Investing •

How to invest as a college student

Investing doesn’t need to be complicated. Here’s how to invest as a college student, even if you only have a few bucks to get started.

Investing is the best way to build long-term wealth. Assuming a 7% average return, every $1 invested in the stock market today could be worth over $29 in 50 years, thanks to the power of compounding interest.

But investing is also complicated—or at least it can seem like it for newcomers! With thousands of investment opportunities, hundreds of platforms, and a variety of shiny distractions to get caught up in, it can all make your head spin.

And let’s face it—as college students, most of us don’t have a ton of money to throw into investments. The barriers to investing seem high, but they don’t have to be!

Here’s how to invest as a college student.

Why should I bother with investing?

Investing puts your money to work for you. Instead of sitting in a bank account earning pennies per year, your money can start to earn real returns and grow over time.

And the key to investing is that the earlier you start, the more time your money has to grow!

And over long periods of time, the results can be massive. Because of compounding interest, investment profits “snowball” over time, growing faster and faster the longer you invest.

For example, $1 invested today will be worth around $2 in 10 years, $4 in 20 years, $7.50 in 30 years, $15 in 40 years, and a whopping $30 in 50 years.

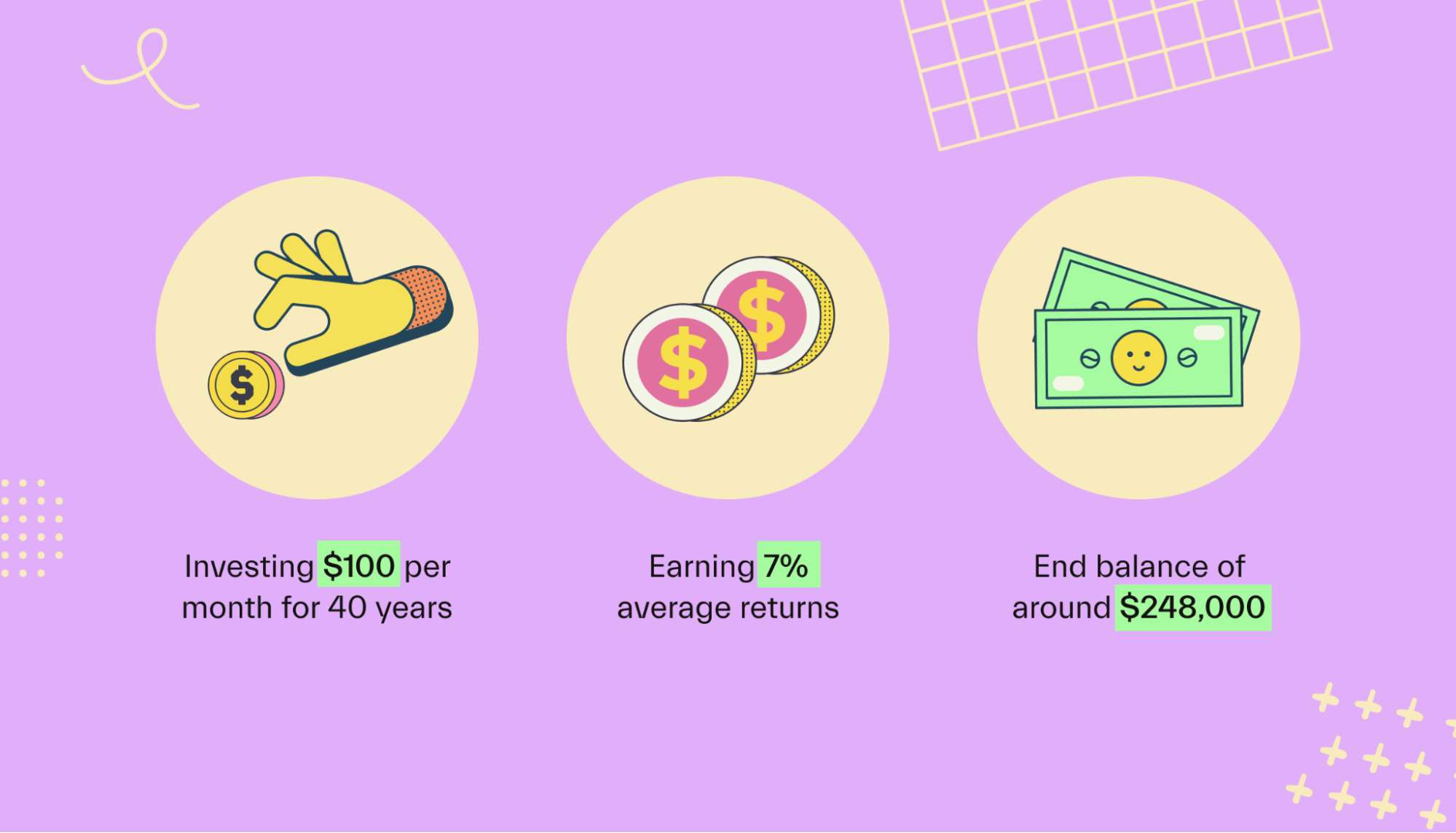

Of course, $1 doesn’t get you very far. Let’s look at some concrete examples using an approachable but meaningful amount of money invested:

Valentina starts investing in college at the age of 20. She invests $100 per month until she retires at age 65. Valentina will have approximately $355,000 in retirement, assuming 7% average returns. The total amount that Valentina would have actually invested would be $54,000—the other $301,000 would be all investment profits.

Samuel starts investing at age 30. He invests $100 per month until he retires at age 65. Samuel will have approximately $172,000 in retirement, assuming 7% average returns. That’s less than half of what Valentina ended up with! Samuel would have invested $42,000 in total—just $12,000 less than Valentina.

The basics of investing

Put simply, investing involves buying assets that you expect to grow in value over time.

For example, you could buy McDonald's stock if you expect McDonald’s to keep growing—or you could buy a rare sports card if you think it will be more valuable in the future.

There are all sorts of things you can invest in, but the most common are:

Stocks (small portions of big companies, like Microsoft)

Index funds and mutual funds (bundles of stocks from many different companies)

