Financial aid •

June 20, 2022

The complete guide to the NYS Tuition Assistance Program (TAP)

New York has many great colleges, but they can be pricey. Learn about the NYS TAP financial aid program and see if you qualify for this New York aid program.

Students in the Empire State have a lot of great options for schools, from elite universities like Cornell and New York University (NYU) to the renowned City University of New York (CUNY) and State University of New York (SUNY) public institutions.

However, most aren’t cheap, and the state of New York realizes that. They provide New York resident students with the NYS Tuition Assistance Program to help them afford school and encourage students to study in New York.

Below, we’ll discuss what the TAP is and how to see if you qualify. We’ll also cover some other forms of aid New York residents can take advantage of to lower the cost of higher education in the Empire State.

What is the NYS Tuition Assistance Program?

The New York State Tuition Assistance Program helps resident students of New York state pay for school if they demonstrate financial need.

It’s a grant administered by the NYS Higher Education Services Corporation (HESC), so you don’t have to pay it back if you’re awarded some money through the program.

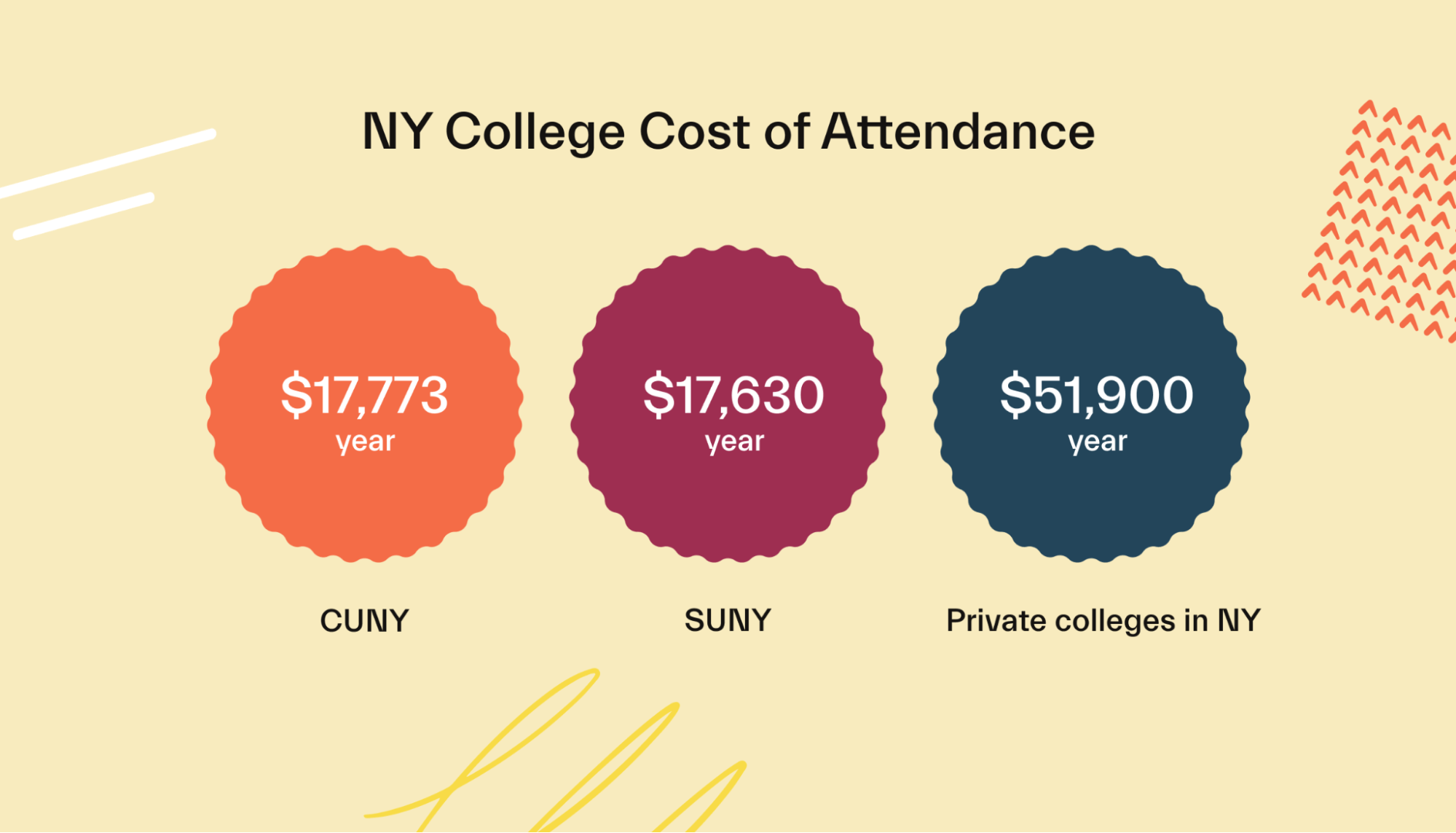

As previously mentioned, New York state has many excellent schools. They’re known for the CUNY and SUNY systems but are also home to great private institutions like Cornell, NYU, and Syracuse.

Tuition prices can make it hard for bright minds to afford these schools. CUNY and SUNY costs of attendance can average nearly $18,000 per year for NY residents, and private NY colleges can climb to $51,900 per year.

If you’re a New York state resident, applying for the TAP program can be a huge help in paying for your dream school within the state.

Am I eligible for TAP?

