Student loans •

October 28, 2022

Is college debt worth it?

College costs are skyrocketing, so it's hard to avoid graduating without taking out loans. Learn if all that student debt is worth it in the end.

With each passing year, a new set of graduates enter the workforce—and many of them with loans. Some may only have a small loan balance, but others have tens of thousands in debt—or even more.

Those in the latter case are saddled with huge monthly payments that they may struggle to make on their new salary.

Naturally, you don’t want to be one of those people—slogging through years of college to be worse off financially than you are now.

If you’re applying to colleges or currently attending, it can leave you wondering if college debt is worth it at all.

Below, we’ll explain why so many students and graduates have college debt these days. We’ll also weigh the pros and cons of attending college so you can see if the loans are worth it.

Why are so many students and graduates in debt?

It’s simple: students and graduates are in debt because it costs a lot to go to school. That wouldn’t be a big deal if people also earned more.

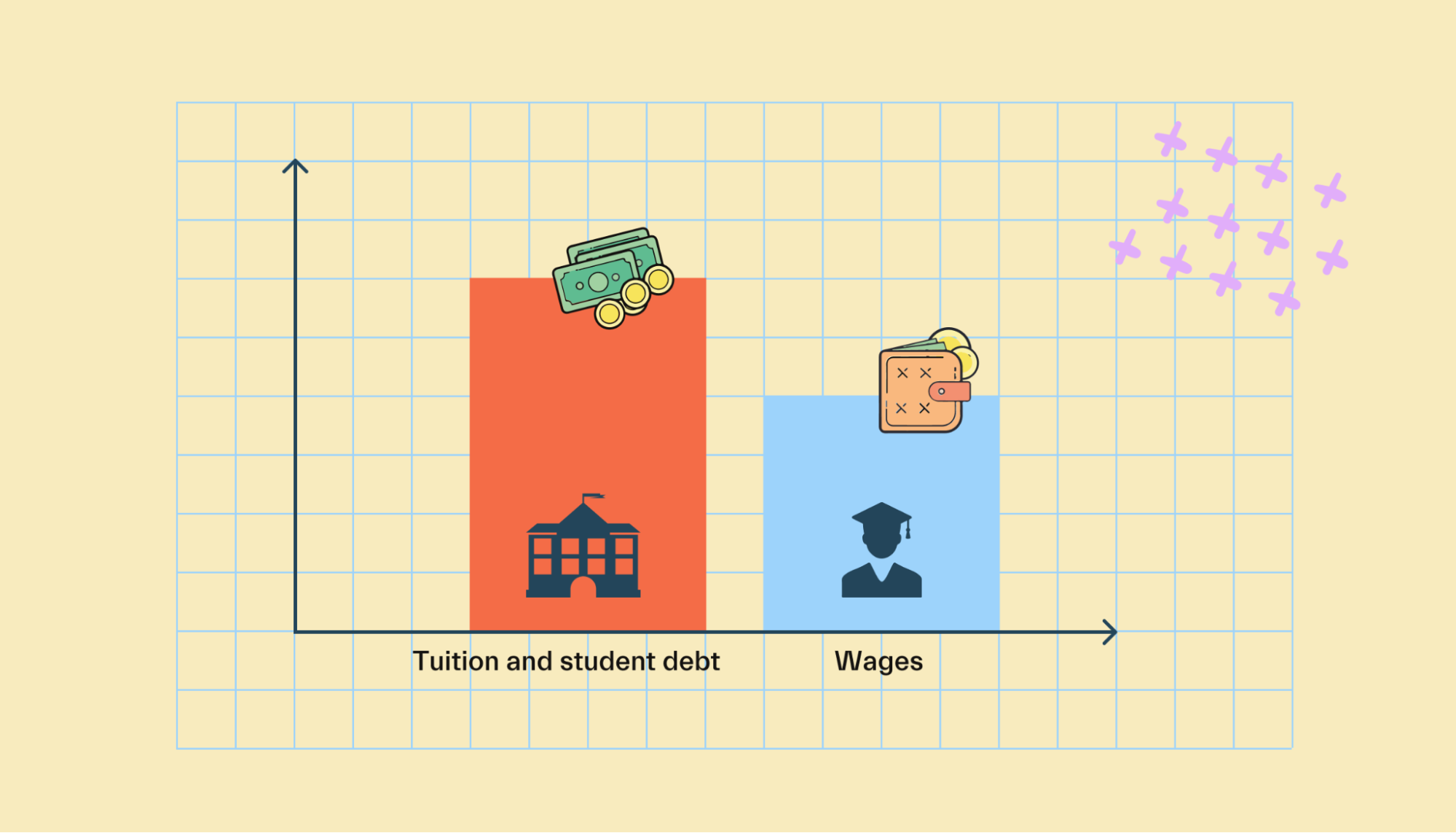

But that’s the problem: college costs have skyrocketed compared to wages.