Bonds (essentially I-O-Us to governments or companies)

Real estate (houses, apartments, etc.)

Cryptocurrency

Collectibles

Investing can be as simple or as complex as you want it to be.

At its most simple, you could open an account and buy a single index fund, like the S&P 500 index. That would allow you to own small pieces of 500 different US companies. You could then keep investing regularly and check back in a few decades!

Don’t worry; investing can be straightforward and low-stress. Let’s break down what you need to know about how to invest as a college student.

Opening an account

For most investments, you’ll need a brokerage account or a trading app. This account will allow you to transfer money, buy and sell assets, and more.

There are 3 basic routes to go here:

Traditional brokers: Stock brokers let you buy and sell stocks, bonds, mutual funds, index funds, and more. They generally offer the widest selection of investment options. If you choose a good company, trading will be free. Some good options include Schwab, Fidelity, and Vanguard.

Trading apps: Newer investing and trading apps let you buy stocks, index funds, and more. They often have a bit more limited selection when it comes to investment, but they make things very simple for newcomers. Some good options include WeBull and Robinhood.

Robo-advisors: “Robo-advisors” are platforms that allow you to invest in pre-built portfolios. Instead of picking individual stocks, robo-advisors ask you some questions about your goals and risk level and recommend a pre-made investment portfolio. The downside is that there are fees involved. Some good options include Wealthfront and Betterment.

Select an account type

You’ll also need to select an account type. There are 2 broad categories here:

General brokerage accounts: These are the “vanilla” accounts that are designed for general-purpose investing. There are no tax benefits, but there are also no contribution limits or restrictions on when and how you withdraw money.

Retirement accounts: These retirement-specific accounts, like the Roth IRA, offer tax benefits when you save for retirement. However, you generally can’t withdraw funds from these accounts until you reach retirement age. If you withdraw early, you may face a penalty. If you’re saving for retirement, the tax benefits are substantial—but if you’re not sure what you’re saving for, it’s wise to stick with a general account.

Determining your goals and risk tolerance

Next up is to consider what you are investing for.

Are you saving for a short-term goal, like starting funds for your life post-college? Or is it for a long-term goal, like retirement?

It’s important to ask these questions because your goals affect how you should invest. The period of time you will be investing for is of particular importance.

