Financial aid •

Do you have to pay back financial aid?

It’s important to understand how financial aid works and when you’ll have to pay it back. Learn what you need to know about paying back financial aid.

College is expensive, and most students can’t afford to pay for it out of pocket. The good news is that there are plenty of financial aid opportunities to help you pay for your education.

But in the case of financial aid, you might find yourself asking: do I have to pay back my financial aid?

The short answer is: sometimes. There are certain types of financial aid that you must repay after you graduate, while others are simply free money that you won’t have to pay back.

Keep reading to learn about the different types of financial aid, which you’ll have to pack back, and which you won’t.

What is financial aid?

Financial aid is money that the federal government, state governments, schools, and private organizations award to students to help them cover the cost of college. Financial aid comes in several different forms and is awarded based on either need (you’ve shown you can’t afford college without it) or merit (you’ve earned it through an achievement).

The federal government is the largest provider of student aid. It helps students across the US pay for school with grants, work-study jobs, and student loans.

However, while the federal government is the largest, it isn’t the only provider willing to give you money for school. Many states and universities offer financial help to students. Plus, there are lots of private organizations you can apply for aid from.

The features of your financial aid will differ slightly depending on the source. But in most cases, whether you need to pay back the money you get depends on the type of aid rather than where you got it.

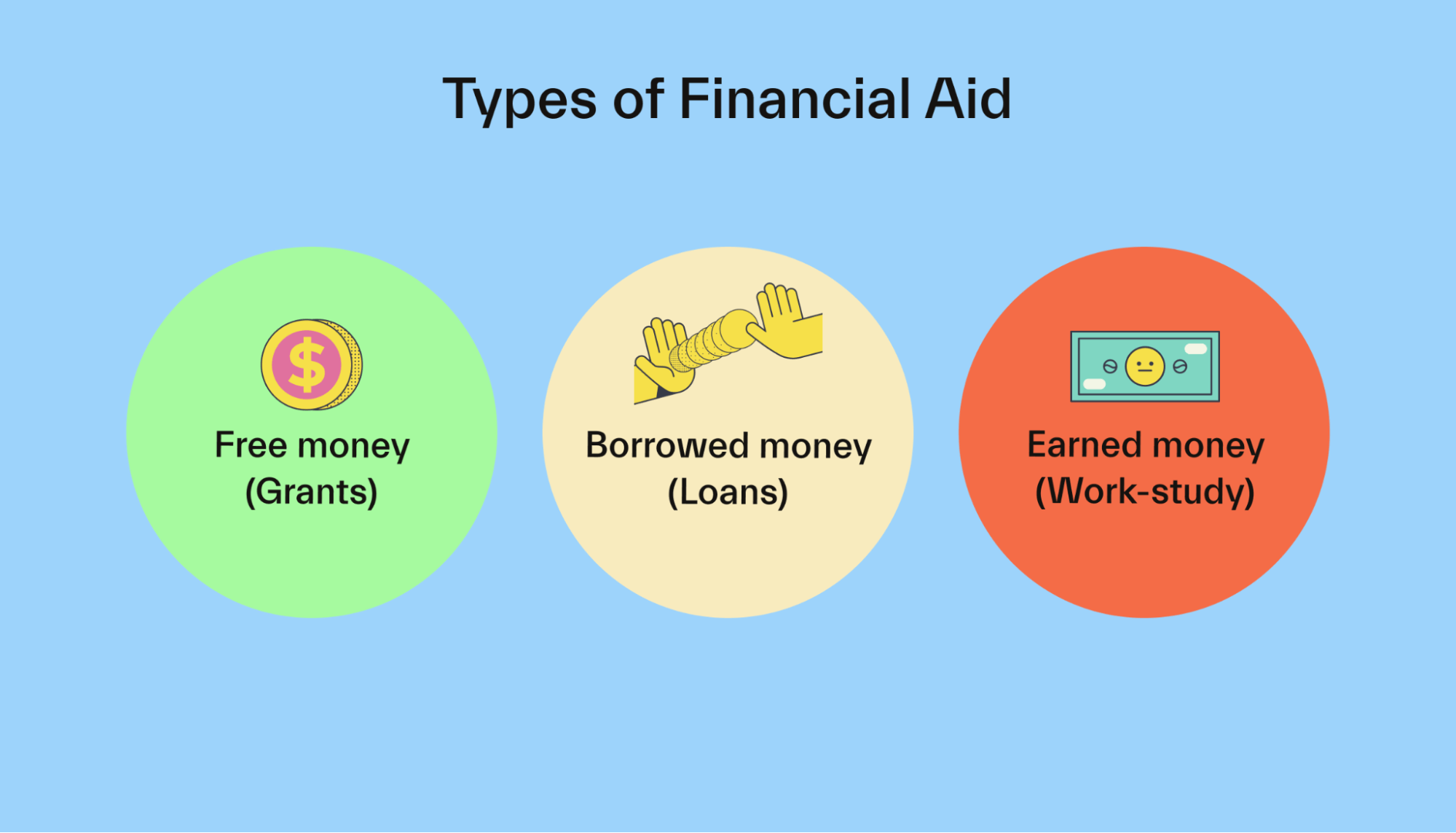

Types of financial aid and their repayment rules

The repayment rules are different for each type of financial aid. Let's talk about the three categories of financial aid and how repayment works for each of them.

