Financial aid •

August 23, 2021

Do you have to pay back grants?

Find out how grants work, the 4 types of federal student aid grants, the situations in which you need to repay grants, and how to pay back grants.

We all know that college doesn’t come cheap.

Most students and their families don’t have the financial means to pay for college tuition without some form of financial aid—and while student loans can help you pay for your education, they also have to be repaid someday.

Because of that, loans should be like your last resort to obtain funding. First, you’re going to want to maximize your scholarship and grant funding to chip away at your tuition fees as much as possible.

A college grant is a financial award given to students to help them pay for their education. Grants are easy to apply for, and in most cases, they don’t have to be repaid.

This guide explains how grants work, the 4 types of federal student aid grants, the situations in which you need to repay grants, and how to pay them back.

How do grants work?

Before diving right into how grants work, let’s go over what grants actually are.

Simply put, a grant is financial aid that students can get from the state or federal government or from their college.

In addition to governments and public bodies, many colleges, universities, and career schools offer their own individual grants.

Academic grants are typically given based on a student’s financial need. These types of grants are called need-based grants.

That being said, grants are also sometimes awarded based on your personal background, the subject you’re studying, or any other number of factors.

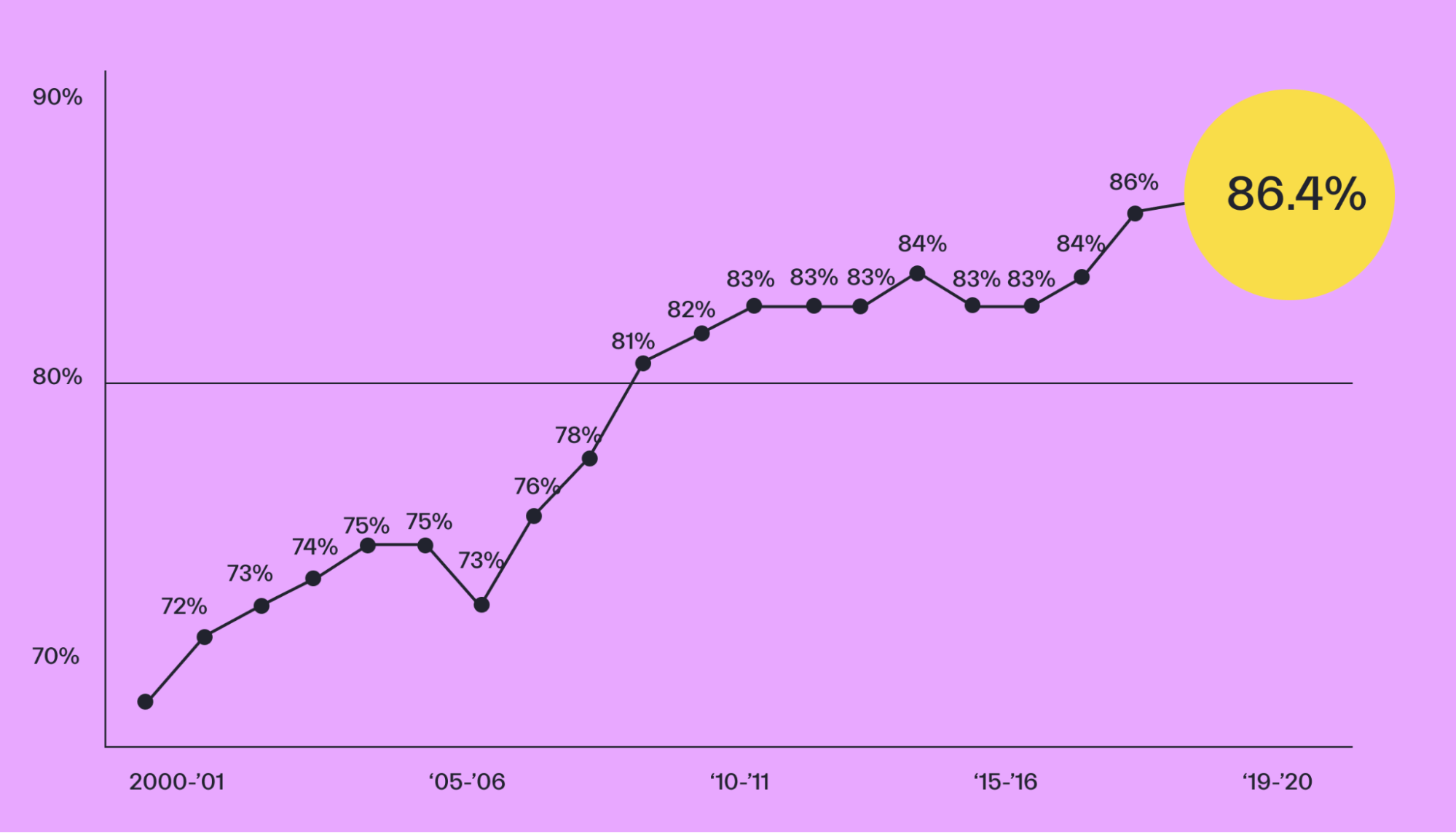

To give you a rough idea, the federal government’s annual budget for student grants is $32 billion—and more than 86% of students accept financial aid every year. 41% of undergraduate students receive an average of $5,179 per year in federal grants.

To apply for most grants, you’ll need to fill out a Free Application for Federal Student Aid (FAFSA).

