Student loans •

What's a student loan grace period?

The grace period is a chunk of time before you have to start making payments on your student loans. Find out more in this article.

College is more expensive than ever, with an average total cost of $35,331 per year.

To pay for school, most students rely on a mix of financial aid, including student loans.

Loans have to be paid back (with interest). But loan issuers know that students usually can’t afford to start making payments while they are still in school.

Fortunately, most student loans don’t need to be repaid until after you’ve left school. And you usually have a period of time after you’ve left school—called a student loan grace period—where you don’t have to make any payments yet.

Here’s everything you need to know about student loan grace periods and how to maximize the benefit of this period of time.

What is a student loan grace period?

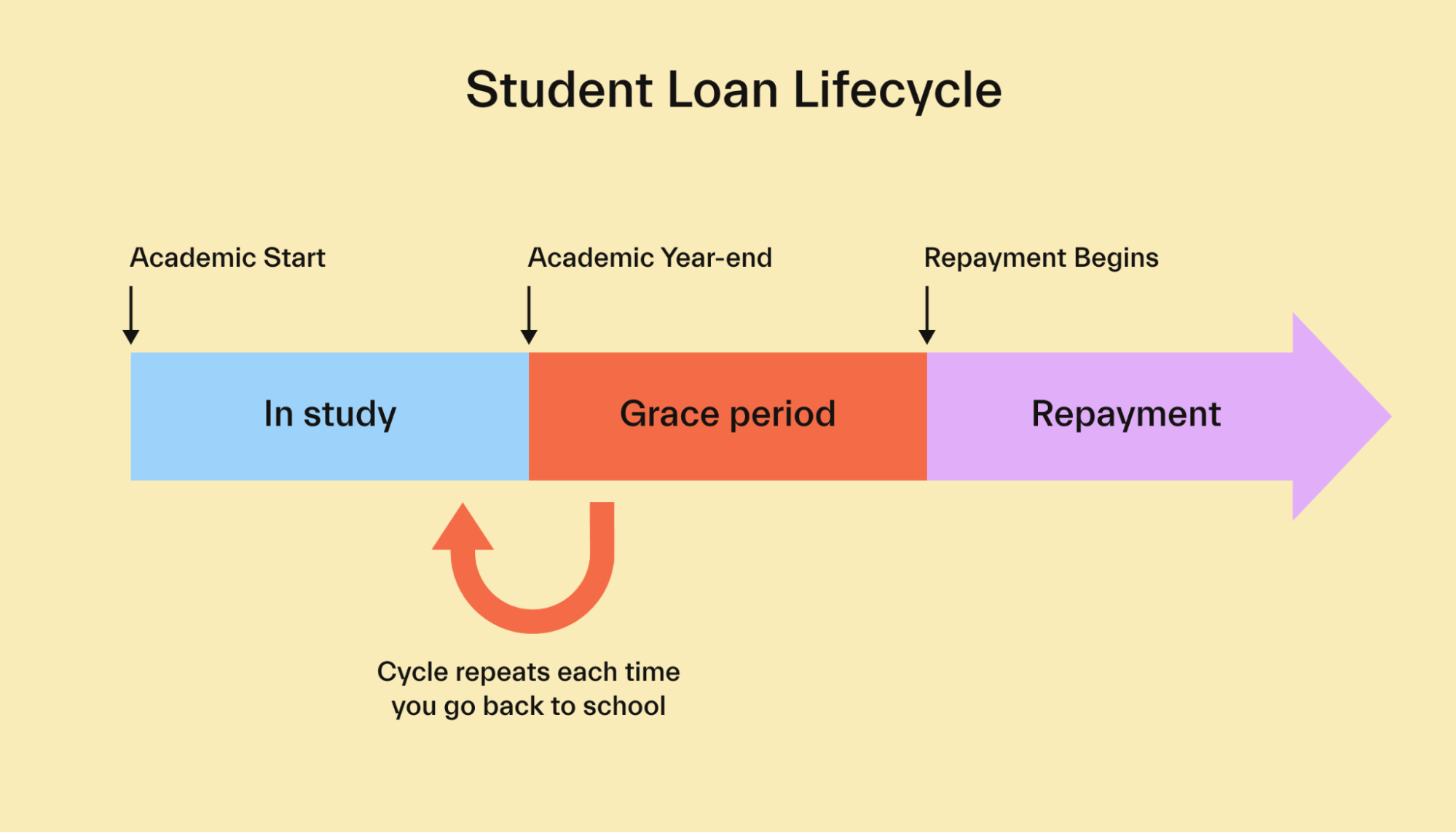

The student loan grace period is a period after you leave college when you don’t have to make payments on your student loans.

For most federal student loans, the grace period lasts 6 months. The period starts as soon as you leave school (or drop below half-time enrollment). That could be when you graduate, drop out, or decrease your class load significantly.

So, if you graduate in early June, your grace period might last until November. If you drop out of school in March, your grace might last until August.

Student loans help you pay for college. But they are loans, meaning they must be paid back over time—with interest.

The grace period allows some breathing room for borrowers to find a job and get settled before they have to start making payments.

Student loans without grace periods

Keep in mind that not all student loans offer grace periods. Most federal student loans have a grace period (6 months, typically). But many private loans don’t.

If a loan doesn’t offer a grace period, that typically means one of two things:

Payments will start being due immediately after the loan is disbursed—AKA, after the cash is in your account or has been paid to your school. That means you’ll need to make payments while still in school.

or

Payments will start being due as soon as you graduate. That means you don’t need to make payments as a student, but you will start payments immediately after graduating (or after dropping out).

If you’re taking out private loans for college, it’s very important to read the fine print. Be aware of all the repayment terms, including whether or not there is a grace period.

How does the grace period work?

The grace period typically begins as soon as you graduate or drop to below a half-time enrollment level.

From there, a clock starts (6 months for most loans, except the Federal Perkins Loan). After those 6 months, you’ll be required to start making student loan payments.

If you go back to school before those 6 months end, then the grace period resets. For example, most students will technically enter a grace period over the summer—but because they go back in the fall, the grace period resets each year.

During the grace period, you can still make payments—but you aren’t required to.

The grace period for private loans works differently than for federal loans. Check your loan agreement for details.

