Budgeting •

May 2, 2022

Breakdown of a monthly budget for college students

Making a monthly student budget can help you reach your financial goals, reduce stress, and prioritize your spending. Here’s how to make a budget that works.

College costs an arm and a leg these days. With tuition, fees, and books eating up so much of your money each month, how do you pay for the expenses of, err… living?

The answer is to make a budget—and stick to it.

A monthly budget for college students can help to identify priorities for spending. It can help you keep your finances on track while also reducing financial stress.

Here’s everything you need to know about monthly budgeting as a college student.

Why monthly budgeting is important for college students

First off, let’s be honest: Most students aren’t exactly ballin’ out. When funds are limited, every dollar you spend counts.

While we don’t want to get too obsessive about couponing for toilet paper or eating nothing but Kraft, it does help to pay attention to where your money is going each month.

A typical college student budget consists of fixed expenses and variable expenses.

Fixed expenses are things like rent, tuition, cell phone bill, etc.

Variable expenses are things like entertainment, food out, etc. For most students, it’s these costs that can make or break a monthly budget.

Variable expenses are also more difficult to track. You know exactly what you spend each month for your dorm room, your cell phone bill, and your cafeteria meal plan.

But how much do you spend on transportation, grocery shopping, dining out, or alcohol? These categories are trickier to nail down.

