Student loans •

How to get out of student loan debt

Learn about your options for how to get out of student loan debt, such as student loan forbearance or forgiveness.

Once you’ve graduated from college, you’ll need to start paying off your student loans.

But what if you’re in a position where you’re not able to start paying back your student loans?

Maybe you haven’t been able to find a job after school yet, or maybe other life and money troubles have shown up unexpectedly and made it difficult for you to make payments.

It’s unlikely that you’ll be able to fully get out of your student loan debt without paying. But thankfully, there are some ways that you can delay or reduce your debt.

This article will explain how to get out of student loan debt through various forgiveness options, as well as methods for reducing or getting a short-term hold put on your student debt.

Can I get out of student loan debt without paying?

The hard truth about student loan debt is that it’s almost impossible to get out of it without paying. While other loans can get discharged in bankruptcy, student loan debt is much harder to get out of.

Your lenders will discharge your debt only in a few scenarios:

You become completely disabled and unable to work

You die

These discharges apply to both federal and private student loans. Outside of these scenarios, it’s almost impossible to get out of student loan debt without paying at least some of the balance off.

How to get rid of private student debt without paying

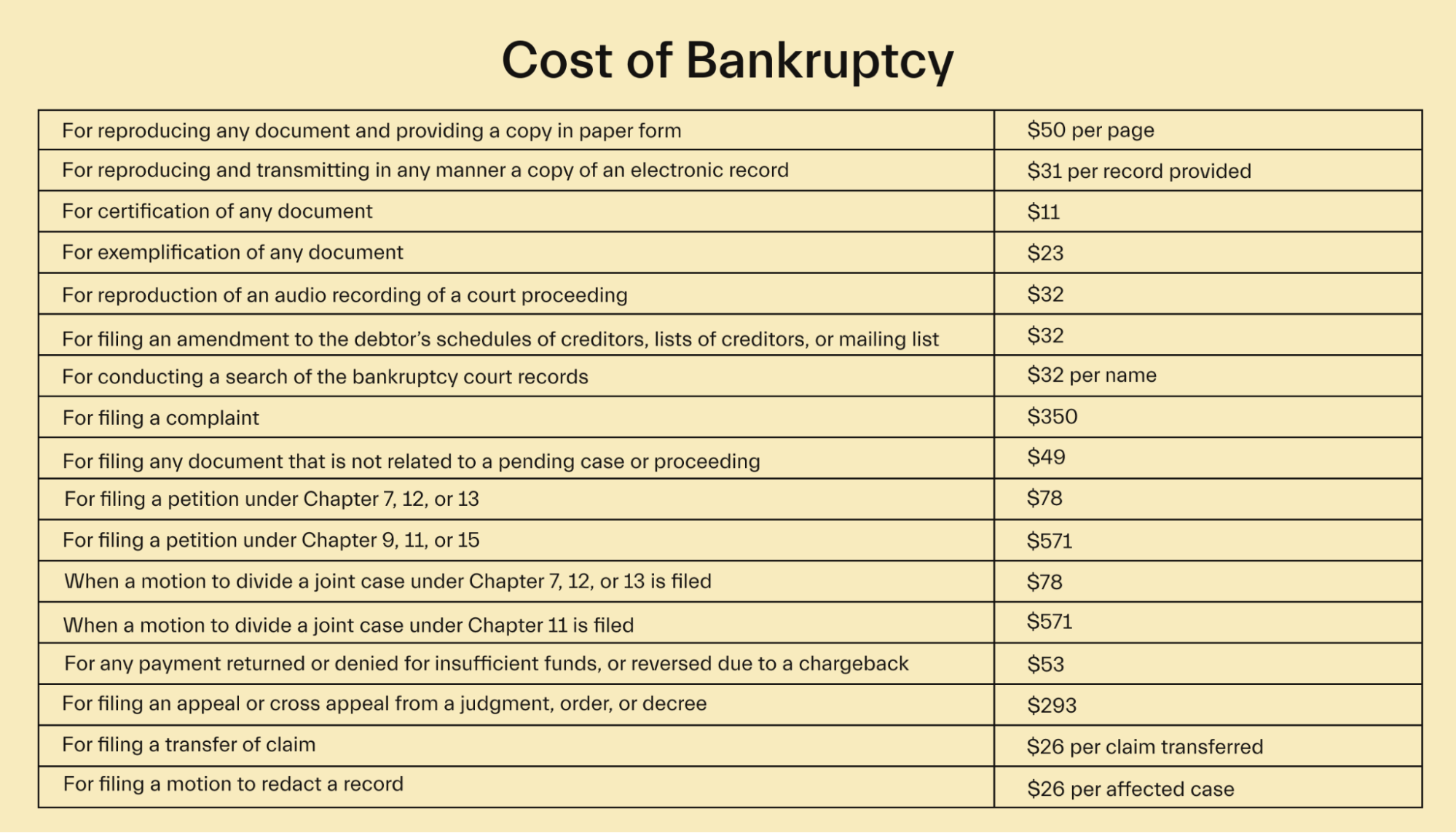

Filing for bankruptcy is a legal process in which you prove that you’re unable to pay back the debts that you owe. The courts will either help you design a repayment plan to settle your debts with your creditors or help you portion out assets to repay your creditors.

Then, the remainder of your debts are discharged, meaning you don’t have to pay the rest off.

Bankruptcy is a last resort. Declaring bankruptcy means losing control over much of your financial life and tanking your credit, making it almost impossible to borrow money for years after.

On top of that, bankruptcy is a long process, and you’ll probably need a lawyer to handle the details. Ironically, declaring bankruptcy, a process designed to help those in debt, can cost thousands of dollars.

Typically, if you declare bankruptcy, you won’t get out of your student loans. You need to file additional paperwork proving that your student loans will cause “undue hardship” on you and your dependents, which can be hard to prove. This makes it almost impossible to get out of paying your student loans.

The best thing for most people to do is to try and make payments or get the balance forgiven.

