Student loans •

October 28, 2022

I can't pay my student loans: what should I do?

Read this guide from Mos.com to find out what to do about federal student loans and private loans you can’t repay.

Student debt is without doubt one of the biggest money issues in the US.

College can be really expensive—and even if you’ve used federally subsidized student loans to pay for your education, keeping up with monthly payments to repay that loan can be tricky. For some, over time, it becomes downright impossible.

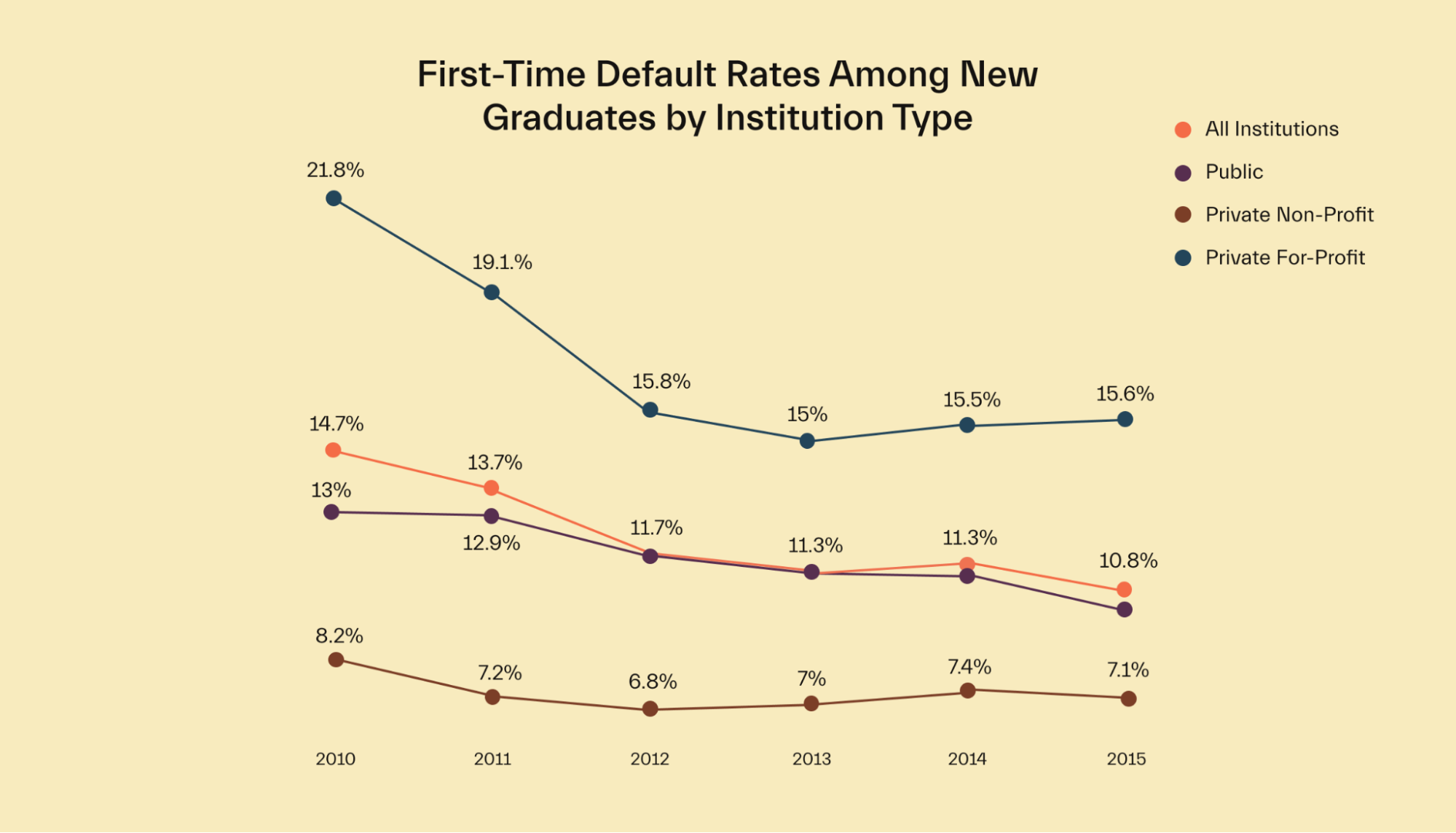

That’s why more than 1 in 10 new graduates default on their student loans within 12 months of graduating — which means they’ve failed to make repayments as agreed with the lender. In total, $124.4 billion worth of the US’s outstanding student debt bills have defaulted!

