Financial aid •

December 15, 2022

10 facts about financial aid in 2023

Learn 10 important facts about financial aid in 2022.

A huge part of planning for college is figuring out how to pay for it.

About 84% of college students get some type of financial aid to help make ends meet.

Still, over $2 billion in student grants (free money that you typically don’t have to pay back) goes unused every year!

To help you make the most of the available financial aid, let’s review 8 financial aid facts that you need to know.

1. Some financial aid is free money

College isn’t cheap, and many families can’t afford to pay for all college expenses. But, student loans should never be your first choice—eventually, you have to pay that borrowed money back.

When looking for financial aid, first seek free money (scholarships and grants) and earned money (work-study programs). You should only consider borrowed money after you’ve exhausted those types of financial aid.

You can qualify for free money by showing a financial need or some form of achievement—even something as crazy as making the coolest duct tape prom dress.

Free money is free financial aid because you don’t have to pay it back as long as you attend school, at least part-time.

Let’s review 2 types of free money: grants and scholarships.

Grants

A grant is free money often based on financial need. To qualify for grants, you show that your and your family’s income aren’t enough to pay for college.

Grants are available from state governments, colleges, and private organizations.

Many grants come from the federal government. For example, the Federal Pell Grant is a federal grant of up to $6,495 for undergraduate students.

Other federal grants are available for students pursuing specific careers. The Teacher Education Assistance for College and Higher Education (TEACH) Grant is a federal grant for undergraduate and graduate students in eligible schools pursuing a career in teaching.

However, keep in mind is some grants come with specific rules. For example, if you receive the TEACH Grant, you must complete a certain service obligation, or the grant will be converted into a loan.

Scholarships

A scholarship is another type of free financial aid you usually don’t have to pay back after graduation.

Schools and private organizations offer scholarships to attract students to a specific school or pursue a career in a specific field or industry.

You can qualify for a scholarship based on many factors, including:

Academics

Athletics

Artistic talent

Leaderships

Community service

Financial need

Area of study

Race or ethnicity

Family background

While all grants require you to prove financial need (meaning you need additional help to pay for college expenses), not all scholarships do.

A merit scholarship is a form of financial assistance that’s awarded based on some form of achievement. And there are a ton of niche scholarships out there to choose from, which can be based on anything from your height to your diet.

An important thing to keep in mind with scholarships is that they may have some requirements that you must meet in order to keep them. For example, you might have to maintain a certain GPA or pursue a specific type of degree. If you don’t meet these requirements, you could lose your scholarship.

2. You can work and keep your financial aid

When you receive free financial aid, such as a grant or scholarship, you’re still able to have a job and keep your financial aid. You may even be able to work to earn more financial aid through a work-study job.

Work-study jobs

Earned money is another type of financial aid for students with financial needs. Work-study jobs are available to eligible undergraduate and graduate students.

About 18% of students earn financial aid through work-study jobs every year! Work-study positions are available on and off-campus.

Universities, local nonprofit organizations, and the federal government employ students through work-study jobs.

Keep in mind that most work-study jobs pay an hourly minimum wage. On average, undergraduate students earn $1,794 per year through federal work-study jobs.

Work-study awards also have a cap on how many hours you can work. If you want to work additional hours, you'll have to earn an additional federal work-study award.

