Student loans •

The student loan interest deduction, explained

Got student loans? The IRS might give you a tax break. See if you’re eligible for the student loan interest deduction and learn about other student tax breaks.

Tax season brings mixed feelings. You might get a refund, but you could also get hit with a tax bill from the IRS. Not fun—especially when a good chunk of your budget goes toward student loan payments.

But the IRS offers a student loan interest deduction to provide tax relief to student borrowers.

That’s right: you may be able to write off your student loan interest on your taxes every year.

In this article, we’ll explain the student loan deduction and help you see if you could be eligible. Then, we’ll cover some other student tax breaks to look at and offer a few non-tax tips to reduce your debt burden and student loan payments during and after college.

What is the student loan interest deduction?

According to the Education Data Initiative, the average student loan repayment time is 20 years, and borrowers accrue $26,000 total interest on average over that time.

The IRS recognizes that $26,000 is a lot of money, and they also realize you’re borrowing to gain skills and education that’ll benefit you and the economy. So they created the student loan interest deduction, a tax break that may let you deduct interest paid on student loans.

Note that your full student loan payment is not deductible—only the interest portion.

How the student loan interest deduction works

The student loan interest deduction lets you deduct up to $2,500 of interest you paid on eligible student loans each year. If you paid less than $2,500, you could only deduct up to the amount you paid.

For instance, if your interest payments on eligible loans total $3,000, you can deduct $2,500.

On the other hand, if you only paid $1,000 in eligible interest, you can only deduct $1,000 from your income.

Student loan interest is considered an adjustment to your income, also known as an “above-the-line” deduction. That means you don’t have to itemize your deductions to claim it like you would with many other kinds of tax deductions.

Also, it’s a deduction, not a credit. That means it reduces your taxable income. It does not directly reduce your taxes dollar-for-dollar like a tax credit would.

For example, imagine you earned $50,000 this year and paid $2,500 in eligible student loan interest. You don’t reduce the taxes you owe by $2,500. Instead, you reduce your income—$50,000—by $2,500 to arrive at $47,500.

Am I eligible for the student loan interest deduction?