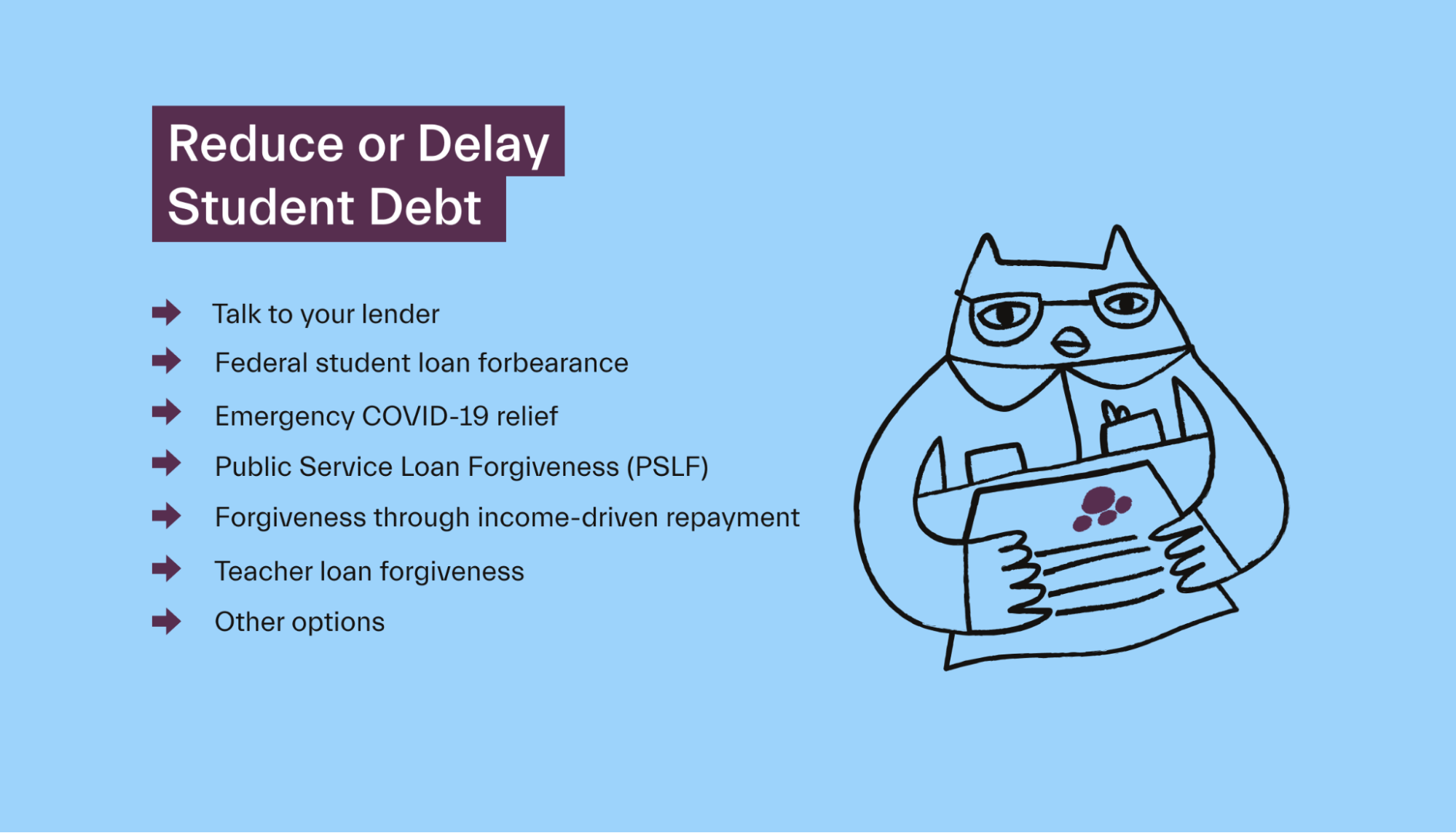

How to reduce or delay your student debt

If you’re struggling with student loan debt, there are a few options you can consider that will help you reduce or delay your loan payments.

1. Talk to your lender

If you’re having a hard time with a loan, the first thing that you should do is reach out to your lender. This is true of any type of loan, not just student debt.

Most lenders are willing to work with you to come up with a plan that will help you make payments. They’d much rather get some money than no money from you.

You might be able to adjust the payment schedule to lower your monthly payment or take a few months off from repaying your debt.

The worst thing that can happen is that your lender says they can’t do anything to help, in which case you can look for other options.

2. Federal student loan forbearance

If you have federal student loans, forbearance is an option that lets you pause your debt payments for a set period of time. During the forbearance period, you do not need to make any payments on your debt, but interest will continue to build up.

That means that once the forbearance ends, your loan balance will be higher, and you’ll have to make higher monthly payments. However, if you hit short-term financial trouble, like losing your job, this can be a way to get some financial relief.

You can request a general forbearance for many reasons, like financial difficulties, medical problems, or a change in employment. There are also mandatory forbearances that you can automatically qualify for, such as if you’re in the National Guard and activated for duty.

Typically, forbearances can last for up to 12 months, and you can have up to 3 years of forbearance during the life of a loan.

3. Emergency COVID-19 relief

COVID-19 has had a huge impact on people’s lives and finances. The government passed multiple emergency relief measures, which are slated to last through May 1, 2022.

These measures include an interest rate reduction to 0% for federal loans, a pause on all payments, and a pause on collection efforts for loans in default.

These measures only apply to federal loans. Private loans aren’t eligible. But for borrowers with federal loans, this relief can make a big difference.

4. Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program is a student loan forgiveness program for borrowers who work for non-profits or government employers.

Under the program, student loan borrowers who make 120 payments toward their federal student loans under an income-driven repayment plan will have the rest of their debts forgiven.

Keep in mind that forgiven debts are treated as taxable income, so you’ll have to be ready for the bill at tax time. Still, the amount forgiven will be far higher than the tax you’ll owe, making it a great option for people who work for qualifying employers.

5. Forgiveness through income-driven repayment

Even if you don’t work for a non-profit or government, you can still get your federal student debt forgiven if you follow an income-driven repayment plan.