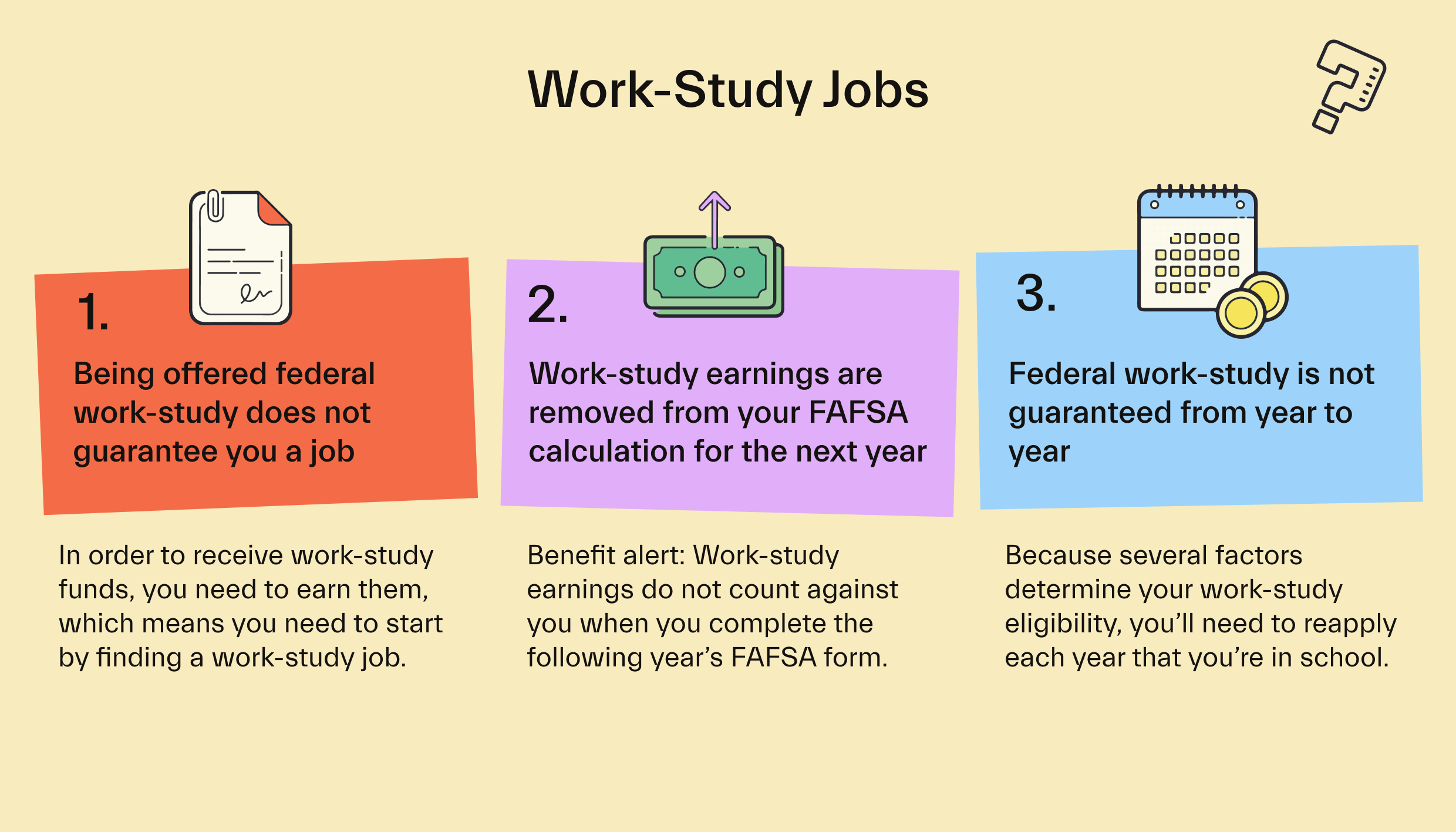

FAQs about work-study jobs

Let’s look at some frequently asked questions (FAQs) about work-study jobs.

Does receiving a work-study award guarantee me a job?

No, you still need to find an eligible job.

Landing a work-study job is a first-come-first-serve process, so plan to apply for jobs as soon as you find out about your award. There are jobs available on and off-campus.

Do earnings from a work-study job affect my next year’s FAFSA?

No, you can deduct what you earn from your work-study from your income reported on your FAFSA.

Will my work-study job carry on to next year?

Not necessarily. You first have to complete a FAFSA every year. You can continue a work-study job only if you receive a work-study award again the next year. Keep in mind that your current employer would also need to rehire you.

3. Need-based financial aid is available in all sizes

A common misconception about need-based financial aid (free financial aid for students with financial needs) is that it's only available to students with very low incomes.

This misconception may explain why the number of students completing the FAFSA continues to decline—68% of families completed the FAFSA for the 2020-2021 school year, which is 9% less than the year before.

