Student loans •

May 6, 2022

How to refinance a student loan

Want to learn how to refinance a student loan? Check out this guide from Mos.

Taking on a student loan is a pretty big commitment. Right now, the average federal student loan debt balance is $37,113—not exactly a great start to post-college life! And even if you’re enjoying all of the consumer protections of a federal student loan, you’ve got to be wary of how this sort of debt can impact your finances.

After all, you may be able to handle the terms of your student loan right now. But in a decade, you may find yourself in a position where you need to adjust your repayment plan or interest rate to fit your lifestyle.

This is where refinancing can be a real lifesaver.

This guide explains what refinancing is, the pros and cons of refinancing a student loan, and how to refinance a student loan.

What is refinancing a student loan?

Refinancing a student loan is just like refinancing any other debt like a car loan. When you do so, you’re essentially trading in all of your current loans to another private lender. That lender will then settle your existing debts with your current lenders. From there on out, you’ll have a new loan that you commit to pay off instead.

In terms of refinancing, most people choose to trade in their existing student loans for a new loan with a better (or easier) repayment plan. Refinancing often enables you to score a new loan deal with a lower interest rate—which will mean lower monthly payments.

Refinancing a student loan can get you a new loan product with the option to pay off your loan earlier using a more aggressive repayment plan over a shorter time period. You can also opt for a longer repayment period that brings your monthly payments down in exchange for allowing your new lender to stretch your repayment timeline.

At the end of the day, refinancing a student loan can be a good option for some people—but it’s not for everybody. A lot of experts specifically advise against refinancing federal student loans (we’ll get to that in just a minute). But if you’ve got private student loans, it is often possible to get a better deal through refinancing.

What are the benefits of refinancing a student loan?

While refinancing isn’t the best choice for everyone, there are quite a few serious benefits you can expect to gain by trading up your student loan for a new deal.

To give you an idea, let’s quickly walk through some of the key reasons people tend to refinance their student loans.

Refinancing lets you change your repayment plan

As we’ve already mentioned, the single greatest benefit of refinancing is that it lets you change your repayment plan.

Generally speaking, most lenders will let you choose a new loan term ranging from 5 to 20 years—assuming you qualify. This puts you back at the steering wheel in terms of driving your own repayment schedule.

By refinancing, you get to decide how quickly (or slowly) you want to pay back your loans. If you go for a shorter repayment plan, that means you’ll be making more aggressive monthly payments—thus escaping your debts quicker so that you can move on to bigger and better financial goals.

On the flip side, if you opt for a longer timeframe, you’ll be able to make lower monthly payments. This will make life a lot easier right now if you’ve got other financial responsibilities draining your income. Just bear in mind that by taking a longer repayment plan, you’ll ultimately be paying back a greater amount over time because of interest.

You get to consolidate loan payments

Another core benefit you can gain by refinancing student loans is consolidation.

If you had to take out multiple student loans to pay for school, most refinancing lenders let you trade in multiple loans in exchange for one new loan, which combines the outstanding amounts.

In some cases, consolidating student loans by refinancing can save you a lot of money. In other cases, it just makes life easier by reducing the number of direct debits coming out of your bank account to just one monthly loan repayment.

You can apply with a co-signer

One benefit of refinancing a student loan is that you may be able to bring a co-signer into the frame to secure a better deal.

Let’s say you initially got approved for a private student loan based on your own credit history—which was just average. If you’ve got a trusted friend or family member with a great credit score, you might be able to get a better student loan deal by getting them to cosign your loan.

When you take out a loan, your lender is going to look at your credit history to decide whether you should get approved. They’ll also look for a low debt-to-income (DTI) ratio before approving you for refinancing.

That’s why a co-signer with a great credit history will help you qualify for a better deal. Just choose your co-signer wisely, and make sure they fully understand all of the responsibilities involved in this role.

After all, becoming a co-signer means they agree to take on any missed payments. So if things go wrong, this arrangement can strain even the closest relationship.

Improve your overall financial picture

By refinancing a student loan, you’re generally going to be able to get a lower interest rate or lower monthly payments on your student loans. That makes it a lot easier to help you avoid missing a payment, which can then go on to improve your overall personal finances.

Why does keeping up with loan payments improve your overall financial picture?

Above all else, one of the core elements of securing a healthy credit score is to make on-time payments for any existing debts. By improving your credit score, you’ll get to qualify for better credit card deals, financing on cars, a mortgage, and more.

