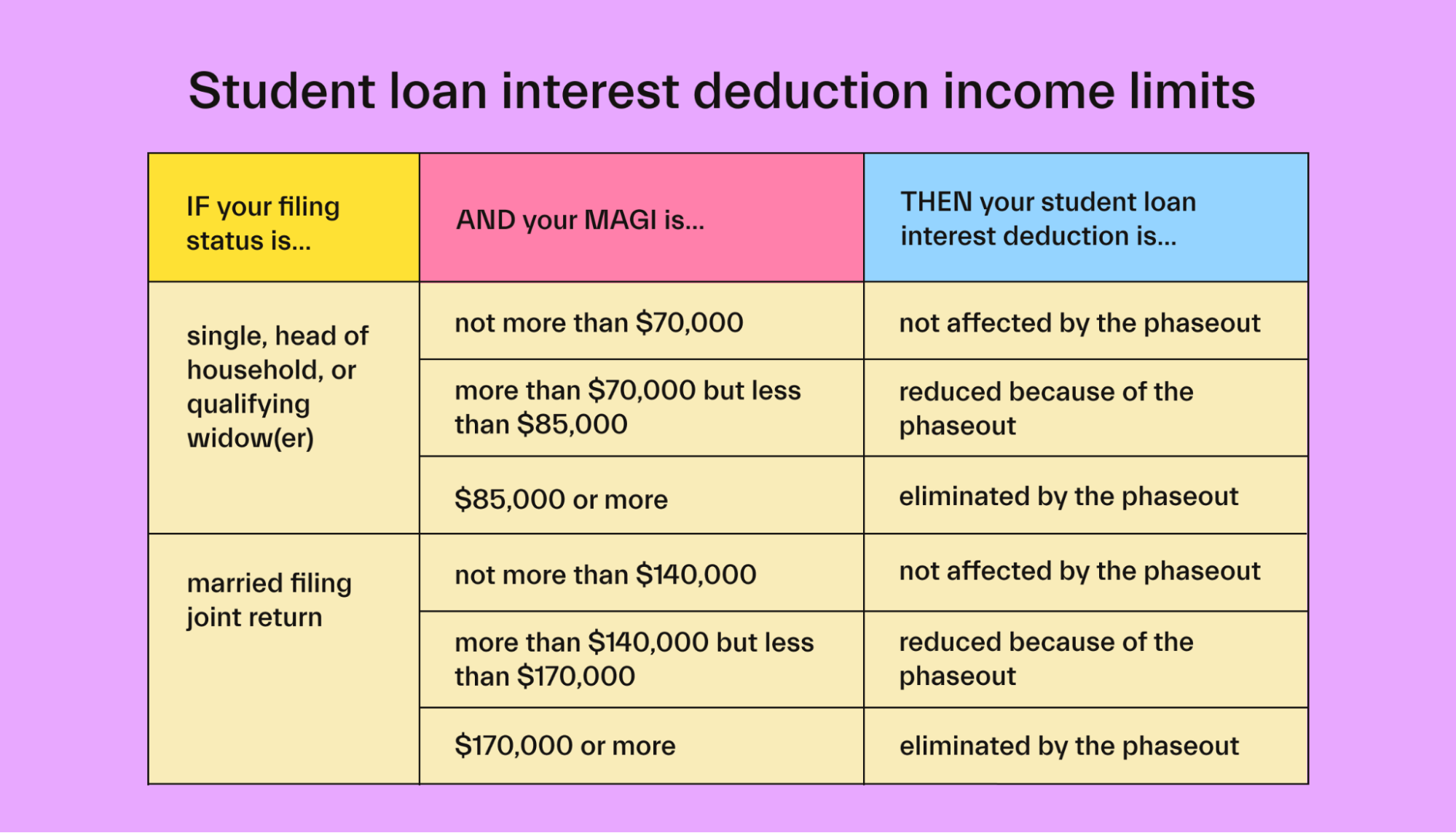

There are also income limits, based on modified adjusted gross income (MAGI).