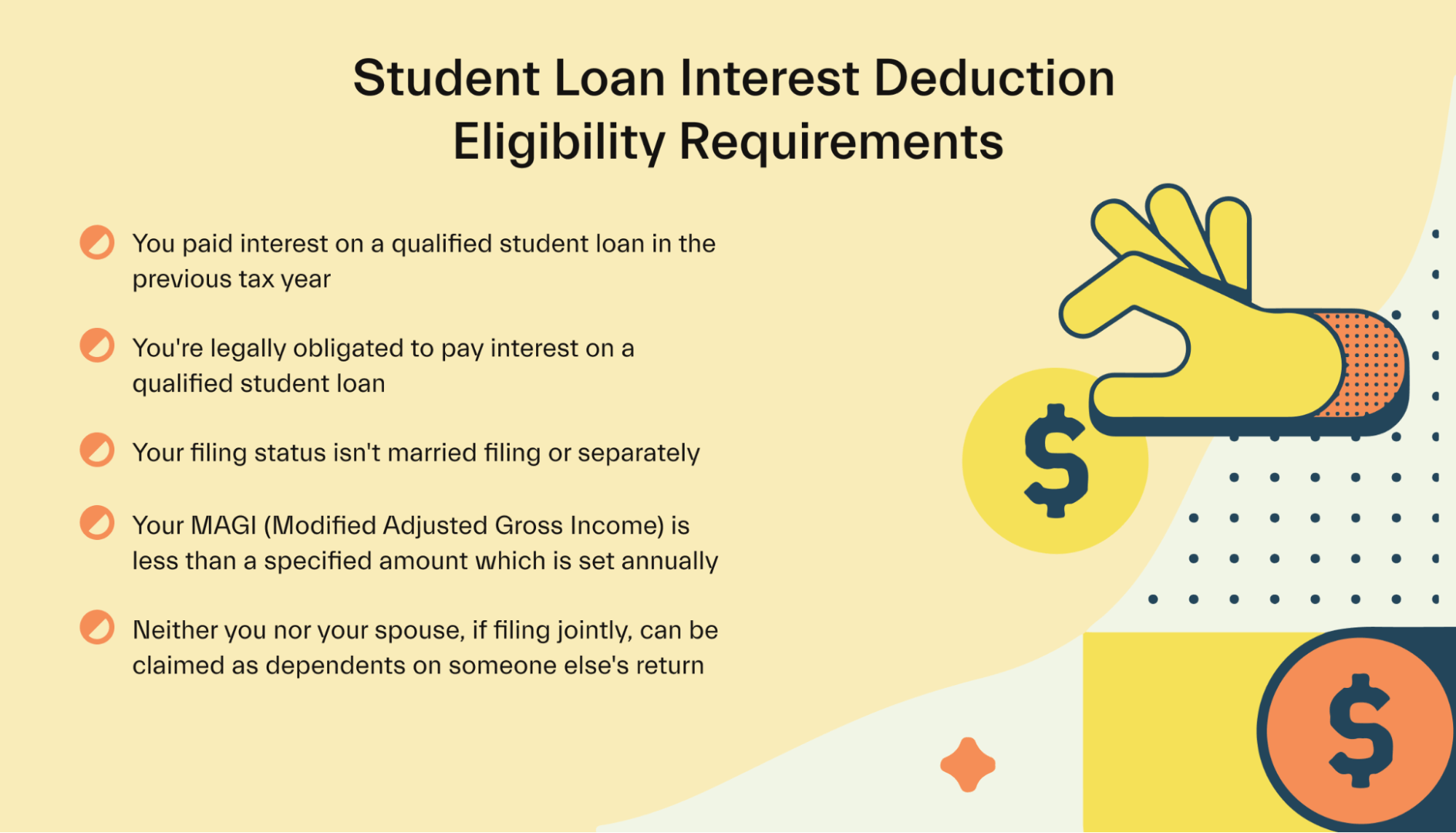

According to IRS Publication 970, you can claim the deduction if:

You claim any filing status except married, filing separately

No one else is claiming you as a dependent on their tax return

You are legally required to pay interest on a qualified student loan and did so in the tax year

Both federal and private loans are good to go for this deduction, as long as you meet the above requirements.

Additionally, this deduction has income limits if you earn a lot, and these limits may change each year for inflation. The IRS looks at your modified adjusted gross income, or MAGI, to see if you earn too much.

The IRS has a worksheet in their Publication 970 that walks you through the MAGI calculation. Many tax software programs do the math for you as well.

All that said, the IRS Interactive Tax Assistant tool can help you see if you’re eligible.

How to claim the student loan interest deduction if you’re eligible

If you’re eligible and paid more than $600 in student loan interest during the tax year, your loan servicer will provide you with a tax form called the 1098-E.

This form should have your total interest paid on all loans the servicer handles.

This number goes on Schedule 1, line 21, where it says Student loan interest deduction. It’s then used with all the other line items on that worksheet to find out your total adjustments to income that go on your 1040 tax return form.

Now, if you paid less than $600, you might still be eligible—you’ll need to contact your loan servicer to find out the interest you paid.

If you have multiple lenders, you’ll receive 1098-E’s from each one you paid at least $600 in loan interest to.

Check out these other tax breaks for students

The student loan interest deduction can be a lifesaver early on in your post-college life, but it’s not the only tax break the IRS offers for recent grads.

Deductions, credits, and savings accounts are available before, during, and after college to cut your tax bill and help you offset your college costs. Here are a few to look into:

