Student loans •

November 11, 2022

How do student loans work?

Learn how different types of student loans work, as well as advice about how much you can and should borrow.

Getting a college degree is expensive. Tuition, fees, room and board, and required course materials can add up to a big, scary bill.

If your grants, scholarships, and savings won’t cut it, you might have to consider taking out a student loan to pay for college.

Student loans can help cover your education expenses, but debt can also become a huge financial burden. There are 2 primary types of loans that you can use: federal student loans and private student loans.

To help you decide if student loans are right for you, let's break it down.

How do student loans work?

A student loan is money that you borrow to pay for college expenses and that you have to eventually pay back (in most cases, but we’ll get to that later).

When you take out a student loan, you sign and agree to a contract detailing the terms and conditions of the loan.

This includes the interest rate, the period when interest starts accumulating, the minimum required monthly payment, and the total time you have to pay back the loan in full. Here’s what that all means:

The interest rate is the cost that the lender (the organization you’re borrowing the money from) charges you for the student loan, and is expressed as a percentage of the total amount being borrowed.

When interest starts accumulating depends on the loan. Some loans charge you interest right away, others cover the interest in case of financial need, and others defer the application of interest rate until graduation. In general, the later the interest starts accumulating, the better.

The monthly payment is the dollar amount that you'll pay to your lender monthly. For example, you may have to pay $250 on the 15th of every month.

The time to pay back the full loan is the total number of monthly payments that you’ll have to make. The repayment period is another way to refer to this.

You should be looking at these terms and conditions when comparing student loans and deciding which one to take out.

Student loans can be taken out by the student or by the student’s parents. In 2020, 34% of students took out a student loan, and 20% of students’ parents took out a loan to help pay for their college expenses.

In the same year, the average amount borrowed by students was $11,836 per year, and parents borrowed an average of $12,535 per year.

How does interest on a student loan work?

Interest is the cost that a lender charges you for lending you funds. Part of every one of your monthly payments covers the applicable interest charge for the period, and the other pays down the loan’s original balance.