In calculating your MAGI, consider income from all sources. Your student loans will not count as income, but certain types of financial aid may affect your MAGI.

If your MAGI is less than $70,000, you can claim the full amount of interest you paid, up to $2,500.

If you earn more than this, you may not be able to take the full deduction, or you may not qualify at all. This reduction in your potential deduction is referred to as ‘the phaseout’ in the image below.

Not sure if you qualify? The IRS has an interactive tool to help you determine if you can deduct your student loan interest.

How to claim the student loan interest deduction

If you pay more than $600 in a given year in student loan interest, you should receive a Form 1098-E. This lists the total amount of interest you have paid during that tax year. You can enter the total from this form when filing your taxes.

If you paid less than $600 in interest, you can still claim the deduction, but you won’t receive the 1098-E form.

This deduction is claimed directly on your Form 1040, the main tax return that most of us file each year. There is a student loan interest deduction worksheet included on the form, which helps you calculate the amount you can deduct.

If you use tax filing software, the software should walk you through the process.

Can a parent deduct student loan interest for their child?

In general, no—parents can’t deduct student loan interest for their children's loans, even if they foot the bill for student loan repayment.

To claim this credit, the IRS requires that the filer be “legally obligated to pay interest on a qualified student loan.”

Because loans are almost always taken out in the student’s name, parents are not legally obligated to pay for them. Therefore, they can’t take the student loan interest deduction.

The exception is when the parent is the borrower, such as with a Parent PLUS loan.

In this case, they can claim the interest as long as they meet all the other requirements we walked through in the eligibility section above.