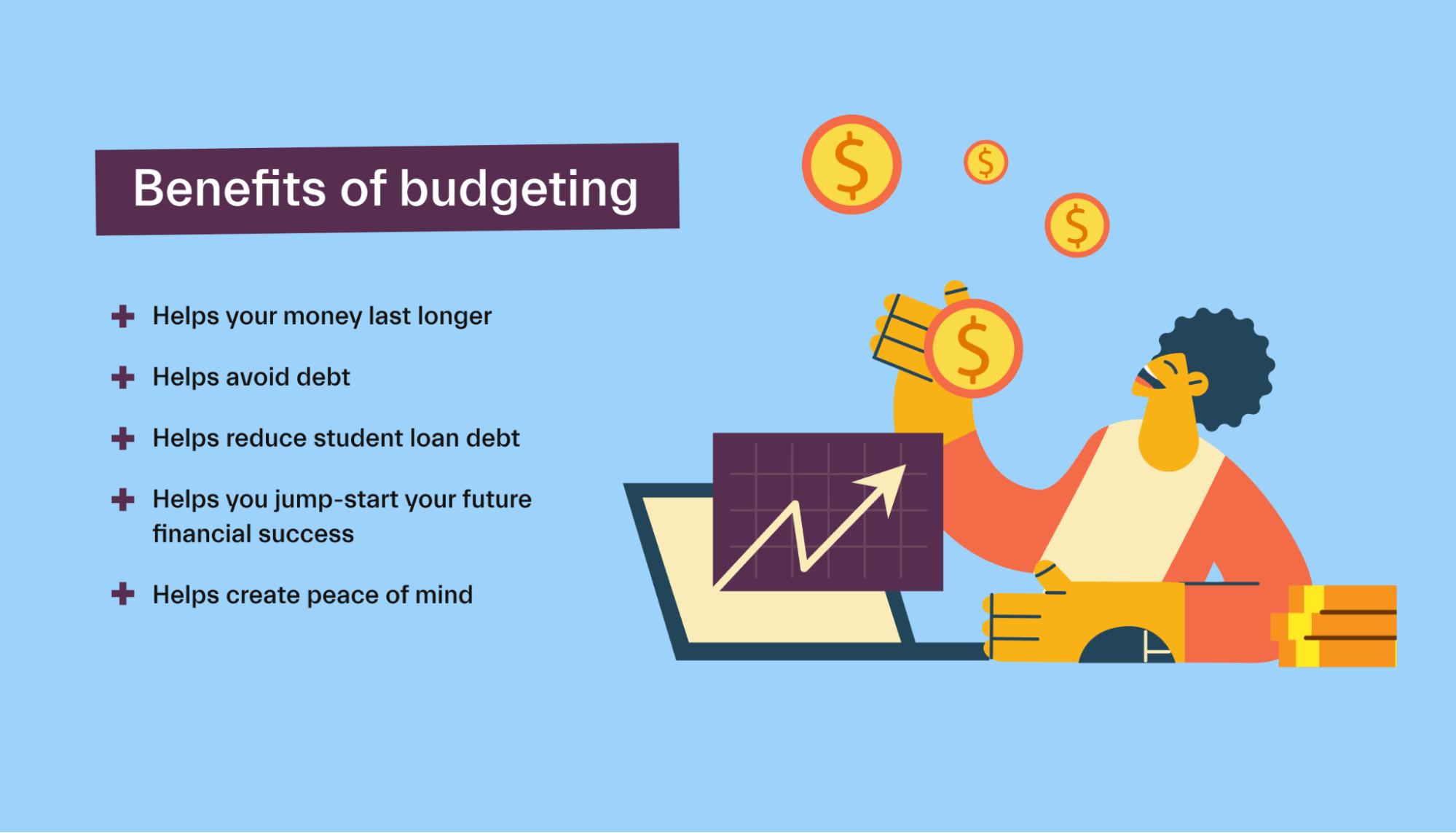

Monthly budgeting for college students is helpful because it:

Helps you understand where your money is going

Helps you reduce stress and financial worry

Helps you focus your spending on what matters most to you

Helps you graduate with less debt, or even debt-free (the dream)

Helps you develop good personal finance habits early on

Helps you work towards long-term financial goals, like saving for a down payment or retirement

Monthly budgeting can be about saving money in college. But it doesn’t have to be.

It might just be a way to prioritize your spending with your values and interests. If you get a lot of value out of going out with friends, you could budget more money each month in that category. If you want to focus on long-term goals like paying off your student loans, you can budget more for extra loan payments.

In other words, budgeting could help you save money in college—or it could help you enjoy your college years even more!

Ultimately, budgeting is about taking control of your spending. It’s a valuable tool for any college student.

