Financial aid •

December 20, 2021

Finding the best way to pay for college: 10+ proven strategies

Learn the best ways to pay for college using our list of tips and tricks.

If you're stressed-to-the-max about finding the best way to pay for college, then we need to spill the beans on something:

There's no one best way to pay for college.

But before you start panicking, let us explain further:

True, there's no one best way to pay for college. But that's because there are multiple, proven strategies to pay for your higher education!

And in this post, you'll learn about these strategies so that you can pinpoint the most practical route to fund your education.

Let's dive in.

12 proven ways to pay for college

Let’s explore 12 strategies that you can use to help you pay for college.

1. Apply for financial aid

When planning out how to pay for college, submitting the Free Application for Federal Student Aid (FAFSA) is an essential step.

The FAFSA qualifies you for different types of student financial aid like government grants and loans, school-sponsored aid, and work-study programs (more on each of these later).

You can submit your FAFSA application starting October 1 of every year, and you must submit it every year you're in school if you want to continue getting aid.

After submitting your application, you'll receive a financial aid award letter detailing the type (and amounts) of financial aid available.

Remember, some financial aid is on a first-come, first-serve basis, so get your FAFSA in as soon as possible.

Even if you don't think you'll receive any financial aid, submit your FAFSA anyway. Although not everyone receives financial aid, it's worth taking 30 minutes to fill out the form because you could receive thousands of dollars to help pay for college.

If you’d like help filling out your FAFSA so that you can qualify for the most money possible, work with a Mos advisor and get every dollar you deserve.

2. Apply for scholarships

Scholarships are free money.

That is, if you're awarded a college scholarship (or multiple scholarships), you usually don't need to pay them back.

There's no shortage of scholarship opportunities available. For example, in 2020, approximately $8.8 billion in scholarships was awarded to US college students.

But how do you discover these scholarship dollars?

Start by filling out the FAFSA.

When you submit your FAFSA, you're put in the running for various government and school-sponsored scholarships.

Some scholarships may ask you to submit additional documents like your grades, letters of recommendation, or a personal essay, so be prepared and have those ready.

And, when hunting for scholarships, don't forget to look in your community.

Local businesses, non-profits, and other organizations often provide scholarships. Although these local scholarships are typically smaller than national ones, they're also less competitive and usually easier to win.

3. Apply for grants

Like scholarships, grants are free money you don't have to pack back, making them one of the best ways to pay for college.

If you've submitted your FAFSA and you qualify for financial aid, you'll be eligible for federal grants like:

The Pell Grant: Awarded to undergraduates who haven't earned a bachelor's, graduate, or professional degree and who demonstrate exceptional financial need. The maximum Pell Grant amount for the 2021–2022 school year is.

The Federal Supplemental Education Opportunity Grant (FSEOG): Awarded to undergraduate students with exceptional financial need. The FSEOG ranges anywhere from.

Again, like scholarships, there are no shortages of grants in the US, with the government earmarking about $32 billion for student grants every year.

Students currently only claim about $30 billion in this free grant money each year, leaving around $2 billion on the table.

4. Take advantage of 529 college savings plans

Money saved is money you don't have to borrow. And one of the best ways to save for college is with a 529 plan.

A 529 plan is a tax-advantaged plan to help cover the cost of higher education.

With a 529, withdrawals are tax-free if they're used for educational expenses like college tuition and fees, books, and certain qualified secondary costs like room and board.

There are 2 main types of 529 plans:

Education Savings Plans: An investment account you can use to cover qualified post-secondary expenses like tuition, fees, and room and board.

Prepaid Tuition Plans: A plan that lets you pay future tuition at today's rates. Prepaid tuition plans only cover tuition and fees. Secondary expenses like room and board aren't eligible.

Remember, 529s are state-sponsored, and the rules are different from state to state, so be sure to review the rules, terms, and conditions in your state.

What's more, not all 529s are equal—terms, fees, investment options, and rates of return vary considerably, so shop around to find the best plans.

