Budgeting •

December 28, 2021

How to save money in college

Our guide to saving money and creating a student budget in college.

Everybody knows college doesn’t come cheap. There are a whole lot of expenses you’ll need to think about when you start college—and unfortunately, they add up pretty quickly.

That’s why it’s really important that you look for ways to save money in college—and one of the best ways to do that is to create a college student budget.

Not only will it help you figure out how to pay for college tuition, but a budget will also help you save money and spend it responsibly to make sure you’re able to maintain a decent lifestyle while you earn a degree.

This guide explains what expenses you should include in your college student budget, what a good budget is for a college student, and how else to save money in college.

Why is it important to create a budget and save money in college?

As a college student, you’re going to have a lot of new academic responsibilities eating away at your time. Likewise, you’re probably going to want to take advantage of a lot of new social opportunities. After all, that’s what college is all about.

But it does mean you aren’t going to have as much time to work, and you’ll likely have a lot of new expenses you’ve never had to worry about before.

Unfortunately, less time working and more bills to pay means you might have to start cutting back on essentials.

By keeping tabs on any spending habits you're developing and working to save money, you can start spending money more responsibly and ensure you have the money you need to pay your bills.

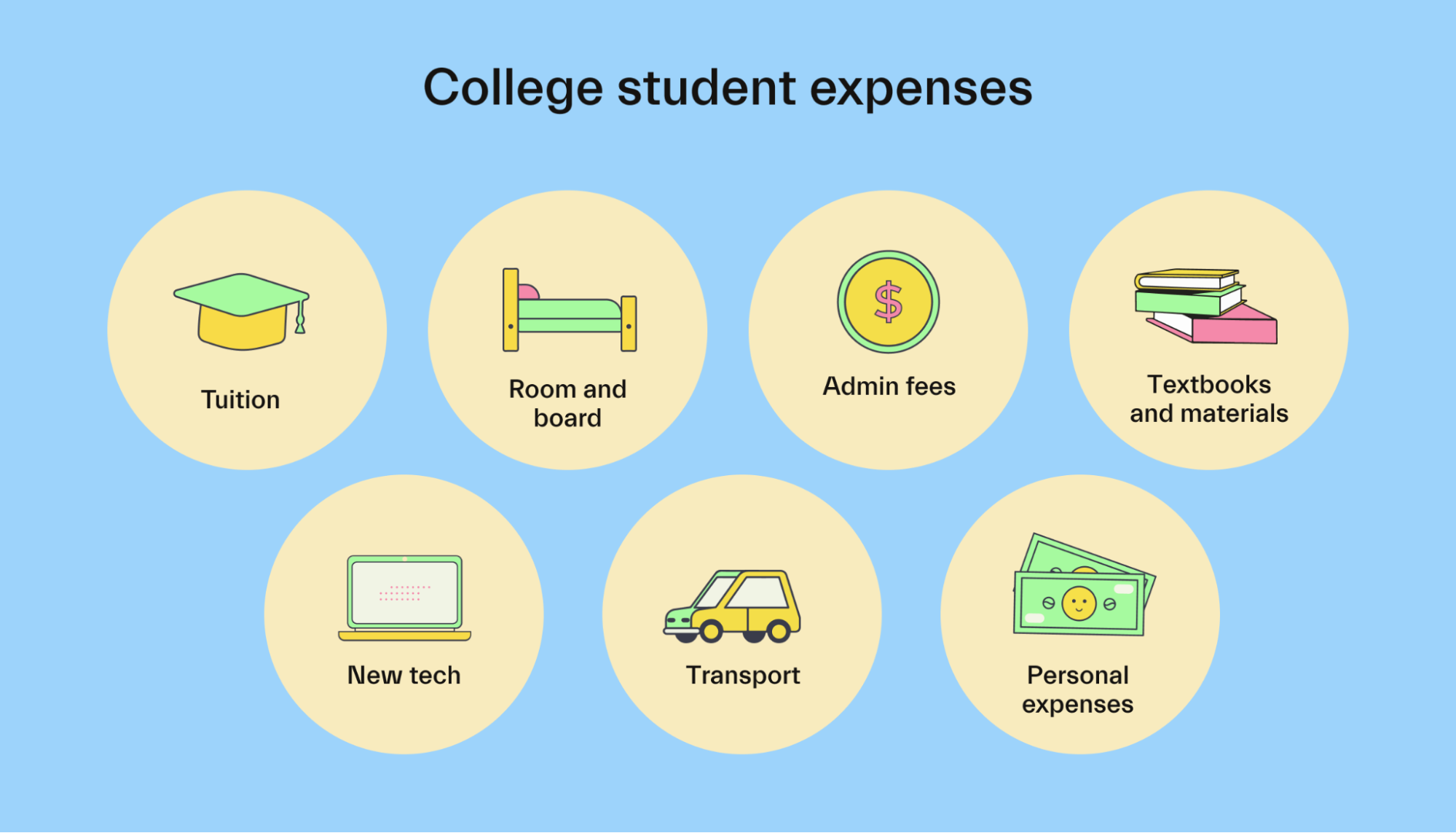

What expenses should you consider when creating a budget?

When you’re trying to figure out how to pay for college, there are a whole lot of expenses you’re going to need to bear in mind.

A lot of these expenses are going to be fixed and set by your college—and so they’ll be out of your control. But there are also quite a few monthly expenses that you have the ability to change based on your income and what you can afford.

To help you get an idea of the basic college expenses you should be budgeting for (and how to bring those costs down), let’s quickly break down a few of the most common overhead college costs you’ll need to cover.

Tuition fees

It probably goes without saying that college tuition fees are going to make up the bulk of your college student budget. That’s exactly why your college tuition should always be the first consideration you take when trying to save money and build your own student budget.

Let’s look at some numbers.

The average tuition price for a 4-year college is currently coming in at $25,362 per year. Multiply that by 4 years, and you’re talking $100,000 worth of tuition fees.

But prices vary a bit more if you drill that number down and split up prices by college type.

For example, at a public 4-year university, the average in-state tuition and associated administrative fees total $9,308 per year. If you want to go out of state, that number instantly jumps to an annual $26,427 in fees.

