Financial aid •

October 28, 2022

Financial aid appeal: why a "no" doesn't have to be the end of the conversation

If your family’s financial situation has changed, you may be able to appeal your financial aid offer to get more money to pay for school.

Nothing makes your heart sink quite like opening your financial aid letter and learning that you won’t be getting as much help paying for school as you thought.

College comes with a large price tag, and if you’re like many of your peers, it’s more than you can swing without a little help. And it’s completely natural to panic if your financial aid letter comes bearing bad news.

Luckily, the offer in your financial aid letter isn’t necessarily the final word. You still have a chance to submit a financial aid appeal, and possibly get more money to help you pay for school.

Keep reading to learn what a financial aid appeal is, what to include in your appeal letter, and what to do if your letter is denied.

What is a financial aid appeal?

A financial aid appeal is a request that the school take another look at your financial situation and reconsider your financial aid offer.

A financial aid appeal might be a good idea if you believe that your financial aid offer doesn’t accurately represent your ability to pay for college, or it was based on outdated information.

Why use a financial aid appeal?

Financial aid offers are largely based on the information you provided in the Free Application for Federal Student Aid (FAFSA).

If the information you provided wasn’t accurate or your situation has changed since you completed the form, then you might have a case for appealing your financial aid offer.

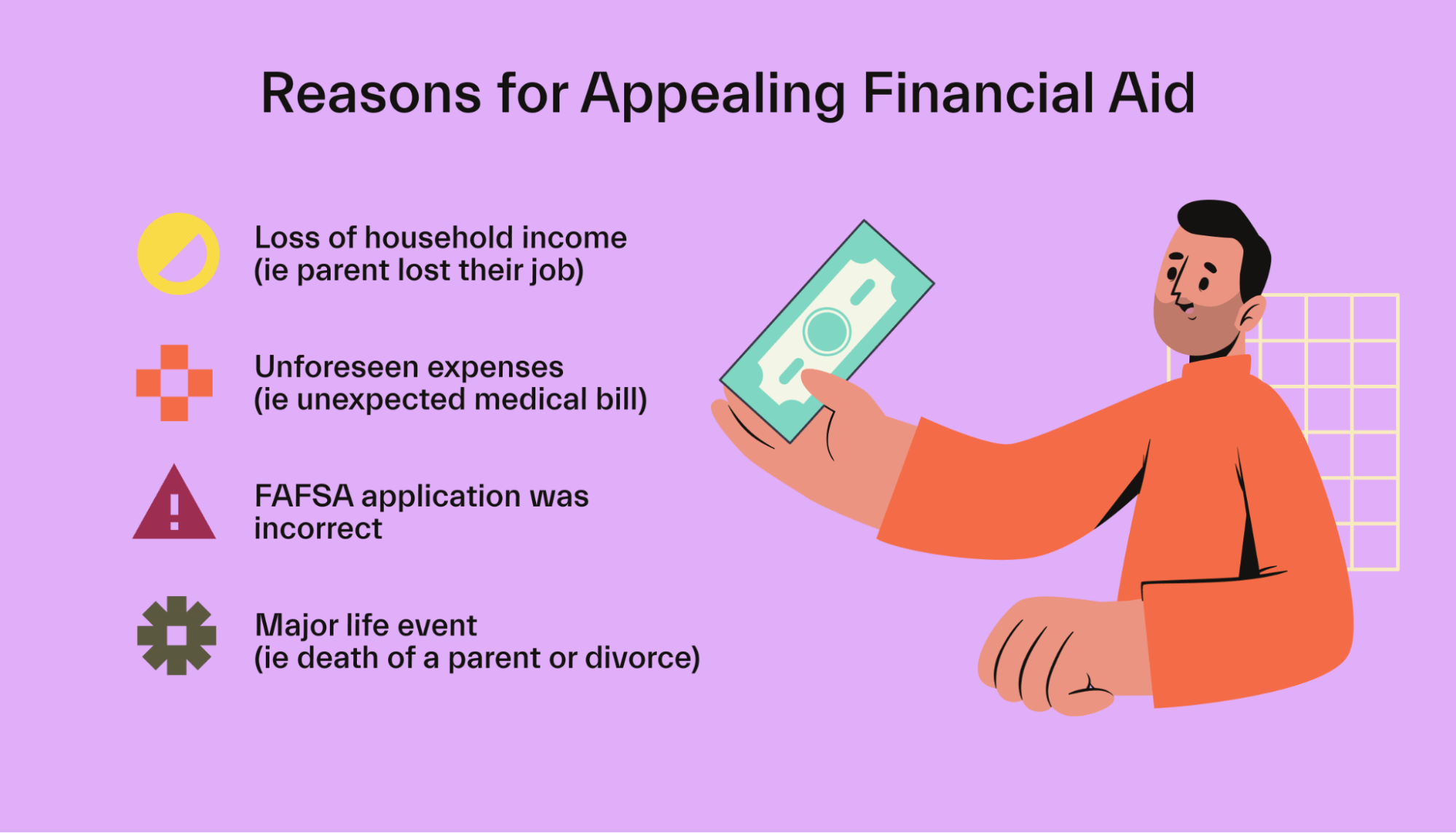

Here are some situations where you might use a financial appeal:

Your family has experienced a loss of household income: This might be the most common reason to appeal a financial aid offer. Given the high unemployment rate during the pandemic, there are plenty of families who have income that’s lower than what their financial aid application might reflect.

Your family experienced a major life event: If your parent or guardian died or left your family, then you might have a case for appealing a financial aid offer. Just like having a parent lose their job, having a parent pass away or leave the family is likely to cause a major drop in household income.

Your family experienced unforeseen expenses: If your parents had a costly emergency, like a large out-of-pocket medical expense, then a school may be willing to change your offer to reflect a lower expected family contribution.

Your FAFSA was incorrect: If your financial aid offer was based on incorrect information provided in your FAFSA, then you might be able to appeal and get a new offer based on accurate information.

Keep in mind that the earlier you notice an error in your FAFSA, the better. It’s much easier to make corrections to your documents while they’re being processed than to have to appeal your award letter later.