This guide explains what to do about federal student loans you can’t pay, how income-based repayment plans and loan forgiveness work, and what to do about private student loans you can’t repay.

What happens if you don’t pay your student loans?

Let’s face facts: life is expensive, and your bank account is always going to have a lot of competing interests. You’re going to have a lot of bills to pay, and sometimes it’s hard to make ends meet.

But you need to do your best to make sure you stay up-to-date on your student loan payments if you can. If you start missing loan payments, or your loan goes into default, it’s going to negatively impact your life in a couple of ways.

Let’s break down what can happen if you fail to pay your student loans.

Negative impacts on your credit rating

If you miss a student loan payment, your credit rating will take a hit.

When you have a loan payment that is 90 days or more overdue, it means that your student loan is officially labeled as being “delinquent.” Your lender will then report your delinquent loan to all three major credit bureaus: Equifax, Experian, and TransUnion.

These three organizations research all of your credit history and provide that information to banks and lenders.

Once they’ve been informed of a delinquent loan, your credit score is likely going to get a lot worse.

From there, any new applications that you make for credit could end up getting denied or only offered at high interest rates.

For example, you might not be able to finance new furniture, secure a loan to buy a new car, or even qualify for a mortgage.

But having a bad credit score won’t just impact your ability to borrow more money. Prospective employers will sometimes look at your credit rating as a measure of your character—which means that by missing a student loan payment, you could be hurting future career opportunities.

Finally, utility companies and other service providers like to run credit checks to determine your ability to make payments. If it turns out you have a bad credit rating, utility companies (like Comcast, Pacific Gas & Electric or Southern California Edison) might demand a security deposit before they start offering you services.

Your account goes into default

If your payments are more than 270 days (or 9 months) late, your loan goes from being “delinquent” to officially “in default.”

Unfortunately for a whole lot of US students, this is a stark reality. At the moment, an average of 15% of student loans are in default at any given time—with over a million student loans entering into default each year.

Together, those defaulted loans represent $124.4 billion worth of student debt! The consequences of those defaulted loans can be pretty severe for former students.

Once your student loan account has gone into default, the entire unpaid balance of your loan (as well as any interest you owe) will become due immediately. This process is called "acceleration."

If you can’t or won’t pay the balance of your loan back to the lender immediately, your lender or financial institution will refer your account to a collection agency.

That collection agency will then do everything in its power to make you pay.

Debt collectors also tend to add administrative and collection fees to cover the work they do to make you repay your loan, and so you’ll end up owing even more money than you did in the first place. Interest will also continue to accumulate over this period.

If the collection agency fails to get you to repay your loan, the federal government can then get involved. The government can keep any of your future tax refunds and apply that money to your outstanding debts instead.

The government may also get in touch with your employer and arrange for a part of your salary to be sent straight to the government to go towards paying back your loans.

That being said, if you’re unemployed the government can offer temporary assistance through forbearance or a deferment. We’ll cover exactly what those are in just a minute.

What to do about federal student loans that you can't pay

We’ve covered the consequences of missing student loan payments. At this point, it’s probably fair to say you don’t want any of those things to happen to you.

Fortunately, there are several government programs designed to help if you’re struggling to make your federal student loan payments.

The first step of getting help is to contact your loan servicer as quickly as you can. In many cases, your loan servicer will be able to help you change your repayment plan and lower your monthly payments.

