FAFSA •

May 2, 2022

Does FAFSA cover summer classes?

Summer classes can get you ahead on your degree, but can the FAFSA cover them? Learn how to pay for summer learning and whether summer classes are worth it.

Summer gives you the opportunity to kick back and relax or get some work experience—but many opt to take a couple of summer classes.

The problem is finding the money for these classes. The FAFSA clearly helps you pay for the regular school year, but can you use it for the summer semester as well?

In this article, we’ll show you how the FAFSA works for summer classes, explain the types of summer financial aid available, and offer a few other ideas to cover your costs. Then, we’ll discuss the benefits and drawbacks of summer classes to help you decide if they’re worth it.

Can you submit the FAFSA for summer classes?

The FAFSA is what lets you access most forms of federal financial aid. It gathers information about you and your family’s financial situation and uses it to determine aid eligibility.

Generally, if you’re eligible to file the FAFSA, you can get financial aid for summer classes.

However, certain types of aid may not be available, depending on your school. For instance, your school may not have work-study positions available in the summer.

Additionally, schools can differ on which academic year’s aid goes to your summer classes.

Say you’re doing summer classes during 2022. Some schools might use 2021-2022’s FAFSA, while others might use 20222-2023’s.

Lastly, keep in mind that you only get so much aid each year and in total for your entire education. Borrowing for the summer counts against these, so you have to plan ahead.