Don’t forget: that’s public colleges we’re talking about. If you go to a private university, the average tuition and fees are currently coming in at a total of $35,801 per year.

Exactly how tuition fees need to be factored into your college student budget will depend on your funding mix and the type of student loans you may have to use to pay for your bills.

When developing your funding mix, you should ideally be looking for as many grants and scholarships as possible. That’s because grants and loans are cash awards you don’t have to repay. By contrast, you’ll be expected to pay back any student loans you’re awarded—and in a lot of cases you’ll have to pay back interest, too.

For that reason, taking out loans should always be your last resort. That being said, you'll gain a couple of benefits by choosing a federal student loan rather than a private loan.

For example, you may go for a private student loan that requires you to start making monthly payments while you’re still in school. Or, you may have a federal direct loan that you don’t need to start making payments on until after you graduate.

That being said, a great way to save money in the long run is to pay off your student loan debt early and try to make interest payments on your federal loans while still in college.

So if you can afford it, budgeting in student loan payments while you’re still studying could be a smart call in the long term.

Room and board

When it comes to exactly how much money you need to plan to spend on eating and putting a roof over your head, the single greatest factor is going to be whether you’ve decided to live on-campus or live off-campus.

By “room and board”, we’re specifically talking about your accommodation and food bills.

While no 2 budgets are 100% alike, it’s worth looking at some national averages.

Last year, the average cost of room and board at 4-year colleges ranged from $10,216–$11,945 per year. This includes both students with dorm meal plans, as well as those living off-campus who are responsible for their own meals.

At public colleges, students that lived on-campus in the dorms paid an average of $11,451 each year for their room and board. By contrast, public college students living off-campus spent a bit less, at an average of $10,781 per year.

If you’re going to a smaller private college, expect to pay a bit more—but not too much. The average room and board at a 4-year private school last year came in at $12,682. Meanwhile, off-campus living came in quite a bit cheaper at $9,762 per year for room and board.

Extra fees

No matter what it is you’re intending to major in or where you’re studying, there will be extra administrative or activity fees to consider.

By “extra fees,” we’re talking about costs like annual parking stickers, participation fees for playing sports or taking part in clubs, a college gym membership, cable TV, or WiFi costs—the list goes on and on.

None of these fees will break the bank on their own, but be careful because these little extras tend to add up pretty quickly.

Textbooks and course supplies

We might be living in a digital era, but expensive textbooks are still very embedded in the college system.