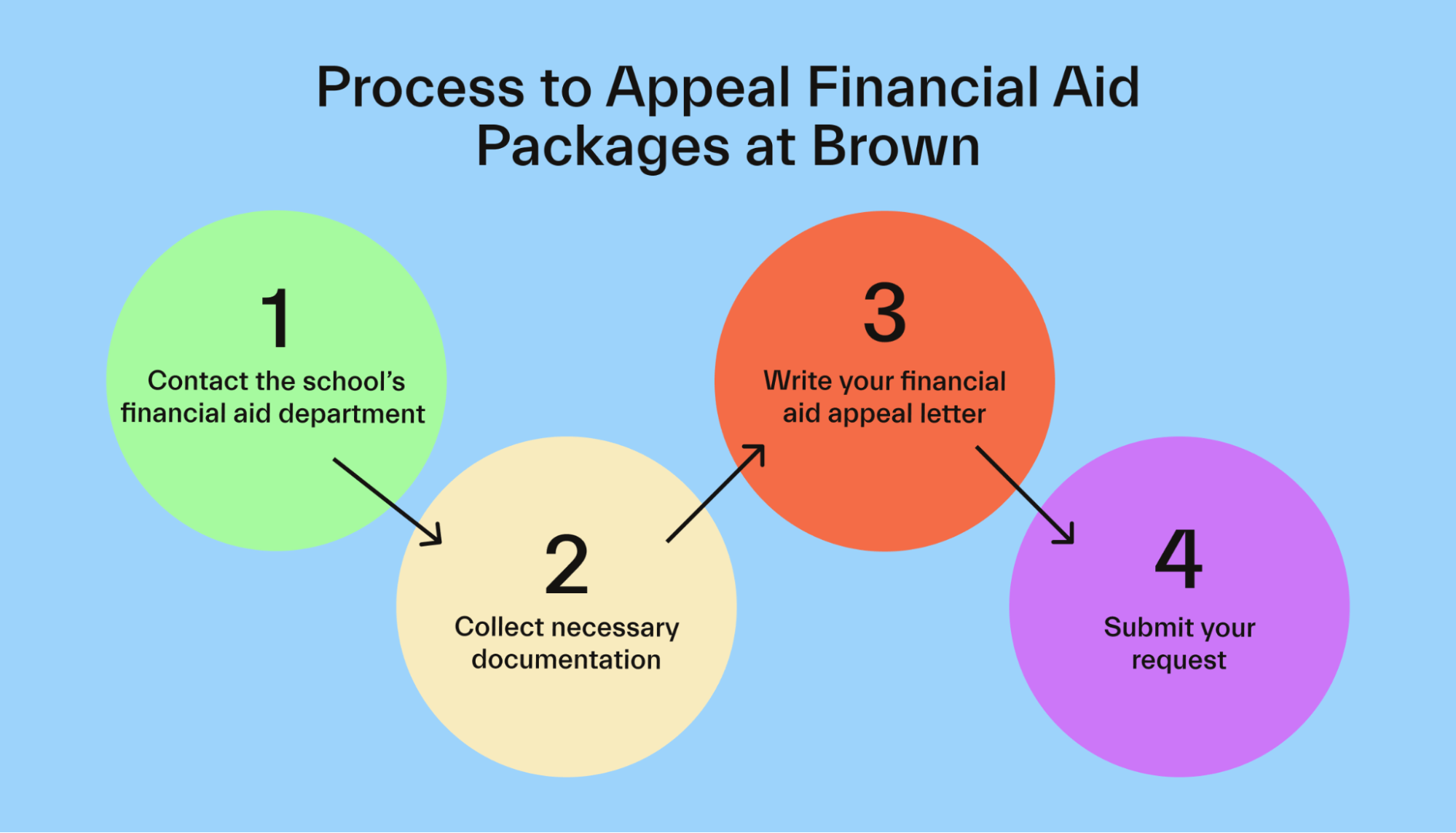

How to appeal financial aid

Do you need to appeal your financial aid offer? Here’s how to appeal in just a few simple steps:

Step 1: Contact the school’s financial aid department

The first step to appealing your financial aid offer is contacting your school’s financial aid office.

Call them or visit them and explain that you’d like to appeal based on a change in your family’s financial circumstances. They’ll provide any special instructions you need to follow.

For example, some schools may have a specific appeal form you’ll have to complete and send in with your request.

Step 2: Collect necessary documentation

Because financial aid appeals are often based on financial need, it’s important to have documentation to back it up.

For example, if you’re appealing your financial aid offer because your family lost a source of household income, provide paperwork to back it up.

Maybe it’s a lay-off letter from your parent’s employer, or perhaps it’s a death certificate showing that one of your family’s income earners has passed away.

Include anything that would be helpful in verifying your current financial situation.

Step 3: Write your financial aid appeal letter

When you appeal a financial aid offer, you have to write a financial aid appeal letter where you make your case as to why you think you should get more money.

Your letter should be professional and straight to the point, providing specific evidence of why you’re appealing your aid offer.

Step 4: Submit your request

Once you’ve written your financial aid appeal letter and gathered all necessary documentation, submit it to the school’s financial aid administrator.

Make sure to submit it as soon as possible, since the school may have many appeals to process. You want to be sure yours is at the top of the list.