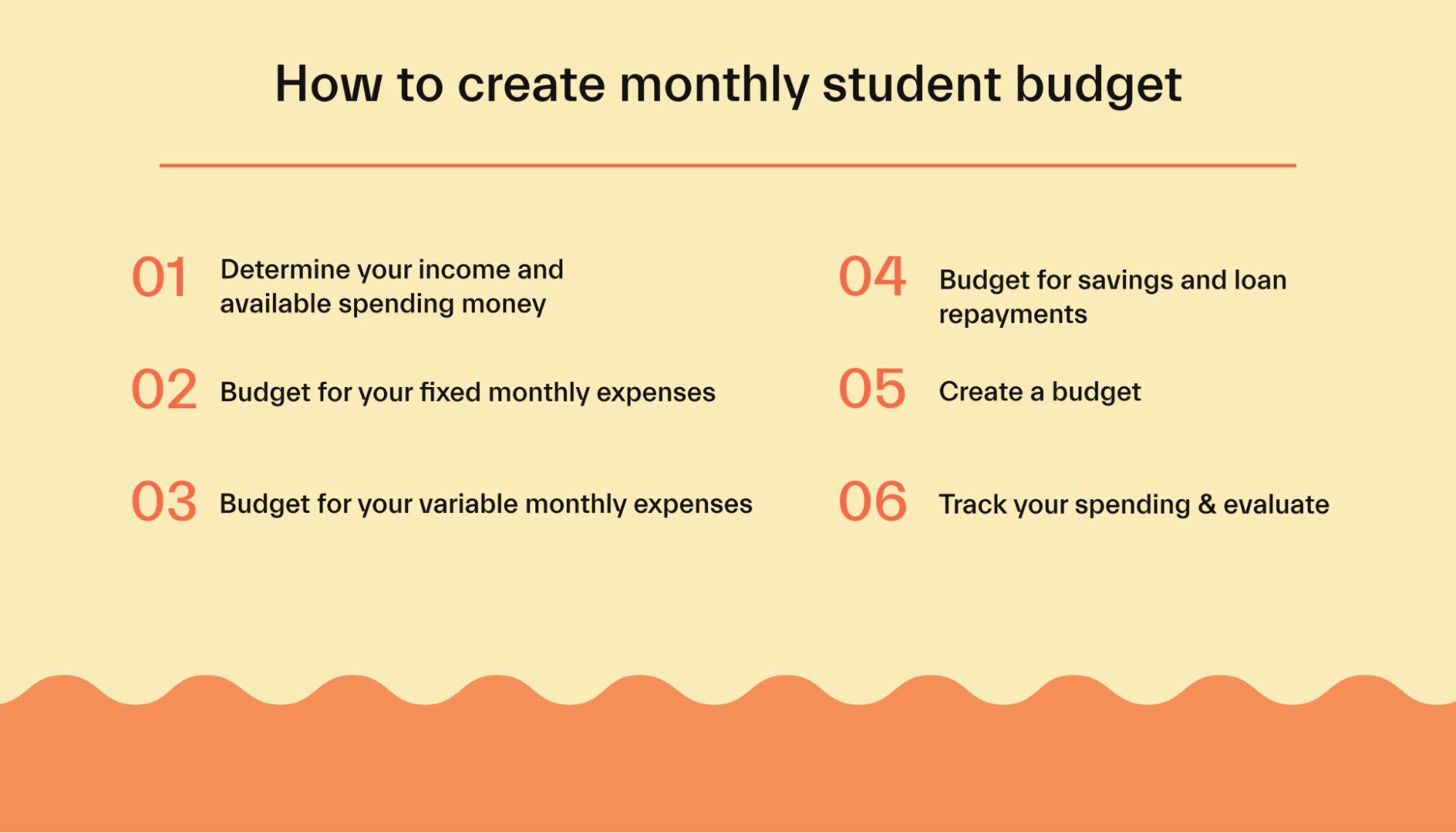

How to create a monthly budget for college students

There are many different ways to budget. You could:

Write out a budget manually on a piece of paper.

Use a budgeting app or service.