Free money

The federal government, state governments, schools, and private organizations give away free financial aid in the form of grants and scholarships.

There are lots of different grants available, but one of the most common is the Federal Pell Grant. This is a need-based grant for students who are getting a bachelor’s degree.

Scholarships, another form of free money, often come from universities or private organizations.

While grants often depend on a student’s financial need, scholarships are often merit-based. This means you can earn them based on your achievements in academics, athletics, arts, or any other area.

Grants and scholarships are a form of gift aid, which means that, in general, you don’t have to pay them back.

There could be some circumstances where you might have to pay back a grant or scholarship.

For example, if you planned to attend school, received grants and scholarships, and then withdrew before the school year started, you may have to pay back the money you were given.

Earned money

There are some cases where financial aid comes in the form of money that you earn, such as through a work-study program.

Work-study is a program under the federal government (and some state governments) where students work at an on-campus job to earn money to pay for school. A work-study job could also be off-campus if it’s related to your field of study or a public interest job.

Work-study jobs are usually part-time, but full-time jobs might be available for students attending school part-time.

Students working a work-study job are paid an hourly wage. The wages can be as low as minimum wage, but they can also be higher for jobs that require more skills or physical effort.

Through the work-study program, you can only earn as much as your financial aid package promised you.

The money you earn in your work-study job is yours to keep. You received it in return for your work, so you never have to repay it.

