Investing •

Investing student loans: is it possible, and should you do it?

Investing student loans is technically possible, but it comes with a whole lot of risks. Get the scoop on investing your loan money right here.

Student loans are intended to be used for tuition and living expenses while you’re in school. But technically, you can use them for just about anything.

Some creative students might be wondering if they can invest student loan funds and pocket the difference between their profits and the interest they are charged.

Is investing student loans legal? And is it a good idea? That’s what we’ll explore in this article. We’ll break down typical student loan contracts, the legality, and the risks and drawbacks of the bold proposition.

Can I invest student loans?

Student loans are intended to be used for educational expenses. However, using them for other purposes is not technically illegal.

You could theoretically use student loan funds to invest in stocks or other assets. However, remember that most loan funds go directly to your school—you’ll only have direct access to loan money left after your tuition and fees.

While it’s not illegal, investing student loans is certainly a gray area—both legally and morally. Put simply: this strategy is using the loans in a way that’s a lot different from their intended use.

Plus, it can be quite risky. You will eventually need to pay these loans back, with interest. If your investments don’t perform well, you could lose money and get stuck with a huge student loan bill.

And finally, it’s difficult to make money with this strategy because you need to earn more than the interest rate you’re paying on your loans.

Student loan interest rates for federal loans range from 4.99% to 7.54%. To make any sort of profit, you’ll need to earn a rate of return that’s higher than the interest rate you are being charged. Considering that the broad US stock market tends to return around 7% per year, that can be difficult to achieve.

Remember: Most student loans are sent directly to the school

An important detail to remember is that most student loan funds are typically sent directly to your school. They are then used to cover tuition and related expenses. This is true for both federal and (most) private loans.

If funds are left over, they can be distributed directly to your bank account. But in general, you won’t receive a check for the full amount of your student loans—therefore, you can’t easily invest the bulk of student loan money.

Federal loans vs. private student loans

One big consideration is whether you’re using federal student loans or private loans.

Generally speaking, federal loans have more strict rules on how they can be used. The Department of Education makes it clear that student loans are meant to be used for education expenses.

Private loans, on the other hand, may be more flexible. Many lenders don’t have specific rules on how the funds can be used—they are more traditional loans based on your creditworthiness. At the same time, private loans are more expensive and often harder to get approved for.

Subsidized loans vs. unsubsidized

There also may be a difference to consider if you are using subsidized student loans. Most federal loans are subsidized by the government, which means that Uncle Sam offers to pay part of your interest.

With subsidized loans, the government provides a lower interest rate than you could otherwise get. The US government considers it an investment in educating the population.

However, subsidized loans present another moral dilemma—is it appropriate to invest loans that taxpayers subsidize?

Subsidized loans could also present a legal hurdle. While there are no specific laws against investing with student loans, it’s possible that the Department of Education could take legal action against students who use student loans improperly.

Should I invest student loans?

Technically, you can invest your student loan money. But should you?

In short: No, probably not.

A lot is working against you when it comes to investing student loan money.

The most significant is that you’re investing money that isn’t yours. You’re investing a loan, and that loan will need to be repaid eventually—with interest.

Consider 3 scenarios:

Worst-case scenario: You take out a student loan, invest the money, and your investment goes south. You lose the invested funds. Unfortunately, you still owe the full amount—and interest is accruing daily.

In this case, you would have to find the money in your budget to tackle the debt, or perhaps even take out another loan to cover the monthly student loan payments.

Mediocre-case scenario: You take out student loans with an interest rate of 5%. You invest the funds, and earn 7% returns on average (the long-run return on investment for the US stock market).

After accounting for the 5% interest you’re accruing, you earn a real return of 2%. On a $10,000 investment, that’s only $200 per year. Is that worth the risk and headache?

Best-case scenario: You take out student loans with an interest rate of 5%. You invest and get lucky with a stock that has high returns. You make some money, and pocket the difference between your returns and the interest rate you must pay.