5. Choose an affordable college

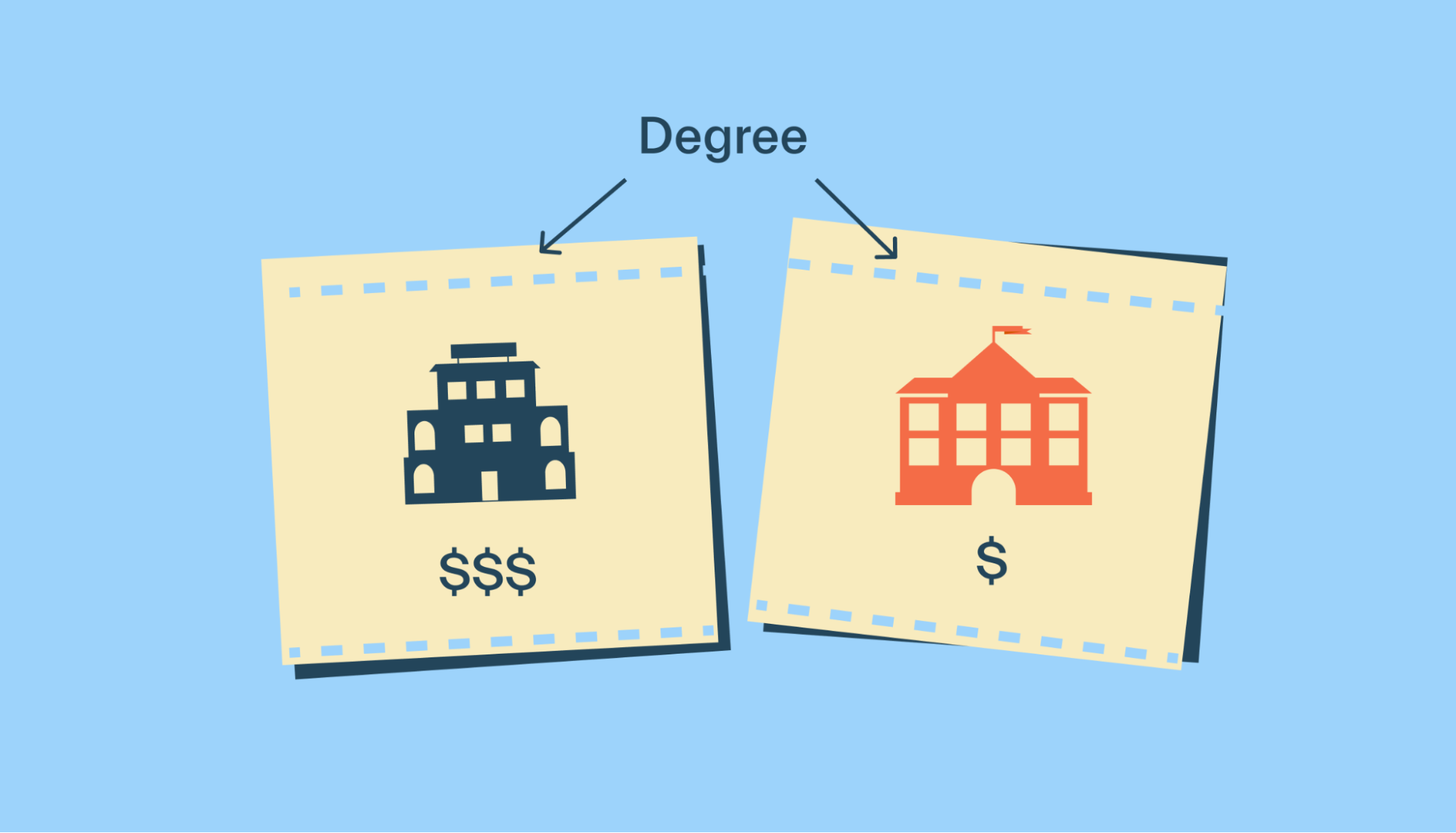

The cost of attending college varies a lot by school.

For example, the average cost of a public 4-year college is between $25,615–$27,437, whereas a private 4-year college costs about $53,949.

Big difference, right?

But just because a school is cheaper doesn't mean it's cheaper for you.

You see, the amount of aid you receive depends, partially, on the school you attend. So if a $30,000-per-year college offers you no aid, but a $60,000-per-year college gives you $40,000 in aid, the more expensive school is the cheaper option.

As a rule, once you have your financial aid award letter and know of any scholarships and grants you've earned, calculate the actual cost of attending your choice schools. You'll typically find cost calculators or net price calculators on college websites.

If you find you need more money after estimating your actual costs, you might want to consider a cheaper school or supplement your financial aid with student loans.