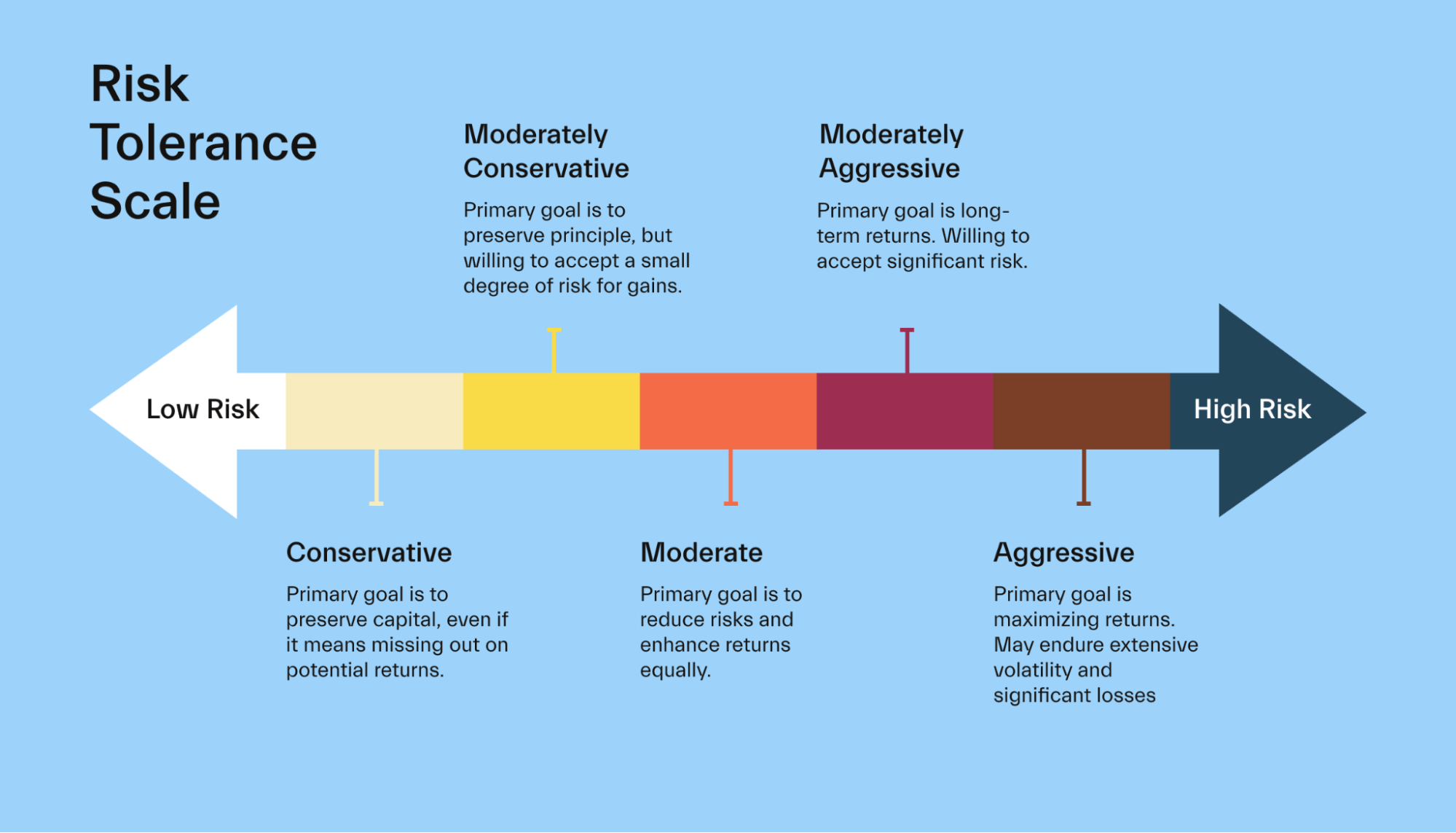

If you are investing for the very long term (like for retirement), you can afford to take more risks. That could mean investing in all stocks, or maybe even some alternative assets like crypto.

If you are investing for the short or medium-term, you should likely stick with somewhat safer options. That could mean keeping 50% of your portfolio in riskier assets like stocks and the rest in safer assets like bonds or cash.

Keep in mind that you can save for multiple goals at once and have a different investment strategy for both. If you’re saving $200 per month, you could put $100 into long-term retirement accounts and $100 into short-term cash savings.

More broadly, it’s a good idea to consider your “risk tolerance.” This refers to how comfortable you are taking risks with your money. A good place to start is this investment risk tolerance assessment from the University of Missouri.

You can then use this knowledge about yourself to decide what to invest in.

Selecting investments

Now it’s time to actually build your investment portfolio!