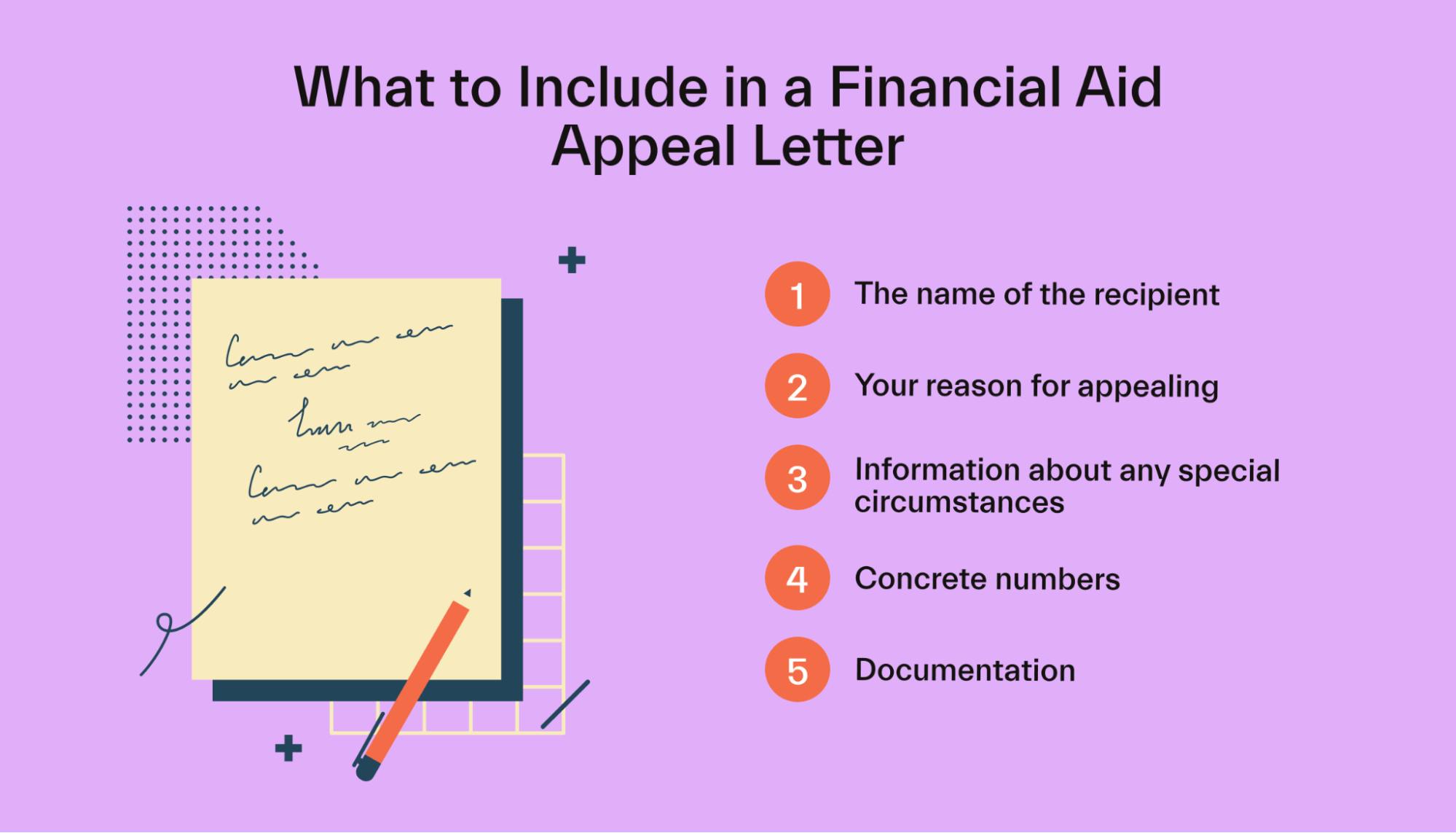

What to include in a financial aid appeal letter

It’s important that your financial appeal letter include everything the school will need to reconsider your financial aid package. Here’s what you should include in your letter:

The name of the recipient: Call the school’s financial aid office and ask who the letter should be addressed to, rather than defaulting to “Dear Sir or Madam” or “To Whom It May Concern.”

Your reason for appealing: It’s important that you explain all the details of why you’re appealing your financial aid offer. Make a specific ask and give them a good reason to say yes.

Information about an extenuating circumstance: Include anything unique about your situation that could make the school reconsider your offer. For example, if a parent recently passed away, explain how your family lost income as a result.

Concrete numbers: The more specific you are in your request, the better. Provide exactly what amount of aid would make school affordable for you.

Documentation: Be sure to attach to your letter any documents that prove how your current financial situation is different from what’s reflected in your FAFSA.

