Financial aid •

March 24, 2023

Your complete guide to the Federal Pell Grant

Tuition’s rising, so you need every free college dollar you can get. Read about the Pell Grant and eligibility, plus other ways to help pay for college.

Plenty of bright and talented students out there come from backgrounds where affording the rising cost of college is nearly out of the question.

Despite qualifying for scholarships and low-interest federal loans, some students still come up short when their families don’t have enough to cover the remainder.

That’s why the federal Pell Grant program was designed. It helps students with a clear financial need to pay for their degree while reducing their debt burden.

In this article, we’ll explain how the Pell Grant works, its eligibility requirements, and how to apply. Then, we’ll go over some other federal grants and alternative sources of aid.

What is a Pell Grant?

Grants are a form of need-based financial aid. This means they are awarded based on a student’s financial status rather than merit.

The Pell Grant is one of the most well-known grants. It’s a federal grant you can qualify for if you file the FAFSA and meet certain requirements.

As a grant, you generally don’t have to pay it back as long as you finish your studies. This makes it easier to cover your expenses and reduce your student debt burden.

Since tuition costs and student loan debt keeps climbing every year, students—especially those from low-income backgrounds—are faced with a choice:

Crushing debt to get a degree, or

No college education

The Pell Grant has helped solve this problem for a large part of students. About 34% of undergraduate students get Pell Grant awards, and 51% of Pell Grants go to families earning under $20,000 annually.

A brief history of the Pell Grant

In 1965, president Lyndon B. Johnson signed the Higher Education Act into law as part of his Great Society initiative.

As the name implies, the Higher Education Act was designed to make higher education more affordable, especially for low-income students. It established several educational policies and aid programs, including a grant called the Basic Education Opportunity Grant.

Throughout the following years, changes were made to the program. In 1980, the BEOG was renamed the Pell Grant in honor of Claiborne Pell—a Democratic US senator from Rhode Island—to honor him for his work on improving access to higher education.

For several decades, the total Pell Grant funds given out increased slowly each year to accommodate inflation and rising college costs. It spiked dramatically from 2006 to 2010, likely because of the financial crisis.

However, total Pell Grant funds given out have shrunk most years since then, despite rising college costs.

What can I pay for with Pell Grant money?

You can use your Pell Grant money for most educational expenses, not just tuition. First, your school will receive your funds and apply them to your student account to cover tuition, fees, and other expenses.

After that, they pay funds out to you to use on things like textbooks, room and board, and transportation if you commute to class.