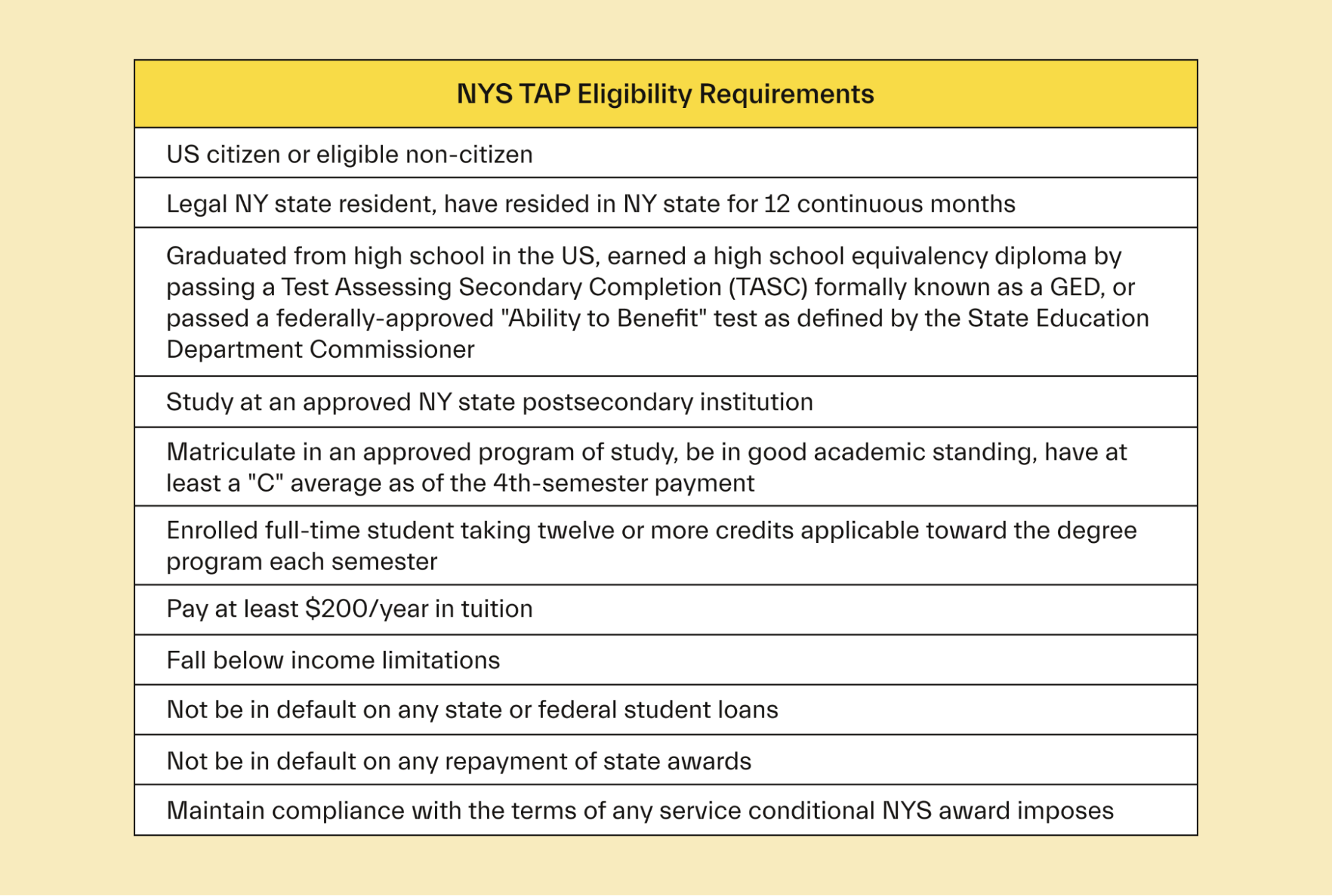

You are eligible for the TAP program if you meet all of the following requirements:

Current New York state resident and have resided in New York state for 12 continuous months

US citizen or eligible noncitizen

Graduated from a US high school in the United States, earned a GED, or passed a federally approved "Ability to Benefit" test as defined by the State Education Department Commissioner

Study at an approved New York state postsecondary institution

Be in an approved program of study and be in good academic standing with at least a "C" average as of your 4th-semester payment

Be enrolled full-time, taking 12+ credits applicable toward your degree program each semester

Be charged at least $200 tuition per year

Meet income eligibility limitations (see below)

Not be in default on any state or federal student loans and not be in default on any state award repayment

