Financial aid •

October 28, 2022

What's financial aid?

Financial aid is money that students can get from the government and other entities to help pay for their college education. It includes grants, scholarships, loans, and work-study.

College is one of the largest expenses you’ll have in your early adult years.

According to EducationData.org, the cost of attending an in-state, 4-year public university is nearly $26,000 per year! That means you’re likely to pay $100,000+ for your entire education—ouch.

Before you panic and rethink your decision to attend college, know that you don’t have to go it alone.

Financial aid is designed to help make college more affordable.

Financial aid comes in many forms and from many sources, and can significantly reduce how much cash you have to fork over to attend college.

Keep reading to learn about the different types of financial aid and how you can get the most aid to help cover the cost of college.

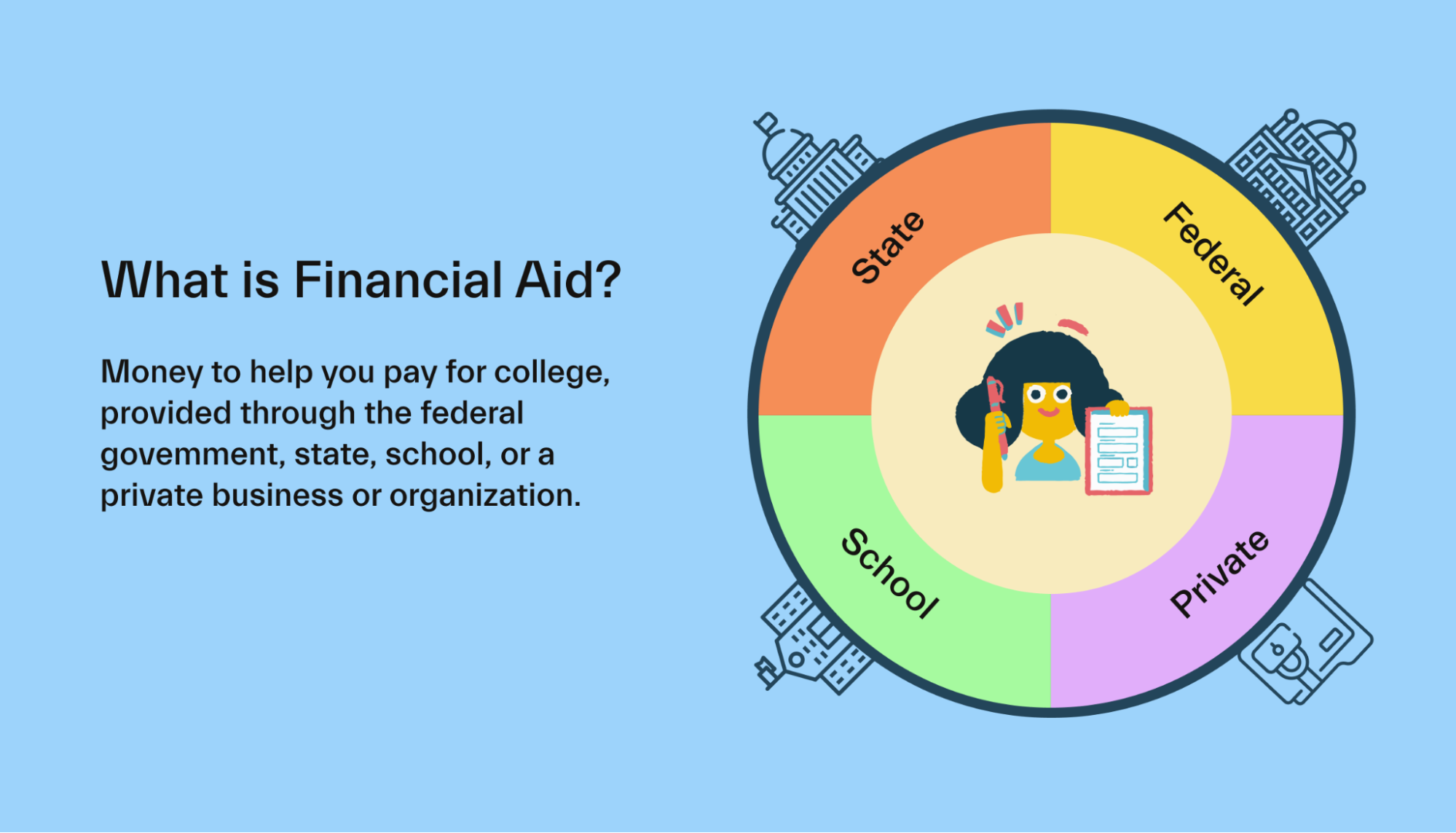

What is financial aid?