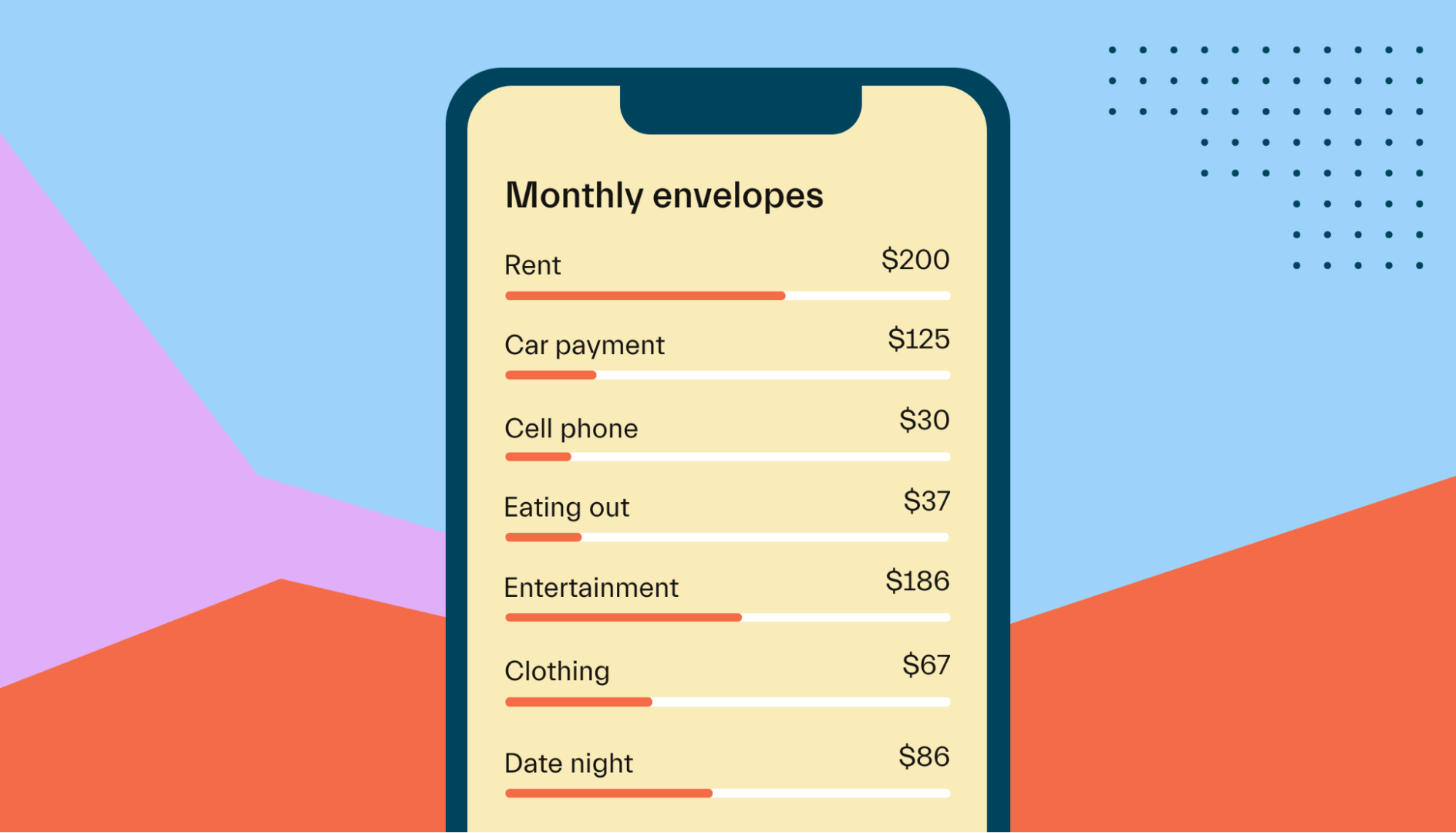

Use the “envelope budget” by putting actual cash in different envelopes for different purposes.

But before you get into using your budget, you need to actually create it. And that starts with gauging your current income and expenses.

Here’s how to create a monthly student budget.

1. Determine your income and available spending money

How much money do you have coming in each month? This could include income from any source, including:

Jobs or work-study

Side-hustles

Financial aid money

Financial support from parents

Add up how much money you receive each month from all these sources combined.

If you have uneven income month-to-month, try to find the average.

Certain sources of income, like financial aid, are disbursed once every academic period (semester/trimester/quarter). For these amounts, you can quickly find the average monthly amount to work into your budget.

You could also choose to exclude financial aid money from your budget. If 100% of financial aid is going to your college tuition and related expenses, you don’t necessarily need to account for this money in your monthly student budget.

The distinction here is to choose from a:

“Full budget,” which would include all income (including financial aid) and all expenses (including tuition), or

“Discretionary budget,” which would exclude financial aid income and also exclude fixed college-related expenses, like tuition.

The goal of this step is to determine how much money you have available to spend each month. If financial aid goes directly to your school, that’s not really “spending” money. But if you’re paying for college out-of-pocket, all your expenses should be accounted for in your budget.

It’s up to each individual student to decide which approach would work best for their financial situation.

Want to qualify for more financial aid, but without the hassle? Connect with a Mos financial aid advisor today.

2. Budget for your fixed monthly expenses

The first line items in any monthly budget should be fixed expenses.

Fixed expenses are costs that are the same every month. Examples of fixed expenses include:

Rent

Certain utilities, like internet

Meal plans

Cell phone bill

Streaming & subscription bills

Car payments and other monthly loans

Other monthly bills

You want to start with these expenses because they are predictable and because they tend to be the most important.

Make a list of all your fixed expenses, along with how much you spend on them each month.

Then, use these to form the backbone of your budget. Fixed expenses will likely eat up the majority of your spending money each month—which is another reason why it’s important to start here.

