Budgeting •

April 7, 2023

How to make money in college

Extra money never hurts, especially for “broke” college students. Learn 6 ways to make money in college that you can start as soon as today.

College is expensive.

If you need some numbers to back up this obvious fact, here they are: The average college tuition is now $9,580 for in-state; out-of-state tuition averages $27,437.

And the average all-in cost, including lodging, food, and books? A whopping $35,720 per year for an in-state education.

While financial aid can often help you cover some costs, most students will also need to find a way to make money in college.

This comprehensive guide will give you a leg-up by exploring how to make money in college. We’ll cover everything from work-study to gig economy jobs—and much more!

An overview of how to make money in college

For a college student, earning money may look a bit different than it does for the average person.

Students usually spend the bulk of their time attending classes and studying (okay, and a bit of partying), so they usually can’t get full-time jobs.

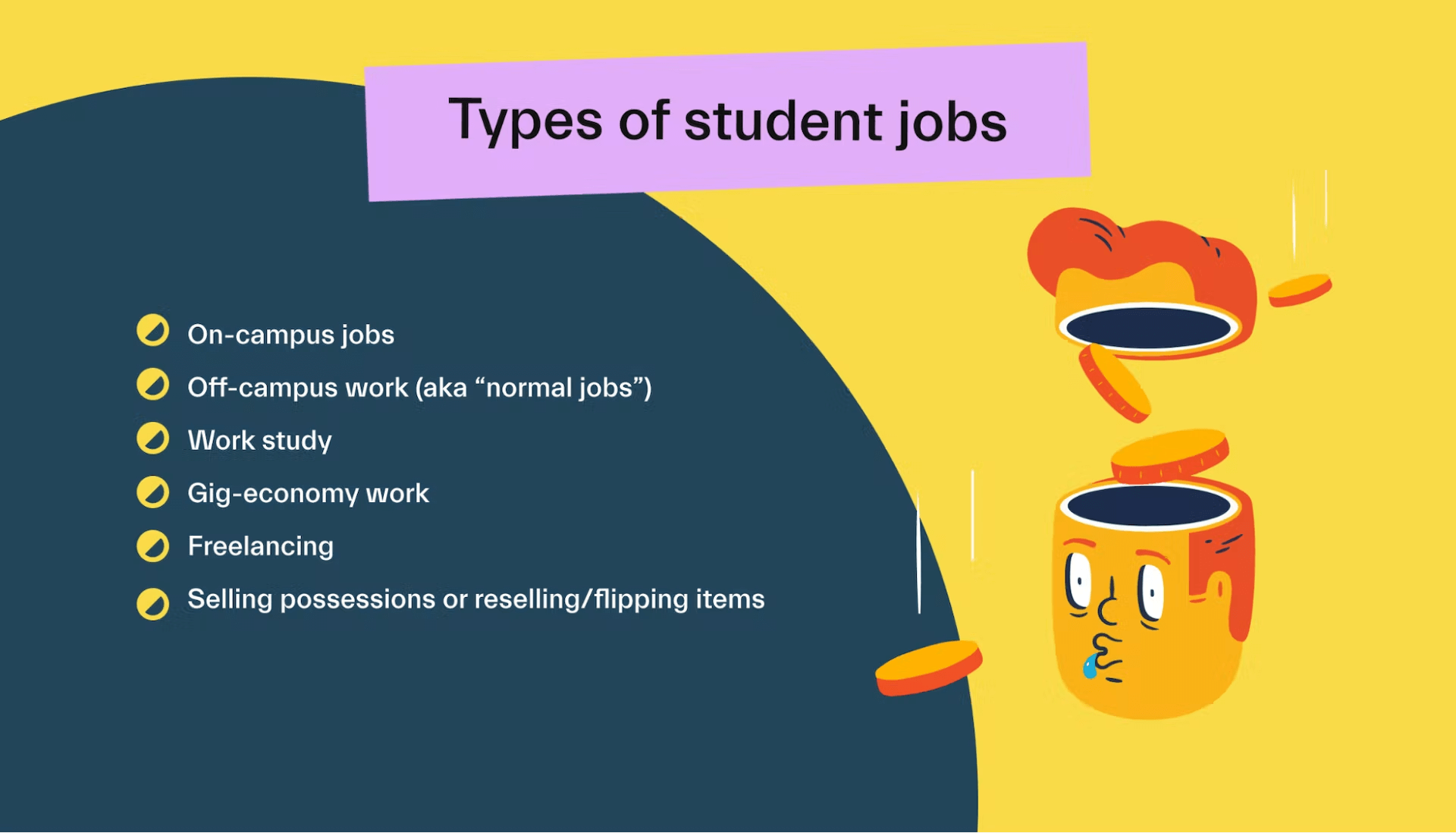

Regardless, there are plenty of ways for you to make money in college. Here are the 6 most common job categories for college students:

On-campus jobs

Off-campus work (aka “normal jobs”)

Work-study

Gig-economy work

Freelancing

Selling possessions or reselling/flipping items

Any of these options can help students pay for college and related expenses, while also providing some spending money.