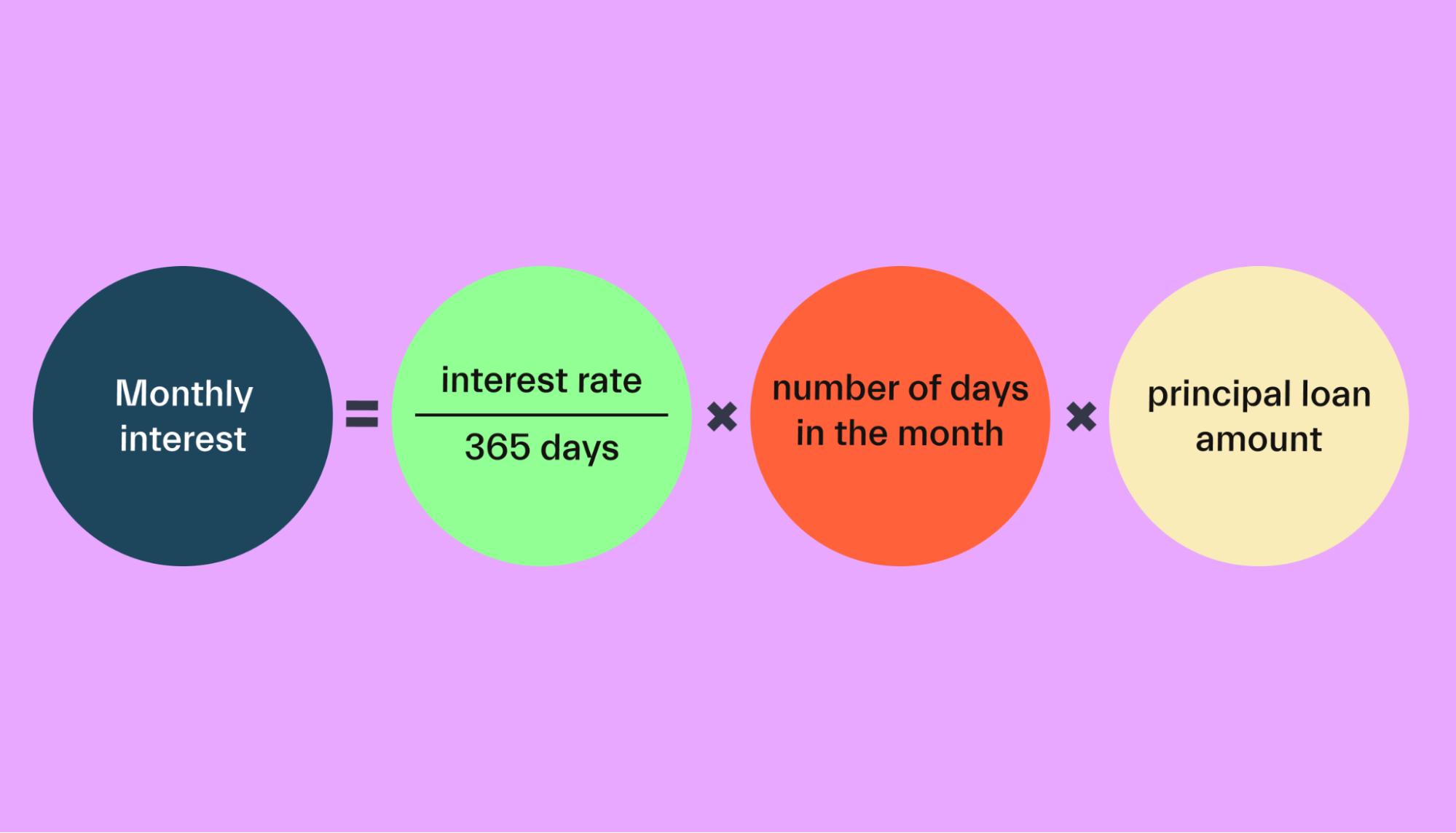

Let’s assume that you have a $5,000 loan with a 5% annual interest rate. Even though the interest rate is expressed as an annual percentage, it’s actually accumulated every day. In a 30-day period, this loan would accumulate $20.55 in interest: [(0.05/365) x 30 days x $5,000 = $20.55].

In this example, if you made a $100 monthly payment towards your loan, you would only be paying $79.45, because the $20.55 of interest would be paid for first.

What are the types of student loans?

With student loans, you have options, so don’t take out a loan until you’ve done your research. The 2 main lenders of student loans are the federal government (federal student loans) and private financial institutions (private student loans).

In 2020, 30% of students used federal loans, and 13% of students used private loans. The loan type you choose is very important because it impacts the cost of the loan and your options for repaying it.

Federal student loans

When you take a federal loan, you’re borrowing from the US Department of Education’s William D. Ford Federal Direct Loan Program (what a mouthful!). This is why we tend to refer to a federal student loan as a direct loan or federal loan for short.

To be considered for a federal student loan, you’ll need to submit a Free Application for Federal Student Aid (FAFSA®) form, also known as the FAFSA. To accept a federal student loan, you’ll need to sign a master promissory note (a legal promise to repay back the loan in full plus applicable interest), and complete loan counseling.