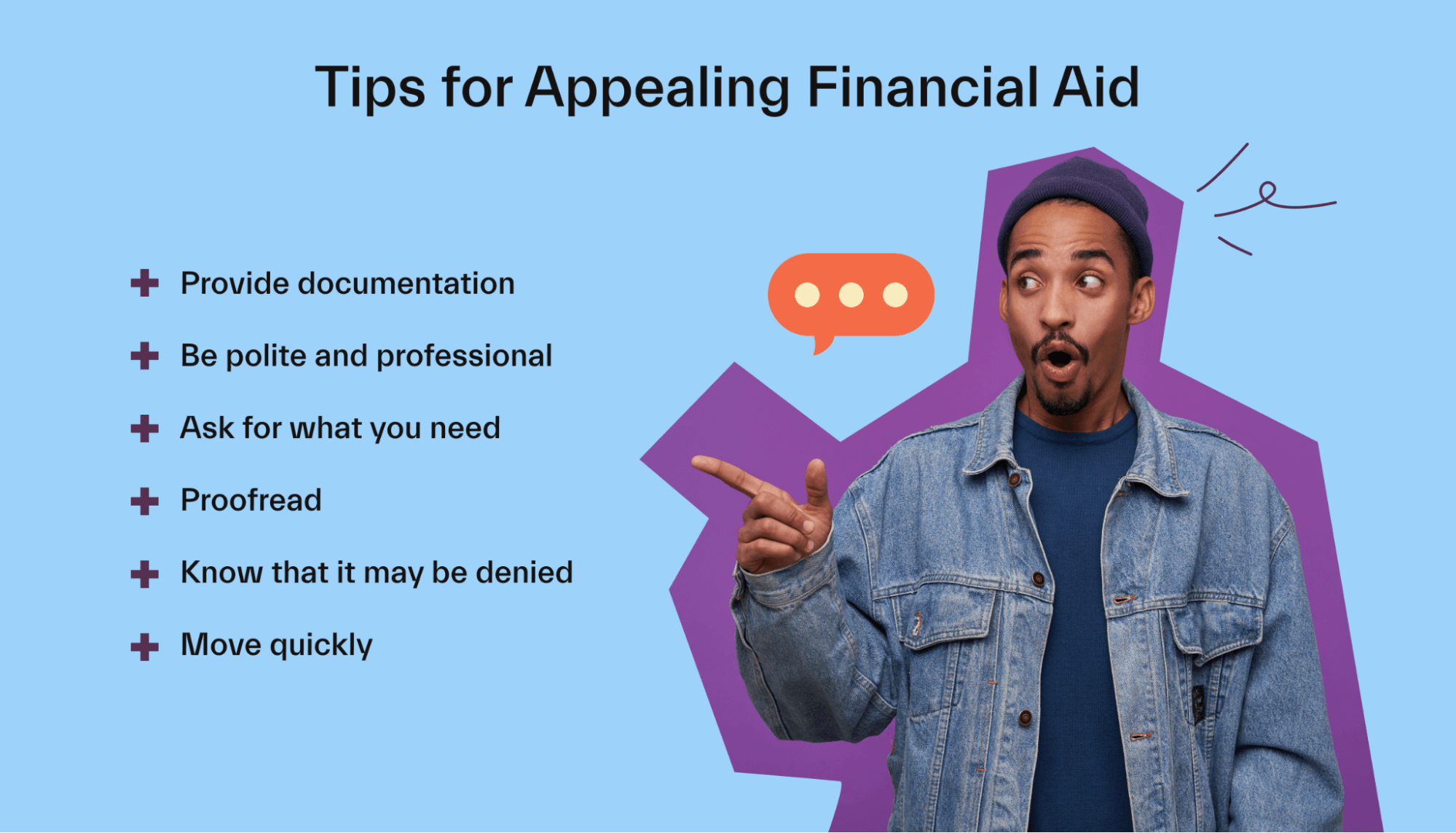

Tips for appealing financial aid

Ready to craft your financial aid appeal? Here are a few tips to keep in mind that may increase your chances of having your appeal approved.

Provide supporting documentation

We’ve already mentioned this, but it’s worth mentioning again. Financial aid appeals are entirely based on financial need.

If you’re arguing that your family’s financial situation is different from what’s reflected in your FAFSA and financial aid package, then you must provide clear documentation to back up your argument.

Acceptable documentation might include:

Lay-off or termination letter

Death certificate

Divorce certificate or marital settlement agreement

Tax returns

Medical bills

Be polite and professional

The letter you send to your school’s financial aid office should be both polite and professional.

First, as the saying goes, you’ll catch more flies with honey than vinegar. In other words, people will be more likely to want to help if you’re kind to them.