Comply with the terms of any service condition imposed by an NYS award

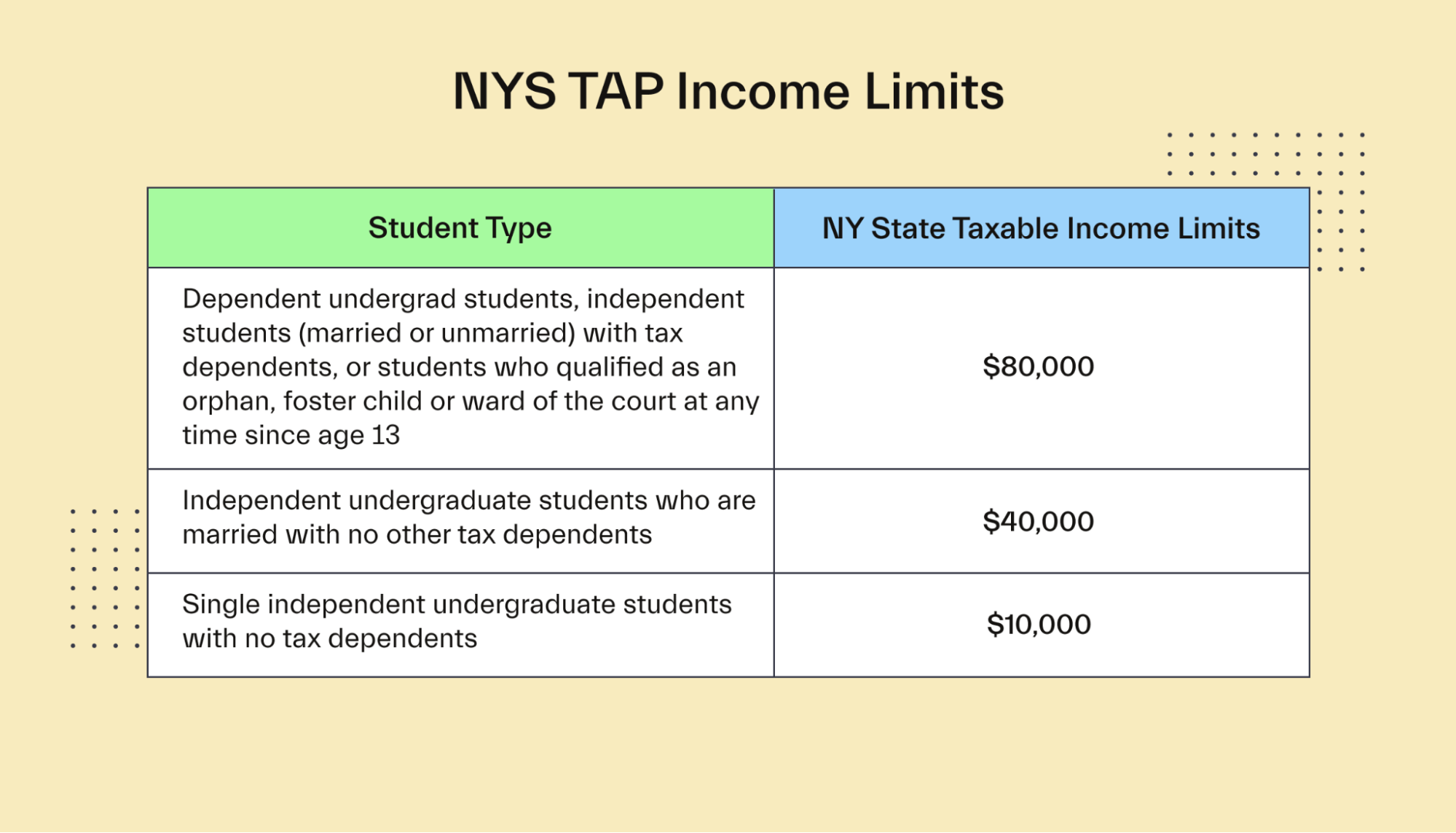

Income limits

TAP has income limits as well based on your taxable income earned within the state of New York. The exact income limits vary based on tax filing status and dependents.

Here are the limits:

$80,000: Dependent undergraduate students, independent students (married or unmarried) with tax dependents, or students who qualified as an orphan, foster child, or ward of the court at any time since age 13

$40,000: Independent undergrad students who are married with no other tax dependents

$10,000: Single independent undergrad students with no tax dependents

How to apply for TAP

You should complete the Free Application for Federal Student Aid (FAFSA) every year if possible. Aside from qualifying you for all kinds of federal aid, it shows you your eligibility for the TAP program if you’re a student in New York.

Applying for the FAFSA doesn’t take too long. You’ll need your parents’ financial information—or your own if you’re independent—then you’ll have to make an FSA ID log into your FAFSA.

From there, you’ll fill out all the necessary information and apply for the FAFSA.

Once you finish the FAFSA and arrive at the submission confirmation page with your confirmation number and data release number, there will be a button linking directly to the TAP application.

If you missed the TAP application on your FAFSA, you can still apply. The HESC will send you an email or mail you instructions for applying online within 3–4 days of completing the FAFSA.

Other New York-specific financial aid

TAP is perhaps the best-known New York financial aid program, but it’s not the only one New York students can take advantage of.

Consider these if you’re a New York resident and you need more aid beyond FAFSA and TAP aid.

Aid for Part-time Study

The Aid For Part-Time Study program is available for students in New York who are in school part-time, meaning 3–12 credit hours per semester or 4–8 credit hours per trimester. Students can earn up to $2,000 or their total tuition, whichever is smaller.