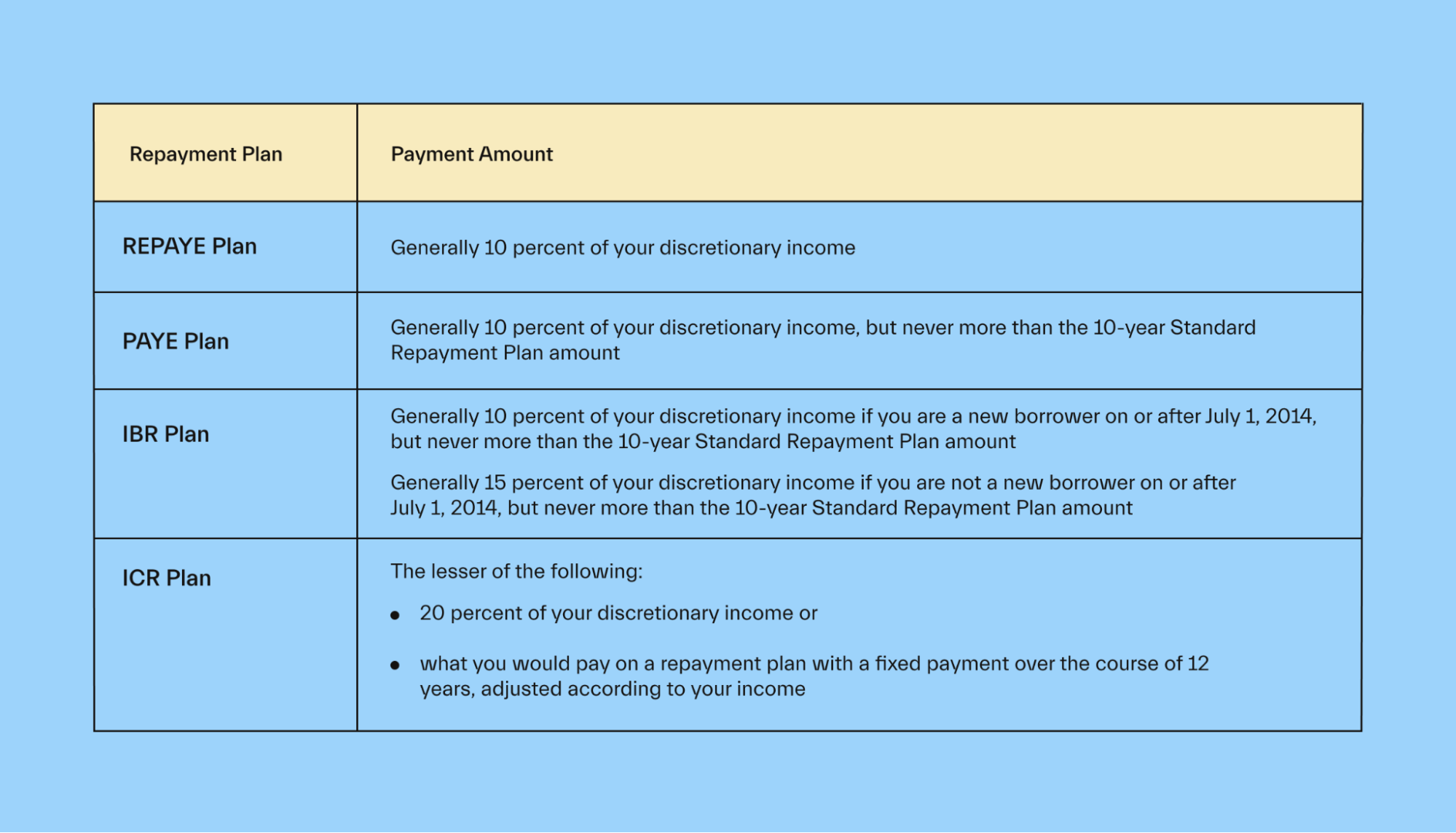

To help you understand how each plan works, we’ll quickly break down a few of those federal student loan repayment plans.

Income-based repayment (IBR)

Income-based repayment (IBR) is a federal student loan repayment method that figures out your loan payments by calculating 10% of your discretionary income— how much money you have after paying for essential things like taxes and living expenses.

One of the best parts of IBR plans is loan forgiveness. If you’re offered a federal IBR plan, any debt you owe after making 300 payments will be forgiven. That equates to 25 years' worth of repayments.

With this plan, borrowers with debt that is more than their annual income will also normally be allowed to lower their monthly payments as soon as they graduate.

It’s important to note that IBR plans aren’t available for all federal student loan types.

IBR payment plans are designed exclusively for borrowers with an existing Federal Family Education Loan Program (FFELP) student loan or a Direct Loan.