6. Apply for Federal Work-Study

The Federal Work-Study program arranges part-time jobs for undergraduate and graduate students.

If you're eligible, it's an opportunity to earn money to cover some of your college expenses.

Here's a quick overview of the program:

Provides part-time employment for undergrad and grad students with financial need

Available for full-time and part-time students

Students earn (at least) the federal minimum wage

Students get paid at least once a month

Student earnings are limited (they can't make more than the total Work-Study award listed on their financial aid package)

Colleges administer the program on behalf of the federal government (i.e., schools are the point of contact, not the federal government)

If you’re looking to participate in the Federal Work-Study program, you must fill out the FAFSA and demonstrate financial need. If you qualify, you'll see work-study on your aid award.

Work-Study job opportunities vary. Some jobs are on campus, like working as a library or research assistant. Other jobs are off-campus, like working for a public agency or a non-profit organization.

Students may also work with private for-profit companies, as long as it aligns with their college studies.

Although you'll often only make minimum wage to start, the Federal Work-Study is an excellent way to network and make connections, which may benefit you in the future.

7. Negotiate for more money

If you've cracked open your financial aid award letter and said to yourself, "That's it?" then this is the section for you.

Don't be afraid to negotiate for more money if you think you deserve it. Start with writing a letter of appeal to your school and then follow up with a phone call.

You see, financial aid is based mainly on your "expected family contribution" (EFC), an index number that colleges use to decide your financial aid eligibility.

Your EFC is calculated using earnings from the previous year. However, circumstances like layoffs and medical bills can drastically change your family's finances.

Always assess your financial aid based on your current situation, and if you feel you need more money, appeal.

A difference in your family's financial health isn't the only reason you should renegotiate your financial aid package.

For example, here are 2 scenarios where you might successfully renegotiate your aid:

If your grades are better than when you filed your FAFSA, making you a more attractive candidate for merit-based aid.

Suppose another school gives you a better aid package. You can use their offer to negotiate with your preferred school.

If you can justify your need for more money, you might just get it!