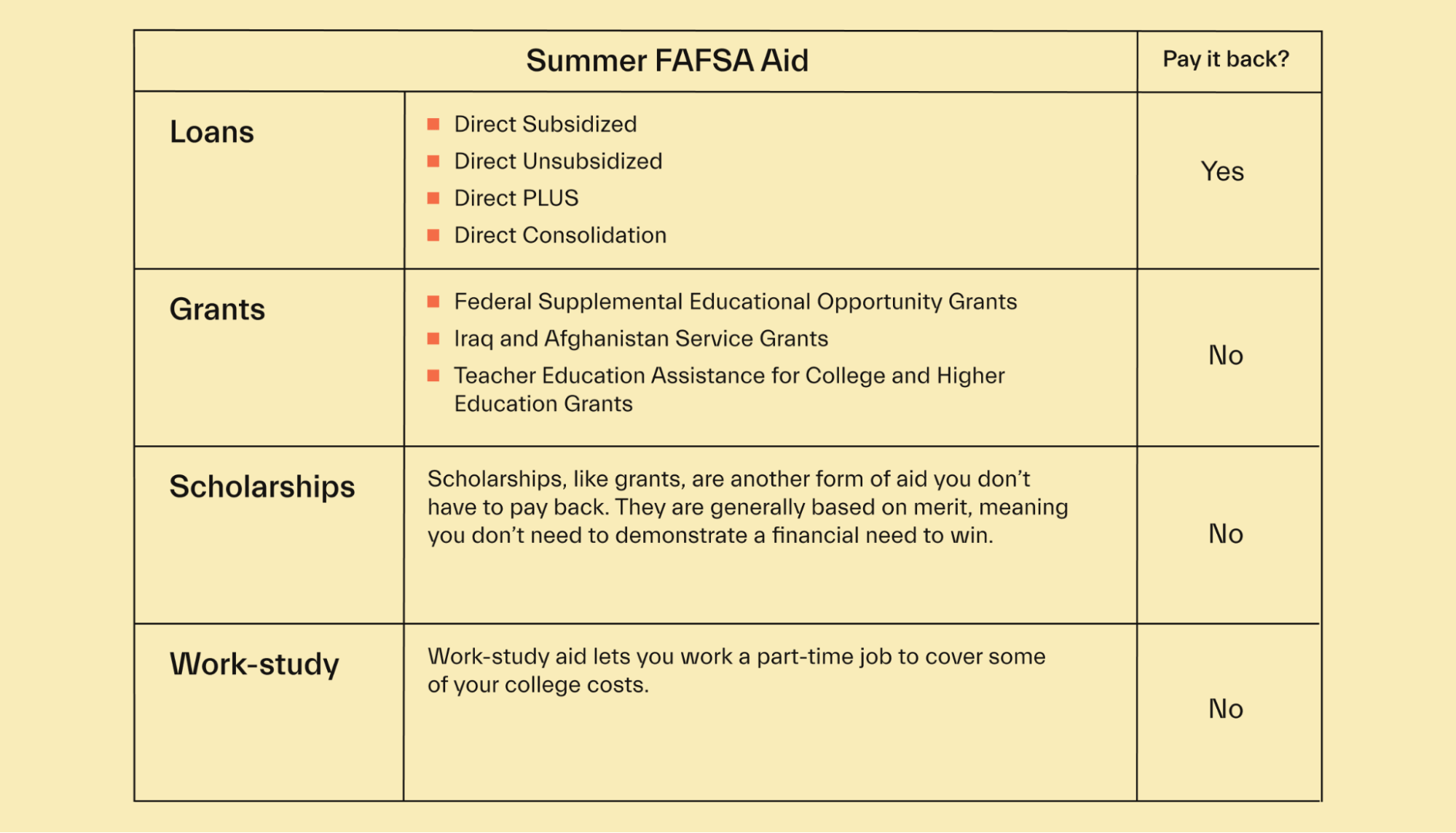

Types of FAFSA aid available for summer classes

Most of the aid types used during the regular year are also available during the summer sessions.

However, you have to fill out the FAFSA to be sure of your eligibility. Once you do so, you’ll see how much of the following aid types you could get to pay for summer classes:

Loans

Almost 45 million Americans have federal student loans, making them one of the most widespread types of aid.

There are a few types of federal student loans:

Direct Subsidized: Based on financial need. Interest doesn’t start to build up until the 6-month post-graduation grace period ends. You can get these as an undergraduate student.

Direct Unsubsidized: Not based on financial need. Interest starts building up immediately, but you don’t have to start paying these back until the 6-month post-graduation grace period ends. You can get these as an undergraduate student.

Direct PLUS: For professional and graduate students and parents of a dependent undergraduate student. Not based on financial need but requires a credit check.

Direct Consolidation: These let you combine all your loans into one loan with one servicer. Makes your loans easier to manage.

Grants

Grants are a form of need-based financial aid that you don’t have to pay back, leaving you with less debt after graduating. This makes them preferable to loans.

The Pell Grant is one of the most well-known federal grant programs. These are available to undergraduate students without a degree, and eligible students can win a Pell Grant of up to $6,495, depending on several factors. That number changes each year for inflation.

Other federal grants besides the Pell Grant include:

Federal Supplemental Educational Opportunity Grants

Iraq and Afghanistan Service Grants

Teacher Education Assistance for College and Higher Education Grants

Scholarships

Scholarships, like grants, are another form of aid you don’t have to pay back. They are generally based on merit, meaning you don’t need to demonstrate a financial need to win.

Now, the FAFSA itself doesn’t formally offer scholarships. However, many scholarship programs need some information from your FAFSA to complete your application.

Scholarships vary widely in requirements. Some ask for essays or a video as part of the application. Others are easier, only asking for your name and email address to enter.

Work-study

Work-study aid lets you work a part-time job to cover some of your college costs.

These jobs are usually on campus, making them easy to schedule around your summer classes. Sometimes, you can get placed into an off-campus job, though.

Regardless, schools do their best to put you in a job related to your major, and sometimes you’ll work for organizations such as nonprofits. This can give your resume a boost.

Keep in mind that work-study availability may be lower during the summer sessions since schools won’t have as much of a need for student workers.