Borrowed money

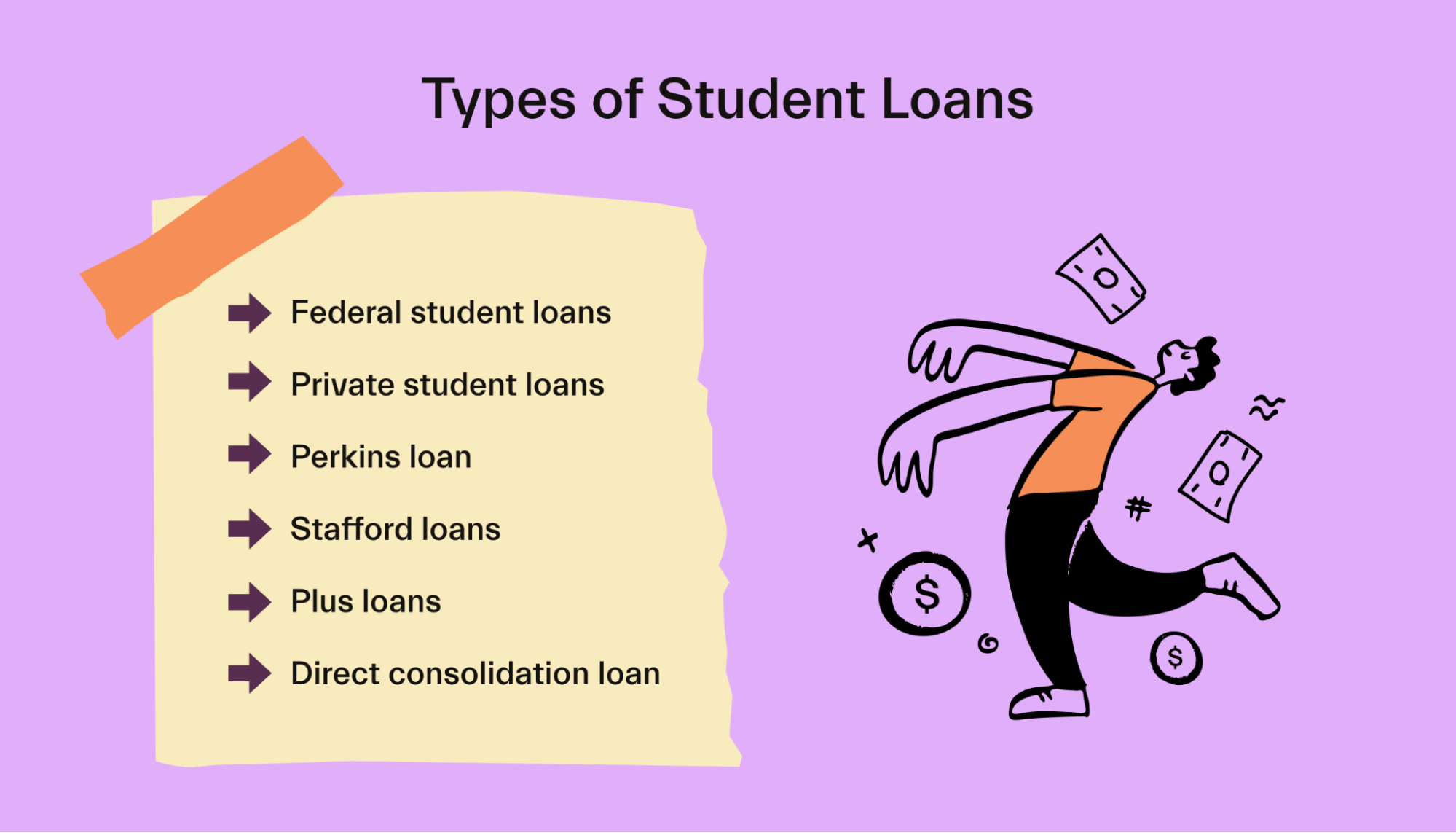

In addition to free and earned money, you can also borrow money to help pay for school. This money comes in the form of student loans.

The largest lender of student loans is the federal government. But there are also loans available through private lenders designed specifically for college expenses.

Let’s talk about the difference between a federal and private loan:

Federal student loans are borrowed from the federal government and repaid to a loan servicer the government contracts with. These loans are need-based. The interest rate on your loan, which is the money the government charges you for borrowing from them, is a fixed rate determined when you borrow each loan.

Private student loans are borrowed from a private lender and repaid to that lender. Your eligibility for loans is based on your credit score, so if you have poor credit or no credit, you might need a cosigner. A cosigner is someone who signs the loan with you and agrees to pay it back if you do not.

The interest rate on your loan can be either fixed (it never changes) or variable (it changes over the course of the loan) and is determined by your creditworthiness when you borrow the loan, among other factors.

There are a handful of different federal student loans you might be eligible for:

Direct subsidized loans are need-based loans for undergraduate students. These loans don’t collect interest while you’re in school or during a grace period of up to 6 months after you graduate.

Direct unsubsidized loans are for undergraduate, graduate, or professional students.l. These loans aren’t need-based, and they do collect interest while you’re in school.

Direct PLUS loans are for graduate and professional students or the parents of undergraduates to cover costs that other financial aid doesn’t cover. A popular example is a Parent PLUS loan. Unlike other federal student loans, PLUS loan eligibility depends on your credit.

Direct consolidation loans are for students who have left school and want to combine their student loans into a single loan and a single monthly payment.

Student loans are unique because they are the main type of financial aid that you almost always have to pay back. Let’s talk about how and when you repay your student loans.

How and when do federal student loans need to be repaid?

Now that you know that you have to repay student loans that you borrow, let’s talk a bit about how and when you do this.

First, the good news is that you generally won’t have to repay your federal student loans while you’re still in school.

Once you graduate, leave school for another reason, or start taking classes less than half-time, your federal student loans will enter repayment status. After that, you’ll have a 6-month grace period before you have to start making payments.

If you have more than one student loan (which most students do when they graduate), you may be able to use a direct consolidation loan to combine them into a single payment.