If you’re enrolling at a public 4-year college, you can expect to pay an average of $1,334 every year on textbooks and other course supplies. That cost is about the same at private colleges, too.

There are admittedly some ways you can cut corners here. For example, you can try to find some second-hand textbooks online or from friends that have taken the course previously. Just make sure you’re getting the right edition, as textbooks are often updated every few years.

New tech and other equipment

Remember what we were saying about living in a digital era? Well, that’s why you need to factor tech expenses into your college student budget, too.

Around 60% of college shoppers need to purchase electronics of some kind, and researchers say they spend an average of roughly $306 per year making sure all of their tech is up-to-date. That means laptops, phones, headphones, gaming equipment, and everything in between.

That being said, this is one of the areas of your budget that you have quite a bit of control over.

You can decide for yourself what you do and don’t need in terms of technology, and whenever you’re eyeing the latest and coolest gadgets, remember there are usually more affordable alternatives that will still meet all of your college needs.

Transportation

Whether you live on-campus or off-campus, there are travel costs you’ll need to factor into your student budget.

If you’re traveling to a college campus, you’ll need to consider the costs of owning a car and your commute. That means fuel, parking, insurance, and maintenance.

If you’re relying on public transport like buses, trains, or a ride-sharing app like Uber, there are travel expenses to bear in mind, too.

But even if you’re living on-campus, don’t forget about the amount of money it’ll take you to travel home for visits.

Add all of those expenses up, and it’s estimated the average college student spends between $1,050–$1,800 on transportation costs every year!

Personal expenses

In terms of personal expenses, we’re talking about clothes, eating out, going to the movies, tailgating expenses, toiletries, and everything in between.

The amount you need for personal expenses is going to depend a lot on your lifestyle—but this is an area that can quickly spiral out of control if you don’t exercise a bit of restraint and self-control.