The reality is that the federal government has about $30 billion in federal grants available each year—$2 billion of which goes unused.

Because of how much there is available, need-based financial aid is available in all sizes.

A Federal Pell Grant for undergrad students ranges from $639–$6,495 per year. The average amount for this type of financial award is $3,900.

The federal government decides how much money you receive using your expected family contribution (EFC), which is the amount of money they think your family can afford to put toward your college education (not the money they actually do pay).

Even if you weren’t eligible for a Federal Pell Grant due to a high EFC, you might still qualify for other types of grants.

For example, the Iraq and Afghanistan Service Grant is free money for students who had a parent or guardian who died during military service in Iraq or Afghanistan.

If you can’t get any federal grants or they don’t provide enough aid, some states have their own grants and use the FAFSA to determine eligibility.

For instance, students resident in New York can win additional funds through the NYS Tuition Assistance Program. All they have to do is fill out a short application immediately after submitting their FAFSA.

You need to submit your FAFSA every year to find out what financial aid you qualify for.

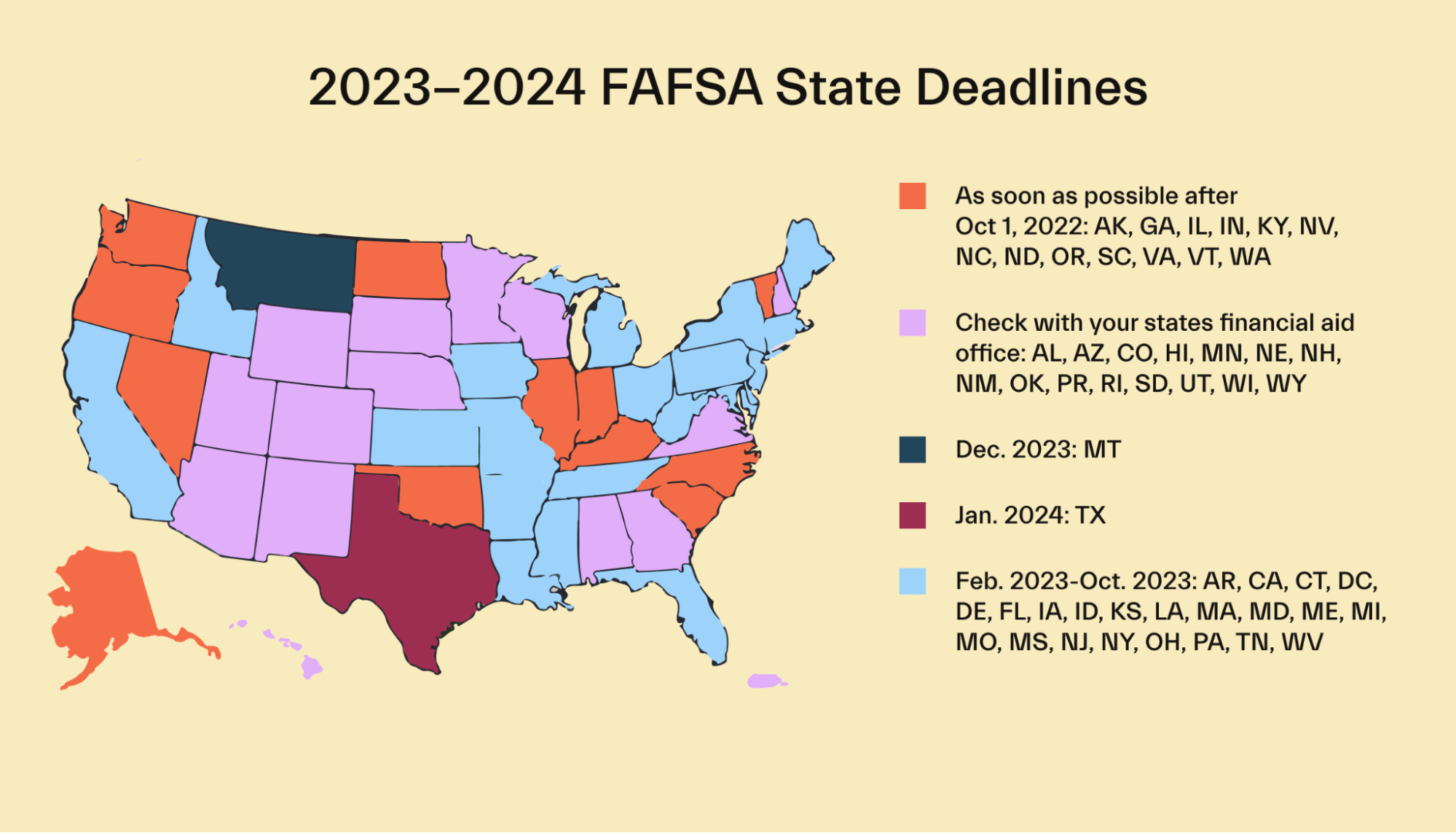

4. The FAFSA deadline varies per state

You’ll need to complete your FAFSA every year to be eligible for free and earned money.

The federal FAFSA deadline is June 30 of the academic year you attend. So, the FAFSA deadline for the 2022–2023 school year is June 30, 2023, and for the 2023-2024 school year, it’s June 30, 2024.

However, depending on your school's state, that deadline might be sooner. For example, if you plan to attend a Connecticut school, the FAFSA state deadline is in February. Schools in some states, such as North Carolina or North Dakota, assign FAFSA on a rolling basis until funds are gone, so the sooner you fill out the FAFSA, the better.

Here’s a map showing the 2023-2024 FAFSA state deadlines across the US:

In addition to the federal and state deadline, your specific school may also have a different deadline.

While the best date to fill out the FAFSA is as soon as possible, check with your school’s financial aid office to learn more about school and state-specific deadlines.