Income-contingent repayment (ICR)

An income-contingent repayment (ICR) plan is a lot like an IBR plan—the only real difference is that ICR plans use a different method to decide how much money you can pay back each month.

ICR plans work out your discretionary income using the adjusted gross income (AGI) on your federal income tax return. That number is then compared to the federal poverty level in your area.

So if you live in an area that has a lot of poverty and few resources, you may end up paying less each month.

ICR plans normally ask the borrower to repay 20% of their discretionary income after working out their AGI. After 25 years (or 300 payments), the remaining debt on ICR plans is then forgiven.

Pay as you earn (PAYE)

Just like ICR plans, pay as you earn (PAYE) student loan repayment plans also base your monthly repayment amounts on your discretionary income.

PAYE looks at your AGI from your federal tax return and decides how much you need to pay each month based on that. But, PAYE plans normally base your monthly payments on 10% of your disposable income rather than 20%.

Similar to IBR and ICR plans, people with a PAYE repayment plan are going to benefit from debt forgiveness if they still have an outstanding balance left on their loan at the end of their term.

But unlike IBR and ICR plans, PAYE debt is forgiven after 240 repayments (or 20 years). That means you can be rid of your student loan debt quicker if you have a PAYE repayment plan instead of an IBR or ICR plan.

It’s also important to note that if your debts are more than 2/3 of your annual income when you graduate, you’ll generally be offered reduced monthly payments under a PAYE plan.

Finally, you must bear in mind that PAYE plans are only available for borrowers that have received a student loan as part of the Direct Loan program.

Revised pay as you earn (REPAYE)

Finally, there’s the revised pay as you earn (REPAYE) plans. REPAYE plans are a lot like PAYE plans because they use your AGI to work out repayments amounting to 10% of your discretionary income.

But where REPAYE plans and PAYE plans really start to differ is when you get to loan terms. REPAYE loans aren’t capped at the point of standard repayment, and so the repayment term for REPAYE loans is 25 years (not 20 years like PAYE loans). That’s the same as IBR and ICR loan terms.

REPAYE plans are only offered to students who have received a loan through the federal government’s Direct Loan program.