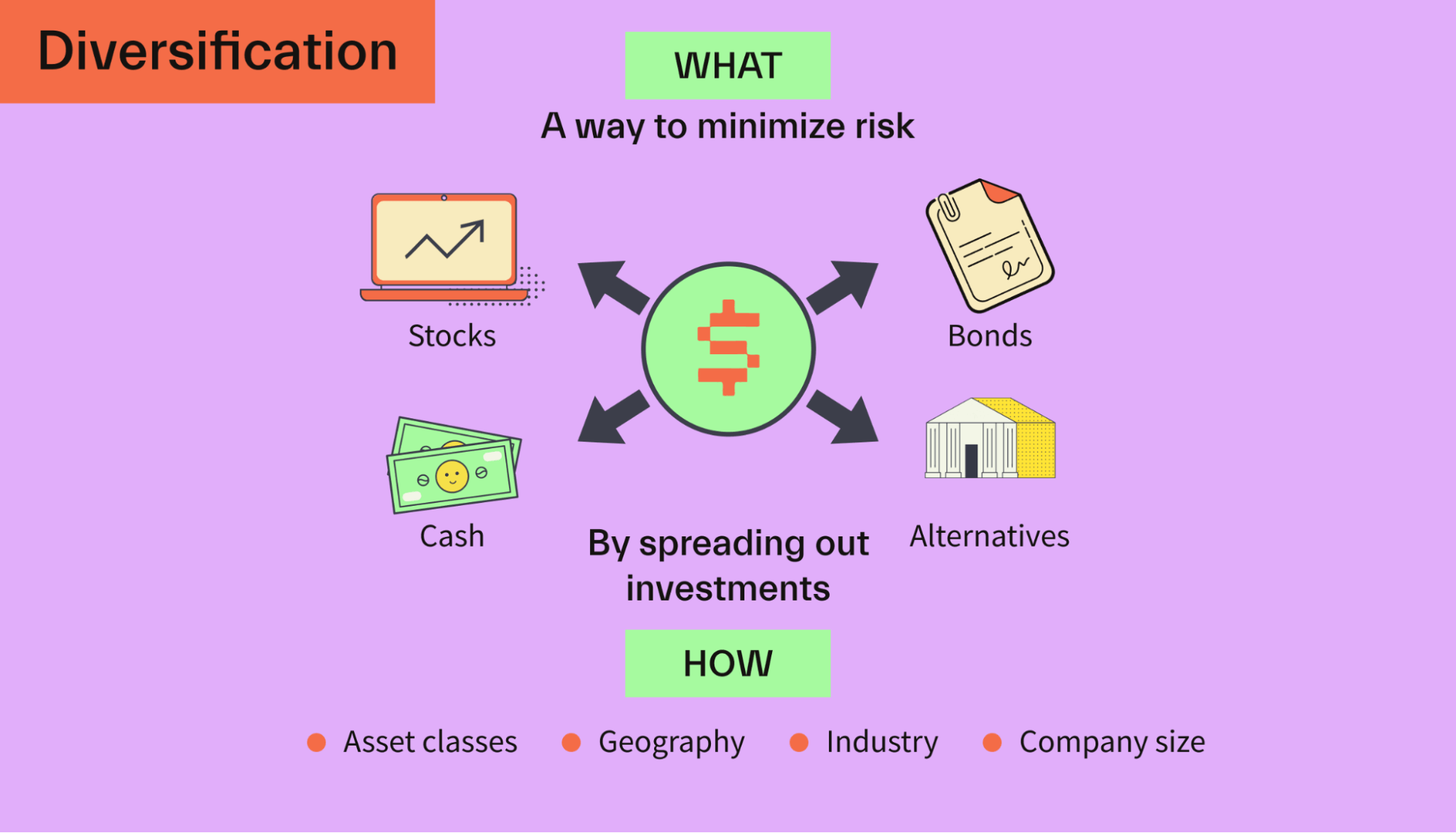

A key principle of successful investing is diversification. Basically, you don’t want to put all your eggs into one basket.

Instead of investing 100% in one company, you might buy an index fund with hundreds of companies. Instead of investing only in crypto, you might invest in a mix of stocks, bonds, and cryptocurrency.