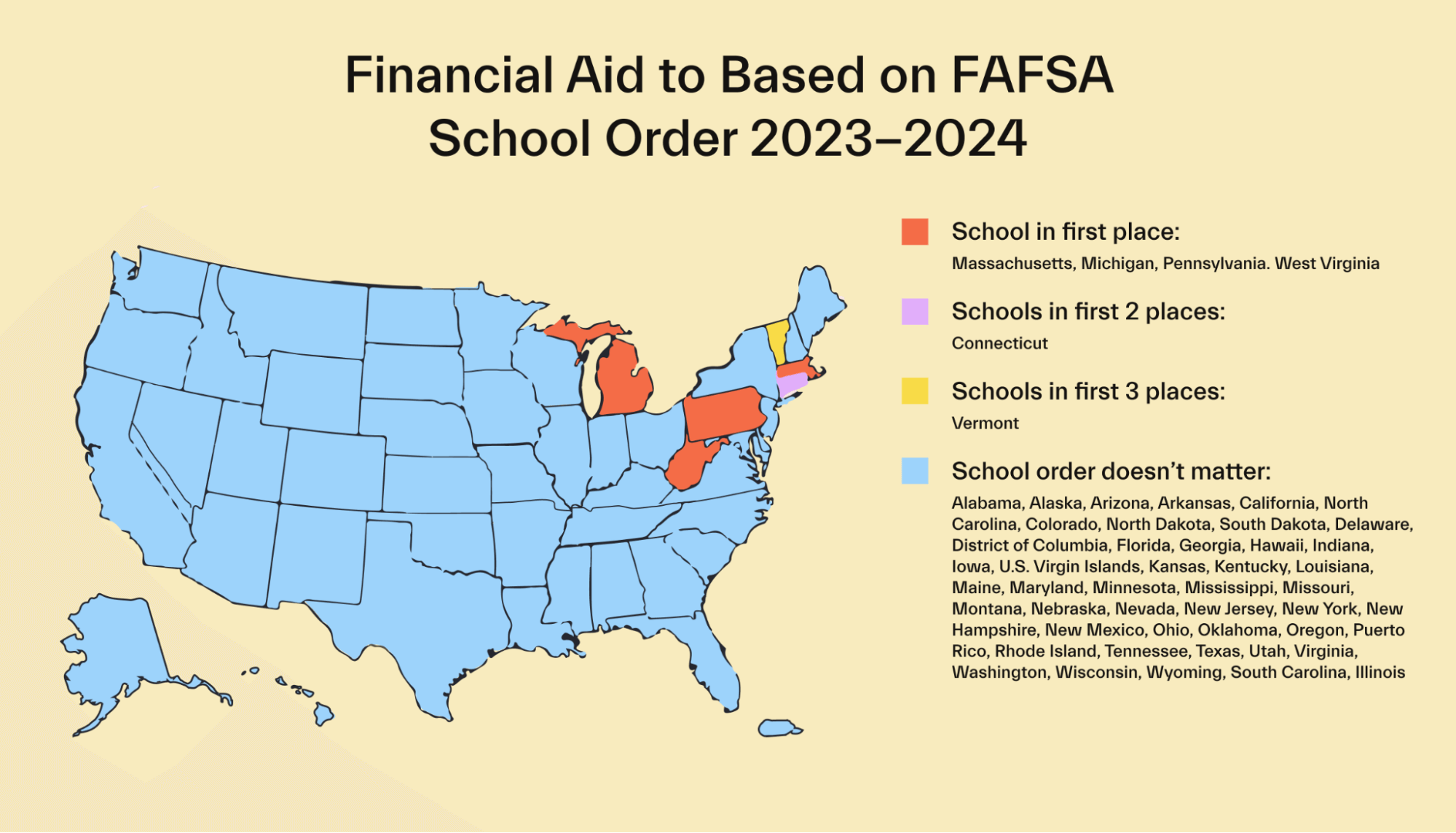

5. You can enter up to 10 colleges in your FAFSA

You have to fill out a FAFSA every year. Each year, you can list up to 10 colleges.

All of those schools will receive a report on your FAFSA that year. It’s a good idea to include all schools you’re considering to save time in the application process.

For federal financial aid, the order of the schools in your FAFSA doesn’t matter.

But the order of schools in your FAFSA is important in certain states. Some states only award state aid to your top choice of school. Other states award financial aid regardless of the order of your school choices.

That can be a bit confusing, so let’s break down which states care about the order of your school choices and which don’t. The following states award financial aid to:

School in first place: Massachusetts, Michigan, Pennsylvania, West Virginia

Schools in first 2 places: Connecticut

Schools in first 3 places: Vermont

School order doesn’t matter: Alabama, Alaska, Arizona, Arkansas, California, North Carolina, Colorado, North Dakota, South Dakota, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, US Virgin Islands, Kansas, Kentucky, Louisiana, Maine, Maryland, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Jersey, New York, New Hampshire, New Mexico, Ohio, Oklahoma, Oregon, Puerto Rico, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, Wyoming

However, if you end up changing your mind about where you want to attend, don’t worry. Suppose you’re in one of the states that cares about the order of schools on your FAFSA. In that case, you’ll need to contact your state agency and prospective university to get your financial aid award transferred to the school you actually want to attend.

That said, you can add more than 10 schools after you receive your student aid report. You can do so in a few ways:

Log into your online FAFSA application and navigate to the button that lets you make FAFSA corrections. Then, add the school codes for the schools you want to send your FAFSA information to.

Call the Federal Student Aid Information Center, provide them your Data Release Number from your SAR, and give them the school names.

Make the changes on your paper SAR copy and mail it back to the Federal Student Aid office.

To learn more about the FAFSA order of schools in your specific state, visit this website.

6. The FAFSA isn’t the only application to seek financial aid

The College Scholarship Service (CSS) Profile is another application you can fill out to seek non-federal financial aid at some private schools.

Unlike the FAFSA, the CSS Profile has a $25 fee, plus an extra $16 fee per added school report.

Filling out the CSS Profile is a worthwhile investment—private school tuition can be more expensive than tuition at public schools, and 83% of students at 4-year private colleges receive some form of financial aid.

About 200 schools require a CSS profile as an aid assessment tool. You can see the list of which schools require it here.

