Financial aid •

What's need-based financial aid? Everything you need to know before applying

Students who demonstrate financial need can qualify for many programs that can get them thousands of dollars to put toward their education.

College is an important investment in your financial future, but the cost of a college education can feel overwhelming.

Few families can afford $103,456—the average cost that a public university charges for a 4-year degree, and private schools can cost even more.

The good news is that many need-based financial aid programs can help people who can’t afford the full cost of college.

Even if you don’t think you’ll qualify for need-based aid, you might be surprised at what’s available for you.

Let’s discuss the major types of need-based aid and how you can get the most possible aid for your college education.

Types of need-based financial aid

There are three major categories of need-based financial aid that college students can qualify for.

Grants

Grants are some of the best financial aid programs available for students.

If you receive a grant, the organization providing it will usually send your school a check. The school will then apply it to your education costs or refund any extra cash to you. Best of all, you rarely need to pay the money back.

One of the top need-based grant programs is the Pell Grant. The federal government awards Pell Grants to undergraduate students who have not yet earned a bachelor’s degree and who display ‘exceptional financial need’.

The maximum Pell Grant amount for the 2021-2022 school year is $6,495, which can go a long way toward covering the cost of a public school.

The amount you receive is calculated using:

Your Expected Family Contribution (EFC)

The cost of attendance (COA) published by your school

Whether you’re a full-time or part-time student

Whether you plan to attend school for the full academic year or less

Students can receive Pell Grants for a total of 12 semesters. If you take more than 12 semesters to earn your degree, you won’t be eligible for Pell Grants once you’ve hit the limit.

Work-study programs

Work-study programs are another form of need-based aid that students can receive. This type of aid is available to both undergraduate and graduate students who display a financial need.

In short, most work-study programs are federally funded, part-time jobs that usually happen around campus. For example, you might work at your school’s technology helpdesk or in the library.

Some work-study jobs are off-campus with local non-profit organizations or other public agencies. A handful of schools partner with private employers for work-study jobs, but you can only work in roles related to your course of study in these cases.

Like any other job, your work-study will pay you at least minimum wage. But, you may be able to earn more depending on your role.

Graduate students can be paid hourly or on a salaried basis, while undergraduates must work hourly.

Your total earnings can’t exceed your total work-study award amount. So you can’t work extra overtime to rake in more money. Your employer and college’s financial aid office will work together to schedule you properly and ensure that you don’t exceed the allowed earnings.

There are also work-study programs offered by individual states. Each has its own terms and restrictions. For example, Pennsylvania’s program is available to residents who attend a school in the state, are eligible for state grants, and who can gain valuable work experience from the job they find.

Typically, work-study funds are awarded on an as-available basis, so it’s important to apply for work-study jobs as early as possible. If funding runs out, or no jobs are available, you won’t receive any money from this program, despite your need.

Subsidized student loans

The federal government offers direct loans to students that can help them pay for college. Based on your financial needs, you might qualify for subsidized direct loans.

The main advantage of a subsidized student loan is that the federal government covers some of the loan’s cost (aka subsidizes it).

The government will generally pay interest for you:

While you attend school at least half-time

For the first 6 months after you graduate or otherwise leave school

During any periods of deferment (when your loan payments have been put on hold)

This contrasts with unsubsidized direct loans and private student loans, which accrue interest at all times, even while you’re in school and payments aren’t required.

There are limits on how much you can borrow with a direct loan. And there are limits on how much of your loan can be subsidized.

In total, dependent undergraduate students can receive no more than $31,000 in direct loans, of which no more than $23,000 can be subsidized. Independent students can receive no more than $57,500 in direct loans, of which no more than $23,000 can be subsidized.

The amount you can borrow and the amount that the government subsidizes for you will depend on these overall restrictions, as well as your financial need.

How do you receive need-based financial aid?

The most common way to apply for and receive need-based financial aid is to fill out the Free Application for Federal Student Aid (FAFSA). Most schools require that you fill out the FAFSA each year to be eligible.

The FAFSA will ask you and your family to provide financial information, such as how much you earn each year and how much money you have saved. The government and your school will use this information to determine the amount of need-based financial aid that you’ll receive.

On top of federal and school programs, most states also offer need-based aid and use the FAFSA to determine eligibility.

The deadline for the FAFSA is typically the end of June. This is after the academic year ends. For example, the 2021-2022 academic year deadline is 11:59 PM on June 30, 2022.