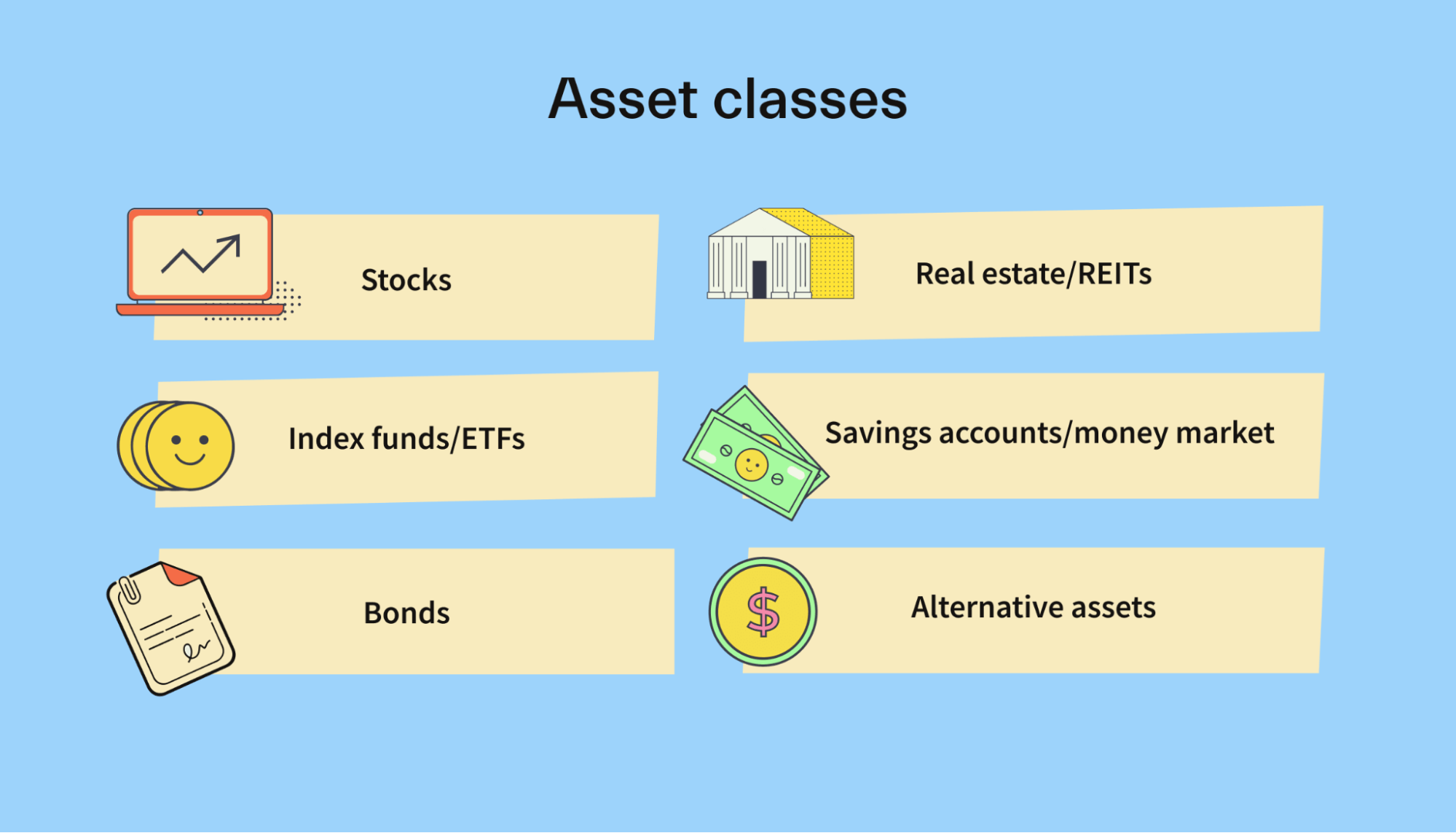

Here’s a brief overview of the most common asset classes.

Stocks: Stocks, AKA shares, are small pieces of publicly-traded companies. When you buy a stock, you own a tiny fraction of that company. If the company grows, the value of your share will grow.

Stock index funds: Index funds are baskets of many different stocks. For example, the S&P 500 index fund invests in the 500 largest public companies in the US.

Mutual funds: Mutual funds are another type of fund that combines several assets into one. Many mutual funds are actively traded, which means professional investors actually buy and sell for you. Mutual funds have higher fees, however.

Bonds: Bonds are essentially I-O-U notes. You buy a bond, and the bond issuer promises to pay you back after a certain period of time—with interest.