We’ll break each option down in more detail as we go.

1. On-campus jobs

On-campus jobs are quite convenient, especially if you live on-campus or don’t have a car.

Most on-campus jobs involve working for the school itself, although there may be private businesses operating on certain campuses as well (banks, fast-food restaurants, coffee shops, etc.)

On-campus jobs can involve anything that keeps a modern college campus running—which is a lot!

Some examples of common on-campus work include:

Barista

Mailroom attendant

Library attendant

Teaching Assistant (TA)

Resident Assistant (RA)

Peer tutor

Janitor

If you’re interested in finding an on-campus job, the first place to start is generally the college career center at your school. They can help explain any roles that are available, and provide resources.

Some smaller schools may not have a career center, but most will have an online job board.

On-campus jobs generally come with flexible hours. Your employer knows you’re in school and will try to give you hours that don’t interfere with your classes so that you have enough time to do your homework.

In addition to a paycheck, you might get some helpful discounts. For example, bookstore employees may get deals on textbooks, supplies, or even school apparel while dining hall employees might get free meals or debit dollars.

Some on-campus jobs can also boost your resume. This opens you up to more opportunities once you graduate.

This is especially true for jobs in your major—for instance, a marketing assistant role looks great if you’re studying marketing. But ultimately, any job listed on your resume is better than no job at all.

2. Off-campus jobs

Off-campus jobs are simply “normal jobs.”

For students, this typically means part-time jobs, although some students manage to work full-time while in school.

Most students prefer to work evenings or nights, as well as weekends, or pretty much anytime your classes are not meeting.

For most students, the classic 9-to-5 schedule will interfere with classes, which is why students tend to prefer a part-time job.

Early risers may prefer crack-of-dawn-type jobs like being a barista. Night owls may prefer the dinner rush at a local restaurant.

There are hundreds of potential jobs for students, but some that may work well for a student’s schedule include:

Restaurant work (cooking, serving, cleaning)

Bartending

Coffee shop work

Overnight positions (grocery store stocking, janitorial work, etc.)

Good student jobs usually have flexible hours, which is vital for managing a changing class schedule each quarter.

In college towns, many employers are familiar with hiring students, and are willing to work around schedules—just be sure to make it clear that you need schedule flexibility when applying for the job.

Off-campus jobs may also offer perks, like discounts, to their employees. For example, a barista might get cheaper coffee at their place of work. And when you are paying for school, discounts never hurt.

And again, off-campus jobs can only improve your resume.

Students can search for part-time work on job sites like Indeed, LinkedIn Jobs, Jobcase, GigMatch, and Monster.

Internships

Internships are another category of off-campus jobs that are worth considering.

An internship is basically a temporary job offer.. They’re commonly offered by local businesses and nonprofit organizations.

Usually, internships are related to your field of study. They allow you to explore a line of work before committing and they are perfect for boosting your resume. And in many cases, internships can lead to a full-time offer when you graduate.

A business major may gain experience by working as an assistant for a startup, while a medical student may get hands-on experience at a local hospital.

Internships can be paid or unpaid, so it’s important to read internship postings carefully.

Unpaid internships can still be worthwhile, both for the experience as well as for the opportunity to potentially be hired by the company after the internship ends.

But obviously, cash is important, and students only have so much time!

Finding a paid internship related to your field of study should be high on your priority list, especially in your junior or senior year. Paid internships commonly pay more than regular student jobs on or off campus since the work is often more specialized.

If you’re interested in taking the internship route, Internships.com is a good place to find opportunities. You can also search for internships on normal job search websites.