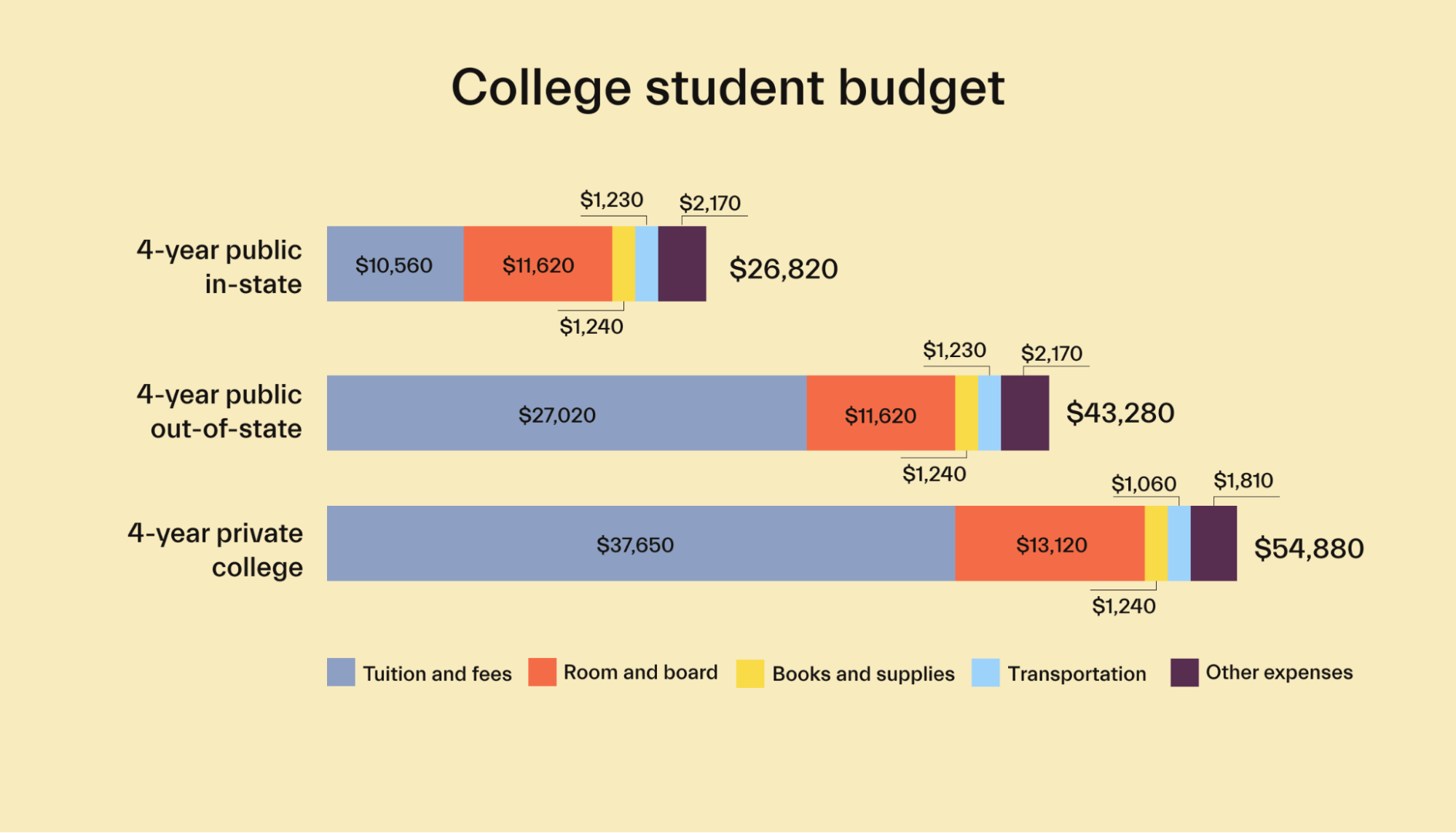

What is a good budget for a college student?

According to the College Board, a moderate college student budget for an in-state student at a 4-year public college averaged $26,820 for the 2020–21 school year. If you’re studying out-of-state, that budget is going to skyrocket—coming in at $43,280 per year.

Meanwhile, students at 4-year private colleges are currently facing an average annual budget of $54,880.

Before you start worrying, remember that the bulk of these annual budgets are tuition fees.

Most of the time, you’ll be covering your tuition costs with student loans, scholarships, grants, or a combination of all three—so this isn’t the amount of money you’ve got to have in the bank every year in order to make it to graduation.

But to keep a lid on your other expenses, you need to make sure you stay organized and plan some practical ways to save money. Fortunately, there are a lot of strategies you can use to get the job done.

How to save money in college

After running the numbers and taking stock of your expenses, it’s really important that you create a budget and look at ways you can save money while you’re a college student.

That might sound a bit daunting if you’ve never had to create and manage your own budget in the past. But don’t stress—there are a couple of fool-proof methods and useful budgeting templates out there that’ll give you a great head start on saving money.