The FAFSA is a form used by the US Department of Education (DOE)’s Financial Student Aid office to determine how much financial aid you’re entitled to. You can fill out the FAFSA online, and after your application gets processed, you will receive an aid offer that outlines the federal grants and other forms of financial aid available to you.

Just be aware that you may be asked for additional information or to complete extra steps before you’re able to get an offer.

This offer may include both state and federal college grants, as well as any grants that apply to you at your specific college or university.

When you accept your aid offer, the financial aid office at your institution will apply it towards whatever it is you owe your school. Any outstanding balance will normally be sent back to you to cover any extra costs associated with college.

Although you’ve got to complete a FAFSA to get a federal grant, it’s important to note that this isn’t the only way to get a grant for college.

There are hundreds of state-based grants, and a lot of these grants will require you to submit an application specific to that grant. Similarly, some grants may ask you to submit a FAFSA, but then complete additional steps afterwards.

You should also be aware that if you don’t qualify for a federal grant, you may still be able to qualify for a state-based grant—that’s why it’s important to do your research.

Unlike a student loan, a grant is a source of free money. Under most circumstances, you don’t have to pay a grant back.

But there are some situations in which you may be asked to pay some or all of your grant back—including if you fail to make satisfactory academic progress. We’ll cover this in more detail in a minute.

If you plan on applying for a grant by using a FAFSA, don’t forget that these forms have to be completed every year.

What are the 4 types of Federal Grants?

The US Department of Education (DOE) offers a number of federal grants to students. These can apply to you if you’re studying at a 4-year college or university, a community college, or a career school.