The eligibility requirements are generally the same as the TAP program. APTS also has income limits based on certain tax criteria like taxable income, filing status, dependency status, and number of dependents.

If you’re interested in applying, you can get an application from your school. Funds are limited and first-come, first-served, so make sure you apply ASAP if you’re a part-time student who needs help paying for school.

NYS Educational Opportunity Program

The Educational Opportunity Program is a state-funded program for New York students considered economically disadvantaged and who may otherwise be financially unable to attend college.

This is more than a scholarship or grant. It provides several services, including financial help, a summer pre-entry program that introduces students to college expectations, tutoring, and counseling for academic and career matters.

Excelsior Scholarship

The Excelsior Scholarship helps New York students cover any remaining college expenses after other federal and state grants and scholarships, including things like TAP.

Excelsior Scholarships can award up to $5,500 to cover these expenses. Most of the eligibility requirements are the same as the TAP program. Income limits change each year to adjust for inflation. For the 2021-2022 academic year, the family adjusted gross income limit was $125,000.

If you still need aid after everything else, consider the Excelsior Scholarship.

Enhanced Tuition Awards Program

Private colleges are generally more expensive than their public counterparts.

The Enhanced Tuition Awards Program is for students attending participating private colleges within the state of New York who opt into the program. It essentially supplements the TAP program.

Schools must provide a match of up to $3,000 and freeze the student’s tuition when they win to offer the maximum benefit to the student.

Altogether, students can receive up to $6,000 in combined TAP, school match, and ETA awards.

Other ways to pay for school in New York

TAP’s a great program for students in New York, but it won’t pay for everything.

Consider the following options to secure or earn more money for college.