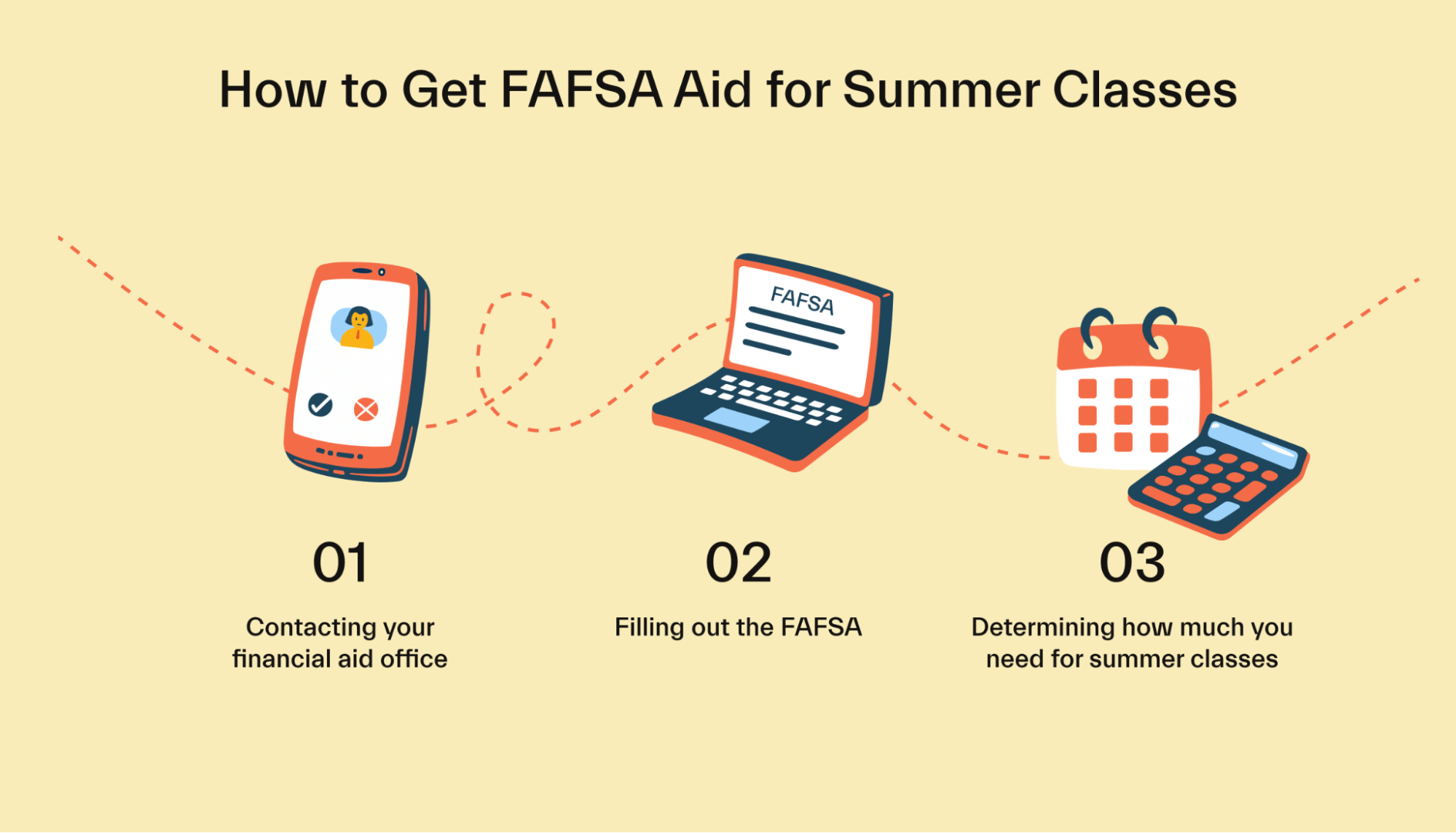

How to get FAFSA aid for summer classes

Getting FAFSA aid for summer classes isn’t too different from the fall and winter semesters. However, you have to make sure you can get it and you don’t use too much of it.

With that in mind, here’s how to get your FAFSA aid.

Contact your financial aid office

First, reach out to your financial aid office to see which year they lump their summer sessions in with.

Knowing this will help you budget your summer financial aid the right way and determine if you even need to file the FAFSA early. For example, if they consider summer classes part of the current academic year, you won’t need to file a new FAFSA to get aid (as long as you already filled one out for the current year).

Fill out the FAFSA

Next, you’ll fill out the FAFSA if you need to. Luckily, the FAFSA is completely free and doesn’t take too long to fill out if you have all the info you need.

To apply, you’ll head to the FAFSA website to start your new application. You’ll provide information about you, your household, and your family’s financial status. If you’re applying to college for the first time or transferring schools, you’ll also add schools to the application.

Do this as early as possible, especially if your school classifies the summer term as the next academic year. Some forms of aid are first-come, first-serve, and they will run out if you wait too long.