Doing this can make paying back your loans easier since you end up with a single loan, a single interest rate, and a single monthly payment.

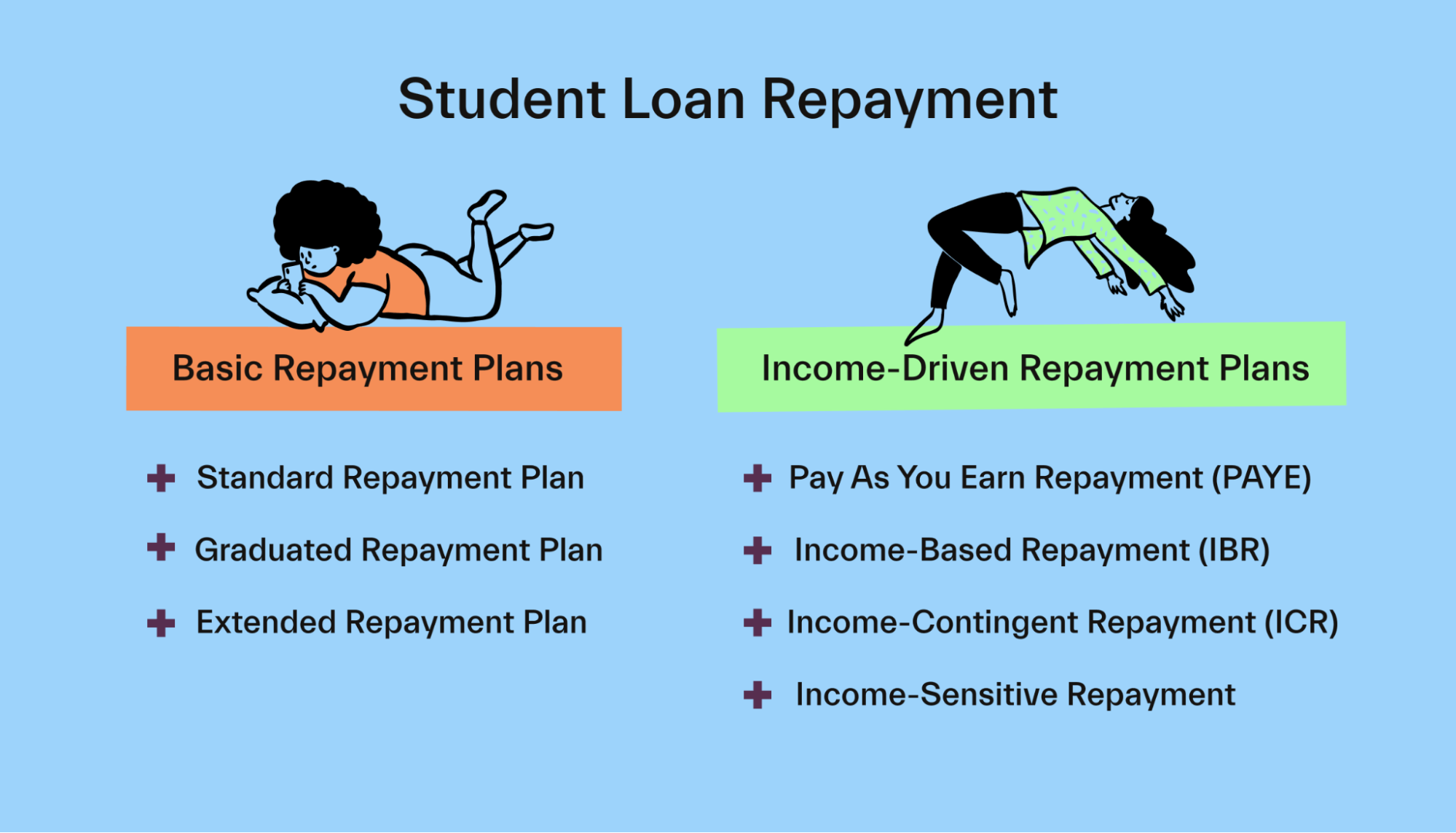

Once you leave school, you’ll be able to choose between different loan repayment options. You’ll automatically be on the standard repayment plan, but you can switch to one of the others.