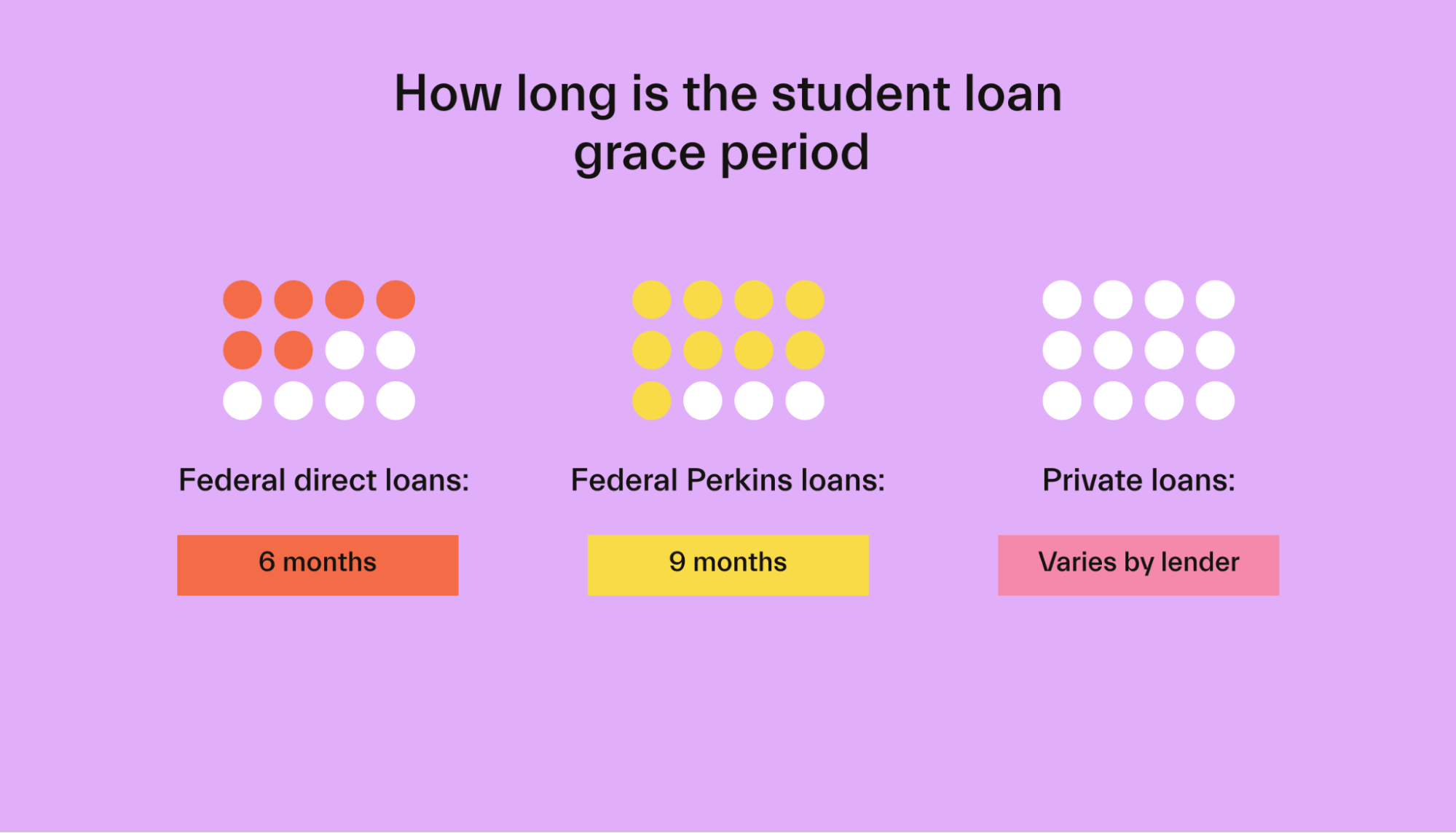

How long is the student loan grace period?

6 months is the standard student loan grace period for most student loan types.

This includes federal direct loans (subsidized and unsubsidized), federal Stafford loans (subsidized and unsubsidized), federal direct PLUS loans for graduate students, and federal direct PLUS loans for parents.

The only exception is the Federal Perkins Loan, which has a 9-month period without payments.

Federal direct loan: 6 months

Federal Perkins Loan: 9 months

Private loan: Varies by lender

Private student loans work differently. Each lender has its own rules. Some have no grace period at all, while others match the federal 6-month grace period. Students should check their loan agreement for details.

When does it start?

For most loans, the grace period begins when you fall below half-time enrollment. This could happen when you:

Graduate

Withdraw

Drop classes to less than a half-time class load

Take a break from school or a gap-year

Each school has its own definition of what half-time enrollment actually means. Check with your school’s financial aid office for details.

When you fall below half-time enrollment, your grace period will typically begin immediately.

For federal loans, the grace period is typically 6 months. So if you graduate, take a gap year, or drop your class load below half-time, you’ll start the 6-month countdown. After those 6 months are up, you’ll need to start making payments on your loans.

Resetting the grace period

What happens if you enter the grace period but then go back to school (or increase your class load) before the grace period ends?

In this case, the grace period essentially “resets” (at least for federal loans—check with the lender for details on private loans).

For example, let’s say you graduate in June. Your 6-month grace period begins in June. You take the summer off, then attend graduate school in the fall.

Because you’re still in the grace period, you won’t need to make payments. Re-enrolling in school means your grace period resets, and you typically won’t have to make payments until you leave school again.

And when you do eventually finish grad school (or drop out), you’ll still get a full 6-month grace period, even though you “used up” a few months already.

Again, this can vary for private loans and certain types of federal loans. Read the fine print or ask your lender to be sure.