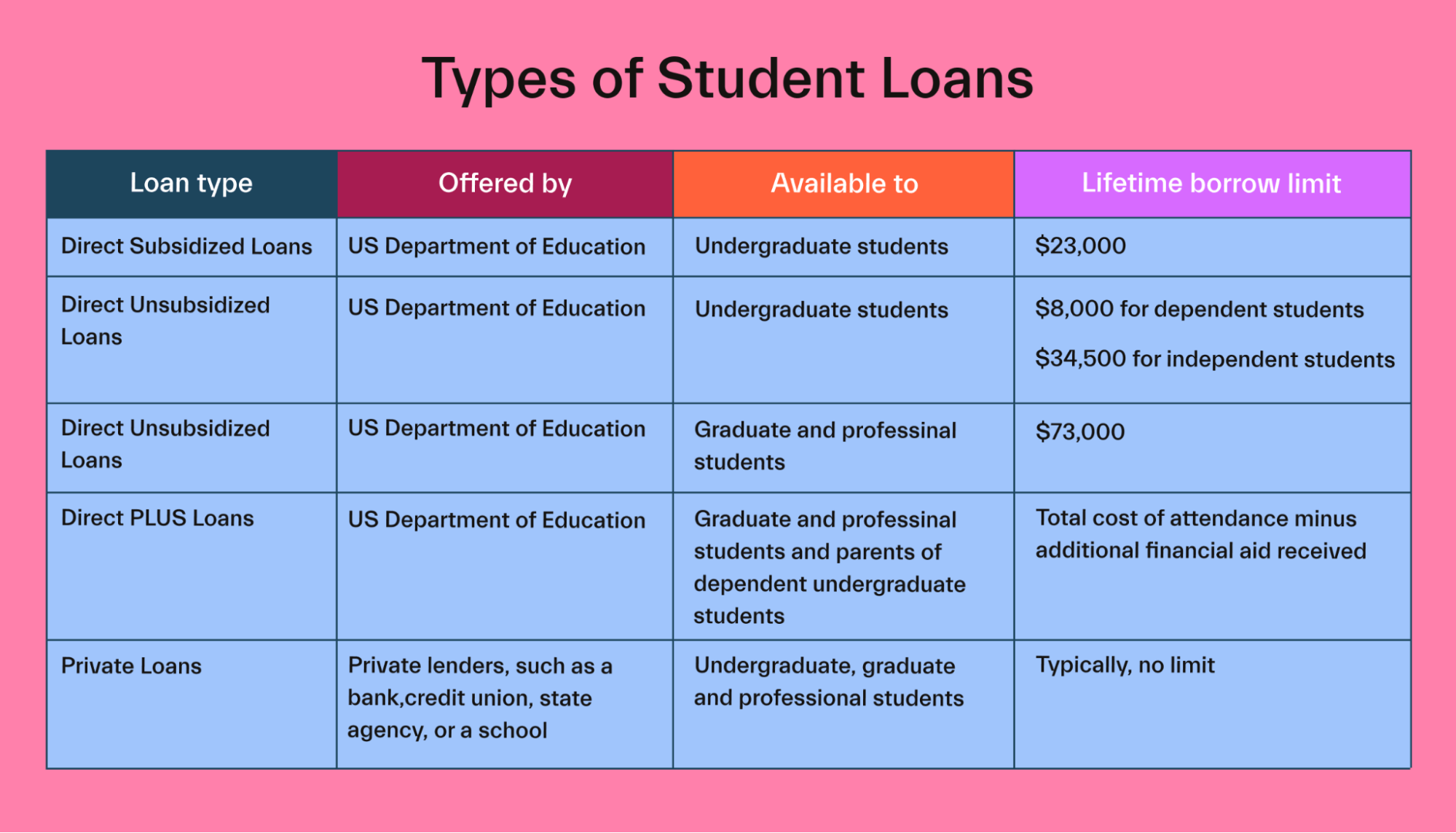

There are direct loans available for both students and parents.

Direct loans for students:

Direct subsidized loans: To qualify for this loan, you need to be an undergraduate student going to school at least half time, and have financial need. A subsidized loan also doesn’t charge you interest until 6 months after you finish school.