The repayment plans are:

Standard repayment plan: Fixed monthly payments for 10 years (or 30 years for consolidated loans). You’ll fully repay your loans by the end of this time period.

Graduated repayment plan: Monthly payments for 10 years (or 30 years for consolidated loans). Your payments will start small after graduation and increase every 2 years. You’ll fully repay your loans by the end of the payment term.

Extended repayment plan: For students with more than $30,000 in loans, this plan has either fixed or graduated monthly payments over 25 years. You’ll fully repay your loans by the end of the payment term.

Pay as you earn repayment plan (PAYE): Monthly payments are 10% of your discretionary income, but never more than you would have paid on a standard repayment plan.

You can use a discretionary income calculator to figure out what your discretionary income is based on your state, age, number of dependents, and adjusted gross income on your tax return.

Revised pay as you earn repayment plan (REPAYE): Monthly payments are 10% of your discretionary income. Payments last for 20 years for undergraduate loans or 25 years for graduate loans.

Income-based repayment plan (IBR): This is for people with high debt-to-income ratios, meaning you have a lot of debt compared to your income. Your payments are either 10% or 15% of your discretionary income, but never more than you would have paid on a standard repayment plan. Payments last for 20 or 25 years, depending on when you borrowed them.

Income-contingent repayment plan (ICR): Monthly payments are either 20% of your discretionary income or the amount you would have paid on a 12-year fixed payment plan—whichever is less. Payments last for 25 years.

Income-sensitive repayment plan: For students with Federal Family Education Loan (FFEL) Program loans, your monthly payment depends on your annual income. You'll fully repay your loans within 15 years.

In the case of REPAYE, PAYE, IBR, and ICR repayment plans, the federal government forgives any remaining balance left at the end of your repayment term, meaning you won’t have to pay the remaining money back.

You have the option to refinance your federal student loans into a private loan to lower your monthly payment or save money on interest when market rates are low, but it’s not often advised.

This is because federal loans come with certain perks, including the variety of repayment options we talked about above.

Another perk is that during the COVID-19 pandemic, the federal government paused monthly payments and interest on federal loans. Anyone who refinanced their loans to private loans would have continued to pay on their loans, and they would have kept building interest.

What about private student loans?

Because a private student loan comes from a private lender, they each have their own repayment rules.

In some cases, a lender might require that you make payments while you’re still in school. But often, private lenders follow the government and let you wait until after you’ve finished school to pay them back.

Private lenders aren’t likely to have as many repayment plans as the federal government. Usually, you’ll have just one repayment term. If you can’t afford it, you’ll have to refinance (in order words, you take out a new loan with new terms to replace your existing loan).

Some private lenders may have programs, like the federal government, where you can pause or lower the amount of your loan payments if you go back to school, deploy on military service, or can’t make your payments due to financial hardship.

How does student loan forgiveness work?

You already know that you'll usually have to repay the student loans you borrow, whether they’re from the federal government or a private lender. But in select cases, you can have them forgiven or discharged, which means you’ll no longer have to pay them.

We’ve already talked about how you can have your loans canceled on income-driven repayment plans, but there are additional types of loan forgiveness.

Public Service Loan Forgiveness is a program through the federal government where government and non-profit employees can have their remaining loan balance forgiven after 10 years of on-time payments (or 120 payments).

In a similar program, teachers working in low-income schools can have up to $17,500 in loans forgiven after 5 years of work.

There are also some situations where you may have your loans discharged for reasons unrelated to your job. Some of those reasons include:

Your school closed while you were attending or shortly after you left

You’re totally and permanently disabled

You die, or a student dies and you had a PLUS loan on their behalf

Your school misled you or engaged in misconduct

Your school falsely certified your eligibility to receive a loan

You withdrew from school, and the school didn’t return the loan funds to your loan servicer

Nearly all cases where you can have student loans forgiven apply only to federal loans, but a recent appeals court ruling found that private student loans can be discharged in bankruptcy.

Conclusion

Financial aid can go a long way in helping fund your college education. But, at least in the case of student loans, you’ll have to pay that money back when you leave school.

Student loans are necessary for many students, and it’s totally normal if you have to rely on them to help you get through school.

But, you should also know that there are other types of aid available to help you lower the amount you’ll have to pay back after graduation.

Mos can help you maximize the amount of free financial aid you’re eligible for. Sign up today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you