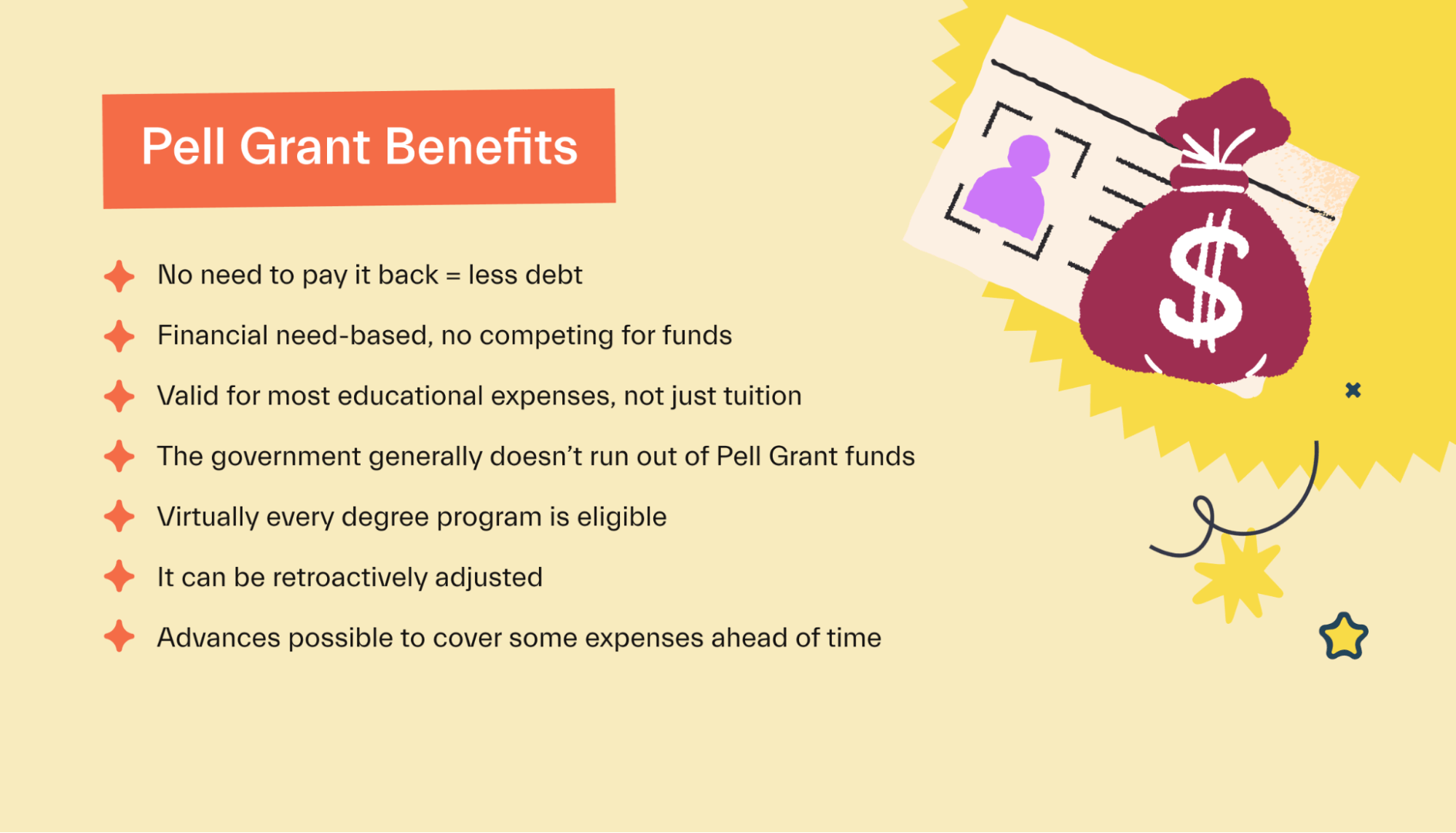

Benefits of the Pell Grant

The federal Pell Grant is one of the best forms of aid if you qualify for several reasons:

You don’t have to pay it back. This reduces your debt burden.

It’s based on financial need. You don’t need to write essays or be at the top of your class.

You can use it for virtually any education expenses, from tuition to textbooks.

Funds generally don’t run out, so you don’t need to worry about going without your grant.

Virtually every degree program is eligible.

The government can retroactively adjust it if you increase your course load or your financial situation changes.

You can get an advance on your grant if you need some of the funds ahead of time.

Am I Eligible for a Pell Grant?

To qualify for the Pell Grant, you must be eligible for FAFSA aid.

Here are the FAFSA eligibility requirements:

US citizen or eligible noncitizen

Undergrad student who hasn’t earned a bachelor's degree (with some exceptions for students in post-baccalaureate teaching programs)

Enrolled already, or accepted for future enrollment as a student in an eligible degree or certificate program

Have a high school diploma or a GED or have completed a high school level education in an approved home-school setting

For the 2023 academic year, this has been extended to people who meet the following descriptions:

Unable to complete studies due to school closing

Borrowers whose loans were discharged under borrower defense to repayment

Students who are incarcerated

How much money can I get?

The maximum Pell Grant award changes every year for inflation and tuition price increases. In the 2021-2022 academic year, the maximum award amount was $6,450 per year, and the minimum was $650.

That said, earning a Pell Grant is dependent on your financial need, so there are limits based on income and finances.