Direct unsubsidized loans: An unsubsidized loan is more flexible and doesn’t have specific requirements. The interest starts accumulating when you’re in school, though. Below is the schedule of rates for July 1, 2022:

Undergraduate direct loan interest rates will increase from 2.75% to 3.73%

Graduate direct loan interest rates will increase from 4.3% to 5.28%

PLUS loans for graduate students and parents will increase from 5.3% to 6.28%

The cost of a direct unsubsidized loan is slightly higher than that of a direct subsidized loan.

Direct PLUS loans: The DOE offers this type of loan to graduate and professional students through participating schools.

Since PLUS loans are also available for parents, a financial advisor or lender often uses the term grad PLUS loan to specify that the loan is for a graduate or professional student.

Unlike with other federal loans, your credit history will be used to decide whether or not you can get the loan.

Direct loans for parents:

Direct PLUS loans: Also called a parent PLUS loan, this is a direct PLUS loan where the parent takes out the loan and not the student. The parent PLUS loan can only be used to cover the costs of an undergraduate degree (like an associate’s or bachelor’s).

Private student loans

Many financial institutions, including banks and credit unions, offer private student loans.

Typically, the interest rate on a federal loan is lower than on a private loan, but private loans are worth considering if you don’t qualify for a federal loan or can’t get a large enough federal loan to cover all your education costs.

The application process for private student loans varies, so you’ll need to get the specifics from the lender offering the private loan.

What are the differences between federal loans and private loans?

Federal student loans and private student loans aren’t the same. The terms and conditions vary —particularly for whether or not it’s subsidized, the start of the repayment period, and repayment options.

Here's a guide on how to evaluate federal loans and private loans:

Co-signer

The parent PLUS loan is the only federal student loan for which you'll need a co-signer (a person who commits to paying back the loan if you can’t). No other federal loans require a co-signer.

Alternatively, most private loans require a co-signer. The exception is when you have a very strong credit history.

Interest rate

The interest rate of federal student loans is fixed—it’s set when you take out the loan and doesn’t change for the rest of the time that you have the loan. Private loans can have fixed or variable interest rates. If your loan is variable, the interest rate tends to be tied to the market rate and can go up or down over the life of the loan. If interest rates rise, you’ll see much higher student loan debt payments and could wind up paying far more than you expected to.

As we mentioned above, the interest rate of a federal loan is typically lower than that of a private student loan.

Fees

Federal student loans have set origination and other fees. For loans issued before October 1st, 2023, the loan fee is 1.057% of the balance.

Private student loan lenders can charge different fees, depending on the lender you choose. You’ll want to shop around to find the lender that offers the least expensive loan.

Start of repayment

A private loan usually requires you to start paying off your loan immediately. On the other hand, you don’t have to make a payment on your federal loan until you graduate. There is typically a 6-month grace period after you leave school before payments begin on federal loans.

One exception: if you abandon your studies or decide to enroll less than half-time, you’ll have to start paying your federal loan before you graduate.

Loan subsidy

When a federal loan is a subsidized loan, meaning that the lender covers your interest payment as long as you meet their requirements.

The usual requirements are that you use the loan to cover undergraduate degree expenses, attend school at least half of the time, and can demonstrate financial need.

Alternatively, private loans are almost always unsubsidized loans that charge you interest immediately and require you to start making payments while you’re still in school.

Loan consolidation

The Department of Education (DOE) offers consolidation loans, which are loans that allow you to combine several federal loans into a single one with a fixed interest rate at no cost.

While some private lenders may also offer a consolidation loan, they often charge a fee. Loan consolidation is useful when you’re paying back several student loans from different lenders. Instead of handling many payments with different deadlines, you’ll deal with a single payment.

Another benefit of loan consolidation is to secure a single loan at a fixed interest rate.

Loan term

Federal loans and private loans can have different repayment terms.

The standard federal student loan repayment term is 10 years. Consolidation loans can have terms of up to 30 years.

On the other hand, private student loans have more variety in their repayment terms. Longer terms lead to lower student loan payments, but you’ll wind up paying more over the life of the loan.

