FAFSA •

April 7, 2023

FAFSA income limits—do I make too much for financial aid?

Learn if you make too much to be eligible for financial aid and how to pay for school if you don’t get enough aid.

Some students hesitate to fill out the FAFSA, worrying that their family is “too wealthy” to qualify for financial aid.

It’s true that you might not qualify for enough to cover the entire cost of education. But your family’s income is just one variable among many.

In this article, we’ll talk about FAFSA’s income limits and what plays into your federal financial aid eligibility. We’ll then show you some ways to make up the difference if you don’t get enough from FAFSA. And we’ll wrap it up by answering a few FAQs.

Does the FAFSA have income limits?

Most students rely on some form of financial aid, as attending college continues to cost more and more.

The Free Application for Federal Student Aid (FAFSA) is the main way for students to get aid for school. It lets you see what you’re eligible for and get federal student aid like loans, grants, work-study, and more.

Every college student should fill out the FAFSA just to see what aid they qualify for, even if they don’t need it. You don’t have to take all or any of the aid they offer, either.

One type of aid you qualify for when you fill out the FAFSA is need-based federal aid. That means your aid eligibility will be limited in some ways based on your family’s income. Eligible students can receive grants like Pell Grants and federal student loans.

In the government’s eyes, if your family makes enough money, you should be at least partly responsible for covering the cost of college.

Now, no forms of aid have a hard ceiling when it comes to your family’s income level. This means there isn’t an exact income limit—how much aid you qualify for depends on your personal situation.

What matters more is your expected family contribution (EFC) and your school’s cost of attendance, topics we’ll explain more in a bit.

Of course, the FAFSA system for determining aid eligibility isn’t perfect. A lot more goes into your financial situation than your parents’ salary.

For example, you may live in a very expensive area. Your family has to put much of its income toward the cost of living, leaving less for college costs.

What factors affect the FAFSA income limits?

The FAFSA looks at several factors to decide how much it will cost for you to attend school and how much they think you and your family can afford to pay. The difference is your financial need.

With that in mind, here are the main factors that affect your FAFSA limits.