However, many states and colleges have their own deadlines, and often award aid on a first-come, first-served basis.

If you want to get the most money possible, it’s a good idea to submit your FAFSA as early as you can.

Beyond FAFSA, you can look for opportunities in your local community to apply for scholarships, grants, and other need-based aid programs.

There could be local business sponsorship opportunities or niche scholarships available to students who demonstrate need.

Each will have different application requirements and processes—so be sure to read the requirements carefully before you apply.

If you want to learn more about financial aid opportunities or how to get the most aid, Mos can help by setting you up with a financial aid advisor. Our advisors not only help with the application process; they also help you find opportunities you almost qualify for and let you know how to meet the requirements.

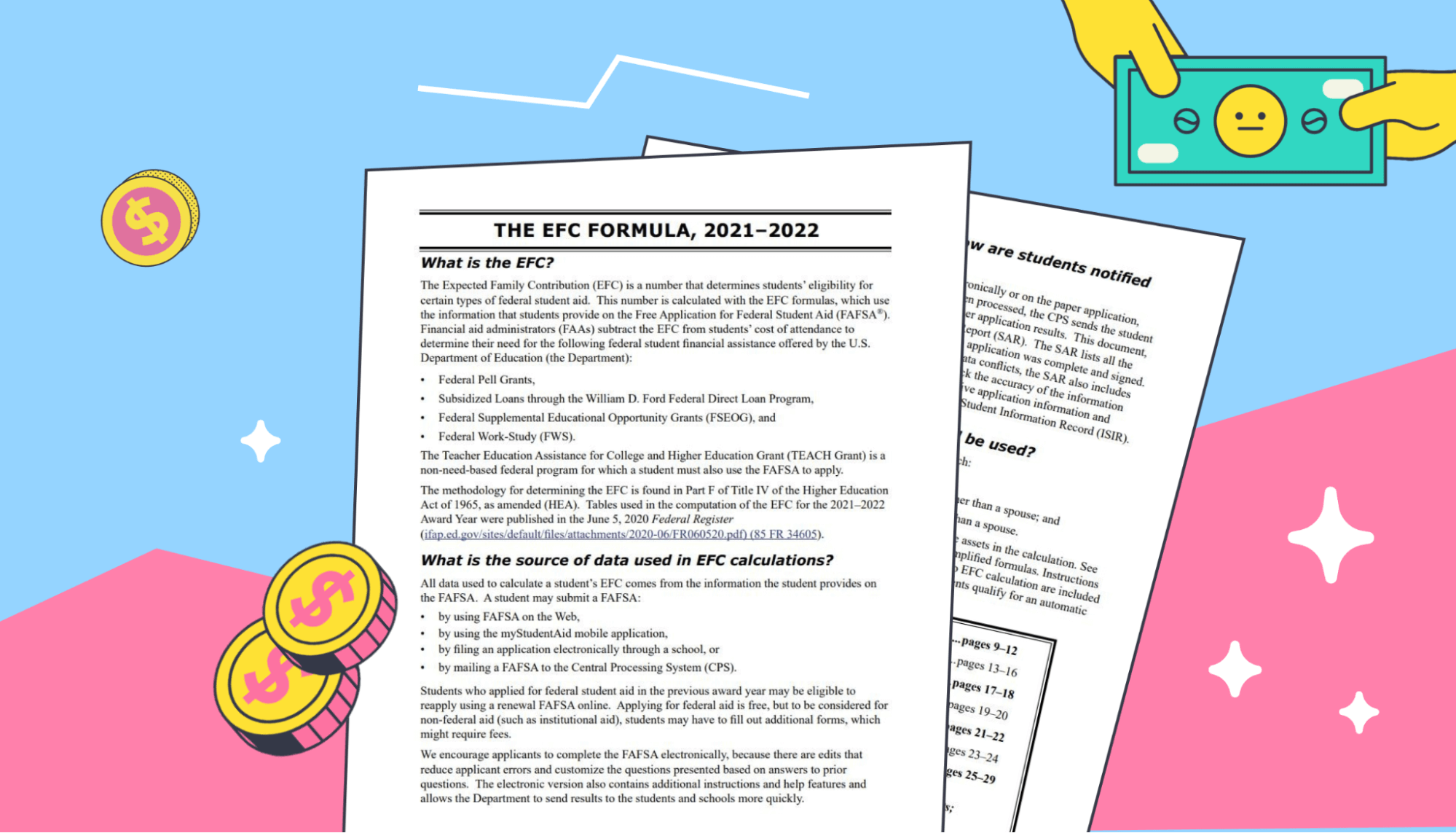

What is the expected family contribution (EFC)?