Investing could pay off, but again, a lot is working against you here. It’s best to play it safe and only invest money you can afford to lose.

Potential benefits

In a best-case scenario, you could earn some money on your investments. If you make wise or lucky investments, and the stock or crypto market happens to work in your favor, you could potentially make some profit.

The question is whether the small potential for benefit is worth the risk—and the stress that comes along with that risk.

Risks and downsides

There are many more downsides than there are upsides. Here are a few of the most important to consider.

Possibility for legal action: While there aren’t specific laws against investing student loans, it’s certainly possible that a lender could threaten legal action for improper use of funds. This may be more likely with government-subsidized loans.

Negative returns: Unless your investments earn more than the interest you accrue on your loans, you will end up with a negative rate of return. This means that you actually lose money. For example, if you earn 4% per year on your investments, that may seem like a profit—until you remember that the loans are accruing 5% per year in interest.

Investing with debt: One of the core rules of investing is that you should only invest money that you can afford to lose. Can you afford to lose money that is loaned to you? What’s your plan if you lose some or all of your invested money and still have to pay back your hefty student loan balance?

Poor timing: The stock market can be a fickle place. Even if you happen to make a good investment, things can easily turn south at any time. For example, you could pick a good investment and watch your money grow for several years—only to have the stock market crash right around the time you need to start making monthly payments on your loans.

Overall, the risks of investing college loans outweigh the benefits of doing so by far.