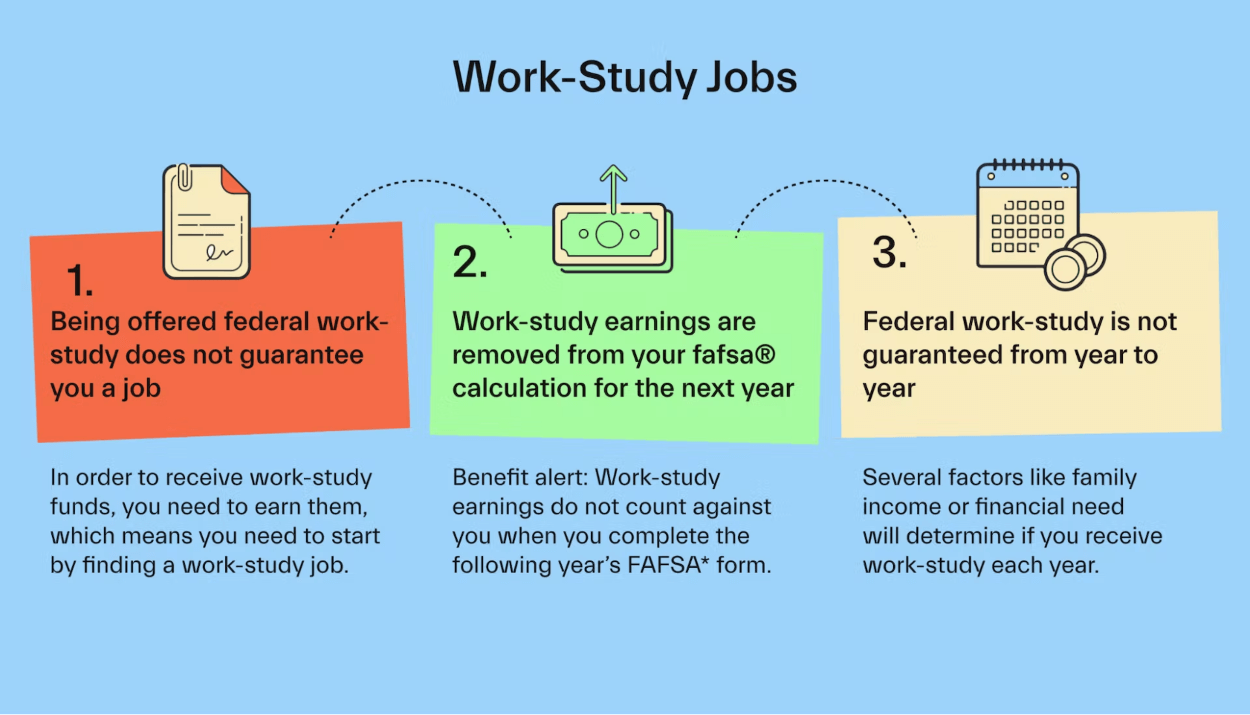

3. Work-study

Work-study is a form of federal financial aid that allows students to earn additional funds while enrolled in college.

It’s a federal program, and eligibility for it is determined by filing the Free Application for Federal Financial Aid (FAFSA).

Here are the basics of work-study:

You must qualify for work-study based on financial need (calculated by the FAFSA)

If you qualify, you can apply for part-time jobs through the program

Work can be on-campus or off-campus

On-campus work is done directly for the school, while off-campus work is typically for local nonprofit organizations

Work is focused on the student’s course of study and/or on community service

Income from work-study doesn’t affect the following year’s reported income for FAFSA calculations

Work-study is quite common, with around 18% of college students earning money through a work-study program! And the average undergraduate student in a work-study program earned $1,847 per year, as of 2021.

Since work-study is directly connected to funding your studies, your employer will make sure your shifts fit neatly into your schedule and that it doesn’t take away from study time.

Learn more about work-study here.

4. Gig-economy work

Gig-economy apps and services provide very flexible work opportunities for college students.

The “gig economy” is a blanket term for the prevalence of flexible, part-time positions in which workers are paid as contractors, rather than employees.

The classic example is driving for Uber or Lyft, but there are now hundreds of opportunities in the gig economy.

Gig work can be a great way to earn some extra cash, and some students even opt to piece together multiple gigs to make a substantial amount of income.

Here are just a few of the opportunities to earn some money in the gig economy:

Driving for Uber or Lyft

Delivering for Doordash, Uber Eats, etc.

Shopping and delivering for Instacart or Shipt

Walking dogs or pet-sitting on Rover or Wag!

Completing tasks on TaskRabbit or Thumbtack

Delivering packages for Amazon Flex

Teaching English online for VIPKid, or tutoring online

Babysitting on Care.com or UrbanSitter

While most gig workers choose to use apps like those listed above, there are also more informal opportunities available. For instance, many college students make money by babysitting children, completing odd jobs, or house sitting for family friends.