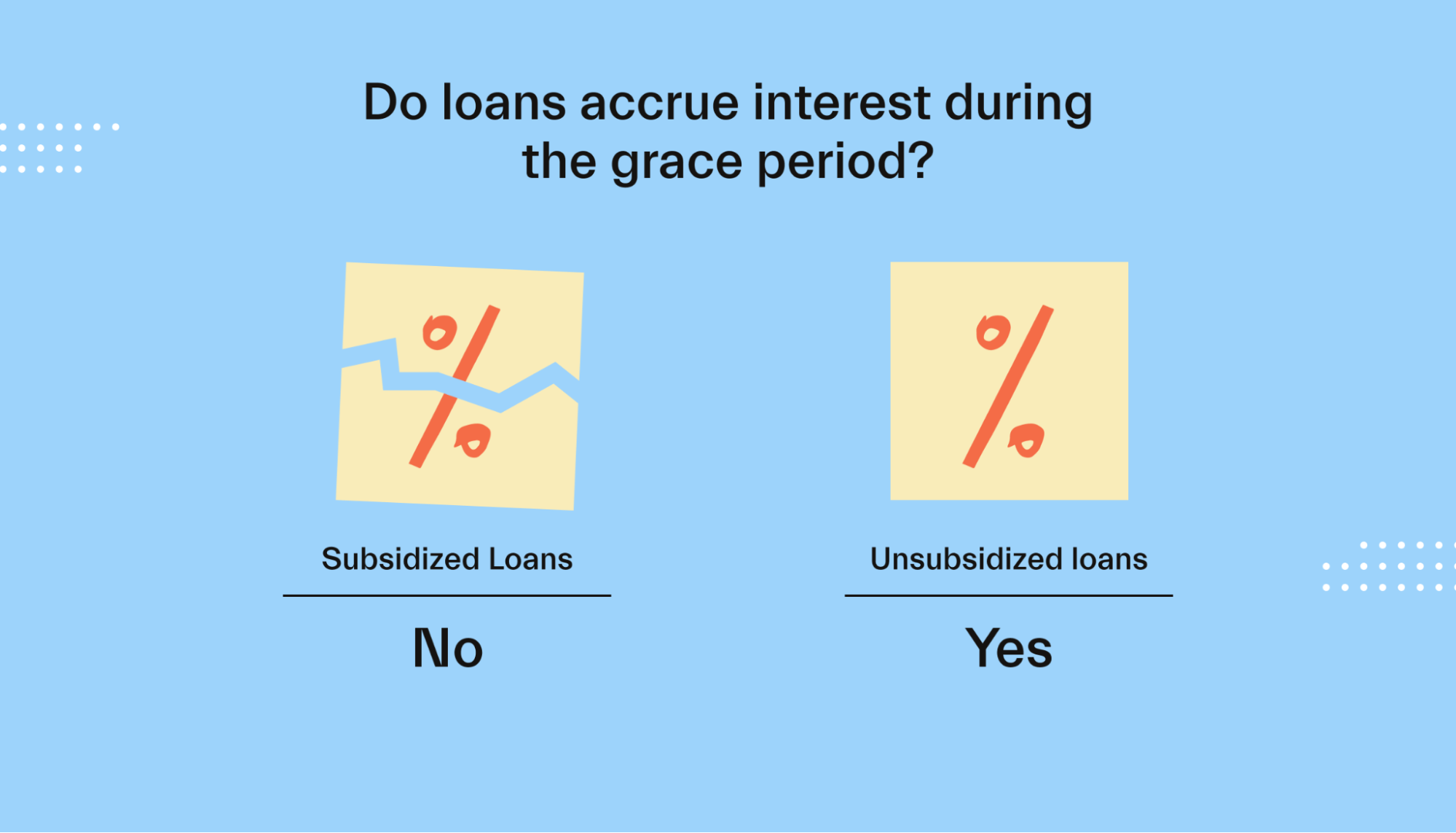

Does interest accrue during the grace period?

“Accrue” is another word for “accumulate” or something getting added on over time. Having interest accrue on a loan basically means that interest is being charged and added to the total loan balance.