8. Trim your expenses

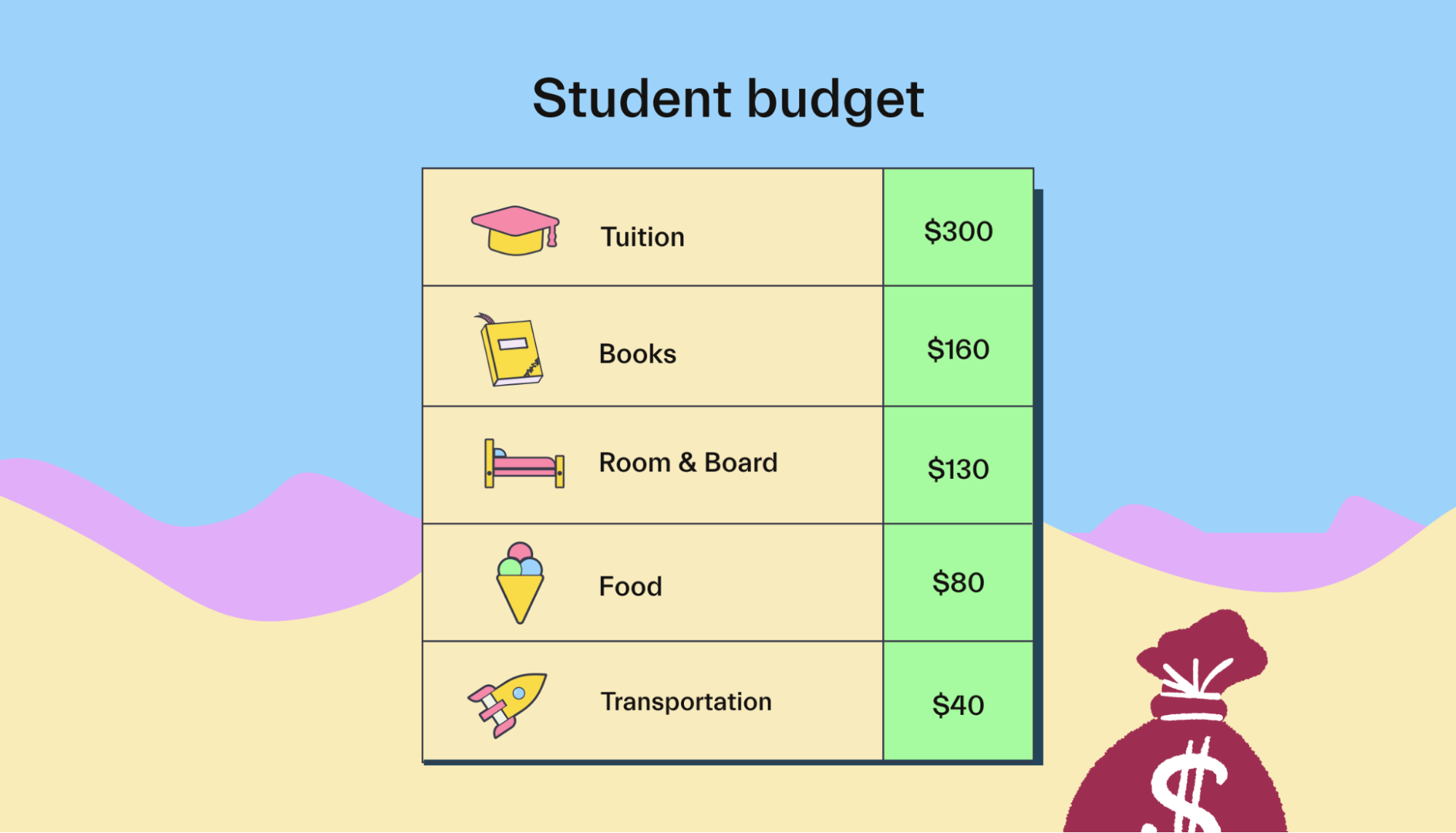

Trimming your expenses is an excellent way to help pay for college because it stretches your financial aid even further.

You can't do much about cutting fixed costs like tuition and fees. But for secondary expenses—like room and board, transportation, books, food, etc.—a cost-conscious attitude can pad your bank account.

Some strategies you can use include:

Living at home

Creating and sticking to a budget

Walking or biking places instead of driving

Eating out less

9. Work part-time (or start a side hustle)

Working and going to school requires a bit of discipline, but the financial rewards are worth it.

For example, having extra income helps you pay for your education and reduces the amount of money you need to borrow.

Plus, when summer rolls around, you don't have to waste time finding a job. Instead, you can try to start working full-time hours at your current job right off the bat.

And if working for someone else isn't your thing, consider starting a side hustle like babysitting or tutoring.