According to stats from the National Center For Education Statistics, college tuition across all universities jumped from $15,604 to $24,623—adjusted for inflation—between 2000 and 2019.

That’s a 57.7% increase in 19 years.

Now, compare that to wage data. Inflation-adjusted weekly earnings for people with bachelor’s degrees only went up about 5% from 2000–2020!

It’s hard to give a definitive reason for this. There are plenty of factors.

For one, the traditional expectation of going to college plays a role. This increases demand for college education, so institutions can theoretically raise the cost of tuition.

Alongside that, the expansion of financial aid may ironically make higher education more costly. Once again, there’s more money flowing toward colleges and universities. Supply and demand take over.

Some blame “bloat” in college administrations—meaning high spending on new buildings and amenities the college doesn’t need, higher salaries for high-level administrators, and so on.

At the same time, some of this spending may be to remain competitive with other universities trying to offer the best programs and amenities. The schools then pass this off to students.

Lastly, less-than-ideal state funding may force colleges to raise tuition.

With all these factors colliding, students are struggling harder than ever to pay for college.

And because of this, some students are weighing whether or not all the debt is worth it.

The pros of going to college

Taking out student debt to afford college has plenty of benefits, despite the high price tag. Not all of them are financial advantages, although those are definitely important.

Here are some ways that your student loans could pay off.

Earning power and benefits

It’s simple: college graduates tend to earn more than their counterparts whose highest degrees are high school diplomas or GEDs—and employers sometimes have benefits specifically related to tuition.

Despite some companies moving away from degree requirements, many still prioritize bachelor’s degrees at the very least.

Master’s degrees could potentially bring even more.

These days, some companies offer tuition reimbursement in their benefits packages, too. This can cut the cost of college and help you go back for another degree if it helps the company out.

Another benefit that’s increasing in importance and available more often to college grads: remote work. Working remotely can mean saving time and money on commutes, among other advantages.

Some studies have shown that college grads have more work-from-home opportunities available to them.

Steadier employment

In general, people with bachelor’s degrees have better employment prospects than those without.

According to the BLS, the unemployment rate for those with bachelor's degrees was 3.7% as of March 2021—compared to 6.7% for high school grads.

Like pay, the reasoning is intuitive.

Those with degrees are generally perceived to have, or actually have, in-demand skills that companies are looking for.

Some fields of study are in especially high demand, such as science, technology, engineering, and mathematics (STEM). You’ll need at least a bachelor's degree for most roles in these fields.

Networking

People often say that getting a job “isn’t what you know. It’s who you know.”

For some people, the networking opportunities in college are priceless. Meeting and building personal and professional relationships with other bright young minds can pay off down the road. You might meet someone who ends up working at your dream company, giving you an “in.”

It’s the same story with networking with your professors. Sometimes, they have connections to awesome job opportunities and can offer you valuable career advice.

Beyond that, you’ve got job fairs and career events coming to campus. These are also great opportunities to get your foot in the door.

Similarly, going after a four-year college degree opens you up to internship opportunities. These can put valuable work experience on your resume before you even graduate.

Even better: they could land you a full-time offer while you’re still in school.

Oh, and many internships are paid. Certainly not a bad thing when you're a student.

Work (and study) abroad

Ever wanted to experience another country? College is one of the best times to do it if you study abroad.

Studying abroad lets you experience a new culture and potentially learn the language while in school.

Aside from personal enrichment, studying abroad can make you appear a more interesting and well-rounded job seeker. Not to mention that in our interconnected world, someone who’s studied in other countries is an attractive job candidate.

Speaking of that, college degrees open up opportunities for working abroad, too. This is especially true if you major or minor in a language.

For instance, if you double major in business and German, you may gain some opportunities to work in the business world in Germany.

Education and personal growth

Today, many attend college primarily to up their skills and land higher-paying or more fulfilling jobs. There’s something to be said about a liberal education, though.

You’re forced to consider new ideas and perspectives. It expands your worldview and makes you more well-rounded. You also meet tons of people you might never have otherwise run into.

Plus, you become able to converse intelligently on a wide range of topics.

College is also a time of tremendous personal growth for many young adults.

You face and overcome a lot of adversity:

Balancing a busy schedule, especially if you work to support yourself

Improving your social skills or ”breaking out of your shell”

Potentially being on your own for the first time

Having more space to be yourself, or, rather, finding out who you are

Going to college solely for a liberal education and personal growth is no longer financially viable for most. There has to be a salary at the end of the tunnel.

However, it’s a fantastic added benefit.