1. Expected family contribution (EFC)

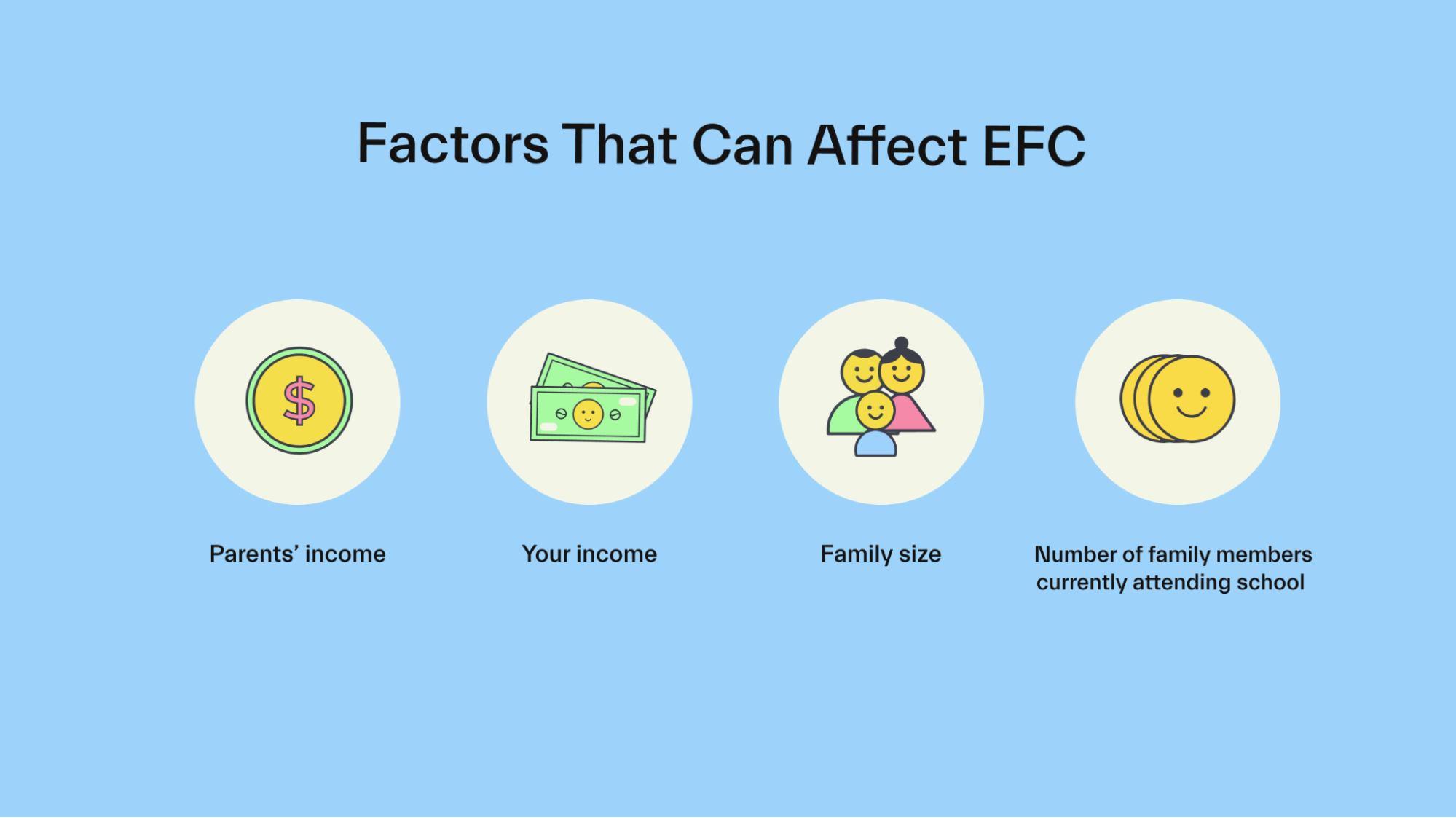

Your expected family contribution, or EFC for short, is an index number a college’s financial aid office uses to decide how much aid you might need to attend their school.

The FAFSA uses your financial information to calculate this. It also considers your family size and how many family members will attend college in that aid year.

A full explanation of how EFC is calculated can be found here.

Now, your EFC may not perfectly reflect your parent’s ability to pay for your schooling. However, it’s currently the fairest way the government and schools have found to calculate student aid needs.

As a note, the EFC will be called the Student Aid Index, or SAI, starting in the academic year 2023–2024. This likely won’t change how a student’s EFC is calculated—it’ll just change the name.

2. Cost of attendance at your school

The next important factor is your school’s cost of attendance. The more it costs to go to school, the more aid you’re likely to qualify for to make up the gap between your EFC and the cost!

They subtract your EFC from your cost of attendance to decide your total financial need.

Cost of attendance for full-time students includes tuition, yes, but according to the Department of Education (ED), it also includes:

Room and board (or living expenses for students who do not contract with the school for room and board)

Books, supplies, transportation, loan fees, and other college expenses

Allowance for child care or other dependent care

Costs related to a disability

Reasonable costs for eligible study-abroad programs

Keep in mind that your year in school can influence the cost of attendance—upper-level courses for an undergraduate student can sometimes cost more per credit hour. Graduate students will usually spend even more on their credit hours.

3. Your enrollment status

If you only attend school part-time, generally less than 12 credits, you may qualify for less aid. This is because you simply don’t have as many credit hours to cover, and you could use the extra time to earn money working.

4. Non-need-based aid

Once your school determines your financial need, they can subtract any aid already awarded to you to decide the non-need-based aid they can give to you.

I’m above the FAFSA income limits. What do I do?

You might need federal aid and even get some—but it might not be enough to cover all your costs of college.

Don’t worry because you have a ton of other options!

Here are some action steps you can take to either get more aid from FAFSA or use some other sources of funds.

1. Double-check your FAFSA

The FAFSA can be confusing—plenty of people make errors when filling it out. Some of those errors may actually change the amount of aid you qualify for.

Make sure to double-check all answers on your FAFSA before submitting it.

Then, check again after you submit it, just in case you missed something the first time.

If you find errors, you can make FAFSA corrections and maybe get even more aid to cover the cost of school!

Do this as soon as possible, so you can get the aid before it’s too late.

There’s almost no chance you’ll get in trouble for an honest error since you’re not trying to be deceptive. Fixing it fast helps your case even more.

2. Fill out the FAFSA every year

Remember, your financial situation changes every year. How much money you qualify for based on the EFC/SAI figures may change as well.

Filling out the FAFSA form is completely free, so you should do it every year. It doesn’t take long, and you could qualify for more aid than you did the previous year.

Plus, you could qualify for other forms of aid you didn’t realize, too!

For example, you might get a Federal Pell Grant without realizing it, allowing you to get some free money you don’t have to pay back.

3. Apply for external scholarships and grants

Scholarships and grants are great because you don’t usually have to pay either one back. They’re both free money.

Scholarships are generally merit-based. A merit scholarship is based on your achievements in areas like academics, athletics, and more.

Scholarship committees generally won’t consider how much aid you’ve already received or how much money your family makes—instead, they’ll only look at how well you meet their requirements.

To apply for the scholarship, you might have to write an essay or written statement, which can be time-consuming. However, some are easier and may only ask for some basic information like a raffle.

Many schools have resources to connect you with scholarships, such as the financial aid office or a search engine.

You can also look online for scholarships.