Other tax benefits of higher education

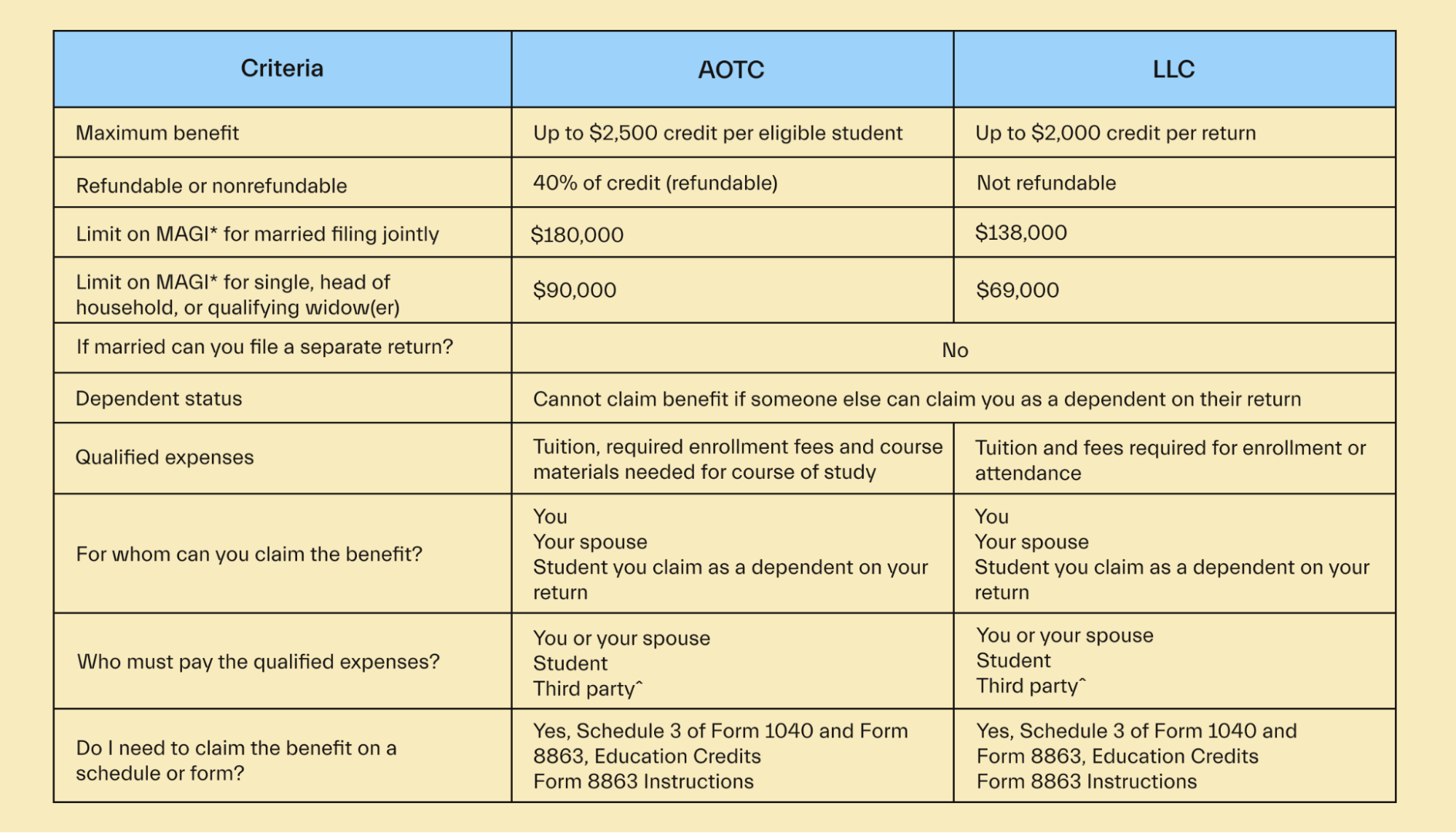

Students may be eligible for other substantial tax benefits, in addition to the student loan interest deduction. The two biggest are the American Opportunity Tax Credit and the Lifetime Learning Credit.

You can’t claim both benefits in a given tax year, so you should choose the one that is best for your situation (and that you qualify for).

Both of these are tax credits, rather than deductions. Credits decrease the amount of tax you owe dollar for dollar, rather than simply reducing the amount of taxable income you have.

American opportunity tax credit (AOTC)

The American Opportunity Tax Credit allows students (or their parents) to claim a tax credit of up to $2,500 to help cover the cost of qualified educational expenses. It can be claimed for up to 4 tax years.

To qualify, students must:

Be pursuing a degree or qualifying educational credential

Be enrolled at least half-time

Have not finished the first 4 years of higher education

Have not claimed the AOTC or Hope Credit for more than 4 years

Have no felony drug convictions

There are also income limits based on MAGI.

The full credit is available to those with a MAGI of $80,000 or less ($160,000 or less if filing jointly), and phases out between $80,000 and $90,000. The credit is not available to those with a MAGI of over $90,000.

Lifetime learning credit (LLC)

The lifetime learning credit allows students (or their parents/spouses) to claim a tax credit of 20% of qualifying education expenses, up to a maximum of $2,000. This can include tuition, fees, and even books.

The LLC can be claimed for any level of higher education, and there is no limit to how many years the credit can be claimed.

To qualify, students must:

Be paying for qualifying educational expenses in the relevant tax year

Be enrolled at a qualifying educational institution

The credit can be claimed by the student, the student’s spouse, or the student’s parents (if the student is claimed as a dependent).

This credit is phased out for MAGI levels between $59,000 and $69,000, and is not available for those with MAGI of over $69,000.

Wrapping up

Student loan payments are not tax deductible, unfortunately—but the portion of the payments that go to interest may be.

The maximum student loan tax deduction for interest paid is $2,500 per year. This can save taxpayers anywhere from $0 to $550 per year in income taxes, depending on their tax bracket.

In most cases, tax benefits such as the American opportunity tax credit and lifetime learning credit will have a greater impact on your overall tax bill.

Maximizing tax benefits is important—but many students leave money on the table by not taking advantage of all the financial assistance available to them.

Mos helps students navigate the financial aid and scholarship process, ensuring that they receive every possible dollar to pursue their education. Join Mos today to get the most scholarship money for your college education.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you