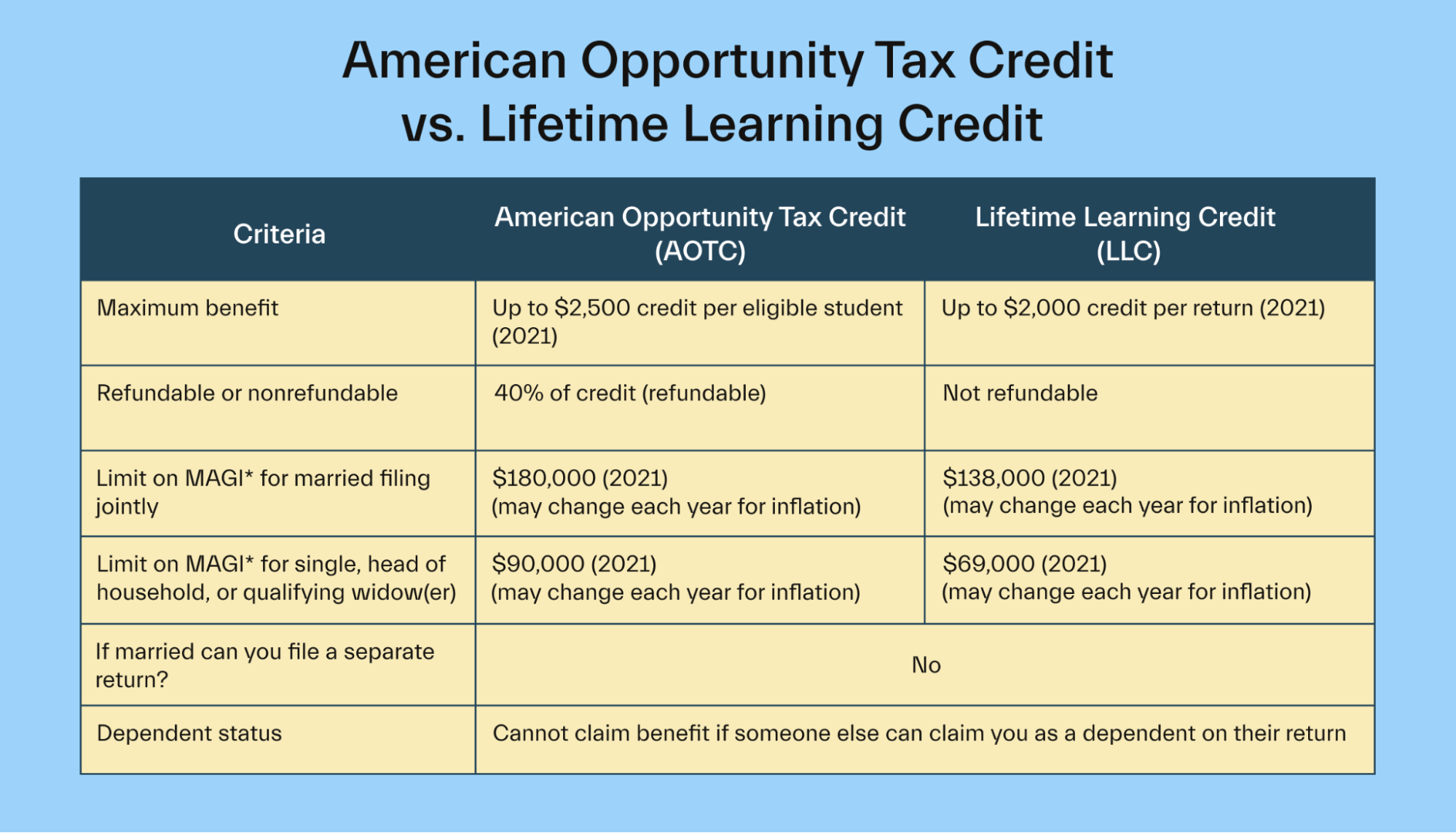

American Opportunity Tax Credit

The American Opportunity Tax Credit lets you or your parents claim up to $2,500 in tax credits for qualified education expenses, such as tuition and fees.

Since it’s a credit, it directly reduces your taxes dollar-for-dollar. It doesn’t just reduce your income like a deduction would.

Per the IRS, you have to meet the following requirements to claim this credit:

Pursuing a degree or other recognized education credential

Be enrolled at least half time for at least 1 academic period starting in the tax year

Haven’t completed your first 4 years of higher education at the start of the tax year

Haven’t claimed the AOTC or the former Hope credit for more than 4 tax years

Haven’t received a felony drug conviction at the end of the tax year

Not filing your taxes as married, filing separately

You can’t be a dependent on someone else’s return, like your parents. If your parents do claim you, they may be able to take the credit instead.

Also, you can’t claim this credit using the same education expenses used to claim another credit, like the Lifetime Learning Credit.

However, there are income limits for claiming this credit to keep in mind.

Your school will send you a Form 1098-T with information on the tuition you paid. You can use this form to calculate your AOTC.