Why is it sometimes not a good idea to refinance a student loan?

Refinancing your student loan might look great on paper—but there are drawbacks to refinancing, too.

To give you an idea, we’ll walk you through a few of the main reasons some people shouldn’t refinance their student loans.

You might not be eligible

The first drawback of refinancing is that not everybody is allowed to do it.

In order to get approved for refinancing, you’ll need a pretty good credit history. Generally speaking, many lenders will look for a credit score of at least 650 before they’ll offer you a refinancing package. But even with a lower credit score, you may be eligible—although the terms of the loans you qualify for may be worse.

You also need a low debt-to-income ratio. A low DTI shows prospective lenders how much of your monthly income currently goes toward paying your other bills (like rent, utilities, and car payments).

When it comes to your DTI ratio, lenders are normally looking for anywhere under 50%. But if you’ve got a DTI ratio way under 50%, your chances of getting approved will be a lot better.

To figure out your DTI ratio, divide the total monthly payments you’re already making by your existing monthly earnings.

If you don’t qualify for refinancing, all is not lost. You might still be able to get a better deal by bringing in a co-signer.

Your credit score determines your new interest rate

Even if you do get offered a new student loan deal, it might not be better than the loan you’ve already got.

That’s because the interest rate you get offered will be largely dictated by your credit score—and so if you don’t have a great credit score, you probably won’t get a great deal, either.

Refinancing can lengthen your repayment timeline

One of the benefits of refinancing a student loan is that you can lengthen your repayment timeline. But for some people, this is actually a big drawback.

If you choose to refinance your student loans and you’re already halfway through repaying them, you can probably get lower monthly payments. But in exchange for those lower payments, you’ll often be stretching out the amount of time it will take to repay your loans completely.

That means you’ll be living with this large debt for longer and usually also pay a larger total amount because of interest.

You could lose consumer protections

Remember how we said that a lot of experts will tell you to avoid refinancing federal student loans? That’s because a federal loan offers some key protections that private loans don’t.

For example, federal student loans have fixed interest rates that help you plan for the future, while a lot of private lenders offer a variable interest rate. Variable interest rates can go up and down, which means your monthly payment might go up in the future.

With federal student loans, you can also negotiate income-based repayment plans. In certain cases, the outstanding balance of your federal student loan can even be forgiven.

Private lenders aren’t obligated to do any of that—which is important to remember because you can’t refinance a federal student loan with the US Department of Education. You can only refinance a federal loan with a private lender.

That means by refinancing, you’ll be trading in your federal student loan for a private student loan, which is almost never a good idea.

Your terms might end up being worse over the long term

If you currently have federal student loans, be very careful with any lenders that promise you lower interest through refinancing. In general, federal student loans offer lower interest rates than all private lenders since they don’t aim to maintain a profit margin on your debt.

Refinancing lenders may try to tempt you with initially low interest rates or low monthly payments, but make sure you read the fine print before signing on that dotted line.