Financial aid can also come from your state’s department of education or other education agency. Contact your state agency or the financial aid office at your prospective university for more details because options vary from state to state.

Lastly, as mentioned, you can seek out grants and scholarships from organizations not part of the federal government, such as nonprofits and businesses.

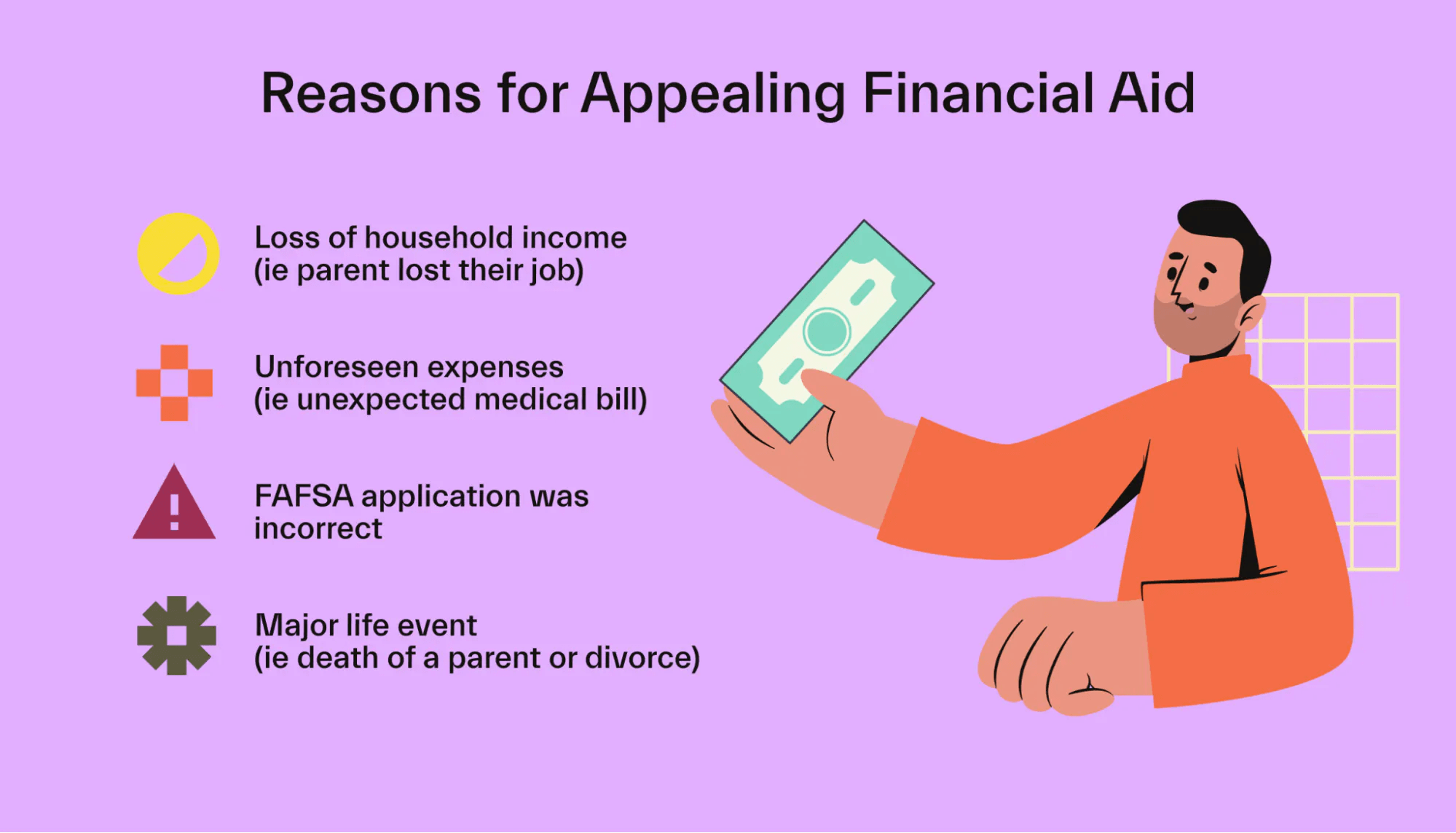

7. A financial aid offer isn’t set in stone

Your financial aid offer isn’t final until you accept it. Think of the first financial aid offer as the beginning of a negotiation.