Financial aid is money that students get from federal and state governments, schools, and private entities—like some businesses—to help pay for them to go to college.

Financial aid generally includes any money that doesn’t come from the student or their family. It often takes the form of grants, scholarships, work-study, and student loans—all of which we’ll define in a moment.

Some forms of financial aid are free—you never have to repay them—while others are only loans that you’re expected to eventually pay back.

With the rising cost of college, many students rely on financial aid and wouldn’t be able to get a higher education without it.

How does financial aid work?

Financial aid is usually awarded directly to students by the federal and state governments, individual schools, and other private entities.

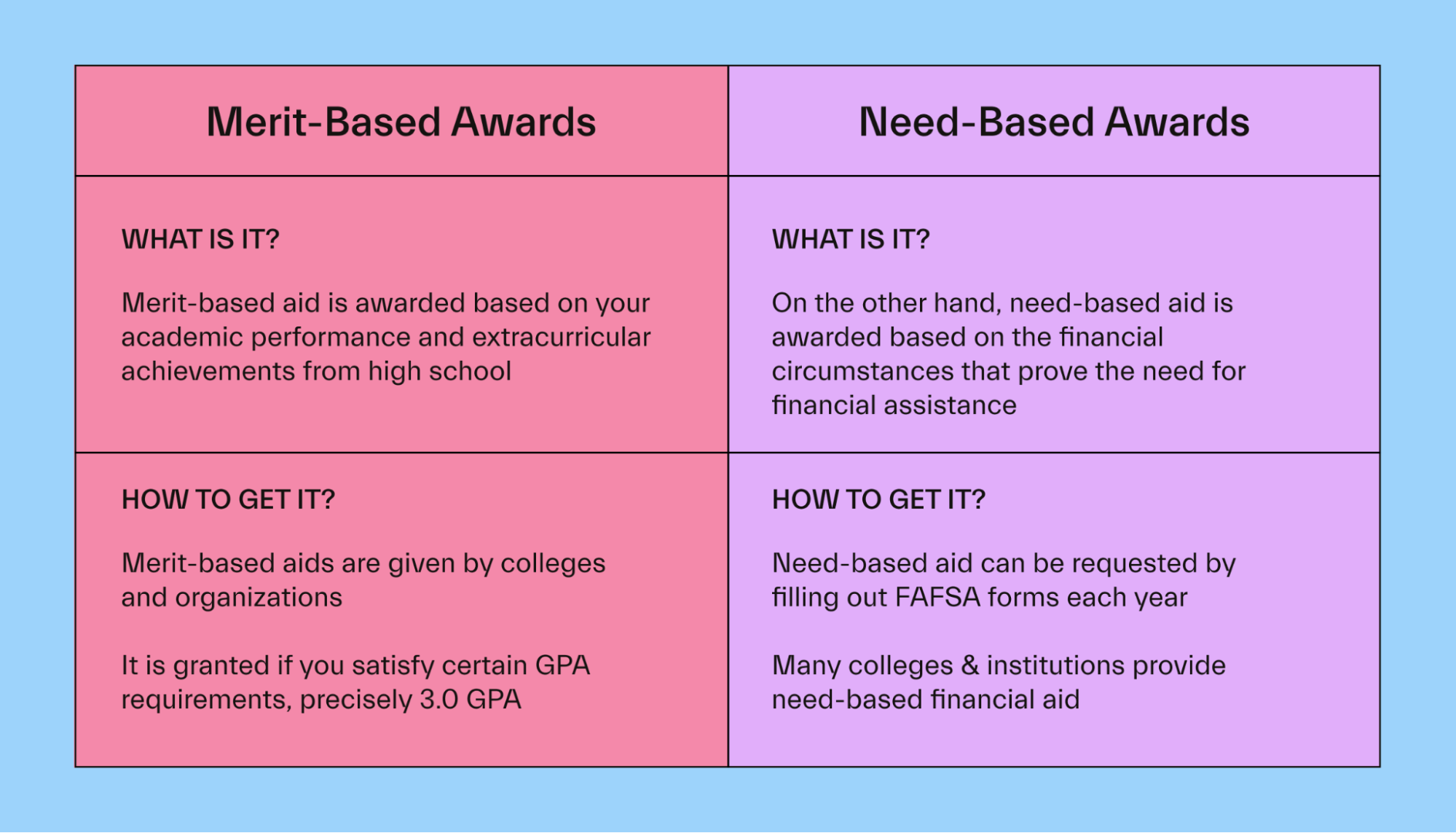

Financial aid can generally fit into two categories:

Need-based

Merit-based

Need-based financial aid is awarded to students based on demonstrated financial need—proof that you can’t afford to attend college without help.