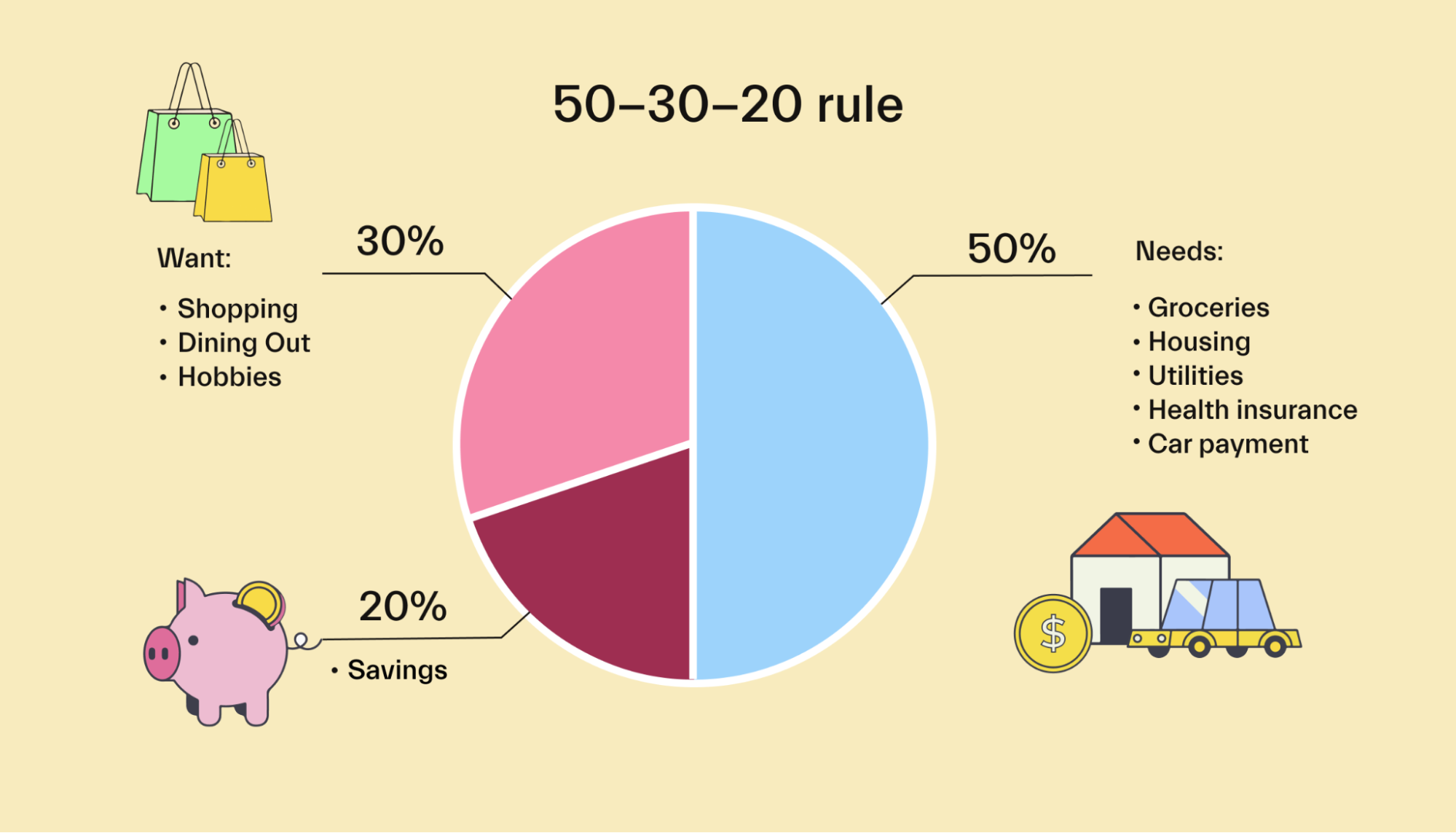

1. Use the 50-30-20 budget rule

The 50-30-20 budget rule is a system a lot of financial planners recommend to help you manage money—and it’s pretty simple.

The 50-30-20 budget rule says you should spend 50% of your income on the stuff that you need. That means essential living expenses like your rent, utility bills, food, and transportation. Tuition fees would fall into this category, too.

Next, aim to spend 30% on “wants.” This includes eating out with friends, shopping, trips, and subscriptions you don’t necessarily need.

Finally, the remaining 20% of your monthly income should go towards debt or savings. That means working to pay off any loans or bills beyond just the minimum payment or stashing your money in a savings account for a rainy day.

Trying to use 20% of your monthly income to save or pay off debt is particularly important if you have an unsubsidized federal loan or private loan that you’re responsible for paying interest on while still at school.