Determine how much you need for summer classes

The FAFSA takes a little while to process, but you’ll eventually receive a financial aid award letter from your school.

This letter details the types of aid and estimated amounts you can get, along with your school's cost of attendance info.

With this, you can determine how much to take out for summer classes.

You’ll want to be careful here. Every dollar you use for summer classes is a dollar less for your education during the regular academic year. You might scale back on the amount of financial aid award you use for summer classes and find other ways to pay—which we’ll discuss next.

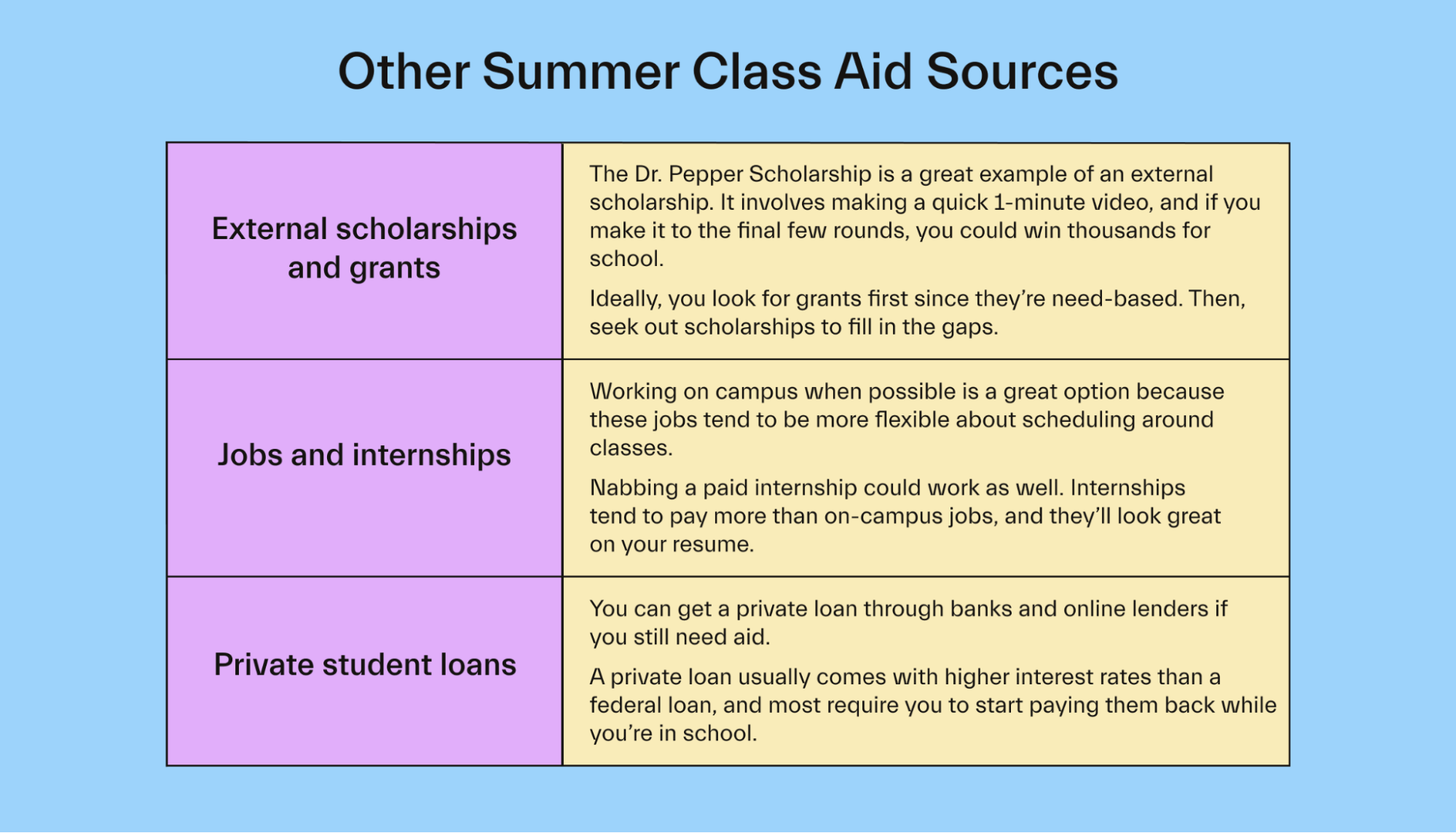

Other ways to pay for summer classes

If you’re trying to save your FAFSA for the fall and winter semesters, here are some other ways you can cover the cost of attendance of summer college classes.