5. Freelancing

Freelancing involves selling your skilled labor to clients, usually over the internet.

It’s not a job, though—you’ll operate as an independent contractor, and will basically run a mini business of your own.

Freelancing can be a way to earn extra income; it can even be a career. There are more than 44 million self-employed individuals in the US, and many of them are full-time freelancers.

Freelance writing is one of the most approachable opportunities for college students, but the options are endless. There’s demand for freelancers in the following areas:

Graphic design and UX design

Translation

Coding and programming

Customer service

Teaching and tutoring

Social media marketing

Writing and copywriting

Sales and marketing

Virtual assistant work

And more

You can find clients directly, or use centralized freelancer platforms such as Upwork or Freelancer.com.

Fair warning: you may need to spend some time doing unpaid work (or low-paying work) in order to create a portfolio that is likely to attract quality clients.

Most freelance opportunities offer flexible hours and a “work-anywhere” arrangement. If you’re wondering how to make money in college without even leaving your dorm room, freelancing may be the right fit for you!

As freelancer, you’ll have to learn how to market yourself, find work, manage your time, and properly pay taxes, as you won’t have an employer to withhold taxes for you.

If you’re interested in exploring the freelance world, this guide is a good introduction.

6. Selling (or flipping) used items

Selling unneeded items could generate some side income while you’re in school. And it doesn’t take long to throw something up on OfferUp or FB Marketplace.

Plus, most college campuses have a very active marketplace for buying and selling used goods, so you likely won’t need to wait too long to make a sale.

There are a few ways to go about selling used items:

Sell locally, through OfferUp, Facebook Marketplace, Craigslist etc. In most cases, this means meeting up with someone in your area to complete the transaction—although some of these platforms now support online sales where the items are shipped. This can work well on a college campus.

Sell online, through general marketplaces like Amazon or eBay. You might be able to earn more money through this method vs. specialty marketplaces. However, creating a compelling listing and arranging the transaction take a lot more work.

Sell online through specialty marketplaces (Poshmark for clothing, for example). This method may not earn you as much since the specialty marketplace has more room to decide the price they’ll pay and will likely take a slice of the sale proceeds. However, you’ll save time since you won’t have to find buyers or arrange transactions.

For most students, selling used items will be a way to make some extra cash to boost their budget, but it probably won’t replace the need for a job or side gig.

Keep in mind that students can also save money by buying pre-owned items for their own use. Even just opting for used books can help save students hundreds of dollars each year.

Flipping items for profit

Certain entrepreneurial types may enjoy flipping items for some extra spending money, rather than just selling their own possessions.

Flipping is simple—at least in theory—just buy low and sell high.

Of course, there are a million and one different items you could flip, so sometimes it helps to specialize.

For instance, if you have extra storage space, there’s plenty of money to be made flipping furniture.

During move-out times (between quarters/semesters), many students sell nice furniture for dirt cheap—or even give it away for free. If you can snag some nice items, you may be able to resell them for a healthy profit when the next term starts.

You could also take the buy-offline, sell-online approach.

For instance, you could purchase used video games and consoles from fellow students (once they realize they don’t have any time to play Call of Duty while taking 15 credits!) and then resell them for a profit on eBay.

If you’re interested in getting into flipping, this guide is a great starting point.

(Bonus!) Applying for scholarships

Important note: Most scholarship funds can only be used for tuition and related expenses.

They say that a penny saved is a penny earned. And as a college student, tuition and books are probably your biggest expenses. Landing scholarships can help you pay for college, which in turn should help free up some of your cash for spending money.

You might not think of scholarships as a way to earn money in college, but this is a very important area for students to optimize.

While college athletes will need to train and play hard to earn athletic scholarships, dedicated students will need to study long hours to earn academic merit scholarships.

Want more free money? We also recommend that you look for grants. However, they’re awarded based on need instead of merit. So you’re less likely to qualify for them if you’re able to afford college easily and just want to make some extra cash.

Conclusion

Making some extra money while you’re in school can help you avoid excessive student loan debt, and can also provide some spending money along the way.

After all, you want to enjoy your college years—inside and outside of the classroom.

Before you work your butt off to pay for tuition, make sure you’re getting all the financial aid and scholarships available to you.

Mos can help you get as much free money for college as possible by helping you apply for financial aid, grants, and scholarships—all in one place.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you