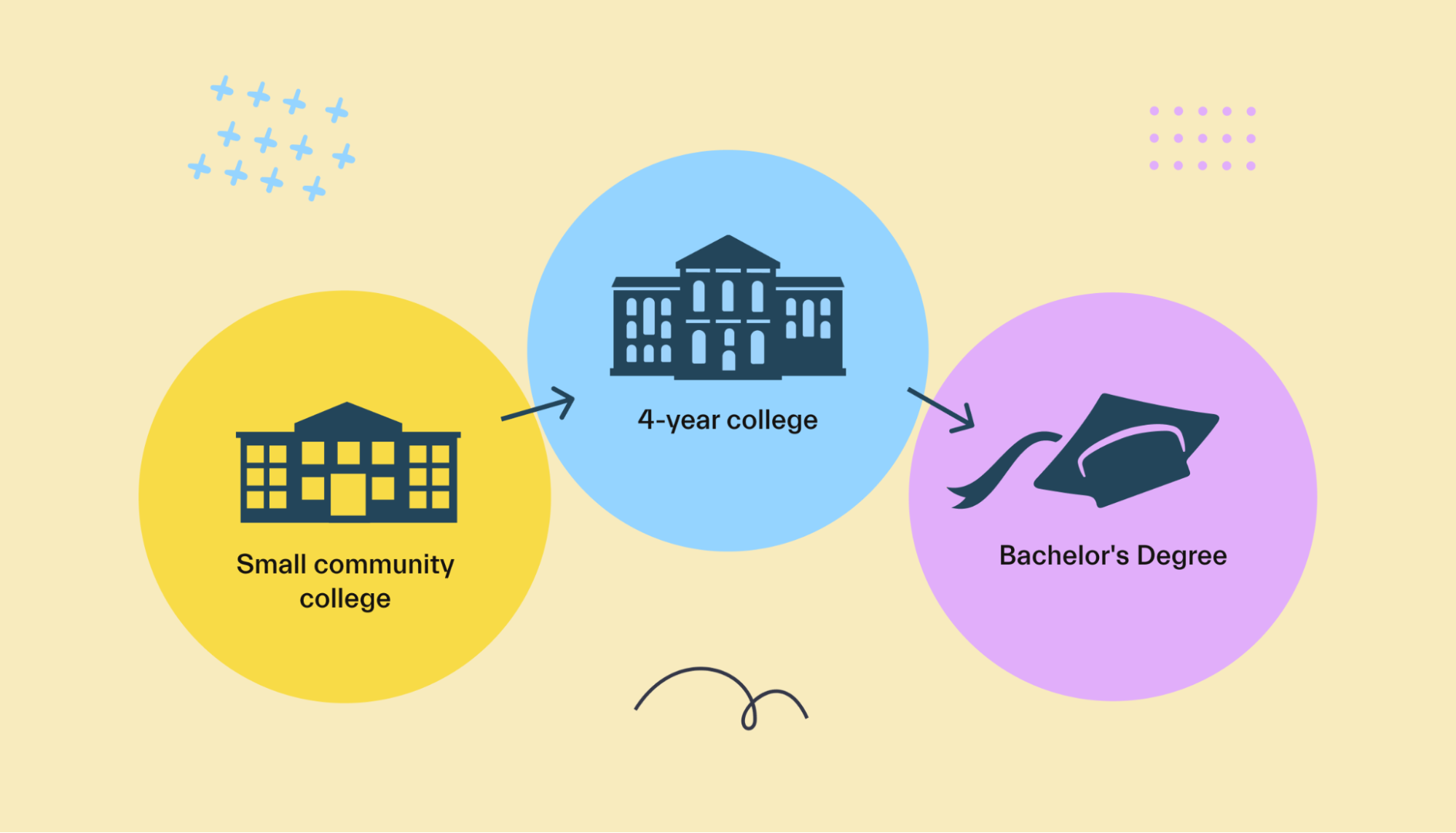

10. Transfer from community college

As we mentioned before, the average cost per year at a 4-year public college is between $25,615–$27,437, and the average cost per year at a 4-year private college hovers around $53,949.

But community college?

$7,460 total.

And the best part?

Many community colleges have agreements with 4-year schools that let you transfer credits toward a bachelor's degree. The net result is spending far less money to earn a 4-year college degree.