Build your credit score with loans

Loans aren’t ideal, but there’s a silver lining: building your credit score.

See, most students have little to no credit history or score. They have to start somewhere—and student loans might be their first foray into the credit world.

Make each monthly payment on time over the years, and your score will slowly rise.

The cons of going to college

College isn’t without its flaws, and taking out loans to go can amplify those.

Despite the data showing that college graduates tend to be more successful by a variety of metrics, not everyone has to go to college to reach their version of success.

With that in mind, here are some drawbacks to attending college.

Debt sets you behind

Debt may help your credit score when managed properly, but it sets you behind financially in other ways.

Every dollar put toward your student loan debt is a dollar not saved or invested for the future. Goals like marriage, starting a family, buying a home, and retiring may feel more out of reach.

This can be a big deal for people who put giant chunks of their paycheck toward student loans. After those loan payments and their regular expenses, they might barely have enough left over to make any financial progress.

Job preparation is not guaranteed

Everyone’s heard the “I don’t use my degree” from someone in their life.

While data on this is hard to collect, it’s fair to say that a good chunk of people might end up in careers that aren’t very relevant to their degrees.

Some people might land a job in their field but only use some of what they learned, whereas others might not use their knowledge from their degree at all. They might learn most of their responsibilities and skills on the job.

You could also end up in a completely different field than what you studied for.

Some majors have lower income potential

Bachelor's degree-holders might earn more than high school grads, but different majors have different average salaries.

Technical majors like engineering and computer science tend to pay the highest on average. Even subfields within those disciplines vary in their pay.

For example, petroleum and computer engineering generally pay more than other forms of engineering.

Meanwhile, less technical majors, such as those in the liberal arts, may not pay as much.

Not all jobs need degrees

Not all jobs need degrees.

Some companies have even experimented with moving away from degree requirements for jobs that traditionally might require them.

Here’s the thing:

You might not even know what you want to do until you’re a few years into adulthood. You might get a degree, work in your field of study, and later find your passion lies elsewhere.

Who knows—maybe that passion doesn’t need a degree.

Lost earning years

For many students, every year in college is a year not earning a paycheck in the workforce.

This is fine if you work hard to get good grades, network, and build your resume—the higher wage potential and faster career growth could pay off.

But keep this in the back of your mind.

You don’t want to spend 4 potential earning years and lots of cash without anything to show for it.

That said, if you go to college, do your best to make it to the end. If you drop out or have to leave, you’ll lose out on earning years and have debts without a degree to back you up.

Stress

Moderate stress can be good for us in short spurts.

Chronic stress, not so much. It can increase your risk of numerous physical and mental health problems, such as:

Anxiety

Depression

High blood pressure

Heart disease or a heart attack

Sleep problems (which can only make your health worse)

Unfortunately, college and student debt can cause the chronic kind of stress.

When you’re in school, you have to juggle classes and studying with extracurriculars, a social life, your health, and sometimes a job. Maybe even a relationship.

Aside from being busy every day, it’s just a lot to keep on your mind. College truly tests your time management and organization capabilities.

It pays off when you enter the working world, but then you replace the schedule-related stress with debt worries.

Even if you can cover your expenses and your debt payments, knowing you have to fork over that amount of money for the long haul isn’t a happy thought.

The verdict: Is college debt worth it?

College debt can be worth it under the right circumstances.

If you’re fairly confident you know what you want to study, that’s a good start. You don’t want to spend extra time and money changing majors multiple times.

Knowing what you want to study also helps you optimize your time in college so that you’re prepared to get a good job after.

However, you don’t need a high-paying major for the debt to be worth it. You’ll just want to work harder in other areas.

In particular, you should try to beef up your resume with leadership positions in extracurriculars and invest time networking with students, professors, and employers.

Debt may also be worth it if student loan forgiveness is available.

For example, if you want to work in a public service job, you may be eligible for the Public Service Loan Forgiveness (PSLF) program. Since the Biden Administration is planning to make this and other programs more accessible, taking on debt could be worth it.

When it comes down to it: if you’re committing to tens of thousands in debt, you should have a plan for paying it off.

Remember: you don’t have to go to college right away. You can work after high school for a year or longer if you need to figure out your career plan. At worst, you save up some extra cash for when you eventually attend college.

College: It’s an investment

Ultimately, you have to think of your college education as an investment. If taking on student debt helps you land a lucrative and fulfilling career, those loans may be worth it.

You can’t see the future, though, and there’s risk involved. Make sure you work hard to succeed and expand your opportunities so that those loans pay off! If you don’t finish school or do poorly, you might not get the opportunities you want.

That said, there are tons of ways to cut down your college debt—even if you don’t get out debt-free. Check out Mos to learn more about managing your college finances.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you