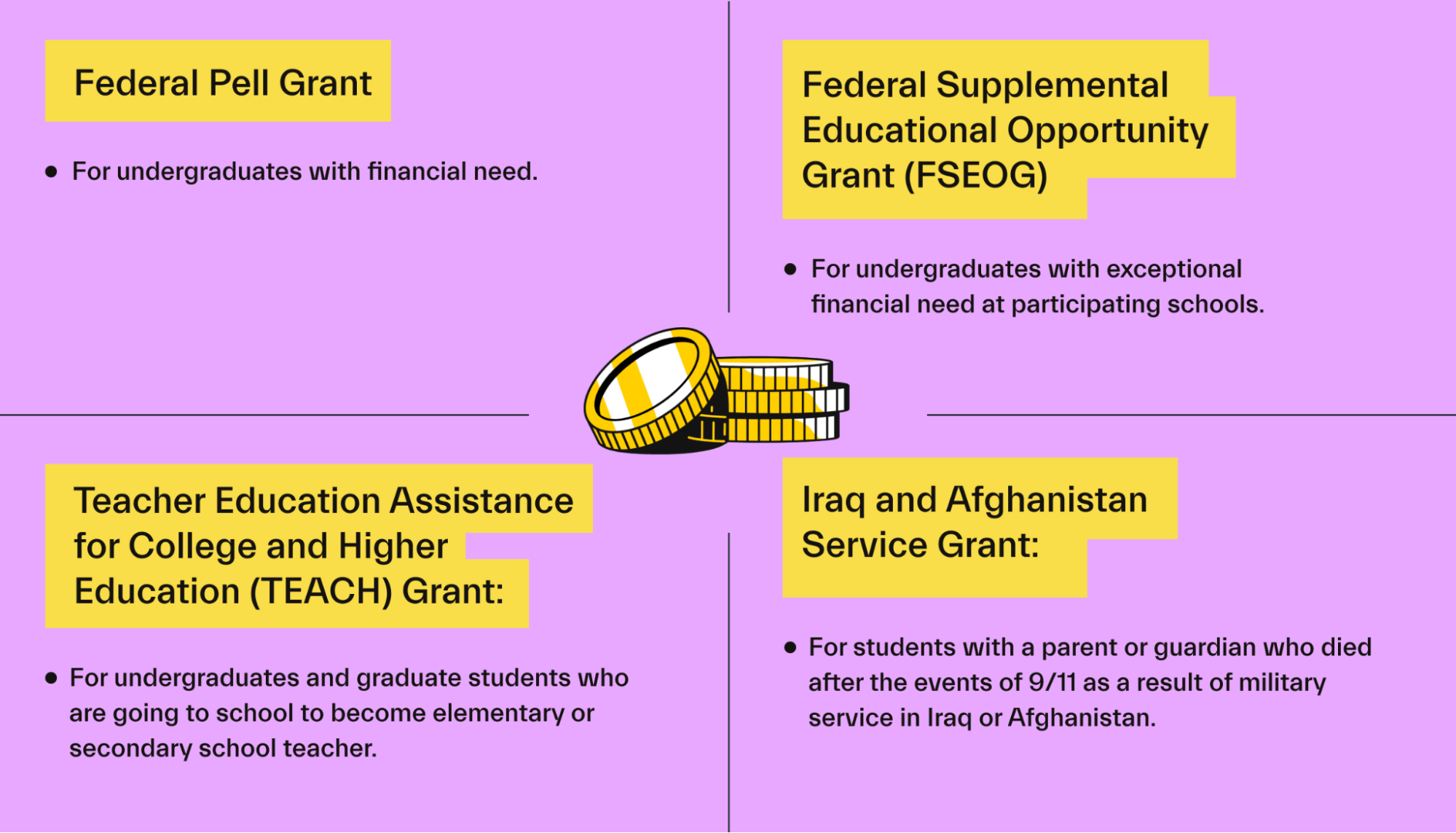

There are 4 main types of grants that students receive for college. These grants are:

Federal Pell Grants

Federal Supplemental Educational Opportunity Grants (FSEOG)

Iraq and Afghanistan Service Grants

Teacher Education Assistance for College and Higher Education (TEACH) Grants

To help you wrap your head around these various grants, we’ll quickly break down each type.

The Federal Pell Grant

The Pell Grant is a federal grant available to undergraduate students without a bachelor’s degree who has an Expected Family Contribution (EFC) below $6,000. Your EFC is the number that your family is expected to contribute on an annual basis towards your tuition. This number is determined and given to you after your FAFSA has been reviewed and your financial aid options have been provided.

An important point to bear in mind is that you might be eligible for a Pell Grant even if you or your parents are not US citizens. You should check your eligibility just to be sure—and if you’re undocumented or are a Deferred Action for Childhood Arrivals (DACA), you might be eligible for state or college-based grants instead.