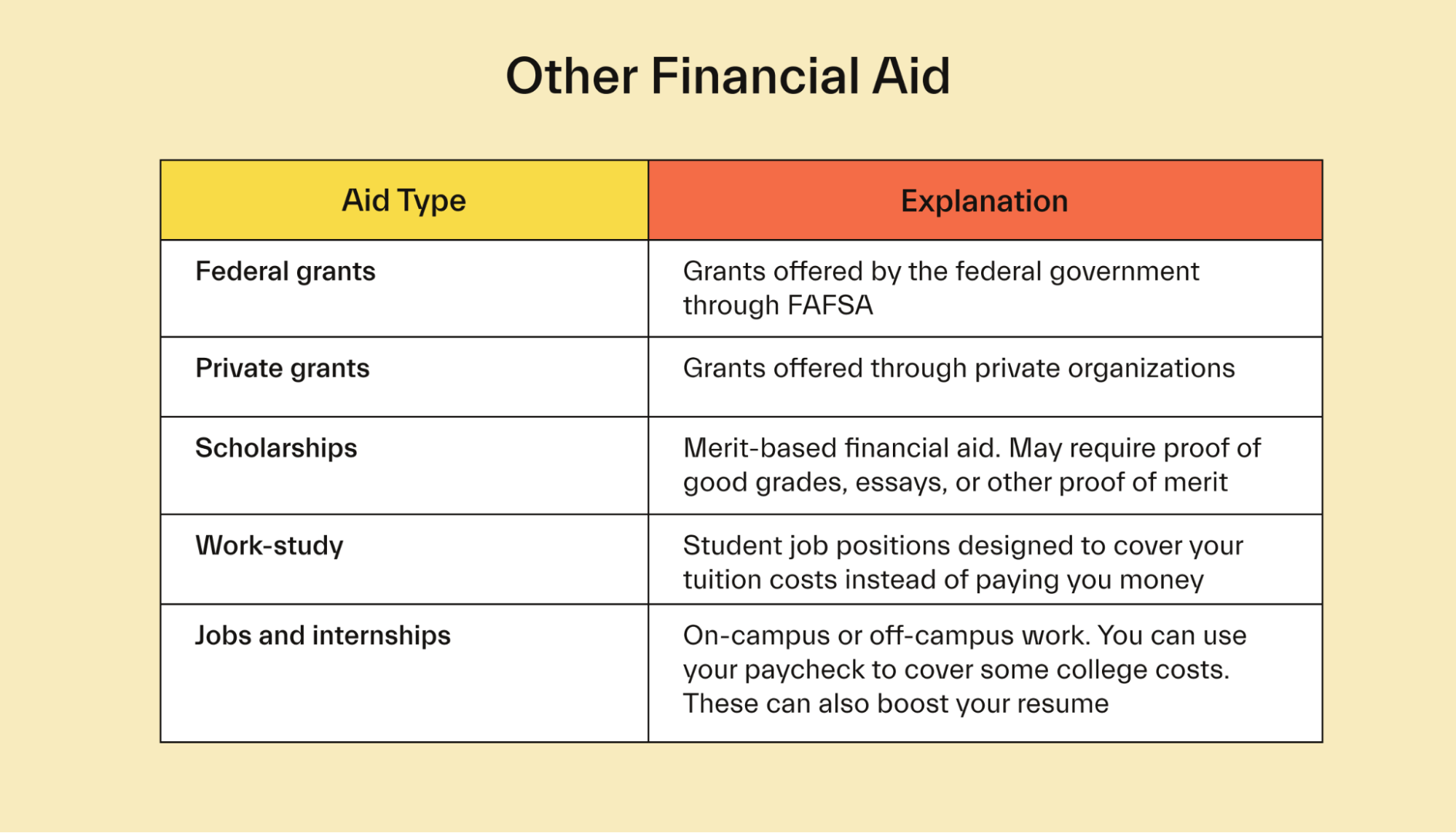

Federal grants

The federal government offers several grants to students with financial needs. Just like NYS TAP, you don’t have to pay these back.

For example, the Pell Grant is the most well-known. Every year, the average Pell Grant winner gets almost $4,500 in aid. Combining that with the NYS TAP could cover nearly half a year’s tuition—all debt-free.