When you submit the FAFSA, the government and your school will calculate your Expected Family Contribution (EFC) toward the cost of school. This is the amount that you and your family are expected to be able to afford to pay for tuition and other college costs.

Calculating EFC is complicated. The government publishes a workbook that describes the process and includes the formula. It’s 29 pages long and includes almost 50 variables.

If you’re a dependent, the formula looks at things like your parents’ annual income, the amount of tax they pay, any savings they have, including investments but excluding retirement savings, and other assets they could sell to pay for school.

Once your EFC has been calculated, the government and your school will compare it to the cost of attendance to determine your total financial need.

For example, if your program has a $25,000 cost of attendance and your EFC is $10,000, your total financial need will be $15,000.

It’s important to remember that you may not receive aid that’s equal to your financial need. Your financial need is simply a starting point for the government and your school to determine your financial aid package.

Some schools advertise that they meet 100% of a student’s financial need, but most do not.

Be prepared to receive less than your calculated financial need in ‘free’ money (that you don’t have to pay back).

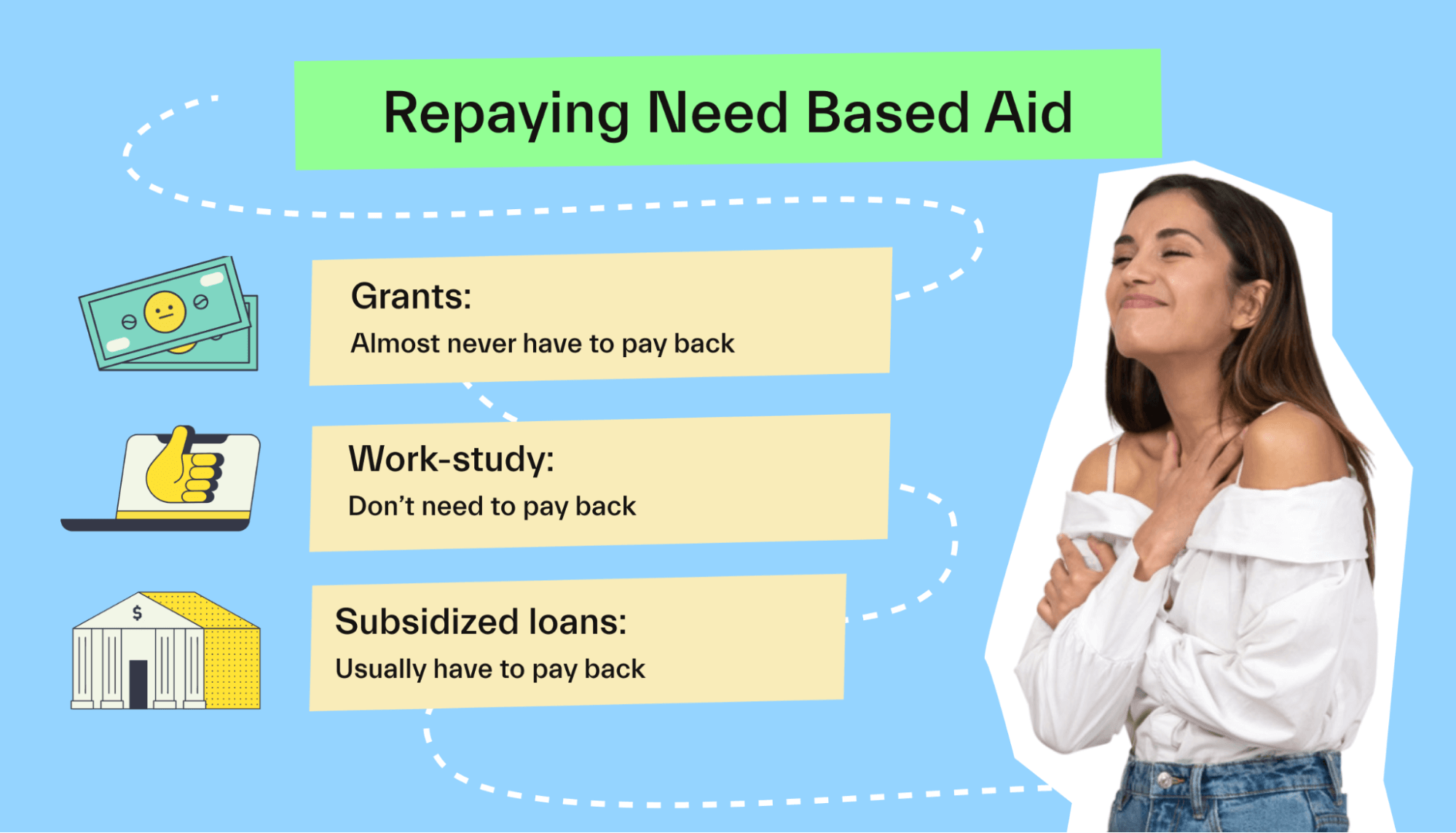

Do you need to repay need-based aid?

One important thing to know about different forms of financial aid is whether you’ll need to pay them back eventually.

The student loan crisis is an ongoing problem in the United States. The average member of the class of 2019 who borrowed money now owes an average of $30,062 in student loans.

In general, the only form of need-based aid that you need to pay back would be student loans, such as subsidized direct loans.

Grants are offered to students and typically require no repayment. Similarly, a work-study program is money you earned by working, so you don’t generally have to pay it back.

You also don’t have to pay back any scholarships that you earn.

Many schools and organizations offer both merit and need-based scholarships, giving you other opportunities to earn financial aid that you won’t have to pay back.

Need-based aid vs. non-need-based aid

The primary difference between need-based aid and non-need-based aid is how the organization offering the aid decides to award it to you.

For need-based aid, the offering organization gives it to you for purely financial reasons.

You’ve illustrated that you need financial assistance to pay for your education and need-based aid helps cover that gap. This is true whether it comes in the form of grants, scholarships, work-study, or subsidized loans.

Non-need-based aid is awarded for reasons other than displayed financial need.

For example, if you earn a merit scholarship for good grades in high school or an athletic scholarship for playing a sport, that’s non-need-based financial aid.

Other scholarships and grants you receive can also qualify as non-need-based aid, assuming the awarding organization does not consider your financial need when making its choice.