External scholarships and grants

There’s a nearly endless list of scholarships and grants you can find outside of your school and the FAFSA.

The Dr. Pepper Scholarship is a great example of an external scholarship. It involves making a quick 1-minute video, and if you make it to the final few rounds, you could win thousands of dollars for school.

That’s just one type of scholarship, and it’s a broad one. You can also hunt for niche scholarships that fit your major, hobbies and interests, volunteer experience, and more! You have a higher chance of winning these since the competition is narrower.

The same is true for grants. Ideally, you look for grants first since they’re need-based. Then, seek out scholarships to fill in the gaps.

Jobs and internships

A job can help pay summer tuition. You’ll most likely have more time for work since many students only take 1 to 2 summer classes.

Working on campus when possible is a great option because these jobs tend to be more flexible about scheduling around your classes. There could be more openings since a lot of students will go home for the summer.

Nabbing a paid internship could work as well. Internships tend to pay more than on-campus jobs, and they’ll look great on your resume.

The one thing to keep in mind is many summer internships are full-time. Even the part-time ones may not be super flexible about scheduling around summer classes.

Private student loans

You can get a private loan through banks and online lenders if you still need aid. However, use private student loans as a last resort.

A private loan usually comes with higher interest rates than a federal loan, and most require you to start paying them back while you’re in school. Plus, they don’t offer the income-driven repayment plans and loan forgiveness programs that federal loans do.

Make sure you exhaust all other forms of aid first—federal loans, grants, scholarships, and jobs or internships.