If you don’t get as much aid as you were hoping for on your financial aid offer, you can still try to negotiate or appeal your financial aid award.

If your financial situation changes dramatically, you go through a major life event (e.g., death of a parent or spouse), or you made an error in your FAFSA, your school’s financial aid letter may not match your current financial needs.

If any of these apply to you, you should try to appeal your financial aid.

Tips for appealing financial aid

Here are some tips to keep in mind if you decide to appeal your financial aid award:

Find out if there’s a deadline and the name of the financial aid officer you’ll be sending your appeal to. Submit your financial aid appeal to your school’s financial aid office as soon as possible.

Write a financial aid letter. Break down the reasons for your appeal in detail.

Include necessary supporting documentation. You can strengthen your case by including documents that back up each one of the reasons that you mention in your letter.

Proofread your letter and review the entire package. This can help reduce the chances of delaying your appeal due to accidental errors.

Review our full guide on how to appeal your financial aid letter.

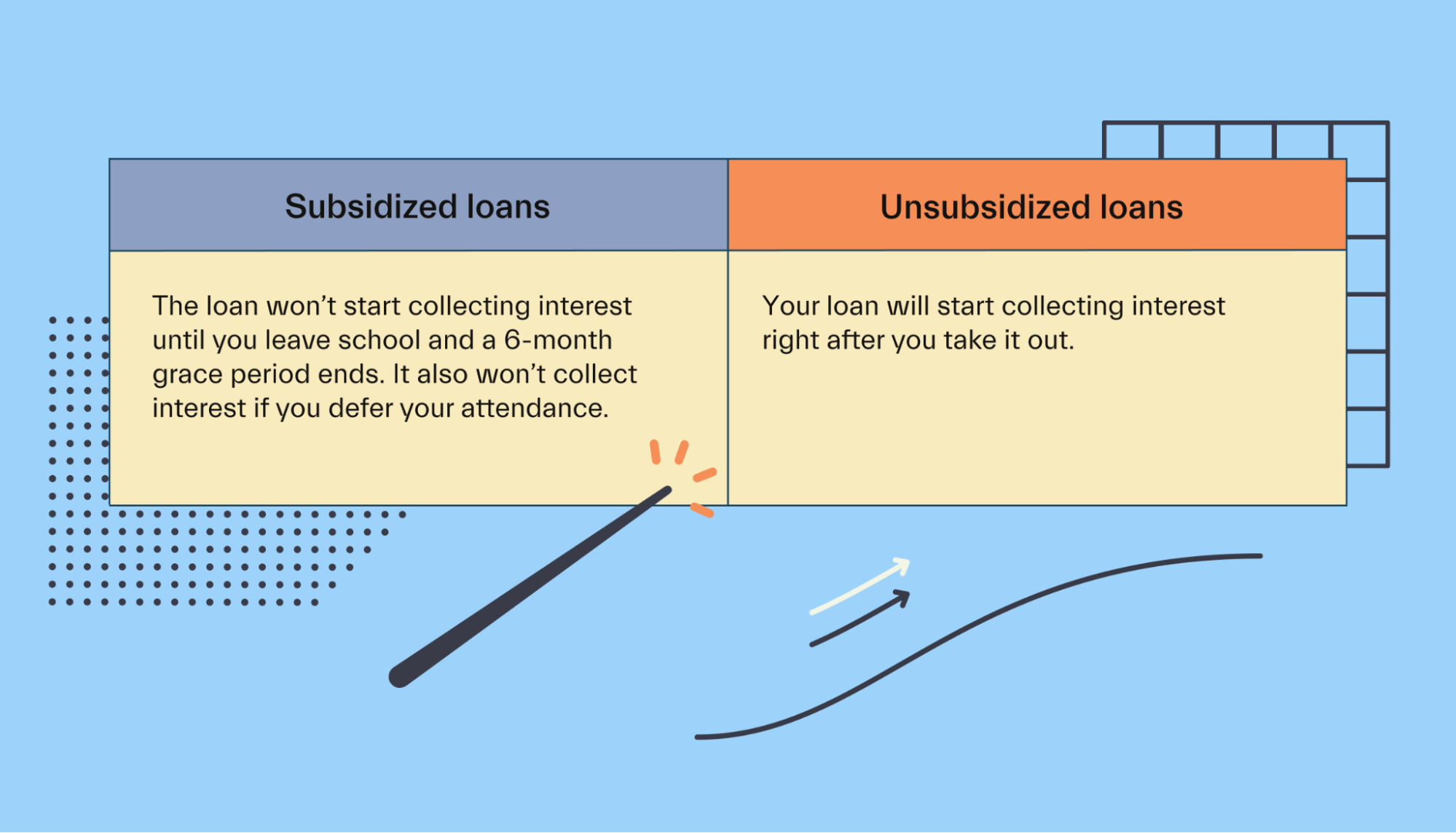

8. Some student loans don’t start building up interest from day 1, but all private loans do

Once you’ve covered all your options for free financial aid and work-study jobs, you’ll have to figure out how to pay for the rest of your college expenses.

At this point, you can consider taking out a student loan. You’ll have the option to borrow money to pay for college from the federal government or private organizations.

If you have to seek a student loan, start with federal subsidized loans (also known as direct subsidized loans because you borrow directly from the federal government).

Why? With a federal subsidized loan, the US Department of Education will pay for the interest of the loan while you attend school part-time. You won’t have to start making any payments until after you graduate and a 6-month grace period ends.

Unlike a federal subsidized loan, all private loans aren’t subsidized—they accumulate interest from day 1.

Choosing a federal subsidized loan over a loan without a subsidy will save years’ worth of interest while you complete your degree!

You can read our article about how student loans work to learn more.

9. The federal government offers loan repayment assistance and forgiveness programs

Two other substantial benefits offered by federal loans are income-driven repayment plans and loan forgiveness.