3. Budget for your variable monthly expenses

Next up are the variable expenses. Put simply, these are expenses that change month-to-month.

Variable expenses can include necessities (like groceries) as well as optional spending (like entertainment).

It’s wise to start with the necessities. This could include line items like:

Groceries

Variable bills, like electricity

School supplies and books

Transportation

Budget for these items first. Not sure how much you’re spending? Take your best educated guess, then track your spending for a month or 2 to improve your accuracy.

Now, start budgeting for optional expenses, like:

Dining out

Drinks

Entertainment

Travel

Clothing/shopping

Because these spending categories are optional, you may want to save them for last (budgeting any “leftover” money toward them). Or, you could choose to prioritize one category. If going to restaurants with friends is important to you, there’s nothing wrong with allocating more money to that each month.

4. Budget for savings and loan repayments

Now, you can budget for optional loan repayments, savings goals, etc.

Student loan repayments often fall in this category. For federal loans, payments aren’t generally due until after you graduate or leave school.

However, you can get ahead on your loans by making payments while still in college. Even a small monthly payment—say $50 or $100 a month—could have a significant impact on your student loan debt upon graduation.

This is also a great time to budget for savings. That could be saving for your first apartment/home, a new vehicle, or longer-term goals like retirement.

It’s good to have a general savings goal to help cover unexpected expenses. Things will often pop up out of the blue—a car repair, an unplanned trip back home, or an expensive required textbook could all derail your financial plans.

To summarize, now is the time to budget for:

Non-required loan payments, like student loans

Savings goals, like retirement or a down payment

An emergency fund for unexpected expenses and emergencies

Other financial goals

Depending on your financial situation, you may choose to prioritize these goals over the optional expenses described in step #3 above. The best approach is to automate these savings, for example, setting up a monthly transfer of $100 to your savings account each month.

5. Create a budget

Now you have estimates of what you can spend each month across every major category. It’s now time to create an actual budget.