Real estate: Real estate refers to physical properties, like houses or apartments. It can also refer to REITs, which are like index funds for real estate (and can be purchased in small quantities through a brokerage account).

Cryptocurrency: Cryptocurrencies like Ethereum (ETH) and Bitcoin (BTC) are digital currencies that run on blockchain technology. They are a high-risk, high-reward investment.

Once you select investments, simply start buying! If you’re feeling lost, here’s our simple recommendation for college students:

Buy a single, low-cost index fund, like the S&P 500 index. These trade under the stock names “SPY,” “VOO,” or “IVV.” This is a set-it-and-forget-it way to invest in the broad stock market.

Investing regularly

Your first investment is only the start! For the best results, make a plan to invest regularly. And remember, the initial investment amount doesn’t matter too much—it’s all about how much you can contribute on a regular basis.

You can set up an automatic transfer to invest funds every month or even every paycheck. You could also choose to funnel any extra money you receive into your investments.

With a long-term outlook and patience, you can really start to grow your wealth.

How to invest as a college student

So, that was a lot of information! Let’s break it down step-by-step. Here’s how to start investing as a college student.

1. Decide how much you have to invest

Let’s face it—most students aren’t exactly rolling in cash. But is there extra money in your budget each month?

Here’s the good news: You don’t need large amounts of money to get started with investing. You could get started with as little as $50 or $100. The key is to make investments regularly to continue to grow your wealth.

You might even be able to squeeze some extra funds out of your college student budget to boost your investing budget.

2. Open an account at a low-cost broker or app

Next, you need to open an account. Here’s the lowdown.

For casual trading and a super-simple user experience, an app like Robinhood or WeBull is a decent option. These offer free trading and are quite simple to use. They may not support mutual funds and certain alternative investments, however.

For more options and a better long-term setup, opt for a brokerage account from a low-cost broker. Fidelity, Schwab, and Vanguard are all good options. These also offer free trading and have more options for your future investing endeavors.

3. Start making simple investments

Now, pull the trigger on your first investment!

A great place to start is a low-cost index fund, like the S&P 500 index. This is a cheap way to gain access to a diversified portfolio of stocks.

If you want to invest in a specific company, you can do that too—just be sure to do your research. Most brokers now support fractional stock trading, which means that you can buy $50 of Apple stock, even if it’s trading at $150 per share.

4. Diversify your portfolio

You eventually want to construct an investment portfolio, which is simply the basket of all your various assets.

Diversification is key. Diversifying your assets basically means spreading out your bets by investing in a wide variety of assets.

Simple diversification usually involves index funds. These funds allow you to own hundreds of companies by purchasing a single stock.

More complex diversification might include a mix of stocks, index funds, bonds, and alternative assets.

You can make it as simple or as complex as you’d like—the point here is to make sure you don’t put all your eggs in one basket.

5. Invest regularly

For long-term success, it’s important to invest regularly. If you can make a habit of chipping in some money every month (or even every week), you’ll build your wealth on autopilot.

To simplify this, you can set up automatic transfers to your investment account. This will automatically pull money from your checking account to your investment accounts on a predetermined date. You could also choose to throw any extra money that comes your way into your investment account.

6. Balance investing with other financial goals

Investing is important—but it shouldn’t override your other financial goals. It’s important to consider the period of time, as well, and to balance both short-term and long-term goals.

For example, it might make more sense to pay off your student loans before you start investing. Or at the very least, to start making extra payments toward them. Because of the student loan grace period, you probably won’t be required to make payments toward your loans while you’re in school—but if you do, you can get ahead on paying them off.

Likewise, if you have debt on credit cards, paying that off first should take priority over investing.

Last but not least, remember that you should also be enjoying your college years! If you set aside a bit of extra money for investing, consider keeping some “fun money” in your budget too.

Conclusion

Investing can help you reach your financial goals—and the earlier you start, the better. Even small investments made during college can grow into substantial sums by the time you reach retirement.

For beginners, it’s helpful to keep things simple. That could mean opening a low-cost brokerage account (Fidelity, Vanguard, or Robinhood are all good options) and then buying low-cost stock market index funds, like the S&P 500. And for best results, keep investing regularly.

Need a hand with the financial aid stuff? Mos gets you an expert’s help with FAFSA, grants, scholarships, and more. Connect with your advisor today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you