Lifetime Learning Credit

The Lifetime Learning Credit lets you claim up to $2,000 in tax credits per year. Unlike the AOTC, the LLC doesn’t cap the number of years you can claim the credit. This means you could potentially use this for graduate school after finishing your undergraduate career.

The requirements are similar to the AOTC, although the income limits are lower. Once again, your parents can claim it instead of you if you’re listed as a dependent.

Learn more about the LLC on the IRS website.

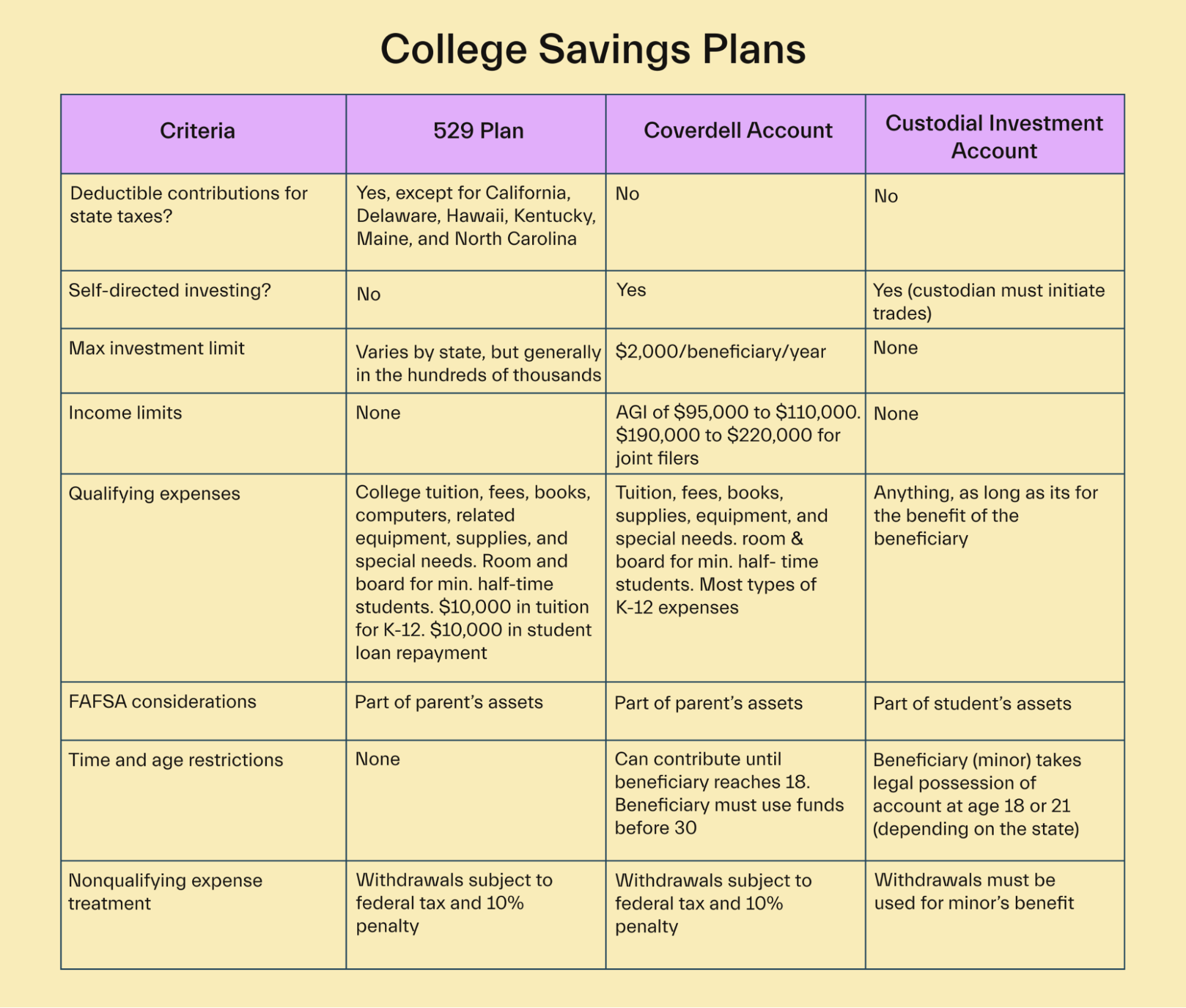

College savings plans

College savings plans are tax-advantaged accounts that all you and your parents to set aside money for college. You can invest the money in the market, and if it grows, you aren’t taxed on it.