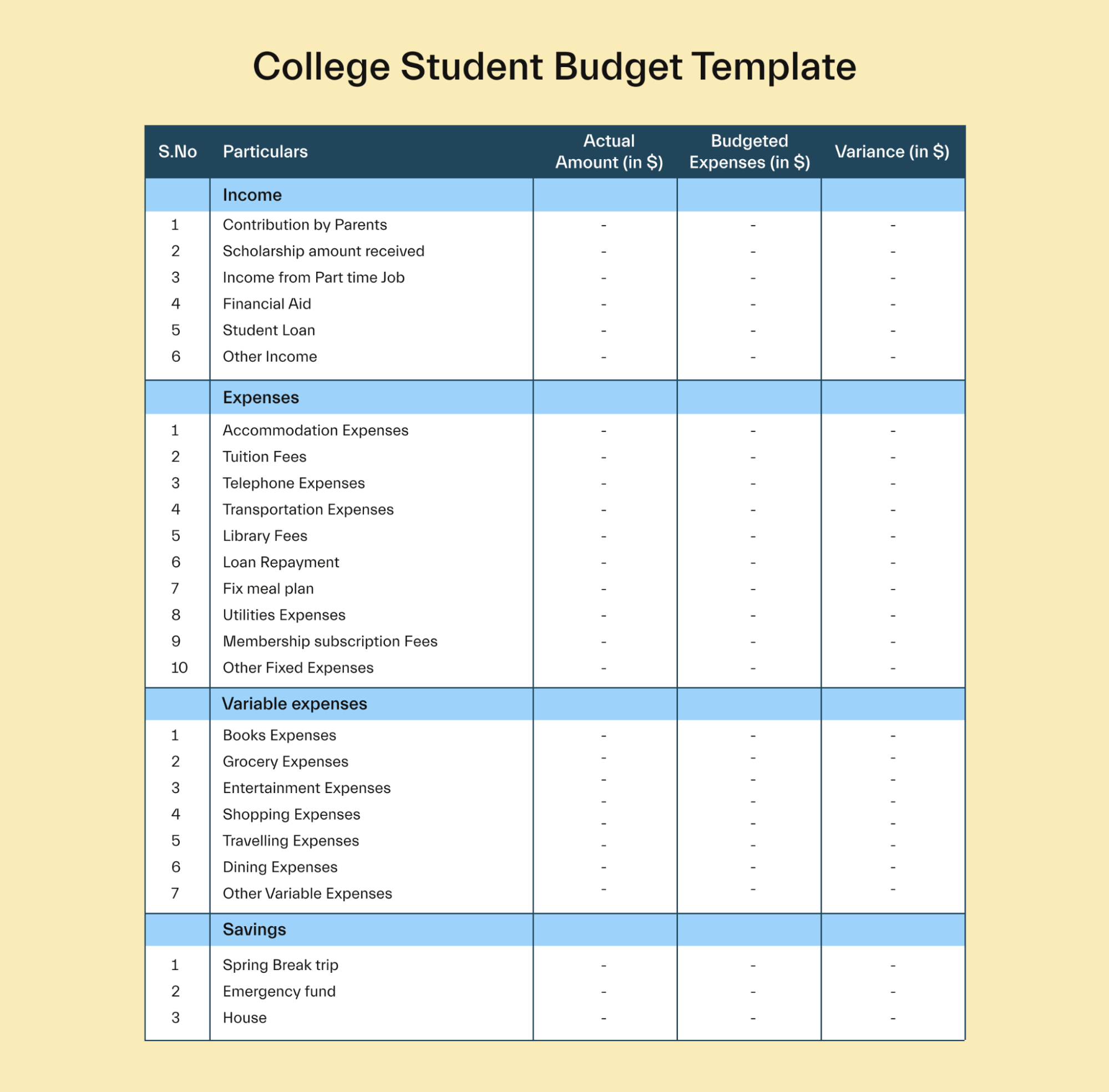

A college student budget template is a great place to start. This will give you a leg-up in getting your budget started, and you can make adjustments as needed.

As for how you actually create and use your budget, there are a few different options:

Make a physical budget with pen and paper.

Use Google Sheets or Microsoft Excel to create a spreadsheet.

Use a budget tracking app, like Mint or YNAB.

Use the envelope budgeting technique.

Different budgeting techniques will work best for different people. Think about what style best suits your personality and preferences.

6. Track your spending & evaluate

For the next month or 2, diligently track what you spend in each category. Then, compare those spending figures to your budgeted amount.

You’ll likely find that you overspend in some categories and underspend in others. You can use this information to adjust your budget moving forward—or to adjust your spending, if needed.

For example, if you find you’re spending $150 on dining out when you only budgeted $100, you need to either reduce your spending or make room in your budget for that extra money.

You can track your spending manually or by using an app like YNAB or Mint.

If you use a credit or debit card for most purchases, you can also track it retroactively. Once a week or so, log into your online banking profile and look back on all your transactions throughout the week. Record them, doing your best to categorize them into the relevant categories.