Most federal financial aid is need-based and is awarded based on the difference between the cost of attending school and the amount a student’s family can afford to contribute.

Merit-based financial aid is awarded based on some form of achievement, whether it be academic, athletic, artistic, or otherwise.

Merit-based aid doesn’t require that a student have a demonstrated financial need for the money. Financial aid that’s based on achievement often comes in the form of scholarships from schools and private sponsors.

In the case of both need-based and merit-based aid, students usually must apply to receive it.

Students can complete the Free Application for Federal Student Aid (FAFSA) and include information about their family’s financial situation to apply for many of the most popular need-based aid options.

In the case of merit-based financial aid, some may be automatically awarded from the schools you apply to—although they still may require you to fill out the FAFSA to qualify. Other merit-based opportunities will require separate applications.

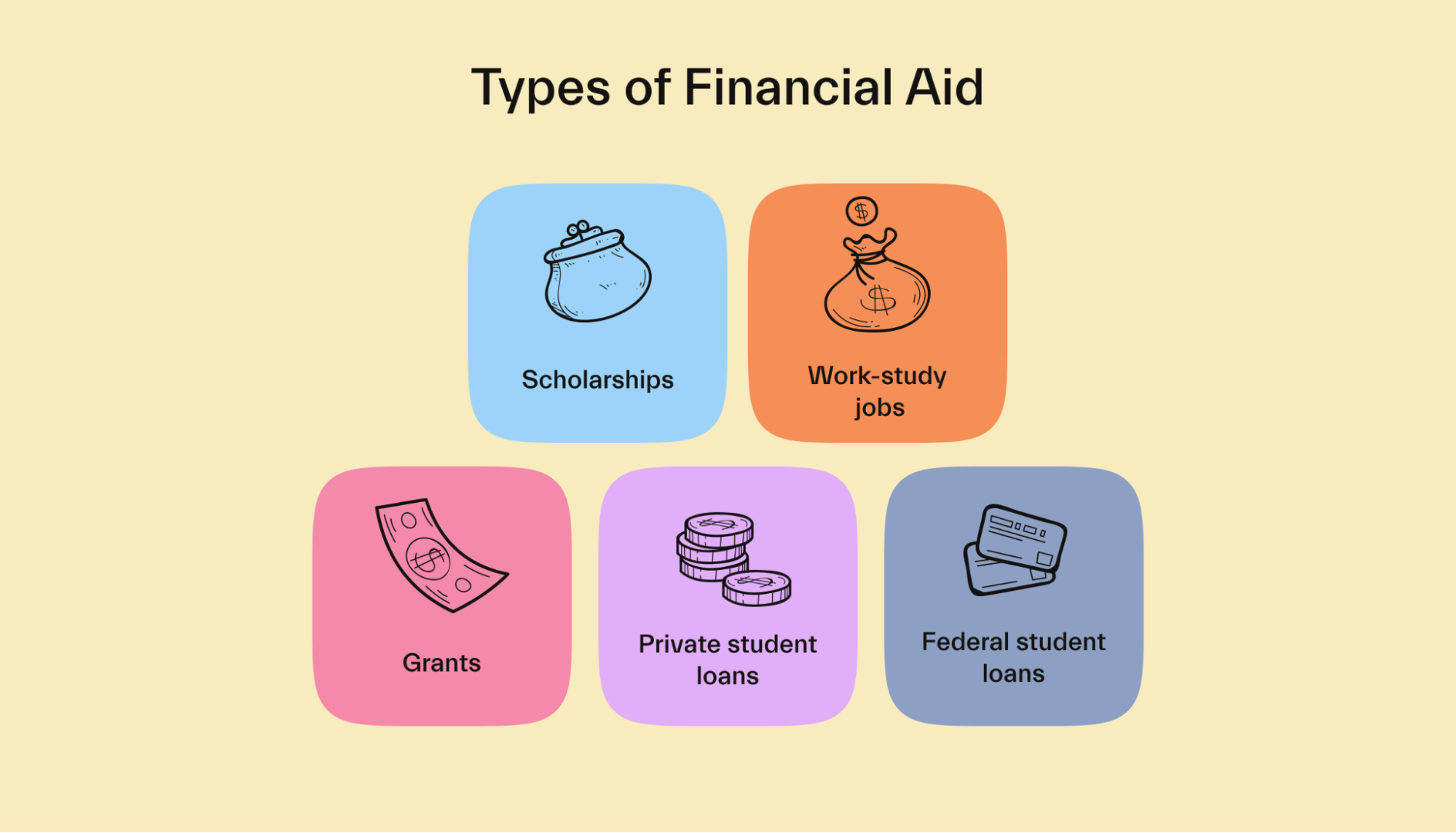

Types of financial aid

There are many types of financial aid available to help students finance their educational expenses. Here are the most common types:

Grants

A grant is a form of free aid that students can be awarded to help pay for college. Grants are often need-based financial aid, meaning they’re given to students who truly need them.

Some of the most common grants are those awarded by the federal government:

The Federal Pell Grant is awarded to any undergraduate student who displays exceptional financial need. The maximum award available is $6,496, though the amount you’re eligible for will depend on your expected family contribution, cost of attendance, and status as a part-time or full-time student.

The Federal Supplemental Educational Opportunity Grant (FSEOG) is awarded to undergraduate students with the greatest financial need. It’s awarded in amounts ranging from $100 to $4,000, but isn’t available at all schools.

The Iraq and Afghanistan Service Grant is provided to college or career school students whose parent or guardian died because of military service in Iraq or Afghanistan.

The Teacher Education Assistance for College and Higher Education (TEACH) Grant is available to undergraduate or graduate students enrolled at an eligible school and who agree to complete a teaching service obligation as a condition for receiving the grant.

In addition to federal grants, there are also grants available from state governments, individual schools, and private organizations.

Scholarships

Scholarships are a type of free financial aid awarded by schools and private organizations.

Like grants, scholarships don’t need to be repaid after a student graduates. They can be need-based but are often based on a particular achievement or skillset.

Scholarships come from many different sources.

First, schools often use scholarships to entice high-achieving students to attend their school instead of a different one. Merit scholarships are most often used by private schools.

Scholarships also often come from industry organizations. For example, professional organizations in the medical field might award merit-based scholarships to students who are going to school to go into the medical field.

Another popular source of scholarships is private companies.

Companies give scholarships for many reasons, including to award high-achieving local students, to reward employees by helping their children pay for college, or by attracting students who might someday come work at their company.

Scholarships are available for nearly every purpose you can think of, including:

Academics

Athletics

Artistic talent

Leaderships

Community service

Financial need

Area of study

Race or ethnicity

Family background

Work-study jobs

The federal work-study program awards part-time jobs to students with demonstrated financial need.

Undergraduate and graduate students who qualify for work-study are guaranteed a certain amount of earnings. But unlike grants and scholarships, they’re required to work and earn an hourly wage to get the federal aid money.

Work-study jobs are available both on and off-campus.

Schools hire students into work-study jobs, and local nonprofit or public organizations can also join the program to provide jobs to students, as long as the job is in the public interest.

Many work-study jobs pay minimum wage, but students can earn more depending on the type of work and the amount of skill required for the job.

Students are limited to working only enough hours to earn their total federal work-study award.

Student loans

Student loans are one of the more common types of financial aid that students use to pay for college and are generally the only type that you’ll need to repay after graduation.

Student loans can come from the federal government or private lenders.

There are four primary types of federal student loans available:

Direct Subsidized Loans are awarded to undergraduate students with financial need. While the student is in school, the US Department of Education (DOE) pays the interest on these loans, so it doesn’t build up over time.

Direct Unsubsidized Loans are available to all undergraduate and graduate students, regardless of financial need. Unlike a subsidized loan, an unsubsidized loan accrues interest while you’re in school, meaning that you’ll owe more money than if your loan was subsidized.

Direct PLUS Loans are awarded to graduate and professional students or the parents of undergraduate students. Unlike other federal loans, eligibility for these loans is based on a borrower’s creditworthiness.

Direct Consolidation Loans are a type of loan you’d borrow after you graduate. It allows you to combine multiple student loans into just one, with a fixed interest rate and a single monthly payment.

In addition to federal student loans, you can also apply for a private student loan through financial institutions. While these loans have some similarities, there are also some important differences.

First, unlike many federal loans, private loans require a credit check, and eligibility and the interest rate offered are based on the creditworthiness of the borrower.

Since you’re a student, chances are you don’t have a lot of positive credit history yet, so you may need someone else—like a parent—to cosign your loan.