Under these plans, your loan payments will generally be equal to 10% of your discretionary income (the money left over after paying for necessary expenses like basic living expenses). This is determined by the federal poverty level for where you live and the size of your family.

There are a few different repayment options that fall under the income-driven repayment umbrella. You’ll have to choose the one that is best for your situation.

If you follow an income-driven repayment plan, you can usually get any remaining debt forgiven after 20 years (25 for graduate student loans). Again, the forgiven debt is counted as taxable income, so be ready for the tax bill.

6. Teacher loan forgiveness

There are many other niche federal student loan forgiveness programs you might qualify for. For example, teachers who teach at low-income schools can qualify for some forgiveness.

Look for options based on your field of work, and you may find other ways to get your debt forgiven.

7. Other options

Beyond loan forgiveness, there are other ways to reduce your student loan payments, such as a federal direct consolidation loan or settling your debt for less than you owe.

If you’re having a hard time making payments, look for programs that can help and talk to a financial professional who can walk you through your options.

Future options to get out of student debt

The student debt crisis is a topic of national discussion these days, which means student loan repayment options are constantly changing.

During his campaign, President Biden promised to forgive at least a portion of federal student loan debt, with many ideas about how he could do so.

Some lawmakers, such as Bernie Sanders, even want to make college free for students, which would nearly get rid of the need for student loans.

Under such a program, students could pursue higher education without having to pay tuition, meaning they would only be responsible for living costs. This could greatly lower the amount they have to borrow, and many could pay these costs with part-time work while they study.

Tips for managing your student loan debt

If you’re struggling with student loans, here are a few tips for managing your debt.