Example of a monthly budget for college students

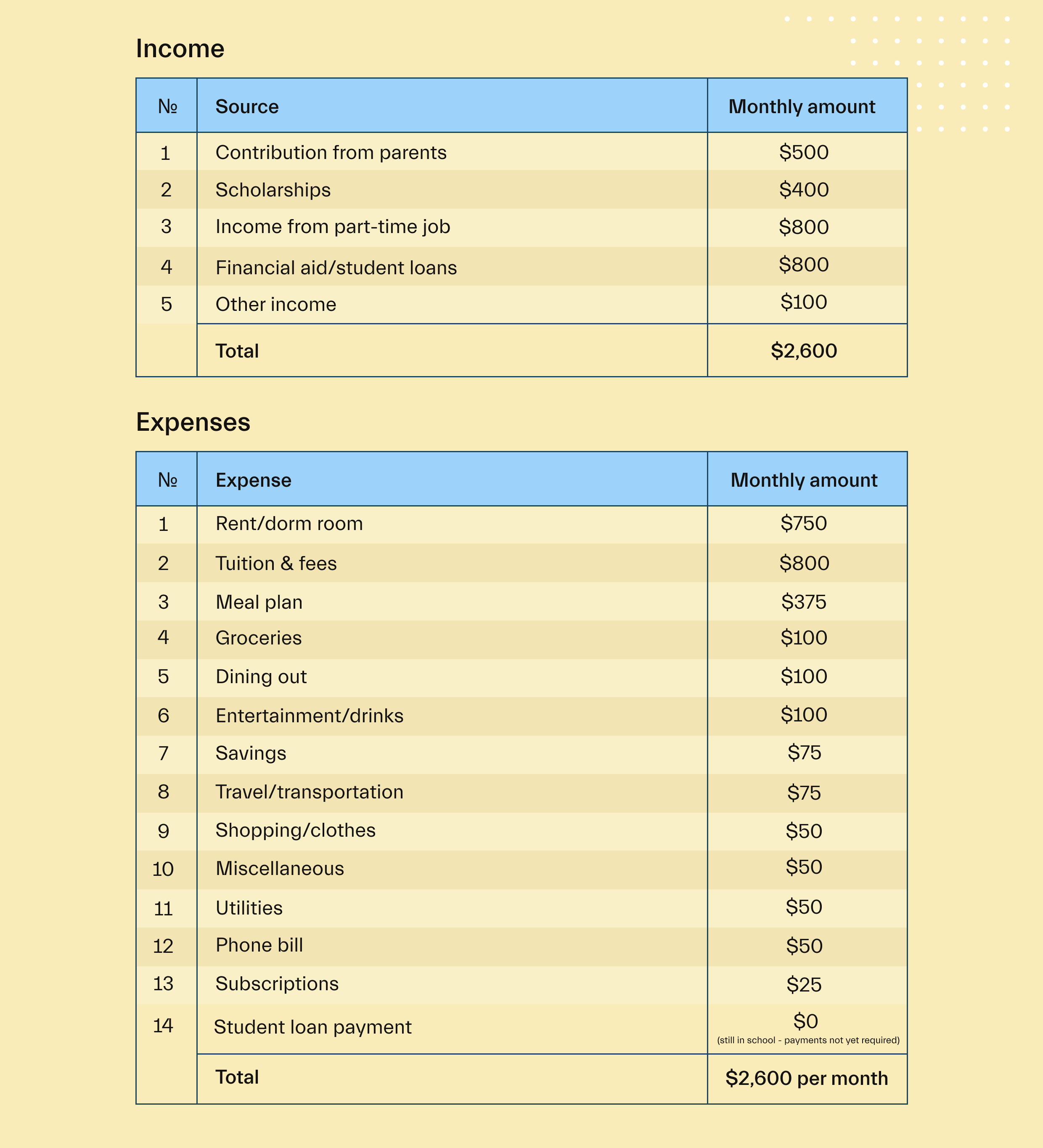

Keeping in mind everything we’ve learned, let’s look at an example monthly budget for college students.

In this case, the student has used the total budget approach and has included tuition in their expenses and financial aid/loans in their income. This gives the student an accurate picture of their overall budget.

However, this also means that the student needs to estimate monthly amounts from income and expenses that aren’t necessarily monthly.

For example, financial aid is typically dispersed several times per year instead of monthly. The student will need to take this into account and ensure that that money is budgeted appropriately.

Because the budgeted income and monthly expenses are exactly matched ($2,600 and $2,600), the student doesn’t have much “wiggle room” in their budget. They will need to carefully review their spending to ensure that they stay on track in each category.

Conclusion

Making a monthly budget can help you automate your money so that you can focus on your classes (and on enjoying college)!

You don’t have to be 100% strict about it—even just writing down a basic budget can be powerful for aligning your financial priorities with your daily spending.

Want a helping hand with your finances while in school? Then, Mos might be the perfect fit.

Mos helps students save on tuition, match with scholarships, and earn extra cash—all in one app. Explore memberships today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you