Then, you can spend the money tax-free if you use it for eligible education expenses.

The 2 most common college savings plans are 529 plans and Coverdell accounts.

Each state has its own 529 plan, so you’ll have to check with your state to learn the rules.

That said, these plans don’t let you choose your investments—they all go into a fund run by your state—but contributions could be deductible from the contributor’s state tax returns.

However, some states have no state income tax, or they don’t let you or your parents deduct 529 contributions. In that case, a Coverdell account might work better.

These don’t let you deduct contributions, which is fine if you live in a state without an income tax or deductible 529 contributions. But with Coverdell accounts, you get to choose what you invest in.

The IRS offers more information about Coverdell requirements here.

Regardless of the account you choose, both let you take out money tax-free if you use the money for qualified educational expenses. This generally includes tuition and fees, room and board, and books and supplies.

Custodial investment accounts

Custodial investment accounts are investment accounts for kids, managed by their parent or guardian—called the custodian.

The kid is considered the owner of the account, but only the custodian is allowed to make any trades in the account or select investments. Plus, family and friends can gift money to the account to help the child save.

Once the child turns 18, the account is turned over to them. They can now legally manage their investments.

What’s great about these accounts is some of the income or gains are taxed at the kid’s rate, which is usually much lower than their parent’s or guardian’s. That can save your family a few bucks on taxes and help prepare their child for a college education without crushing debt.

Other ways to reduce your student loan burden

Tax breaks aren’t the only way to save money on interest and get out of student loan debt faster. Try the following programs and tips to catch more breaks on your student loan payments.

Seek out non-debt aid

If you’re still in school, prioritize non-debt financial aid first because you don’t have to pay these types of aid back.

Grants are a good place to start. These are need-based, meaning they’re awarded based on the winner’s ability to pay for school.

After that, look at scholarships. These are usually based on merit, helping you fill the gap if grants don’t get you all the aid you need.

You can find many scholarships online and through your school’s financial aid office. Some require essays, whereas others only ask you to fill out a short form.

Look at loan forgiveness programs

Loan forgiveness programs completely erase your loans if you have qualifying federal loans and make your loan payments on time for a certain number of years and meet other requirements.

The Public Service Loan Forgiveness program is one of the most well-known. It forgives the loans of many government workers, nonprofit employees, public safety professionals, and educators if they meet specific requirements.

Loan forgiveness is generally available for federal loans only. Private loans don’t count.