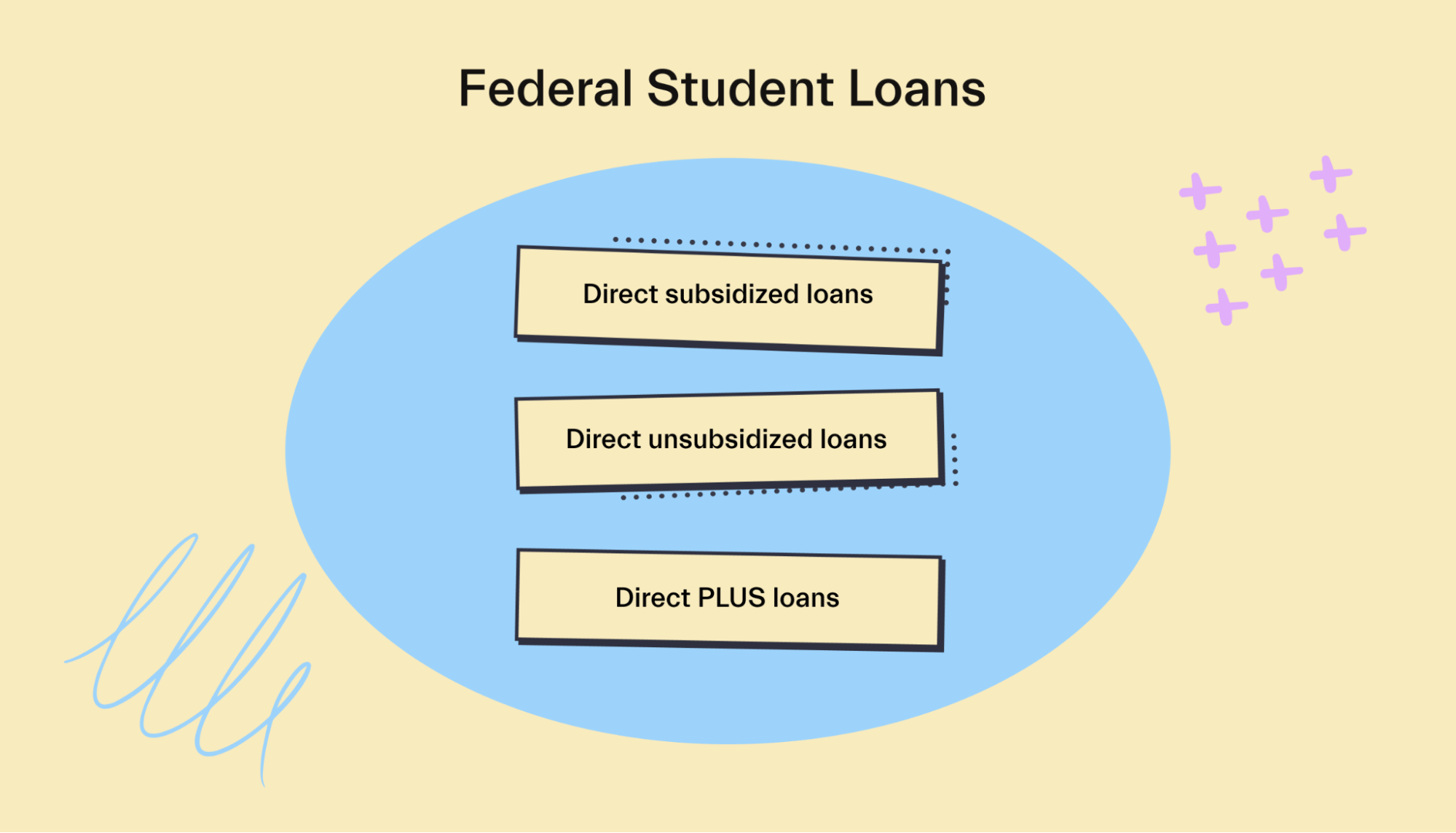

11. Consider federal student loans

As of 2021, there are 42.9 million Americans carrying student debt, each owing an average of $37,105!

As you’ve probably guessed, student loans aren’t the most ideal way to pay for college. Not only do you have to pay back what you borrow, but you have to pay it back with interest.

However, borrowing money is unavoidable for some students, with around 30% of undergraduates saddled with federal student loan debt (and that doesn’t include private loans or lines of credit).

If you must borrow student loans, here's a quick breakdown of the types of loans available:

Direct Subsidized Loans: Available to undergraduate students who demonstrate financial need. The federal government covers the interest on these loans while you're in school and for the first 6 months after you graduate. The maximum amount you can borrow per academic year is between.

Direct Unsubsidized Loans: Available to all undergraduate, graduate, and professional students, and financial need doesn't apply. Unsubsidized loans start building up interest immediately, even while you're in school. The maximum allowable amount you can borrow per academic year is $5,500–$12,500 for undergraduates and for graduate students.

Direct PLUS Loans: Available to graduate or professional students. Financial need isn't necessary, but a credit check is required for Direct PLUS loans. The maximum amount you can borrow is the cost of attendance minus any other federal aid you've received. Parents of college students can take out a similar loan called the “Parent PLUS loan.”

Direct Consolidation Loans: Plans that lets you combine all your federal student loans into a single loan with one interest rate

12. Consider private loans

Private loans should be your last resort.

But if you've exhausted all other options like scholarships, grants, and federal student loans, then private student loans are always an option.

Banks, credit unions, and other lenders provide private student loans. You'll generally need to pass a credit check or have a cosigner to qualify.

Many people steer away from private student loans because they don't have the same advantages and protections as federal student loans, like loan forgiveness, tuition reimbursement, deferment, and flexible payment options.

But, where federal student loans have an annual cap, private student loans let you borrow the total cost of attendance if you qualify.

Just make sure you shop around because each lender has different terms and conditions.

Take action and find your best way to pay for college

If you’re looking to afford higher education, you’ll likely have to stack the deck with different forms of financial aid.

Start with filling out your FAFSA and tackling strategies that will minimize your student debt, like scholarships and grants.

You can also work, haggle, budget, and take advantage of 529 plans to help pay for school.

And if you’ve chased every opportunity and still need extra cash, student loans are always an option.

If you’d like a little extra support, give Mos and shout and let us get you the financial aid you deserve.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you