How to start investing as a college student

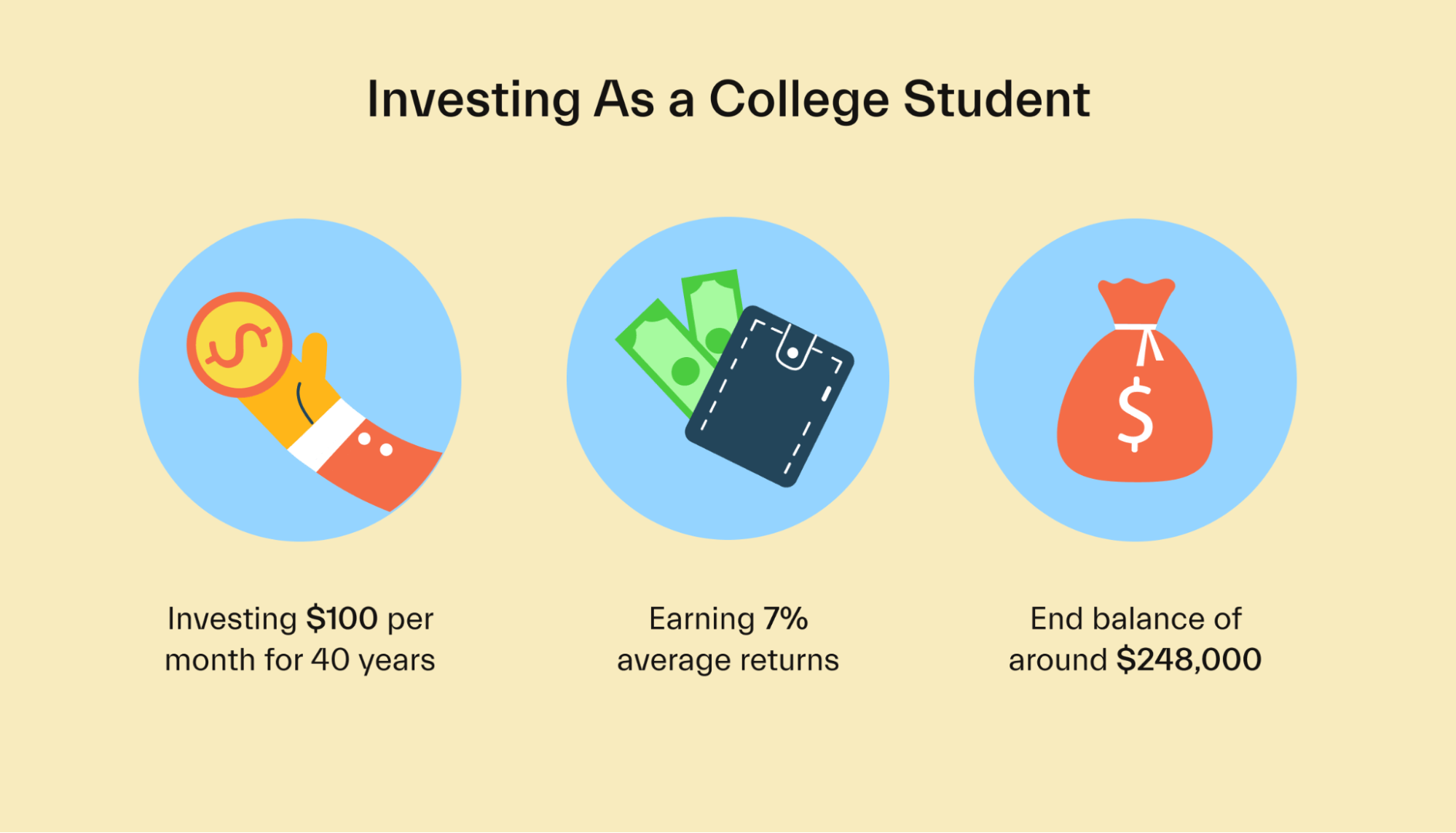

It’s not generally a good idea to invest student loans. But that doesn’t mean you shouldn’t start investing while you’re in college!

Even small monthly investments can really add up over time. $100 per month for 40 years would result in a balance of around $248,000, assuming 7% average returns.

And the earlier you get started, the more time your money has to grow. So whatever amount you can afford to invest, the key is to get started as soon as possible.

So, how do you get started? Here’s the brief rundown—for more details, see our guide on how to invest as a college student.

1. Open an account

First up, you’ll need an investment account. You can open a free account at a stock broker like Charles Schwab, Fidelity, or Vanguard. Or, you can opt for an app like Robinhood or WeBull. All of these options are free and offer free stock trading.

2. Select investments

Now, choose what you want to invest in. Since you’re young, you have a long time horizon for your investments—which typically means that you can afford to take a bit more risk. So, investments like stocks are a good option.

Not sure where to start? Investing in index funds is a simple way to invest in the stock market. Index funds include 100s of different stocks bundled into one. A great option is an S&P 500 index fund, which includes shares in the 500 largest companies in America.

3. Diversify

Diversifying means spreading out your investments so that you don’t have all your eggs in one basket. This is an important principle of investing.

Buying things like index funds is an easy way to diversify your investment portfolio. If you choose to buy individual stocks, you should aim to spread your bets by investing in various companies.

4. Contribute regularly

The key to investing success is to keep making more investments over time. Ideally, this means setting up a regular monthly or even weekly investment plan. You can set up automatic transfers from your bank to make this easier.

If you can make room in your strict student budget for investments, your future self will thank you! And even if you just invest extra money when you come across it, you will still greatly benefit from investing early in your life.

5. Consider your other financial goals

Investing is important, but it’s not the only financial priority to consider. You may wish to start building an emergency fund to cover unexpected expenses. Or you may want to work on paying off your student loans early.

The basic idea is to make a list of all your various financial goals, and then start prioritizing them. It may be that you can only afford to work towards one goal at a time—and that’s perfectly okay!

Wrapping up

Technically, you can probably get away with investing student loan funds. But is it a good idea? Almost certainly not!

Even if your investments do well, remember that you still pay interest on your loans. To generate a profit, your investments need to beat the interest rate you are paying.

Investing with any sort of loan is highly risky, and can lead to some serious financial consequences if things go badly. It’s best to play it safe.

From FAFSA to filing appeals, you can do the financial aid stuff on your own. Want an expert to take over? That's cool too--and where Mos financial aid advisors come in. Work 1-on-1 with an advisor who’ll review your annual aid offer, draft custom tuition negotiation letters, and more. Explore Mos memberships to get started.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you