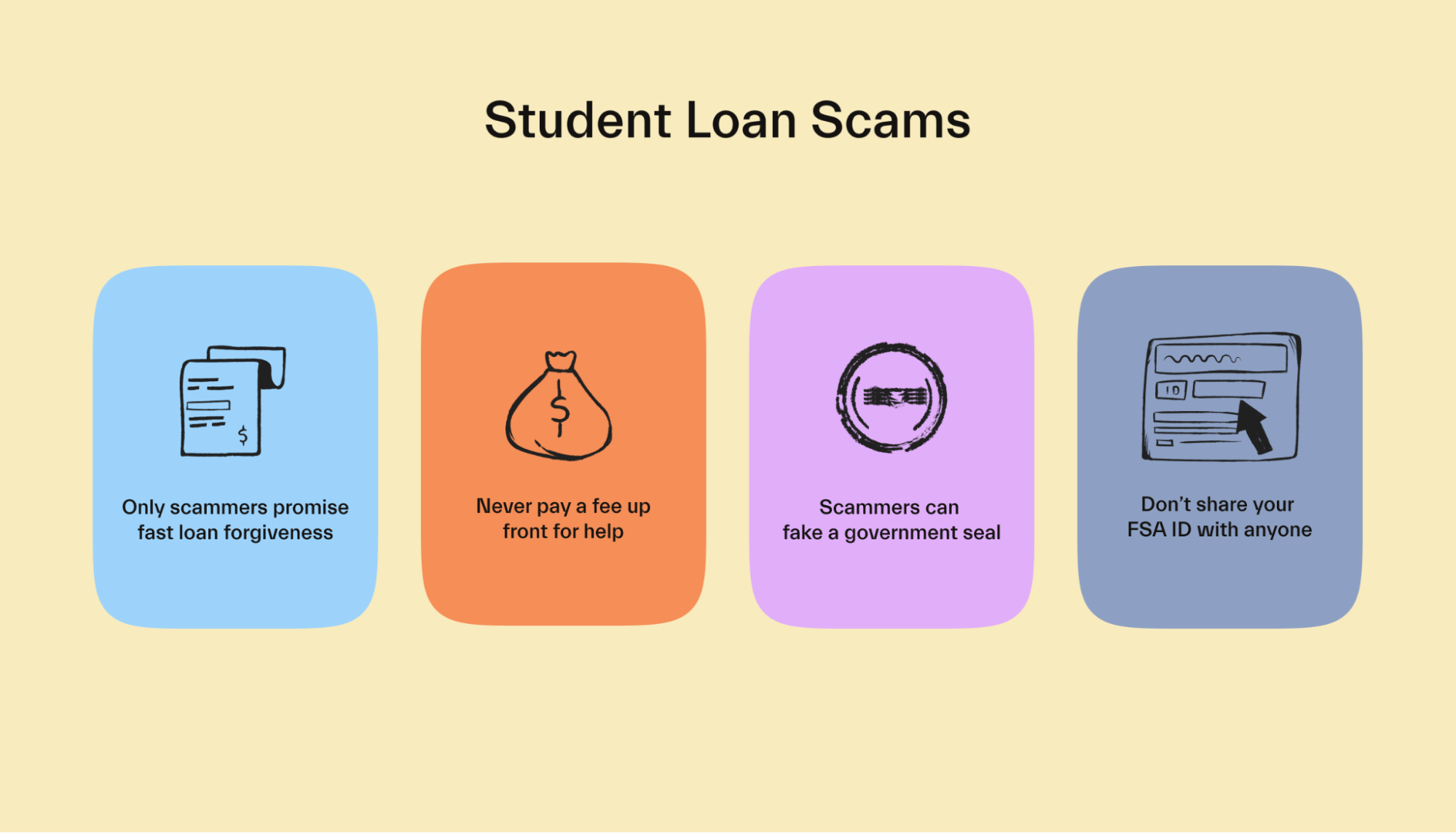

Watch out for student loan scams

Roughly 43 million Americans have some amount of student loan debt. That makes student lending a prime target for scammers looking to make quick money.

Often these scams take the form of people claiming to help you get out of debt or reduce your payments for a fee. If something sounds too good to be true, it usually is, so be on the lookout for these kinds of scams.

While some of these services are real, it’s also usually possible for you to do what they do on your own without paying for the service. Many of these companies will simply help you consolidate your loans and take a fee from you. Often, they’ll consolidate your loans into private loans with fewer protections.

You can go to studentaid.gov on your own and consolidate your federal loans for free while keeping the protections and benefits offered by federal loans.

Don’t wait to deal with your unpaid student loan debt

If you’re having trouble paying your debts, the worst thing that you can do is ignore the problem and hope that it goes away. The longer you wait, the more fees and interest will pile up, adding to your student debt.

If you’re struggling to pay your loans, you should reach out to your loan servicer, whether it’s the government or a private lender, and let them know what’s going on.

Most of the time, your lender will be willing to work with you, especially if you’re honest about what’s happening in your life.

If you ask, you can likely work out a forbearance, reduced payments, or another plan that will help you keep your loans out of default.

If you wait too long, your credit can take a major hit. In the worst case, your loans could wind up with collections agencies. These companies are usually difficult to deal with and will push you until you pay your debts. You want to deal with the problem before it gets to that point, if at all possible.

What are my options if I’ve already defaulted on my student loan?