If interest is accruing, your loan balance is growing (making your student debt larger and larger). If interest is not accruing, your student loan debt balance stays the same.

Interest can accrue during the student loan grace period, but it depends on the types of loan and the loan terms.

For federal unsubsidized loans, interest will accrue during the grace period.

For federal subsidized loans, interest won’t accrue during the grace period. For these loans, interest doesn’t begin until you enter repayment (which happens at the end of the grace period).

For a private student loan, interest may or may not accrue during the grace period. Check with your lender for details.

Can you make payments during the grace period?

Yes, you can absolutely make loan payments during the grace period.

All the grace period really means is that you aren’t required to make payments. You can always make payments towards your loans—even if you’re still in school or if you’re in your grace period.

If you can afford to make payments, you should start ASAP. It will help you get a jump on getting out of student loan debt.

Even if you don’t start making payments immediately, it’s wise to start budgeting for them.

For federal loans, you’ll go through student loan exit counseling once you graduate. This will show you how much you will owe each month. For other loan types, check with your lender to see what your monthly payments will be.

Here are two strategies to consider during your six month period after graduation:

Make normal monthly loan payments. Check your monthly payment amount—if you can afford to, make full monthly payments as if you weren’t in a grace period. This will help you get used to that expense in your monthly budget, and can also help you get ahead with repayment.

Make interest payments. If interest is accruing on your loan (see above), you could also choose to make payments just to cover the interest charges. This will prevent your student loan balance from growing during the grace period.

Below, we discuss more strategies for how to take advantage of your student loan grace period.

How to maximize your student loan grace period

The grace period can provide some breathing room. Here’s how to maximize it to help you get ahead, both financially and mentally.

Enjoy yourself. If you’ve just graduated, you’ve definitely earned some time off. Kick back, relax, and enjoy your newfound freedom. It might be helpful to take a month or two off to fully rest and recharge before jumping into the job search or whatever your next steps might be.

Make finding a job your “job.” If you’re on the hunt for a job after graduation, it can be helpful to consider the job search as your job. The financial breathing room from the grace period should give you a little more flexibility in your budget, so (hopefully) you won’t have to settle for whatever job is immediately available.

Make payments if you can. Grace periods mean that you aren’t required to make payments. But if you can, you can do your future self a big favor by making payments towards your loans.

Explore student loan repayment plans. Check with your loan issuer to see what your standard monthly payment will be. Weigh your options, including income-driven repayment plans, which can result in lower monthly payments if you’re low-income or not yet working.

Explore student loan forgiveness. Planning to work in public service as a teacher, firefighter, government worker, etc.? You might qualify for public service student loan forgiveness. If you do, you could potentially have your loans forgiven after 10 years of payments—it pays to look into the details ASAP if you think you might qualify.

Consider refinancing. If you have a private student loan, you might want to shop around for refinancing deals. Refinancing involves taking out a new loan to pay off your old ones. It makes sense if you can find a loan with a lower interest rate. It’s not generally worth refinancing federal loans, as you’re unlikely to find lower rates than what the government can offer. Note: Refinancing will be easier once you start working and have a reliable income.

Make a financial plan. Adult responsibilites kick in hard after graduation. There’s no better time than now to start working on a financial plan, exploring budgeting, and doing what you can to set yourself up on a strong footing. The 6 months after graduation can help you get a head start.

Address other financial priorities. You have 6 months where you won’t need to make payments on your loans. Do you have other financial priorities that need attention? Maybe you’ve been putting off going to the dentist or repairing your car. Now might be a good time to tackle these priorities.

Conclusion

For most federal loans, the student loan grace period lasts for 6 months after graduation (or after you leave school).

This period can provide some breathing room for new graduates—but it’s wise to still make payments if you can! If you feel completely overwhelmed, check out our in-depth guide on how to pay off student loans.

And before you take on any additional loans, it’s important to maximize any scholarship opportunities. Scholarships don’t need to be repaid.

Mos can help you find and apply for scholarships that you qualify for. Mos is a banking solution for students that also provides access to the largest scholarship pool in America!

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you