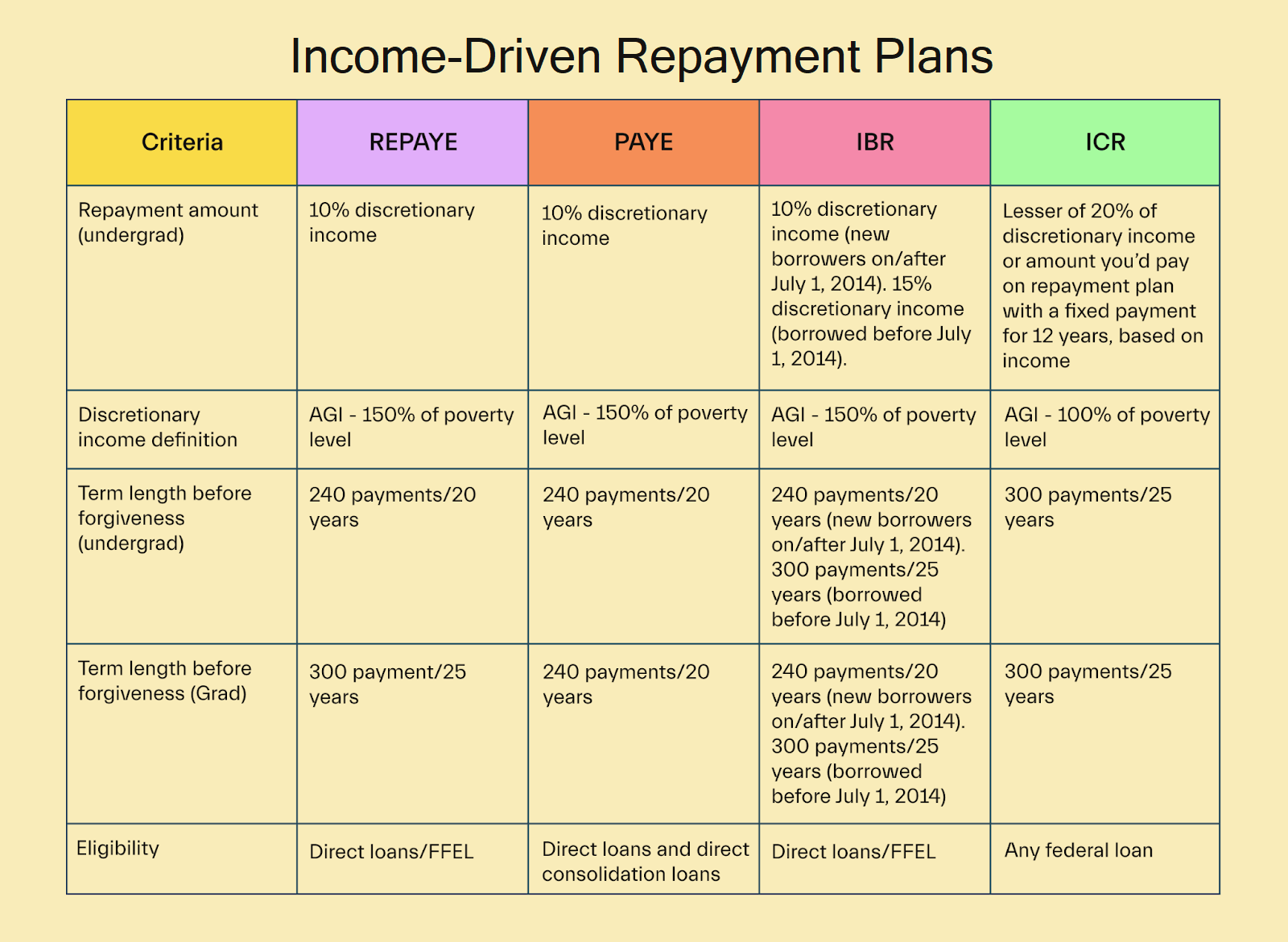

Consider income-driven repayment plans

If your monthly federal loan payments are high compared to your income, income-driven repayment plans can help. There are 4 kinds:

Revised Pay-As-You-Earn Repayment Plan

Pay-As-You-Earn Repayment Plan

Income-Based Repayment Plan

Income-Contingent Repayment Plan

These adjust your payment based on your income and family size so you can continue making required payments on time.

Each type of income-driven plan also offers loan forgiveness after making timely payments for 20-25 years, depending on the plan and what you used the loans for.

Refinance your loans

Refinancing involves paying off an existing loan with a new loan that has a lower interest rate, lowering your monthly payment. This can be a great option if you have private loans since these loans can’t be forgiven.

For example, if you have $20,000 left in student loans at 5% interest, refinancing could involve getting a $20,000 loan at 3.5% to pay off the old loan. You’re still $20,000 in debt, but at the lower 3.5% interest rate.

Sure, you pay less in interest, which lowers your potential tax deduction. However, you’ll save a lot more money in the long run.

All that said, not everyone has a good enough credit score to refinance right away. Keep making loan payments on time to slowly raise your score, then refinance down the road when your score’s good enough.

Pay down loans while in school

Pay some of your loans down while in school if you have the ability. Reducing your principal balance early on means you pay less interest.

This is especially true for subsidized loans, which don’t start accruing interest until your 6-month post-graduate grace period ends. You could make a decent dent if you’re willing to start paying these loans off early.

Working a job to make some money while in college is an excellent way to get started on your loans. Creating a budget can help you find other ways to save money that you can put toward loans.

Pay down some loan interest and get a tax break

Student loan payments can eat up a big chunk of your monthly budget. Fortunately, the IRS lets you write off some of that interest to cut your tax bill or boost your refund.

Regardless of your eligibility for the student loan interest tax deduction, you have plenty of other options to save money on college costs, including tax credits, college savings plans, non-debt aid, and more.

For more ways to reduce your debt burden before, during, and after college, check out our guide on how to graduate debt-free.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you