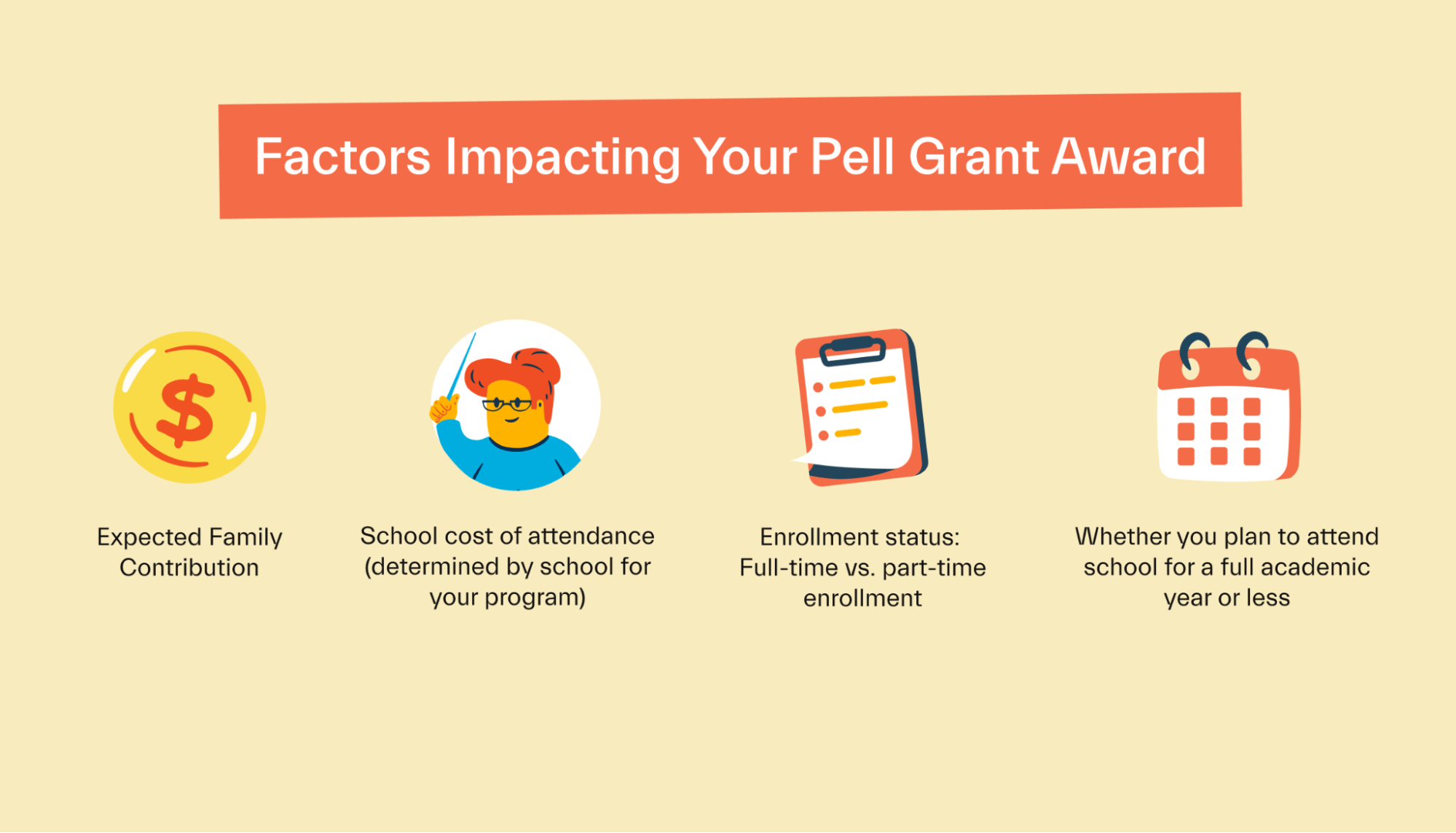

The government determines your financial need based on the following:

School cost of attendance (determined by school for your program),

Full-time vs. part-time student status

Your plan to attend school for a full academic year or less

The amount you win applies for an entire award year—from July 1 to June 30.

Additionally, students can win additional aid if their parents died in the line of duty when the student was:

Under 24 at the time

Enrolled in school at least part-time

The Department of Education covers how Pell Grant awards are calculated in more detail and your eligibility on its website.

How to apply for Pell Grant

The FAFSA lets you see your eligibility for all sorts of federal financial aid—the Pell Grant being one of the most important.

Luckily, applying for the FAFSA doesn’t take too long. You can probably knock it out in a day (or faster, if you’ve got a couple of cups of coffee to fuel your typing). You’ll need your parents’ financial information, or your own if you’re independent, and to create an FSA ID for logging in.

Then, fill in the information the FAFSA asks for and submit it.