Private student loans also have some downsides after graduation.

There often aren’t income-based repayment plans available with private loans—these are plans that adjust your monthly payment based on how much money you’re earning.

Students may also have a more difficult time pausing their payments or seeking loan forgiveness if they’re experiencing financial hardship.

In general, private student loans should be your last option for paying for college, as they’re the most expensive.

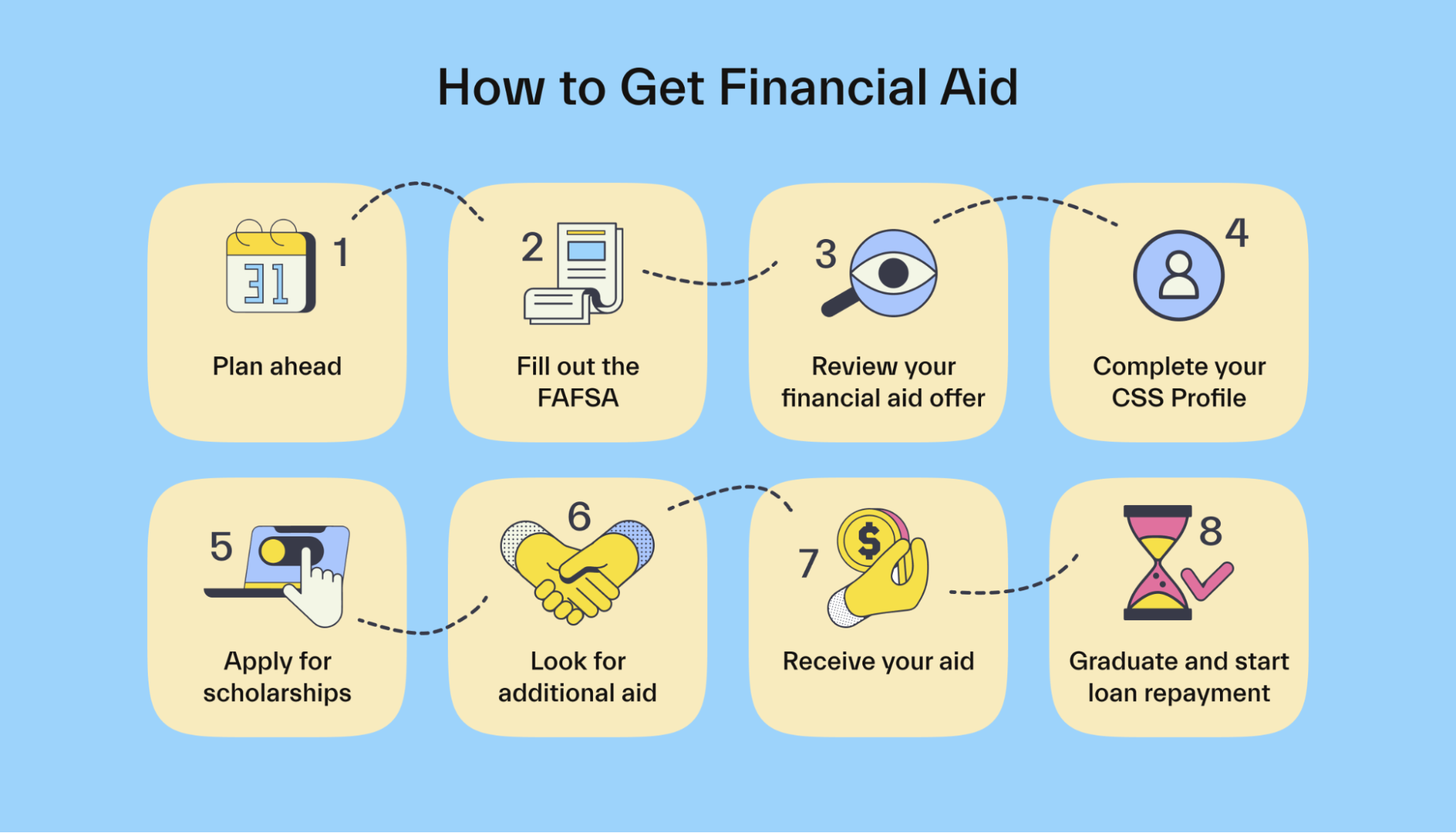

How to get financial aid

Are you looking to apply for financial aid to help cover the cost of your education?

Here are eight steps to follow to get the financial assistance you need:

Step 1: Plan ahead

Once you know you’ll be heading off to college, it’s never too early to start planning and applying for financial aid. Many scholarship applications are open to students as early as their early high school years.