In this instance, you can check to see if the state you’re in offers an alternative application. For example, in Texas there’s the Texas Application for State Financial Aid (TASFA) which is used for Texas residents who aren’t eligible for aid through a FAFSA.

Federal Pell Grant amounts change on an annual basis. For the 2021-22 academic year, the maximum grant award is $6,495.

The exact amount you can get depends on your expected family contribution, the cost of attendance at your school, and whether you’re a full-time or part-time student.

To receive the Pell Grant, you just need to fill out the FAFSA.

The Federal Supplemental Educational Opportunity Grant (FSEOG)

Federal Supplemental Educational Opportunity Grants (FSEOG) are awarded by the financial office of individual colleges or universities.

The FSEOG is need-based, and each participating school gets a certain amount of FSEOG funds every year from the US Department of Education’s Federal Student Aid office.

You can get between $100 and $4,000 per year. This all depends on your need, when you apply, and the amount of financial aid you’re getting from elsewhere.

Just like the Pell Grant, you can apply for a Federal Supplemental Educational Opportunity Grant (FSEOG) using the FAFSA.

Iraq and Afghanistan Service Grants

Iraq and Afghanistan Service Grants are academic grants designed to help the children of some veterans fund their college studies, and it’s specifically for students who don’t meet the income requirement for the Pell Grant.

To qualify for an Iraq and Afghanistan Service Grant, your parent or guardian needs to have been a member of the US armed forces and died as a result of their service in Iraq or Afghanistan after 9/11.

You also must be under 24 years old or enrolled in college at the time of your parent or guardian’s death.

You can apply for the Iraq and Afghanistan Service Grant using the FAFSA.

Teacher Education Assistance for College and Higher Education (TEACH) Grants

A Teacher Education Assistance for College and Higher Education (TEACH) Grant is a financial award that requires you to complete 4 years of teaching as a condition of getting your grant.

That teaching can be in an elementary school, secondary school, or an education agency that focuses on teaching low-income students.

You must complete your 4 years of full-time teaching within 8 years of graduating from college.

If you fail to complete your teaching service obligation, your TEACH grant will turn into a loan. You must then repay that loan in full with interest.

The TEACH Grant Program offers grants of up to $4,000 per year depending on financial need, academic performance, and availability.

Just like other federal grants, you can apply for a TEACH Grant through the FAFSA. But first, you’ll have to contact your school’s financial aid office to see if it participates in the grant program. Different schools may require additional steps, too.

How to apply for state-based gants

Not everybody is eligible for a grant through Federal Student Aid—but don’t worry if you’re unable to secure a federal grant. You may still be able to apply for a state-based grant.

Each state will have its own set of eligibility requirements, and so you’ve normally got to do a bit of homework and check out the funding body in your state to see how to apply and whether you’ll be eligible.

Some state grants have their own application forms. For example, if you want to apply for a state-based grant in New York, you’d need to complete a Higher Education Services Corporation (HESC application). But if you’re based in Minnesota and want to apply for financial aid through the Minnesota State Grant Program, all you’ve got to do is complete a FAFSA.

Undocumented migrants or non-citizens can often apply for state-based grants. But those students may need to fill out separate or additional forms (like the TASFA in Texas) demonstrating their eligibility or financial need.

Do you have to pay back grants?

Generally speaking, no, you don’t need to repay a grant. That’s why grants are such a great way to fund your studies.

That being said, you should be aware there are several scenarios in which you might have to pay back part or all of a federal grant. But don’t stress, because these scenarios don’t apply to most students.

First, you may have to repay some or all of your grant if you withdraw early from the course you’ve received a grant to pursue. Translation: if you want to keep your grant money, don’t drop out.

Second, you may have to repay your grant if your enrollment status changes to reduce your eligibility.