Grants, on the other hand, are generally need-based. Your other sources of aid can affect your grant eligibility. You still don’t usually need to repay them, though.

4. Get a job before and during school

Tuition can be hard to pay out-of-pocket for most students, so saving any amount of money before college helps.

At worst, you’ll have some extra cash for living expenses.

Plus, getting a job goes a long way once you're in school.

You have 2 options here:

Work-study: You can qualify for a work-study program based on your FAFSA information. These may offer fewer hours than regular jobs, but they’re generally more flexible about scheduling around classes. They also tend to be in your field, boosting your resume.

Non-work-study: If you don’t qualify for work-study, you can get an on-campus or off-campus job as a regular employee. You may be able to work or earn more, but your employer might be less flexible about classes.

If you go the latter route, try to nab a paid internship. These generally pay pretty well, give you great experience on your resume, and could even get your foot in the door at a company after graduation!

5. Find private loans

When you apply for the FAFSA, it will show you your eligibility for federal loans. These aren’t your own loan options, though.

Banks and other private lenders also offer students private student loans, but these should be your last resort.

Private loan interest rates tend to be higher than federal loans. Many of them build up interest and require you to make payments while you’re in school.

Lenders might make you get a co-signer if you have little to no credit, too.

Finally, most private loans don’t come with the perks of federal loans, such as

Deferment

Forbearance

Income-driven repayment plans

Exhaust all other options: FAFSA aid, external scholarships and grants, and a job. You should only get private loans if you still need more and only take out what you truly need.

FAFSA income limit FAQs

We’ve covered the basics about FAFSA income limits and your options if you need more aid. We also talked about correcting your FAFSA information if you made a mistake.

If you still have some questions, check out our list of frequently asked questions below.

What is the maximum income limit to qualify for financial aid?

There’s no maximum income limit to qualify for financial aid on the FAFSA. That’s because there are too many variables to account for.

However, your and your family’s income does influence how much aid you may qualify for. It plays into your EFC (soon to be SAI), along with other factors like cost of attendance, year in school, and enrollment status.

Why does FAFSA limit your aid?

FAFSA awards need-based aid, not merit-based aid. That means they try to evaluate how much you can theoretically pay, then supplement the gap with additional aid from the school.

It’s not a perfect system, as it’s hard for the government and schools to get your exact situation right.

You can always seek out more aid through external scholarships, grants, and private loans if your FAFSA aid isn’t enough.

My family makes a lot. Should I apply for FAFSA?

Yes, you should always apply for the FAFSA.

You never truly know what kind of aid you qualify for, even if you think you make too much. Applying is free and doesn’t take long, so you may as well.

Remember: you can accept as much or as little aid from the FAFSA as you want. If you need less than offered, just take what you need. If you don’t need any, turn it down or don’t take any action.

What if I’m considered an independent student?

If you meet several ED eligibility requirements, you may be considered an independent student. This means you rely mostly on your own finances to fund your education—unlike a dependent student, who usually leans on their family to help cover the costs.

Your answers to questions on the FAFSA mostly help you determine dependency status.

If you qualify as an independent student, your financial information—and your spouse’s if you’re married—is considered. Your parents are left out of the picture, although they’re free to contribute if they want.

Does the FAFSA only impact need-based financial aid?

While the primary benefit of filling out the FAFSA is to qualify for need-based aid, you may need to fill out the FAFSA to qualify for non-need-based programs. For example, while subsidized loans are a form of need-based aid, anyone can get an unsubsidized federal loan. The only eligibility criteria for unsubsidized loans is filling out the FAFSA.

Some schools may also have non-need-based financial aid programs that require students to submit the FAFSA.

Can filling out the FAFSA hurt me?

Filling out the FAFSA won’t negatively impact the type of financial aid you’d receive. The only thing that would hurt the level of aid you receive is not filling out the FAFSA at all, which would leave you without the opportunity to get federal student loans or participate in federal work-study programs.

Some students worry that schools will use their financial information, such as family income when making admissions decisions. However, most schools use need-blind admissions processes, so your FAFSA information won’t impact your ability to get into a school.

Should undocumented students fill out the FAFSA?

Yes, undocumented students should fill out the FAFSA. While these students can’t receive federal student aid such as Stafford loans or Pell grants, some states may have aid programs available for undocumented students.

Private colleges may also offer aid programs for undocumented students and base the awards on the information contained in their FAFSAs.

Don’t let FAFSA income limits prevent you from paying for school

The FAFSA awards aid based on need. There’s no hard limit, but they won’t necessarily pay for your entire cost of attendance if they think you could afford to pay for some.

Still, because of the high cost of school, you and your family may be able to cover the gap. In that case, looking for other forms of aid and working a job might make the difference.

To learn more about financial aid and some of the types available to you, check out our Financial Aid FAQs.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you