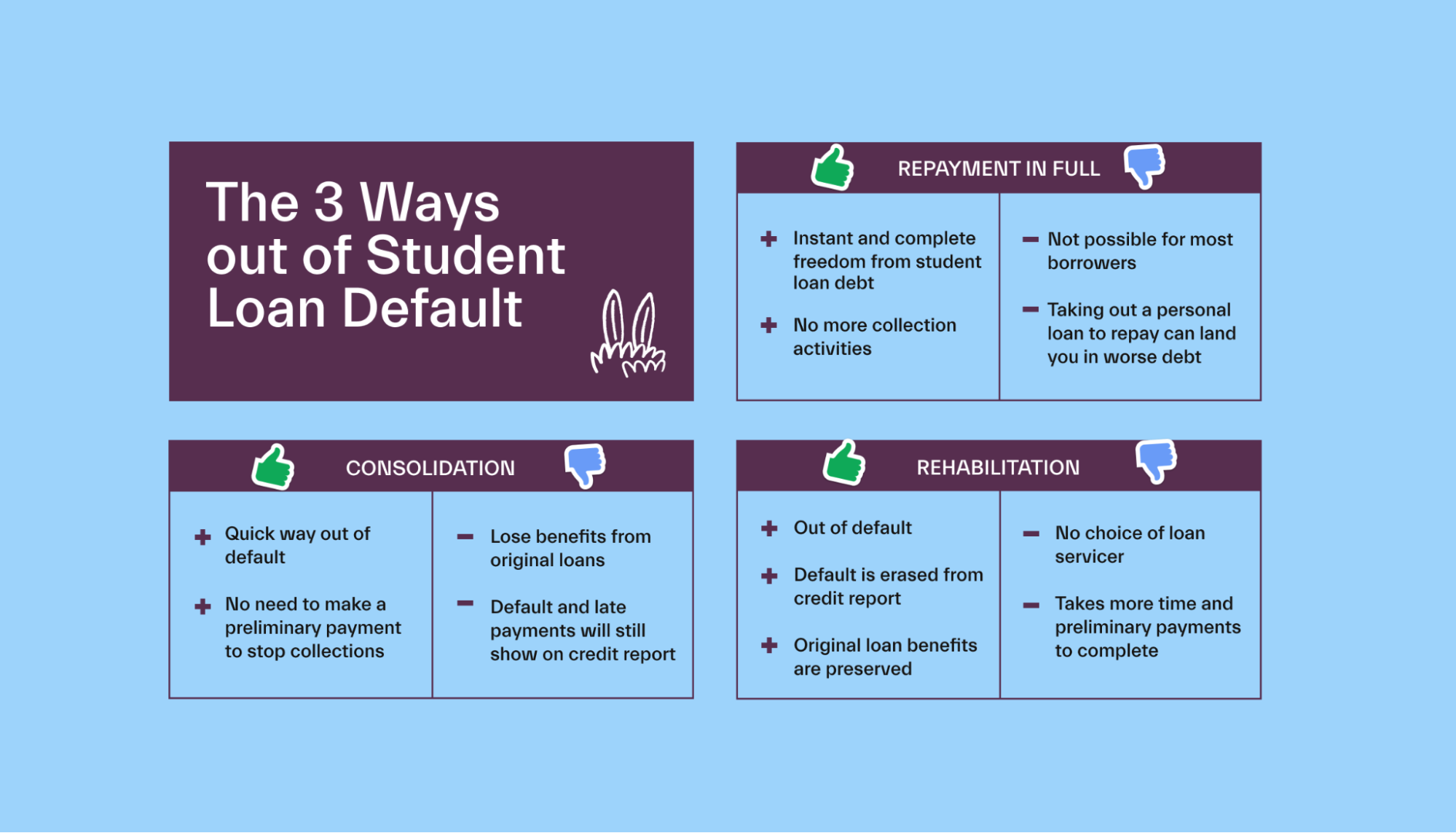

If you’ve already defaulted on your student loans, there are steps you can take to get out of default. Getting out of default can help you qualify for various federal direct loan protections and help improve your credit.

One option is to simply pay your outstanding balance in one loan payment. This will get rid of your loan entirely and take it out of default.

You can also enter “loan rehabilitation”. To do this, you’ll have to reach out to your loan holder and agree to restart making payments on the loan. If you make 9 payments over 10 consecutive months, your loan will be rehabilitated.

This will stop collections proceedings and wage garnishments and make you eligible for loan programs like deferment or forbearance.

Finally, you can consolidate your existing debts into a new loan. This will turn your multiple monthly payments into a single, more manageable payment.

To do this, you’ll need to reach out to your student loan servicer, agree to make payments, and make 3 consecutive payments prior to consolidating. Or, you’ll need to agree to make payments under an income-driven plan after you consolidate.

You have options

Many people borrow money for college and later find that they’re struggling to make ends meet and cover their debts.

If you find yourself in this position, it can feel hopeless. However, these tips can help you take control of your debt and find a way to make your student loans manageable.

If you want to know more about student loans and college finances in general, Mos can help you manage the cost of your education.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you