After you submit the FAFSA, you’ll eventually receive a student aid report that tells you your eligibility and award amount for the Pell Grant, along with other forms of federal financial aid.

Go here to learn more about filing the FAFSA, including how long it takes.

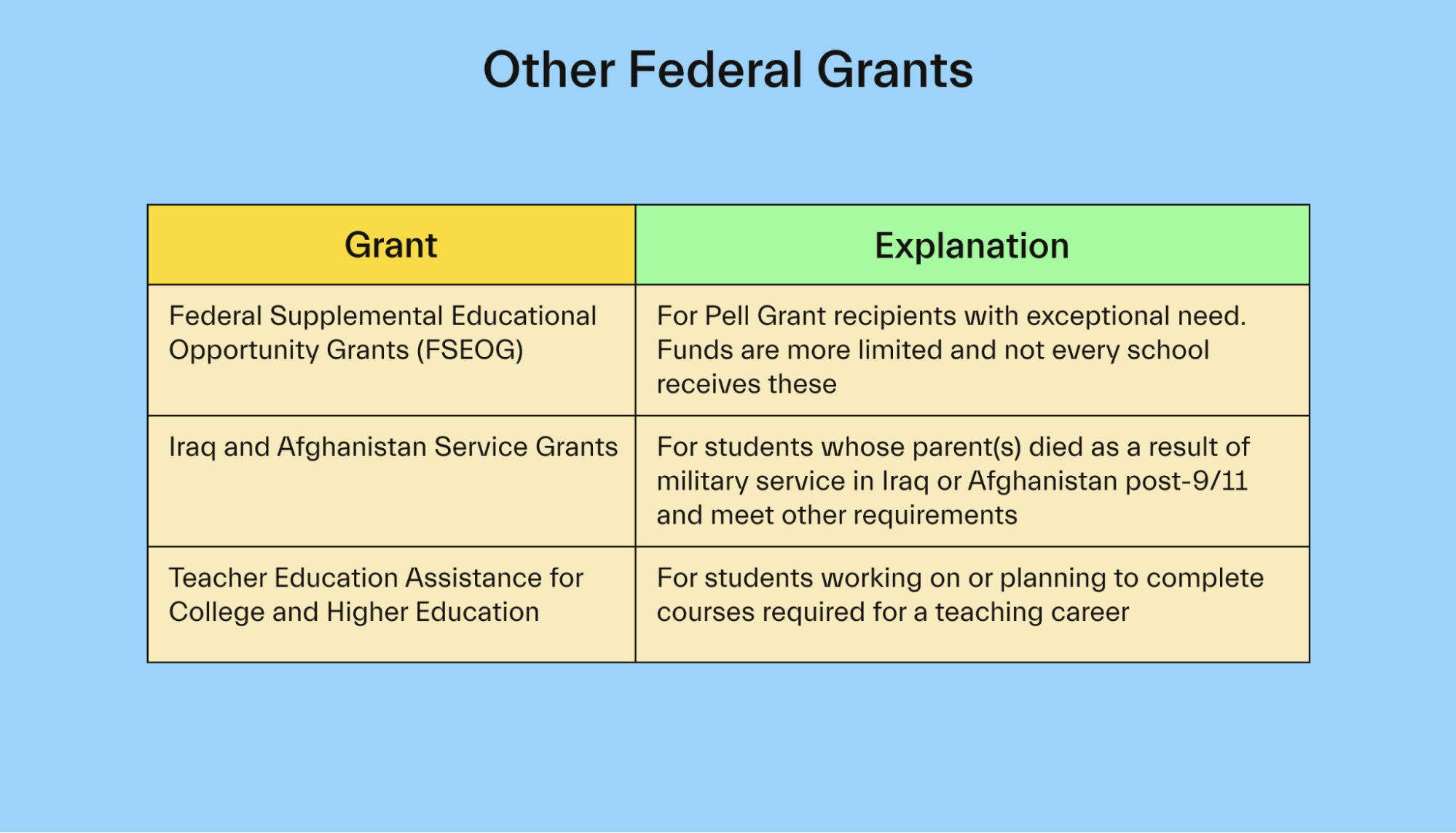

Other federal grants from the US Department of Education

The Pell Grant is the most well-known federal grant, but it’s not the only one. There are few others designed for students in specific situations.