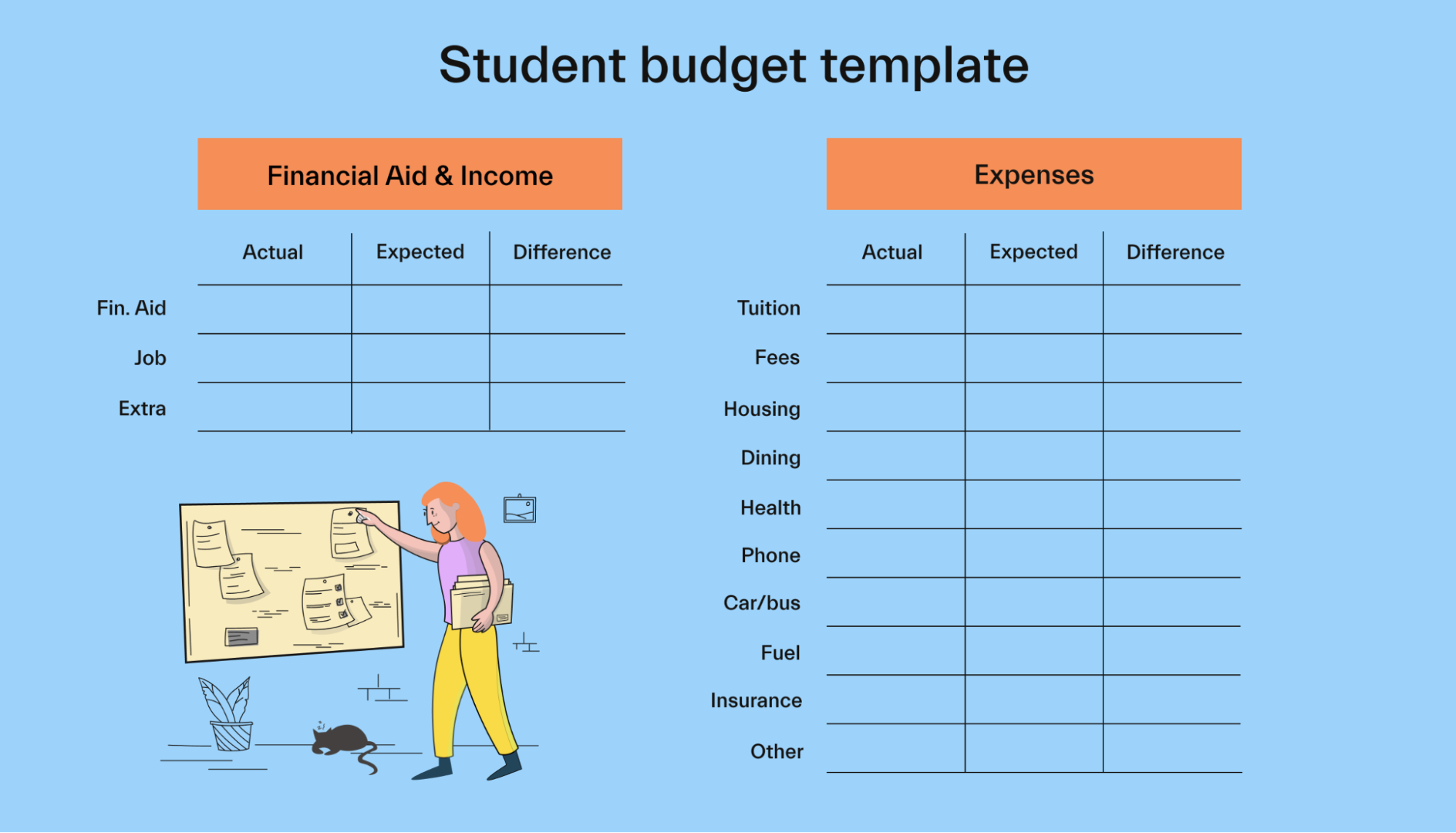

2. Use a college student budget template

The best way to figure out how much you’ll be able to save or use to pay your expenses is to sit down and crunch numbers.

That means writing down all of your income sources (loans, grants, scholarships, income, help from family, etc.) and pairing it against all of your outgoings (room and board, travel, personal expenses, and university fees).

It’s pretty easy to do this on any app with a spreadsheet function—plus, there are a few apps and sites out there that can even offer you a simple college budget template to help you get started.

Your college’s student support services may even be able to sit down with you, help you complete a model budget, and offer advice.

3. Cut your college costs

If you want to start saving money in college, you're going to need to cut costs. After developing a budget, you should be able to get a better idea of where you might be overspending.

For example, maybe you've been eating out too much, and could switch to ramen noodles or less expensive meals for lunch.

Likewise, you might realize you haven't been using that gym membership you've been paying for—so you might decide to cancel your membership.

Cutting costs isn't always a fun process, but you won't believe how much money will be in your bank account after you start cutting back.

4. Get a part-time job

If you’ve developed a spending habit but have already cut costs everywhere you can think of, you’re going to need to start bringing in some extra cash.

The best way to do that is to get a part-time job.

There are going to be loads of opportunities available both on-campus and off-campus—and although you’ll need to work around your class schedule, gaining some extra income will relieve a lot of the financial pressures you might be feeling.

Conclusion

When it comes to living expenses, it doesn’t matter whether you go to a public in-state school or a private little university all the way across the country. Either way, you’re going to be facing tens of thousands of dollars worth of annual bills.

Translation: you need to make sure you stay on top of your spending and take advantage of any and all financial aid opportunities available to help you cover the cost of your studies.

That’s where Mos comes in. We’ll match you with loads of scholarships and other financial aid opportunities to help you make the most of your time in college. Learn more today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you