You’re also likely to be taken more seriously if you write your letter in a professional format. Using a template is a great way to make sure your letter is properly formatted.

Ask for what you need

In your letter, be direct and specific about asking for what you need. The more vague your letter is, the less your chances of getting what you need.

Proofread

While it’s unlikely that your financial aid appeal will be denied based on poor spelling or grammar, it’s still important to proofread your letter. Typos can be distracting, and could even make your letter difficult to understand.

Know that it may be denied

It’s okay to be hopeful, but it’s also important to understand that your request could be denied. And if that happens, there’s likely little you’ll be able to do to change the school’s mind.

It’s worth having a backup plan in mind from the start.

We’ll walk you through some options in a minute.

Move quickly

There’s a good chance your school is going to receive financial aid appeal letters from other students in similar situations. And often, there’s only so much aid money to go around.

Get a jump on things by sending your appeal letter as soon as you realize your financial aid offer won’t cut it.

Negotiating vs. appealing financial aid

Financial aid offers are typically based on financial needs. As a result, if you’re going to appeal your offer, you’ll probably need a solid financial reason to do so. Often, it’s because your family’s financial situation has changed since you completed the FAFSA.

But in other cases, the reason you need more money has nothing to do with a change in your financial needs. Maybe your family could never afford their expected contribution. Or maybe you just want to reduce the amount of loans you have to pay.

This is where negotiation comes in.

The fact is that just like students are competing for spots at the top schools, schools are competing for the top students. And if you fit that description, a school might be open to negotiating.

One common way to negotiate is using an offer letter from another school.

If you’ve got a high GPA and make an attractive candidate for their school, the financial aid office might be willing to offer more merit-based aid to sway you to attend their school instead of another. While there’s no guarantee it’ll work, it doesn’t hurt to take a shot.

What to do if your financial aid appeal is denied

A financial aid appeal is a request to your schools’ financial aid office to reconsider your financial aid offer. But just like any other request, it’s one that could be denied.

If that happens, it’s time to find another strategy to help finance your education.

First, consider attending a different school. Remember that your out-of-pocket expenses are bound to look different at each school.

You might be able to find another school that has a smaller price tag, making it more affordable. Or you might find that another school is willing to offer you more financial aid, meaning you don’t have to foot as much of the bill.

If cost is your top priority, then choosing a more affordable school is a simple solution.

If you’re set on attending a specific school and that school denies your financial aid appeal, then you’ll have to find alternative means of financing your education.

The first place to look for help is through scholarships. There are countless scholarships available for every purpose you can imagine. Many organizations offer scholarships to students with certain backgrounds, ethnicities, household incomes, GPAs, hobbies, college majors, and more.

No matter what your background, financial situation, or school performance, there’s a good chance you can find a scholarship you’re eligible for.

Grants are another great option. Grants provide free money, and there may be local businesses or organizations offering grants to potential students.

Always look for aid opportunities outside of the FAFSA. (FYI: We can help with this.)

If you can’t find enough scholarships or grants to cover your entire out-of-pocket costs and you weren’t offered enough federal student loan money to make up the difference, then you can apply for private student loans to cover the rest of your costs.

There are a few things to consider before applying for private student loans. First, unlike with federal loans, private lenders consider your creditworthiness. And if you’re just heading off to college, you might be at an age where you haven’t built up a credit history. In that case, you may need to enlist the help of a cosigner (a parent or guardian who will agree to pay back the loan if you can’t).

Another thing to remember about private loans is that they don’t come with all the same benefits as federal loans.

Most private lenders don’t require you to start repaying your loan until you graduate, but you may have a shorter grace period. You may also not have access to the same flexible repayment plans as you would have with federal loans.

Conclusion

If your financial aid offer wasn’t as big as you’d hoped, don’t panic just yet. A financial aid appeal letter gives you the chance to make your case to your school’s financial aid office and explain why you think you should get more money.

If your federal financial aid award is based on inaccurate information or your situation has changed since you filled out your FAFSA, you’ve got a decent chance of getting more aid than the school originally offered.

You also don’t have to appeal by yourself. Mos.com helps students appeal their financial aid awards and get all the money they deserve. Sign up today to get started.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you