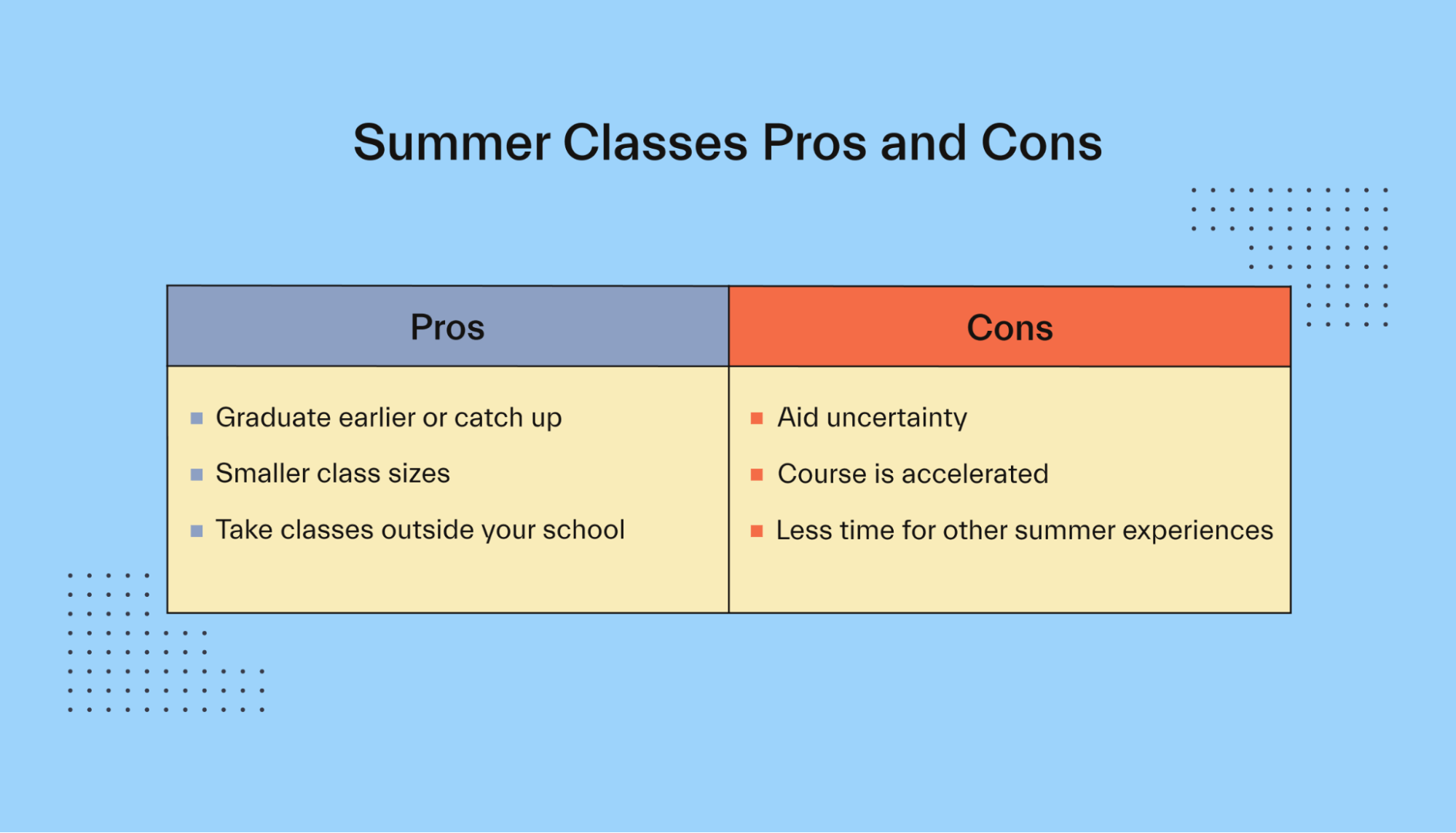

Are summer classes worth it?

So you know the FAFSA is available for the summer with some caveats.

But are summer classes worth it at all? Or should you spend the summer months traveling, working full-time, or just relaxing?

Let’s look at the pros and cons of taking classes during the summer semester.

Pro: Graduate earlier or catch up

Did you fall behind on your classes? Maybe you had to drop a class to take care of your physical or mental health.

No problem—signing up for a summer course or 2 can catch you right back up.

Or maybe you want to forge ahead, graduate early, and start making a full-time paycheck faster. Once again, summer classes are there for you.

In both situations, taking your hardest class during the summer might make sense. Things are accelerated, but you can dedicate all your study time to that one tough class.

Pro: Smaller class sizes

Most summer courses have much smaller class sizes because most college students aren’t taking summer classes.

No more giant 200-person lectures. Smaller class sizes make it easier to get personal help from the professor. You might even find your class easier because of this!

Pro: Take classes outside your school

Another way to save money on summer classes is to take them at a community college.

Per the Education Data Initiative, the average 4-year university course costs $170/credit hour than the average community college course. That saves you $510 per three-credit class!

If you take community college classes every summer, you could save thousands and get your 4-year degree early.

Of course, tuition varies by school. Do the math first to see if you’d actually save money before enrolling in community college courses.

Additionally, make sure any credits you earn from community college transfer to your university.

Con: Aid uncertainty

As we talked about earlier, summer financial aid availability can be different than during the fall or spring semesters. You have to budget your aid award properly to make sure you have enough for the rest of the year and the remainder of your education as well.

Con: Course is accelerated

Summer sessions are much shorter at most colleges, so your professor will cram a semester’s amount of work into less time.

This often means longer class times and more material to learn per week. Fortunately, if you only take 1 to 2 classes, you can still manage an accelerated curriculum.

Con: Less time for other summer experiences

When you take classes during the summer term, you have less time for other college summer experiences. For instance, you have to plan your studies around any summer traveling you plan on doing.

You can still work or take internships, but having courses could limit your opportunities when it comes to finding full-time work during the summer. And you still have to make time to study when you’re not working.

Get the money you need for summer classes

Summer classes can help you get ahead on your degree and knock out some tougher classes when you have a lighter course load—if you don’t mind having less time for other summer experiences.

Fortunately, the FAFSA can cover some or all of the cost of your summer classes, depending on your school and aid eligibility. Check with your financial aid office to be sure, though.

But whether it does or not, you can also fund your summer term through outside scholarships and grants.

For more ideas on covering your college costs year-round, check out our guide on the best ways to pay for college.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you