Repayment options

Here are three ways that federal loans provide more flexible repayment options than private loans.

Federal loans include an option to set your monthly payment to your level of income. This option is available under an income-driven repayment plan. So if you make less, you can pay less. Not all private loans have that option––you have to check with your lender!

With a federal loan, you may be able to reduce or delay your monthly payments if you can prove financial hardships.

Last but not least, If you work in an eligible profession, such as nursing and teaching, or in public service, your federal loan may qualify for loan forgiveness. A private lender often doesn’t provide these kinds of payment relief options, particularly loan forgiveness.

How much can you borrow in student loans?

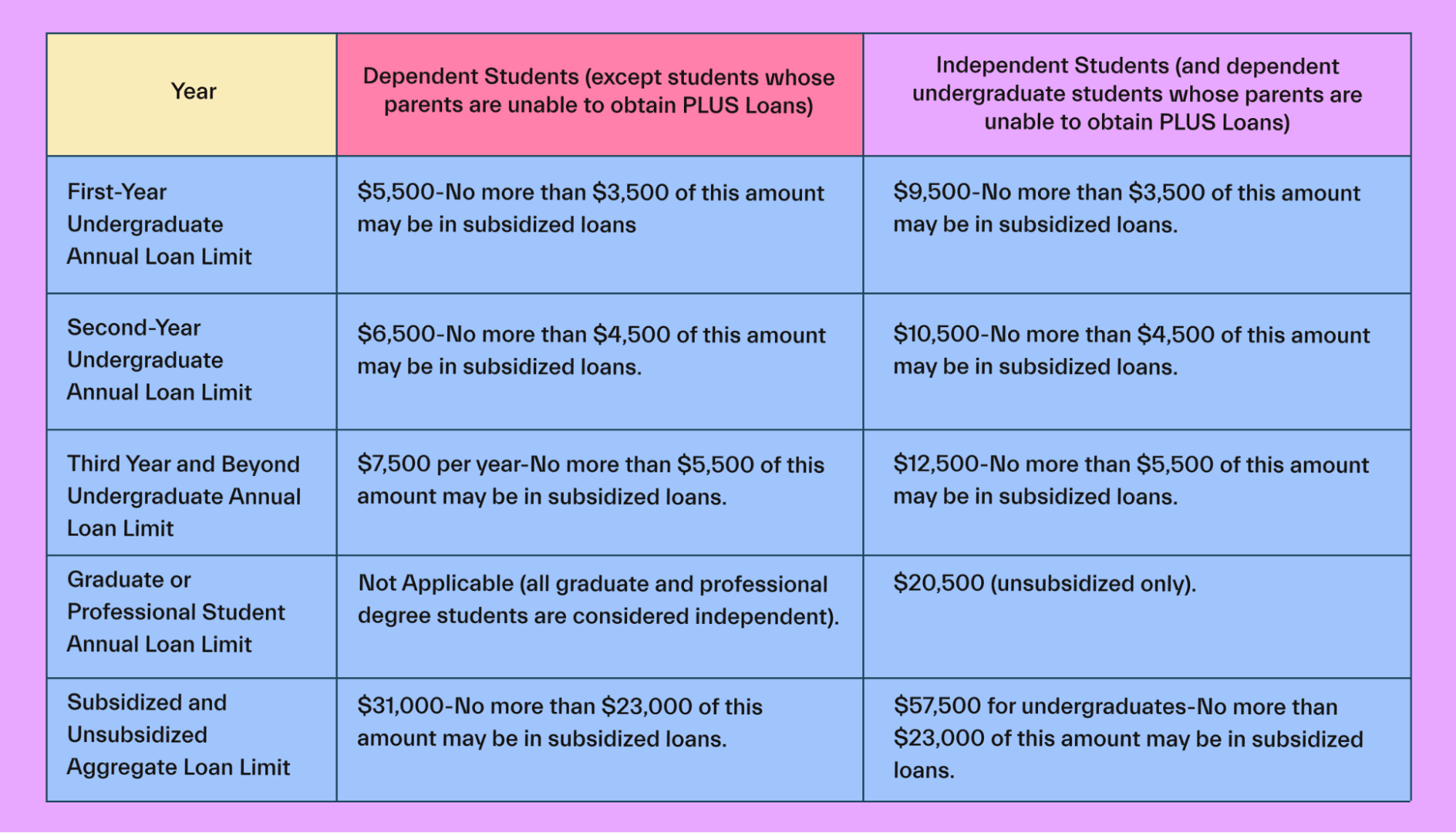

The DOE sets an annual limit on how much you can borrow based on these factors:

Whether you’re a dependent or independent student, according to FAFSA

Your grade in school

What type of degree you’re getting (undergraduate vs. graduate)

How much you’ve borrowed so far

For example, a first-year college student who is a dependent may borrow up to $5,500 in federal loans. However, that same student may not borrow more than $3,500 out of that $5,500 in subsidized loans.

Let’s fast-forward a couple of years in the college life of that same student.

In the fourth year, all things equal, they may borrow an extra $7,500 in federal loans ($5,500 or under in subsidized loans), as long as they don't exceed the $31,000 combined loan limit from all their student loans ($23,000 for subsidized loan limit).

Here’s a summary of the annual and total limits for federal loans.

It’s also important to note that you can’t get more in federal student loans than your college’s cost of attendance minus the other aid you’ve received. If your school’s cost of attendance is $20,000 and you got a $15,000 scholarship, you can only receive up to $5,000 in federal loans. If you get a lot of other aid, it could impact your borrowing limits.

How much should you borrow?

While you could borrow as a dependent undergraduate up to $5,500 in federal loans in your first year, it doesn’t mean you should.