The good thing about these grants is the little required extra work beyond completing the FAFSA. Filling out the FAFSA will give you an idea of your eligibility for each.

So with that said, here are the 3 other grants made available by the Ed Dept.

Federal Supplemental Educational Opportunity Grants (FSEOG)

The Federal Supplemental Educational Opportunity Grants program is designed to help the Pell Grant winners with the most financial need.

You can win $100-$4,000 if you qualify for this grant. However, funds are more limited, and not every school has these. So make sure to check with your school’s financial aid office to see if and how much FSEOG funds are available.

Iraq and Afghanistan Service Grants

Iraq and Afghanistan Service Grants provide more financial aid for students whose parent(s) died as a result of military service in Iraq or Afghanistan post-9/11.

Students must have been under 24 and enrolled in college at least part-time at the time of their parent’s death.

To qualify, you have to exceed the Pell Grant EFC limit and meet all the other Pell Grant eligibility requirements.

As for the award amount, it’s generally equal to that year’s Pell Grant amount. For 2022, that means a max award of $6,435.

However, the Budget Control Act of 2011 reduces any Iraq and Afghanistan Service Grant first disbursed on or after October 1, 2020, and before October. 1, 2022, by 5.7% from the amount you’d usually win.

Teacher Education Assistance for College and Higher Education (TEACH) Grants

Students in eligible teaching degree programs can get free money through the Teacher Education Assistance for College and Higher Education program.

You have to be enrolled in a TEACH-eligible program, meet grade point average requirements, and go through TEACH Grant counseling every year to qualify and stay eligible for a TEACH grant.

Students can win up to $4,000 per year. That said, there are a ton of details to this program you need to know to understand if you qualify. You can find these on the Federal Student Aid website.