You can also begin researching early so you know what types of aid you might be eligible for and what requirements you should try to meet.

One of our Mos advisors can help identify which scholarships and grants you’re close to qualifying for and what you need to do to meet the requirements, so you can get the most free money possible.

Step 2: Fill out the FAFSA

The FAFSA is the form that the federal government and schools use to determine what need-based financial aid you’re eligible for.

The FAFSA collects information about your family’s income and assets to figure out how much of your education your family can afford to pay for out-of-pocket.

The difference between your cost of attendance and your expected family contribution is often the maximum amount of need-based aid you’re eligible for.

Step 3: Review your financial aid offer

After you complete your FAFSA and receive your college acceptance letters, you’ll receive a financial aid offer letter from each school.

This letter lays out how much aid—and what types—you’ve been offered from the federal and state government and the school. Your offer letter may include a combination of several types of financial aid.

Step 4: Complete your CSS Profile

The CSS Profile is a financial aid application that many private schools use to award non-federal financial aid to students.

Similar to the FAFSA, the CSS Profile will ask for detailed information about your family’s financial situation to determine how much money you need.

Unlike the FAFSA, which is free, the CSS Profile requires a $25 fee, with an additional $16 for each additional school report.

Step 5: Apply for scholarships

As we mentioned early, plenty of private organizations award scholarships to students based on many factors. Some scholarships are need-based, while many are merit-based.

You can find scholarships for nearly every type of achievement, background, skill set, and more.

There are plenty of niche scholarships available, which are those available to a small, very specific group of people.

Step 6: Look for additional aid

If there are any gaps to fill in financing your education, now is the time to seek out additional aid.

In many cases, that will mean applying for private student loans to help cover your remaining costs.

You can also research additional sources of grants and other funding for students with financial need.

Check out local resources as well, to see if any local businesses or nonprofits are offering aid you may qualify for.

Step 7: Receive your aid

Once you’ve applied for all of the aid you can, it’s simply a matter of waiting.

In the case of federal aid, you contact your school’s financial aid office to find out when any money will be awarded and how it’ll be provided.

Usually, your aid will go directly to cover your tuition and other fees, but you might get a check or direct deposit from your school with the excess to cover the cost of books, room and board, and more. In the case of scholarships, some may send the money to you directly, while others may send the money to your school.

Step 8: Graduate and start loan repayment

Once you graduate, it’s time to start repaying any borrowed financial aid such as federal and private loans.

You’ll typically have a 6-month grace period for federal student loans. During that time, you can start preparing your budget and choose your repayment plan.

Financial aid FAQs

Do you have to pay back financial aid?

Both federal and private student loans must be repaid after you graduate unless you qualify for one of the federal loan forgiveness options.

But other types of financial aid like grants, scholarships, and work-study don’t generally have to be paid back.

What if you don’t qualify for enough financial aid?

If you don’t qualify for enough financial aid to finance your entire education, you can apply for private student loans to help fill the gap.

You can also consider working throughout the school year and during summer breaks to fund part of your tuition in cash. Or opt for a more affordable school. There may be other ways to reduce your costs as well, such as living at home, or attending school part-time.

There are billions of dollars in aid that goes unclaimed every year—much of which is passed over because students either don’t realize they qualify or don’t know how to apply. If you’re worried about not receiving enough money to pay for school, reach out to one of our advisors and we’ll help you get the most money possible to pay for your education!

How will you find out what financial aid you’re awarded?

Shortly after you receive your college acceptance letter, you’ll receive a financial aid award letter outlining the federal grants, loans, and work-study you’ve been granted.

The letter will also include any aid you’re eligible for directly from the school.

In the case of private aid, the timeline and means of communication will depend on the organization.

Which forms of financial aid are best?

While all types of financial aid can be useful in financing a college education, the best are those that are free.

In other words, you don’t have to work for them and don’t have to pay them back after graduation. Forms of free financial aid include grants and scholarships.

Conclusion

Financial aid can significantly reduce your out-of-pocket costs to attend college. Not only can it help reduce your costs while you’re in school, but certain types of aid can help you start your post-grad life with less student loan debt.

Financial aid is available from many sources, including the federal and state governments, as well as private organizations.

No matter what your financial situation, there’s a good chance you can find financial aid that you’re eligible for.

Need help finding and applying for financial aid? Sign up for Mos for help completing your FAFSA, finding scholarships, and finding every dollar of student loan you’re eligible for.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you