The other major grants offered by the federal government include:

Federal Supplemental Educational Opportunity Grants (FSEOG)

Iraq and Afghanistan Service Grants

Teacher Education Assistance for College and Higher Education (TEACH) Grants

Like the TAP program, you can qualify for federal grants by filling out the FAFSA each year. You’ll see how much Pell Grant money you qualify for on your student aid report, a document sent to you after submitting your FAFSA.

Non-government grants

There are thousands of public and private grants beyond federal grants and the TAP program. They’re basically all need-based and designed for specific groups (like certain majors or schools), but some include a merit component.

You can apply for these grants at any time throughout the year to win free money that you don’t have to repay.

Scholarships

Scholarships are another form of money you don’t have to pay back. The difference is most scholarships are based on merit—they’ll weigh factors like your grades, extracurriculars, and other relevant information.

Some scholarships are easy to apply for, only requiring a short application. Others are longer, asking you to answer one or more questions with an essay or video.

Many scholarships are specific to certain niches. For instance, they may be designed to help students of particular minority groups afford college. Other niche scholarships could be targeted toward students in certain majors or people who live in specific states.

You can find tons of scholarships online and you can use a service like Mos to identify the scholarships that fit your situation.

Work-study program

Work-study is a federal aid program that lets you work part-time, up to 20 hours per week. Instead of getting paid directly, the money you’d earn covers your education costs.

These jobs are often related to your major, such as working in your major’s department at the school as a research assistant. However, you could also get something more general, like a dining hall job.

Additionally, some work-study jobs are off-campus at nonprofits, public agencies, and some small businesses.

Jobs and internships

If you don’t qualify for work-study, consider getting a non-work-study job to make some money for college.

On-campus jobs, like the dining hall or a department office, tend to be more flexible about scheduling around your classes. You could also get some nice benefits, like free or discounted campus dining meals.

If you’re a graduate student, you could try for a graduate assistant job, too. These look great on a resume.

All that said, off-campus jobs offer more variety and, sometimes, higher pay.

Speaking of higher pay, look for paid internships. Not only do they often come with bigger paychecks, but you’ll get a great resume builder and see some class material in real life. Regardless, you can find internships on-campus or off.

Work with an expert to find additional opportunities

Mos can help you explore the opportunities discussed in this article (and find more!) so you can find the best financial fit for your facts and circumstances.

Here's how a Mos advisor can help:

Evaluate your financial situation: Mos advisors can evaluate your financial situation and help you understand your options for financing college. They can help you identify sources of income, savings, and financial aid available to you.

Assist with scholarship applications: Your advisor can assist you with applying for scholarships and grants, which are sources of funding that don't need to be repaid. They can help you find scholarships that align with your academic goals and personal interests and provide guidance on completing the application process.

Explore work-study programs: Mos can also help you explore work-study programs, which allow you to work part-time while attending college to help offset the cost of tuition and fees. They can guide how to find work-study opportunities and how to balance work and school.

Provide advice on budgeting: An advisor can provide advice on budgeting and financial management to help you make the most of your resources. They can help you create a budget that considers your income, expenses, and financial goals, and guide managing your finances effectively.

NYS TAP FAQs

Have more questions about the NYS TAP program? Check out our FAQs below.