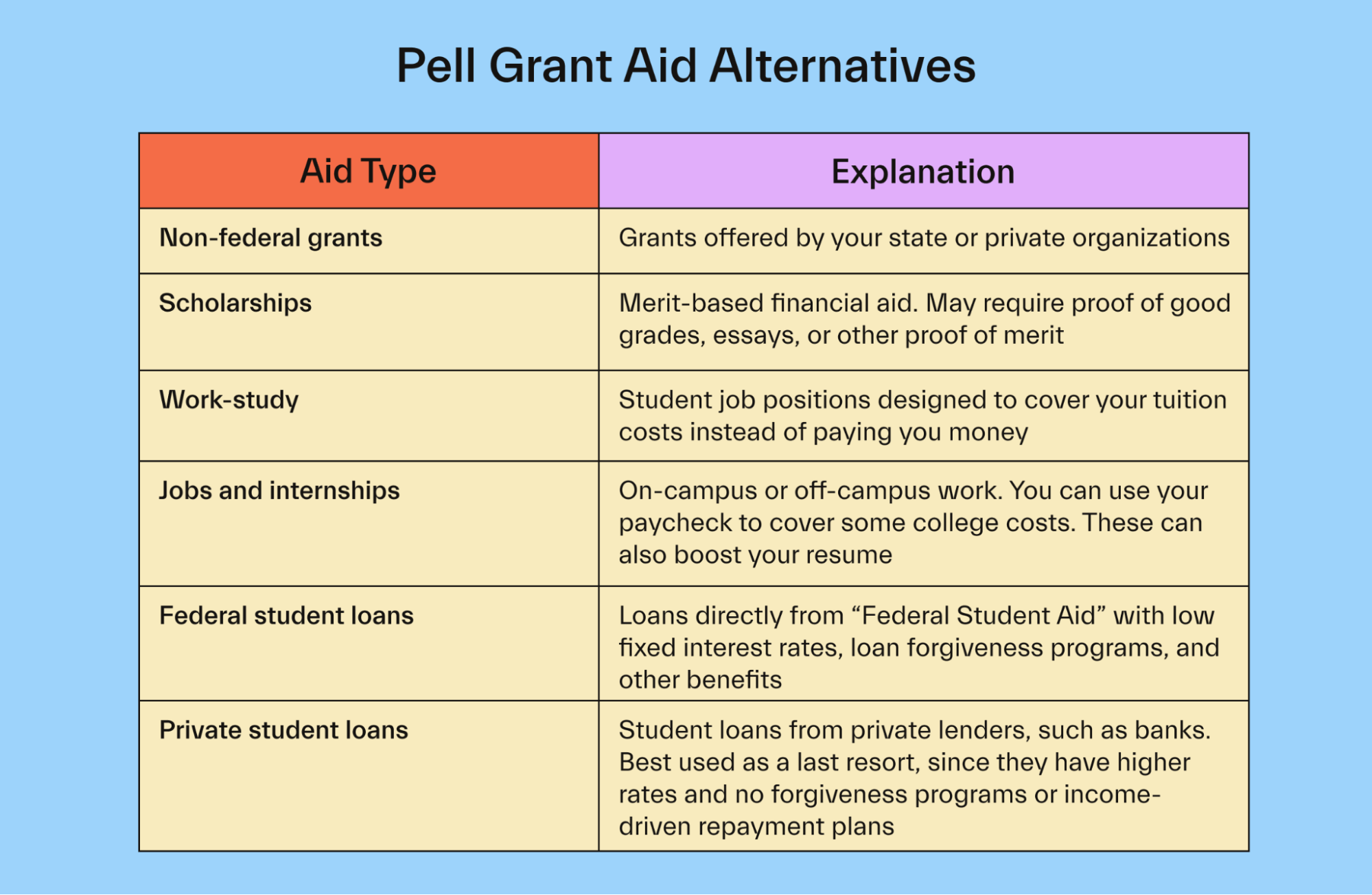

Other ways to pay for school if the Pell Grant isn’t enough

Pell Grants make a great financial aid foundation, but for most students, they’re only part of a college funding package.

If you need more aid after Pell Grants, consider these other ways to pay for college.

Non-federal grants

States also give out grants, usually to students who reside and attend college in that state.

For instance, New York resident students who also attend college in New York State may qualify for a grant through the Tuition Assistance Program (TAP). This year, qualifying students could qualify for up to $5,665 in TAP aid.

As you can see, combining federal and state grants can go a long way in covering your education cost.

Beyond that, you can also look for grants through private organizations. Organizations like Kiwanis and Rotary hand out grants to eligible students who seek them out.

Scholarships

Scholarships are another form of aid you don’t have to pay back. However, unlike grants, they’re generally based on merit.

This means you have to work harder to win, but at the same time, you won’t be capped on aid based on need. In theory, you could win enough scholarships to cover all your costs.

Some scholarships are on the easy side of things. They only ask you to fill out a short application and answer a question or 2.

Others involve a lot more work, such as long essays or videos, but the award amount can be huge.

Scholarships are also targeted to all sorts of niches, such as certain majors or minority groups. For instance, the Ron Brown scholarship offers up to $10,000 per year to Black high school students demonstrating exceptional dedication to community service.

Your financial aid office can point you toward scholarships, but you can also browse online or use a service like Mos to be matched automatically to great scholarships.

Work-study

Work-study is a federal aid program that lets you work a job—up to 20 hours per week—in exchange for some tuition assistance.

Many of these jobs are on-campus and in your major, such as in your major’s department as a clerk or research assistant. However, you could be placed in a more general role, like in the dining hall.

In some cases, you could be placed off-campus at public agencies, nonprofits, governments, and some small businesses.

Work-study tends to be more flexible about scheduling around your classes than a regular job, but there’s less choice in job type, and you can’t work more than 20 hours per week.

Just like other federal aid types, you have to fill out the FAFSA to see if you qualify for work-study.

Jobs and internships

Getting a job or internship while in school is a classic way to make money in college and cover some of your costs while avoiding loans.

On-campus jobs are usually more accommodating when it comes to scheduling hours. They know you have to study and go to class. You could work in all sorts of roles, from the dining hall to the library, to a research lab, and more. Depending on the role, you could get a nice resume booster.

If you’re willing to sacrifice potential scheduling flexibility, finding an off-campus job could open you up to more pay and better career development opportunities.

You could even look for an internship in your major. These tend to pay well, and it’ll look great on your resume. As a result, you might land an awesome job right out of college.

Your college probably has an online job board where you can start your search. You can also contact individual departments.

If you’re looking off campus, check out job sites like Indeed and search in your area. These days, with the right skills and knowledge, you could even land a remote job in college and work right out of your dorm room or apartment.