For example, if you switch from being a full-time student to a part-time student, the amount of your grant award will probably be reduced. In this situation, you probably won’t need to pay your entire grant back—but you may need to repay part of it.

The upside to both these situations is your tuition bill has probably decreased as well, meaning you won’t be out the whole amount.

Finally, you’ll have to repay your TEACH Grant if you don’t meet the requirements of your TEACH Grant service obligation.

That includes the obligation to teach full-time at an elementary school, secondary school, or another education service that services low-income students for at least 4 years after graduating.

Some states have similar programs, with work obligations in the state after graduation.

If you do find yourself in a situation where you have to repay a student grant, it’s absolutely critical that you repay that money.

Failing to pay back a grant or a loan can impact your credit score, which can have a huge impact on your life. For instance, a lower score will make it harder to qualify for a car loan or mortgage, and make your payments higher if you do qualify.

Make sure you do your homework and understand the terms of your grant or financial aid before accepting.

How do you pay back grants?

If you have to repay some or part of a grant, the finance office at your college or university will get in touch with you to let you know.

From the point that you’re notified that you must repay a portion or all of your grant, you have 45 days to take one of 2 options:

You can either repay the money owed in full, or you can enter into an approved repayment arrangement with your school.

If you choose to strike a repayment agreement with your school, your school will generally assign that debt to the US Department of Education (DOE) for collection. But, it might also choose to keep the debt and let you make payments directly to your school.

It’s important that you understand how your repayment plan works.

With TEACH Grants, things work a little bit differently.

We’ve already talked about how teaching students have extra eligibility requirements that apply to their academic grants—and the top condition is that you fulfill your service obligation.

If you’re unable to perform your TEACH Grant service obligation, your TEACH Grant servicer will notify you. Then, your grants will automatically be converted to Direct Unsubsidized Loans.

Those loans must then be repaid to the US DOE in full. You will also have to repay interest on the loan, which will be charged from the date when your TEACH Grant was disbursed—not the date it switched over to being a loan.

It’s crucial that you know and understand repayment terms before committing to a plan.

This will ensure that you can actually repay your grant as required to make sure you’re not breaking any rules. Otherwise, you might not be able to get any more grants in the future, and you could end up with a hefty bill.

How to appeal for missing financial aid

If you receive a financial aid offer that’s lower than you were expecting, don’t worry. You might be able to appeal to your college for additional aid you think is missing or that you deserve because of your financial circumstances.

It’s important to bear in mind that appealing for missing financial aid isn’t like haggling over the price of a car. You can’t just bluff your way into a better deal. But if you’re able to present your institution’s financial aid office with documentation or evidence demonstrating that you deserve more aid, it’s often possible to secure an offer of extra grant money.

The first step you’ve got to take is to contact your financial aid office. Explain your situation and the offer that’s been made to the office team, and question how the assessment of your ability to pay was made. By talking you through the decision, you might find that the financial aid office failed to take certain elements of your family circumstances into consideration.

After chatting about your aid offer over the phone, most colleges will have their own appeals process. This often starts with writing a formal appeal letter, and you’ll likely be required to include documentation or proof demonstrating your family circumstances or financial situation to prove that the grant you received was too low.

If you’re considered a dependent, then a parent or guardian might need to write the appeal letter on your behalf.

Conclusion

Grants are an amazing way to fund your college fees because a grant is money that you won’t have to pay back.

Unlike a federal student loan, a grant is a source of free money—and grants are generally offered on a financial need basis. They can also be awarded by course, school, background, or subject.

Although grants don’t usually have to be repaid, there are some situations in which you’ll be expected to repay some or all of your grant. These situations vary by grant type, the program you’re studying, and other sources of funding you may be getting.

You need to do your homework about a grant you’ve received so that you truly understand what you’re getting into before you accept an offer of financial aid.

But if you need help doing your homework, Mos can help you find the most money you’re eligible for.

Join Mos now to get matched with all available grants you qualify for.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you