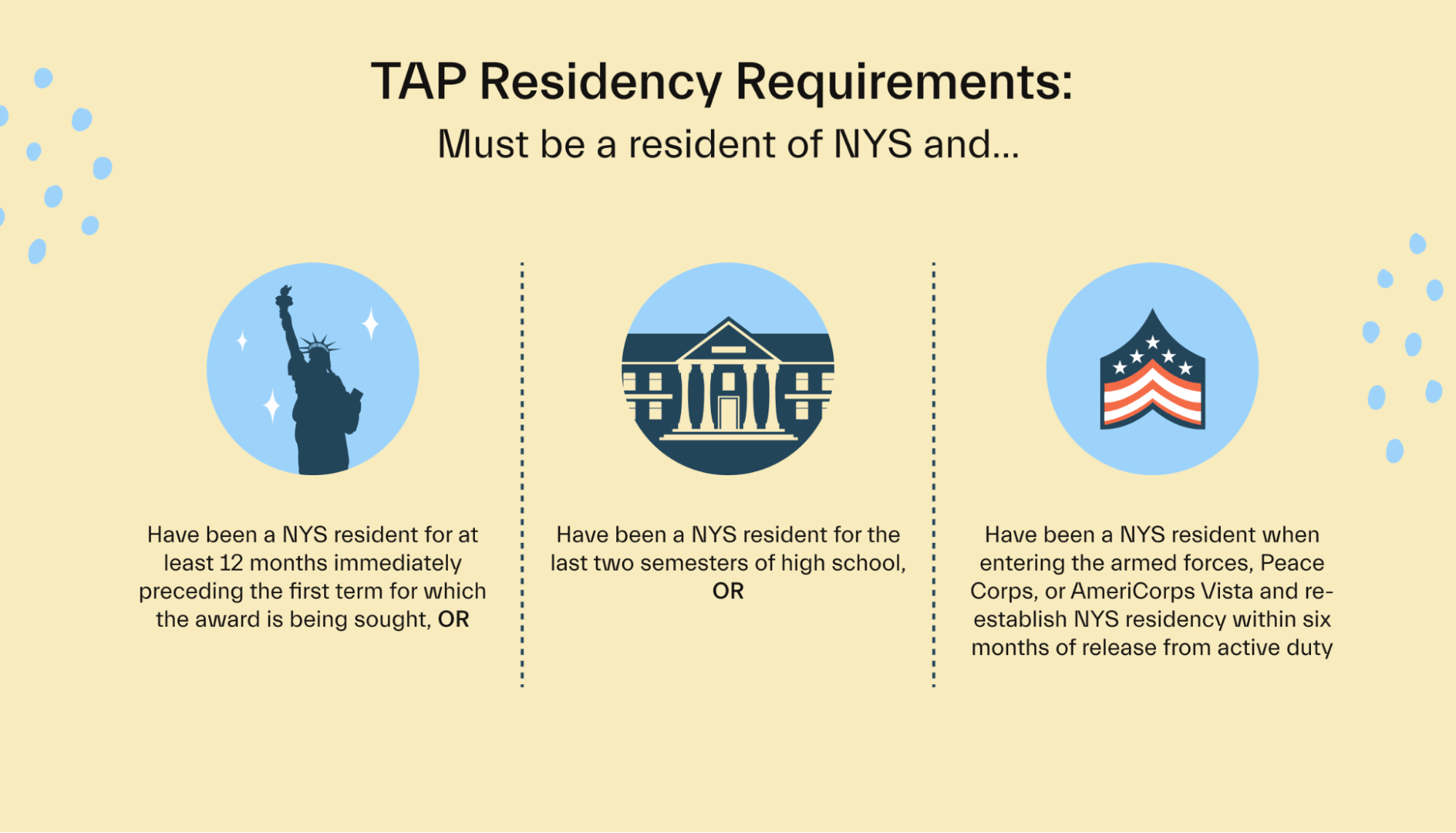

What is a NY state resident for TAP purposes?

The NYS HESC defines a NY state resident for TAP purposes as the following:

A legal NY resident for at least 12 months immediately preceding the first term you plan to use the award for, OR

A resident for the last two semesters of high school, OR

A resident of NY when entering into the armed forces, Peace Corps, or AmeriCorps Vista and re-establish NY residency within six months of release from active duty

I missed the TAP on my FAFSA. Can I still apply?

Yes. If you qualify as a New York state resident and listed a school in New York state on your FAFSA, the NYS HESC will send you TAP application instructions via mail or email within 3–4 days of submitting your FAFSA.

Once you receive those, you can apply here.

What schools does TAP let me use aid for?

TAP lets you use funds at most public and private colleges and universities within New York state. You can view a full list of approved schools on the HESC’s website.

How long does my TAP application take to process?

Your TAP application can take 3–5 weeks to process. During certain times of the year, submitting corrections to the TAP program or completing requests for information can take longer.

Additionally, the NYS HESC says to consider your award amount as an estimate until your school certifies your TAP eligibility.

New York residents: Get help paying for school

The TAP program makes New York’s many highly-ranked schools a little more affordable to any residents that meet the requirements. You don’t have to pay it back since TAP is a grant.

But keep in mind that TAP won’t cover all of your costs at your chosen New York state college or university. For more information on affording your education, check out our guide on how to pay for college.

Need help navigating the TAP program application process? You can sign-up to work 1:1 with a Mos advisor that will answer your questions and get you through the process smoothly.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you