Once you land a job, you’ll want to manage your money responsibly to cover your expenses and reduce financial stress. Go check out our guides on saving money in college and grab one of our student budget templates to jump-start your personal financial management.

Federal Student Loans

If you’ve exhausted the above and still have college costs, you’ll want to look at loans.

The first type of loan programs to look at is federal student loans.

These tend to offer better rates than private loans and offer other benefits, like income-driven repayment plans, deferment and forbearance, and loan forgiveness. Plus, they come with a 6-month grace period after you leave school, during which you don’t have to make payments.

This gives you time to find work so you can be financially prepared for repayment.

You can qualify for these by submitting the FAFSA. There are a few types. First, those designed for undergraduate students:

Direct Subsidized Loans: These don’t accrue interest or require payments until your grace period ends.

Direct Unsubsidized Loans: These begin accruing interest right away, but don’t require repayment until the grace period ends.

There’s another type of loan, called a Direct PLUS loan, of which there are 2 types:

Grad PLUS Loans: These are designed for graduate and professional students.

Parent PLUS Loans: Parents can take these out to help pay for their dependent student’s college.

Check out our grant vs. loan comparison to learn more about the benefits and drawbacks of each aid type.

Private student loans

Private student loans are any student loans you can get through lenders, banks, and other private institutions.

These should be your last resort because they have a few downsides.

For one, they come with higher rates than federal student loans, in some cases significantly higher. They don’t offer loan forgiveness or income-driven repayment programs in most cases, and may not provide deferment or forbearance.

Additionally, the lender might demand you start repaying these loans while in college. Not exactly affordable when you’re a student.

Plus, even qualifying for one can be harder than federal loans. If you have little to no credit score or history, the lender might make you get a cosigner, like your parents.

Pell Grant FAQs

Have more questions about the Pell Grant? Take a look at our Pell Grant FAQs below.

Do I ever have to pay back federal grants?

You generally don’t have to repay grants, except in certain uncommon circumstances:

You withdrew early from a program a grant was given to you to pay for.

Your enrollment status changed in a way that reduces grant eligibility, such as dropping from full-time to part-time.

You got outside scholarships or grants that cut your financial aid needs.

You got a TEACH Grant but didn’t meet your TEACH Grant service obligation requirements.

Do I have to apply for Pell Grants every year?

Yes. You have to apply for the Pell Grant through the FAFSA every year that you wish to win it. The FAFSA is free and doesn’t take long, so there’s no downside to applying—even if you don’t think you’ll win.

Do I have to accept my Pell Grant?

You do not have to accept your Pell Grant every year, although you should if you need aid since it’s tax-free when used for education expenses, and you don’t need to repay it.

You can also return disbursed Pell Grant funds midway through the year if unused. This may increase your lifetime eligibility again since the funds weren’t used.

Are Pell Grants first-come, first-serve?

Pell Grants are not first-come, first-served. In fact, they’re one of the only forms of aid that generally doesn’t run out, alongside student loans. Every school receives enough money to fund the program.

However, most other grants may run out—especially private and state grants.

Similarly, scholarships and work-study can run dry.

How is my Pell Grant paid out?

If you accept a Pell Grant, the school will credit your student account to cover your tuition, fees, and other expenses they charge. The remainder, if any, is paid to you directly. You could then use these funds to pay for other expenses yourself.

The school then gets reimbursed by the government for the funds they dole out.

Can I use the Pell Grant for the summer semester?

Potentially. Students eligible for a regular Pell Grant may qualify for additional aid to cover summer classes.

If you’re eligible, you can receive up to 150% of your typical Pell Grant award for the year. For instance, if you typically qualify for $4,000 in Pell Grants total for the fall and winter semesters, you could get an additional $2,000 for summer courses.

Contact your financial aid office to learn more about getting Pell Grant aid for summer classes.

That said, keep in mind that you can only get Pell Grants for 12 semesters, or 6 years maximum.

Get debt-free financial aid through the Pell Grant

Pell Grants help bright minds get the college education their hard work has earned them. At the same time, it makes it easier to get through school with a little less debt, setting you up for a less stressful life post-graduation.

But for most students, Pell Grants won’t cover all school costs. Instead, it’ll make up a portion of an overall plan to pay for college.

Check out our guide on how to pay for college to learn more ways to cover tuition, fees, and other education expenses.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you