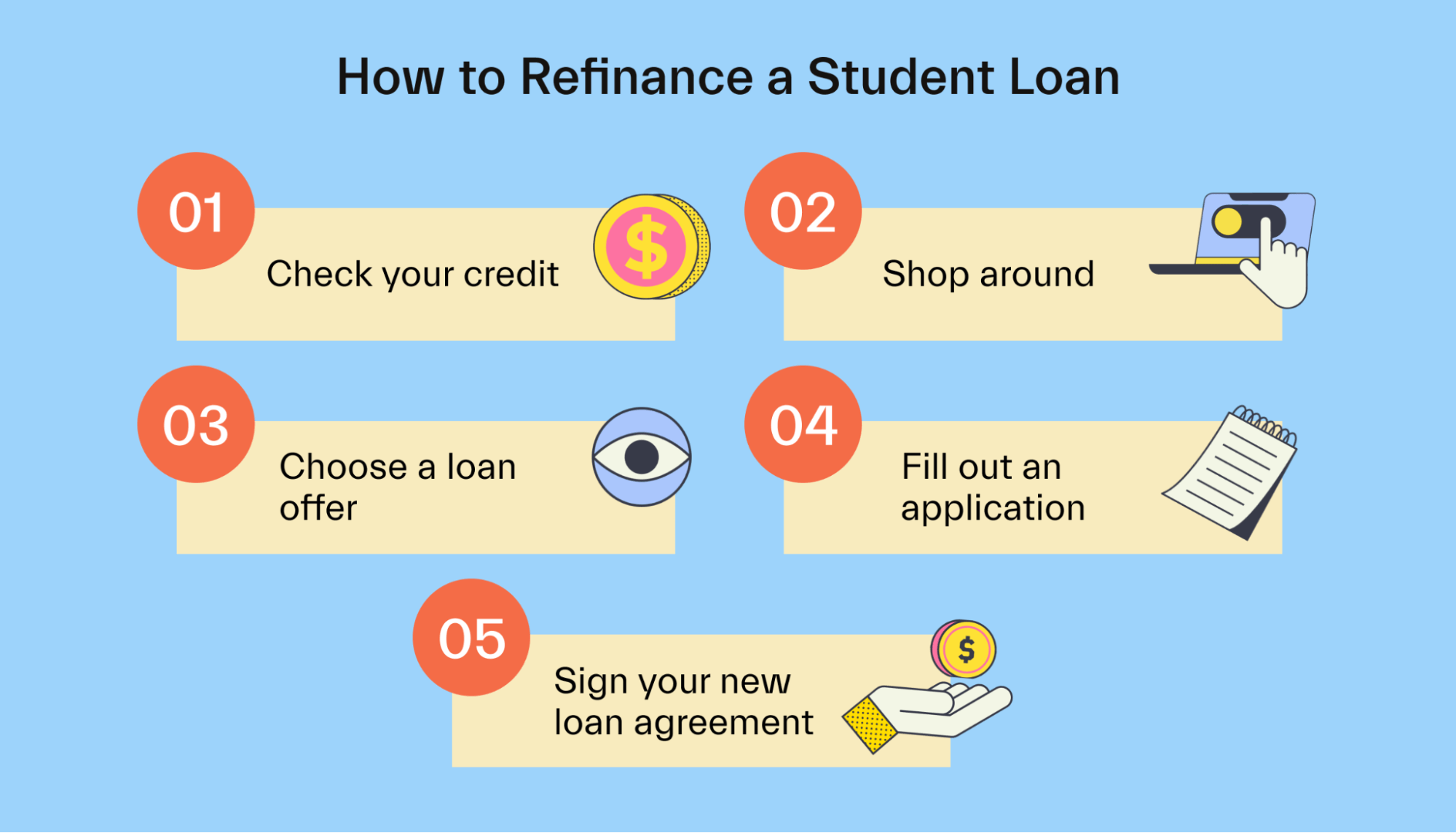

How to refinance a student loan

When refinancing a student loan, you need to remember some key factors. Consider your credit score, the type of loan you have, the remaining time you have left on that loan, your current interest rate, and your monthly payment.

Armed with this information, you’ll be able to cross-reference these key points while shopping around to find out if lenders are actually able to offer you a better deal or not.

Shopping around is the first step when refinancing. Browse different options online and compare the rates and fees of each lender. Many lenders offer prequalification tools that perform a soft credit check on your credit report. Soft credit checks are your friend—because if you have too many hard credit checks taking place, this will be a red flag for potential lenders.

By getting prequalified, you’ll be able to get a clearer picture of all the rates and loan terms you might qualify for.

After you’ve seen all of the rates available, it’s time to choose your new loan product! Most lenders will be in a position to offer you more than one loan product. If you need help determining which is the best of those options, don’t be afraid to get in touch with the lender to ask for help.

Next, you’ll have to fill out your loan application.

The official loan application form is required even if you’ve gone through the lender’s prequalification process. You’ll need detailed information about your finances at hand for this step—we’re talking pay slips, tax returns, debt statements, asset statements, and more. Prepare all the documents you need before starting the process.

Finally, you sign your new loan agreement and start making payments on your new loan. Just keep in mind that your new lender may not pay off your former loans right away. Sometimes the process takes a few weeks, which means you might continue to make loan payments to your previous lender.

Conclusion

Refinancing a student loan can help you get out of debt sooner, but this depends on whether you’re eligible for a good deal.

Getting a good deal is all about doing your homework, comparing multiple offers, reading the fine print, and considering both the risks and benefits of refinancing before you fill out an official loan application.

If you decide that refinancing is a good option for you, the process is relatively straightforward. Just be sure to ask questions and look out for other funding opportunities that can help you pay for college faster.

If you’re still in school, join Mos now to find out more about financial aid and to get matched with loads of scholarships and other financial aid opportunities to help you make the most of your time in college.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you