It’s important to remember that the total amount of financial aid that you receive cannot exceed your school’s cost of attendance.

For example, if the cost of attendance is $20,000 and you receive $15,000 in need-based aid, you can only accept up to $5,000 in non-need-based aid.

Of course, ‘cost of attendance’ is not just tuition and fees. It also includes things like room and board, books, transportation, and more.

FAQs about need-based financial aid

How can I get the most financial aid?

One of the most important things you can do to maximize the amount of financial aid you receive is filling out the FAFSA as early as possible.

Many state programs award need-based aid on a first-come, first-served basis. If you wait too long to file your FAFSA, these programs could run out of money, and you could miss out on aid you would have otherwise received.

You should also look for scholarship and grant programs in your local community and from larger, national brands.

Many companies and organizations offer scholarship programs, and every dollar you qualify for can help pay for school.

Mos can help you find some of the best programs to apply for and help you get the greatest possible amount of financial aid.

Should I apply for need-based financial aid even if I don’t need it?

Yes, you should apply for need-based financial aid even if you don’t think you need it.

Many schools want students to submit the FAFSA and make it a requirement to receive any form of student aid, even something merit-based. You may also be surprised at what you’re eligible for.

Applying for aid can never hurt, so it’s worth taking the time to fill out an application, just in case.

What should I do if I don’t get enough aid?

Need-based student aid isn’t guaranteed to make up the full difference between the cost of your program and your Expected Family Contribution. If you don’t receive enough aid, there are a few things you can do.

One option is to talk to your college’s financial aid office. You may be able to work together to find additional funds that you can use to pay for school or negotiate your award letter.

Check out niche scholarships and grants, as well as state and local financial aid that require their own applications. You can also appeal your FAFSA award if your circumstances have changed since your application or if you have a unique situation you feel they should consider.

You could also turn toward other sources of funding, such as private student loans. Just remember that these loans can be very expensive, and you will have to pay them back eventually.

Yet another option is to choose a more affordable school.

Conclusion

Need-based aid is one of the best ways to get help paying for college. Make sure you remember to fill out your FAFSA and take steps to maximize the need-based aid you qualify for.

With need-based aid, merit-based aid, and other sources of funding, you can help bridge the gap between your ability to pay and the cost of school.

If you’re looking for the best way to pay for school, Mos can help.

With Mos, you can get help negotiating for more financial aid, applying for hundreds of scholarships and grants with ease, and work with an advisor. Get started today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you