Income-driven plans set your payment based on your family size and discretionary income to help you afford your payments. There are four kinds that each calculate your payment differently.

They also all offer loan forgiveness after at least 10 years of successful payments, depending on the plan you qualify for.

Speaking of loan forgiveness, the federal government may erase some or all of your student loans under various programs.

The Public Service Loan Forgiveness program is among the most well-known. Anyone who works for the government or in a public or non-profit organization, such as teachers and firefighters, can qualify.

The government offers several others, and private employers may even provide student loan assistance or tuition reimbursement to help you cover student debt costs.

Keep in mind that if you refinance your federal loans into private student loans, you lose all of these benefits.

Private loans may be forgiven in certain circumstances, but it’s very difficult. Most people aren’t able to have private loans forgiven.

10. Students loans can help you start building credit

A good credit score helps you get a credit card, buy a car, refinance loans, and take out a mortgage—and do so at the best interest rates and terms.

But new credit users have a dilemma: building credit when they have no credit.

That’s an overlooked benefit of student loans. These loans are reported to the credit bureaus, meaning you can build credit if you make consistent on-time payments once you’re in repayment.

Both private and federal loans offer credit-building benefits. However, federal loans generally don’t require a cosigner, which is someone with a good credit score who agrees to take on the debt if you can’t.

Therefore, federal student loans can be a great way to get your credit history and score started early on. When it’s time to buy that house or car, you could be much more likely to get great rates.

Conclusion

Receiving financial aid can help you make the most of your studies. A strong financial aid package helps you cover your college costs and enables you to focus on school instead of paying bills.

College can be expensive—but Mos is here to help. Our mission is to tear down financial barriers and make higher education more accessible.

You get access to the largest scholarship pool in America with Mos, and you can even get help from a personal advisor who will navigate you through the scholarship process.

Want to learn more about the financial aid available to you? Find the best Mos membership plan for you.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you