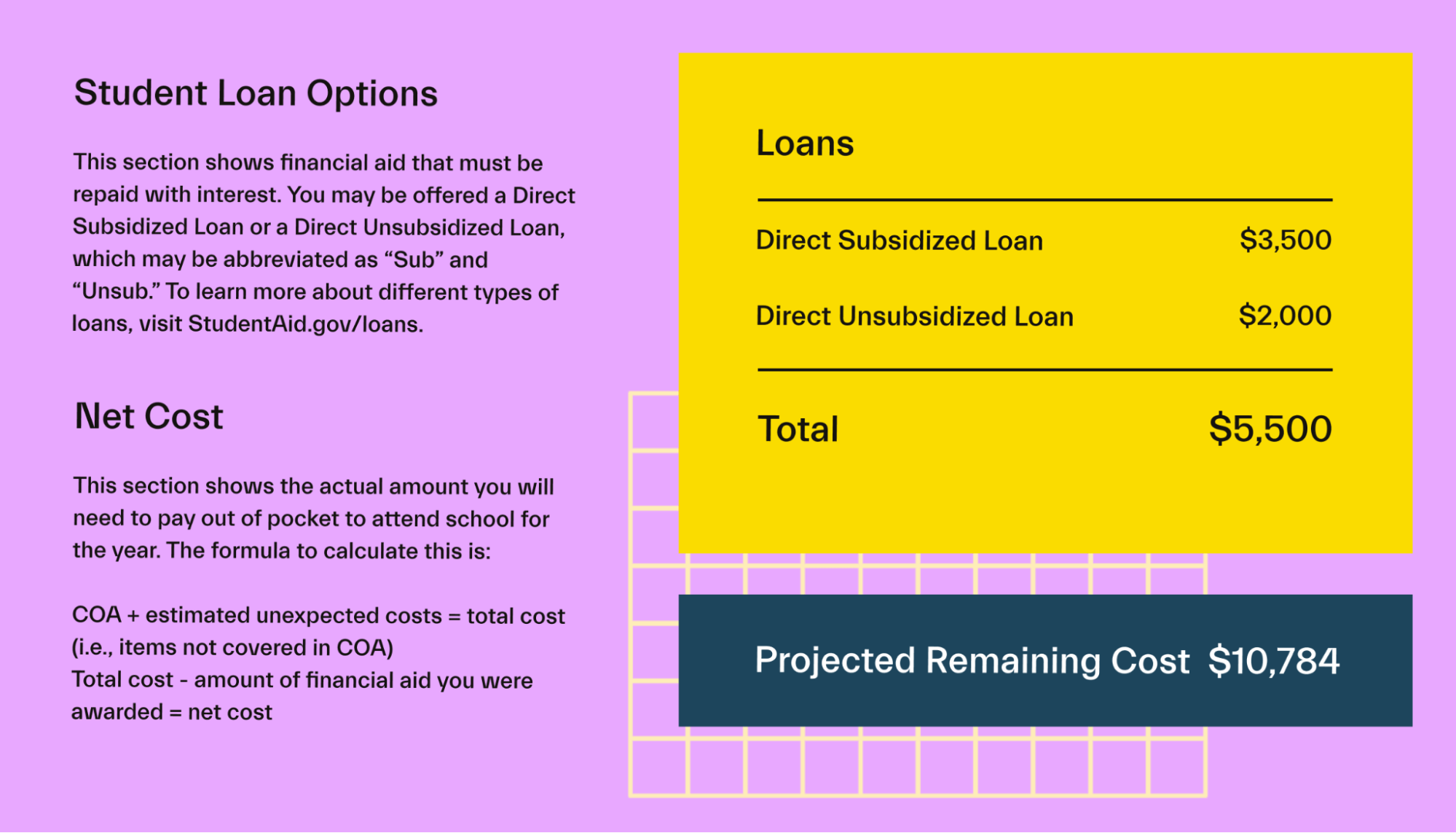

Once your FAFSA application has been processed, your school will present a financial aid offer, which will break down your financial aid and available federal student loans.

Take as long as you need to review your funds and remember that you don’t have to take the full amount offered. You can always take less.

You want your student debt to be manageable, not overwhelming.

In the event that you absolutely need to take out debt to afford going to college, a subsidized loan is always preferable to an unsubsidized loan. And much better than alternative forms of debt, such as credit cards and personal loans.

But, scholarships, grants, and savings are always better than debt you will eventually have to repay.

How does student loan repayment work?

Repaying your loan looks different depending on what type of loan you took out.

For private student loans, repayment generally starts right away. You’ll need to start making monthly payments while you’re in school and according to the repayment schedule. Contact the private lender to check if they offer any repayment options.

For federal student loans, repayment typically starts upon graduation. Some exceptions are when you stop your studies or change your enrollment status to under half-time.

What happens if you can’t afford the payments?

With federal loans, no repayment plan is set in stone. The DOE offers many repayment options to help you when you can’t afford your loan payments. Some of these options are:

Payment based on income: The DOE provides payment relief through income-driven payment plans. For example, a recipient of a direct loan may ask for a Pay as You Earn Repayment Plan (REPAYE) and set monthly payments as 10% of disposable income.

Delay of payments: You may postpone your payments due to financial hardships or other qualifying reasons. Keep in mind that interest may still rack up while your payments are on pause.

Discharge or forgiveness: Under certain circumstances, the DOE can cancel or forgive your loans. Some examples include disability, school closure, or benefit from working in a specific industry or type of organization.

Conclusion

Before taking out a student loan, it’s important to understand how the process works from start to finish.

Of course, the best student loan is no student loan at all! That’s why we encourage students to apply for all the free money (grants and scholarships) before taking out a loan.

A lot of students leave free money on the table, either because they don’t realize it’s available, or because they’re not sure how to apply for it.

If you want to get the most financial aid available to you, why not join Mos today? We’re here to help.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you