What to do about private student loans that you can't pay

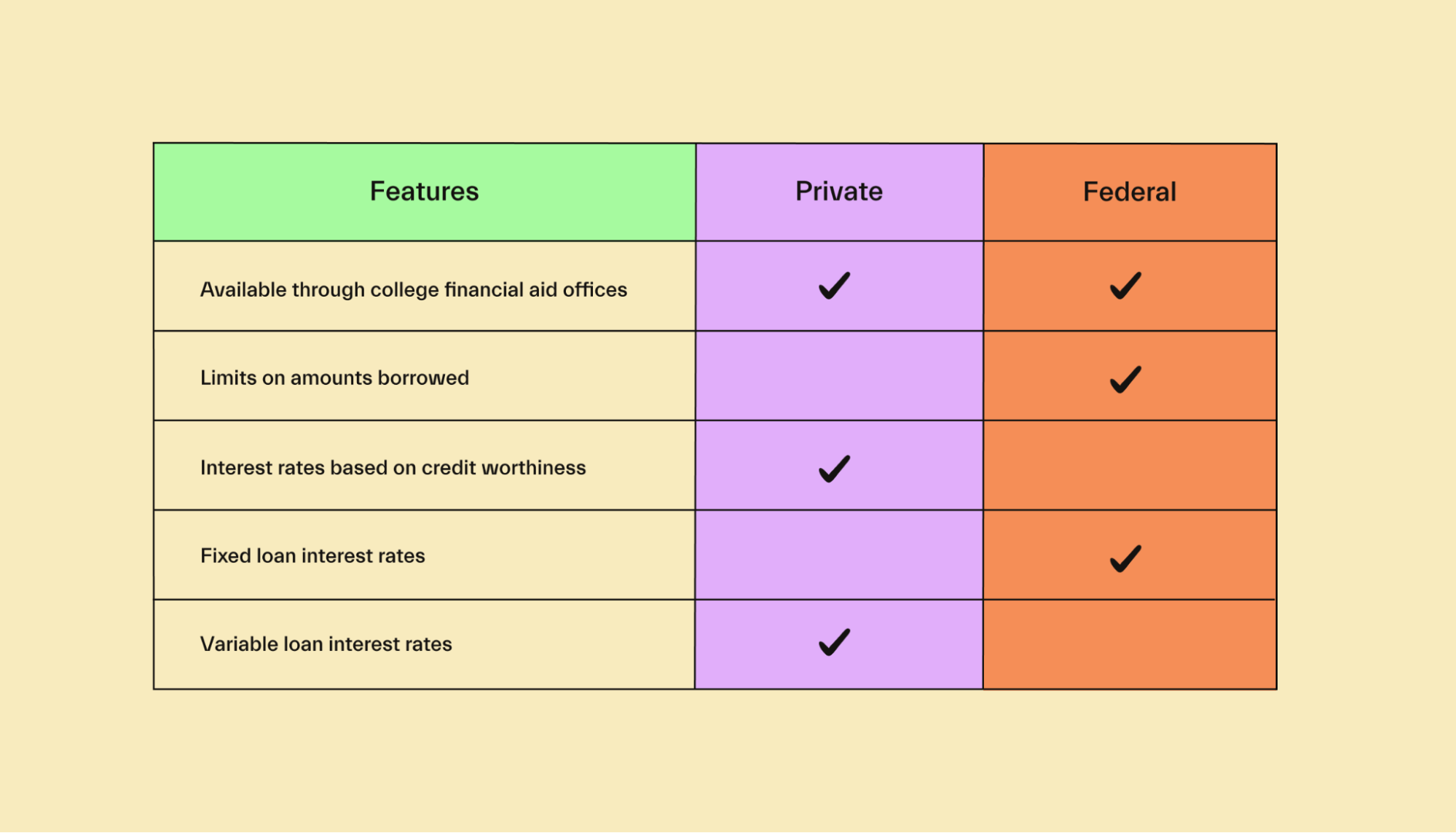

One of the major benefits of securing a federal student loan is that the repayment plan options are pretty straightforward. But if you select an unsubsidized loan from a private lender, your options are going to vary a lot from one loan to the next.

It’s probably going to be a bit more challenging to secure a new repayment plan if you have a private student loan.

If you can't afford your private student loans, the first thing that you’re going to need to do is talk to your lender. Explain the problem you're having, and ask what that lender will be able to do to help.

Options for private loan repayment plans aren’t as well-known as the federal student loan repayment plans that help you pay back Federal Student Aid. But the truth is that most private lenders are generally able to offer some form of assistance program that will help you keep on top of your payments.

After all, it’s in the interest of your lender to help you reach a repayment plan that works for you—otherwise, they’re going to lose money, too.

Another option for private student loan holders is to ask for “forbearance”. Forbearance means that your lender lets you postpone your repayments instead of forcing your account into default of foreclosure.

By securing a temporary postponement of your payments, you might benefit from a little bit of immediate debt relief.

It’s important to note that there are no laws saying that private student loan providers have to offer forbearance to borrowers. But just like repayment plans, a lot of private lenders do so voluntarily.

Beyond securing a new repayment plan or a temporary forbearance, your next best option will be to refinance your private student loan.

If you choose to refinance with another provider, your debt will be transferred to a new account that could offer you a better interest rate or repayment terms that you can actually afford.

Again, it’s important to note that most private student loans don’t benefit from loan forgiveness or income-based repayment options. That’s why most borrowers choose to go for a federal student loan wherever possible.

But if you’ve taken out a private student loan and you’re struggling to repay it, it’s important for you to remember that there are real solutions out there.

You just need to reach out to your lender and be honest about what’s going on in your life and how much you can afford to pay them back.

In a lot of cases, your lender will try to help you get back on track.

Conclusion

We all know college doesn’t come cheap. Even if you’re lucky enough to land a federally subsidized student loan to help you pay for college, keeping up with monthly payments to repay that loan can be tricky for a lot of us.

Failing to keep up with those repayments can cause you major problems. If your loan becomes delinquent or goes into default, it could impact your credit rating, employment opportunities, or even your monthly pay.

You don’t want that to be you—so if you’re having trouble making payments, you need to get in touch with your loan servicer and find out what options you have.

Want to learn more about how to pay back your student loans? Check out our guide on creative ways to pay off student loans and visit our learning hub to find out more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you