Financial aid •

Financial aid refund: everything you need to know

Got financial aid money left after paying your tuition? Learn how to check your financial aid refund eligibility and what to use your leftover refunds on.

After cobbling together FAFSA federal aid, scholarships, grants, and other sources, you might find yourself with more aid than your tuition and fees cost.

That money doesn’t just vanish. The school pays it back to you in the form of a financial aid refund. While the money is yours to use, that doesn’t mean you should spend it carelessly.

Below, we’ll discuss financial aid refunds in more detail, how to check if you’re eligible, how to get your refund, and some good and bad ways to use that refund.

What is a financial aid refund?

A financial aid refund is any aid money you have beyond what your school bills you for tuition, fees, and other costs required to attend the school. These leftover financial aid funds are paid out to you within a few weeks of the start of classes.

For example, if you get $11,000 in aid this semester but tuition and fees run you $10,000, you’ll get a $1,000 refund.

Your refund can come from FAFSA need-based aid, such as student loans and federal grants, but private grants and scholarships often push you over the edge toward getting a refund. After all, in most cases, need-based financial aid awards aren’t designed to pay for everything.

How do I check if I’m eligible for a refund?

Most schools have an online portal telling you if you get a refund. It may tell you outright, or it might just show your total aid vs. the amount your school billed you.

In the latter case, you’ll have to do some simple math to calculate your potential refund.

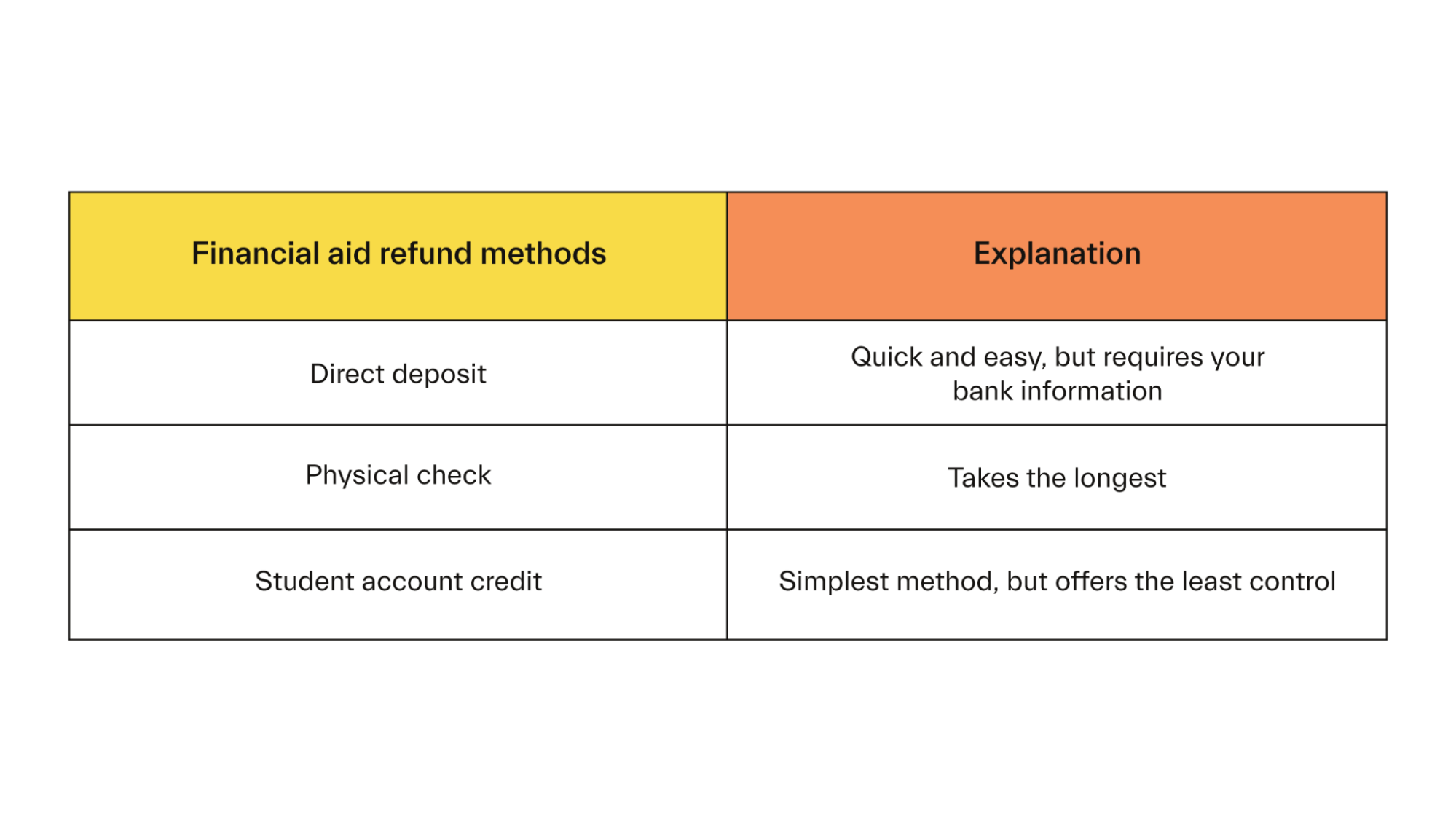

How can I receive my financial aid refund?

These days, many schools let you select your refund preference. Here are the 3 ways you can ask to receive your refund:

Direct deposit: Direct deposit lets your school electronically send the money straight to your bank account. This method is fast, and there’s no risk of losing a paper check. However, you must complete a direct deposit form and double-check that your banking information is right. If your bank info ever changes, you’ll have to fill out a new form with the new information.

Physical check: Your school will mail you a physical check. If you prefer not to provide your bank information, you can opt for this method. However, you’ll have to deposit the check, making sure you don’t lose it in the meantime.

Student account credit: Some schools might let you leave the refund as a credit on the account. This credit can then be applied to future tuition and fees. For example, if you have $1,000 left over, your school may just use that money up on next semester’s tuition and fees.

What can I use my financial aid refund for?

Every aid has certain rules regarding what you can use it on. Check these before using your refund.

That said, most college-related expenses are valid.

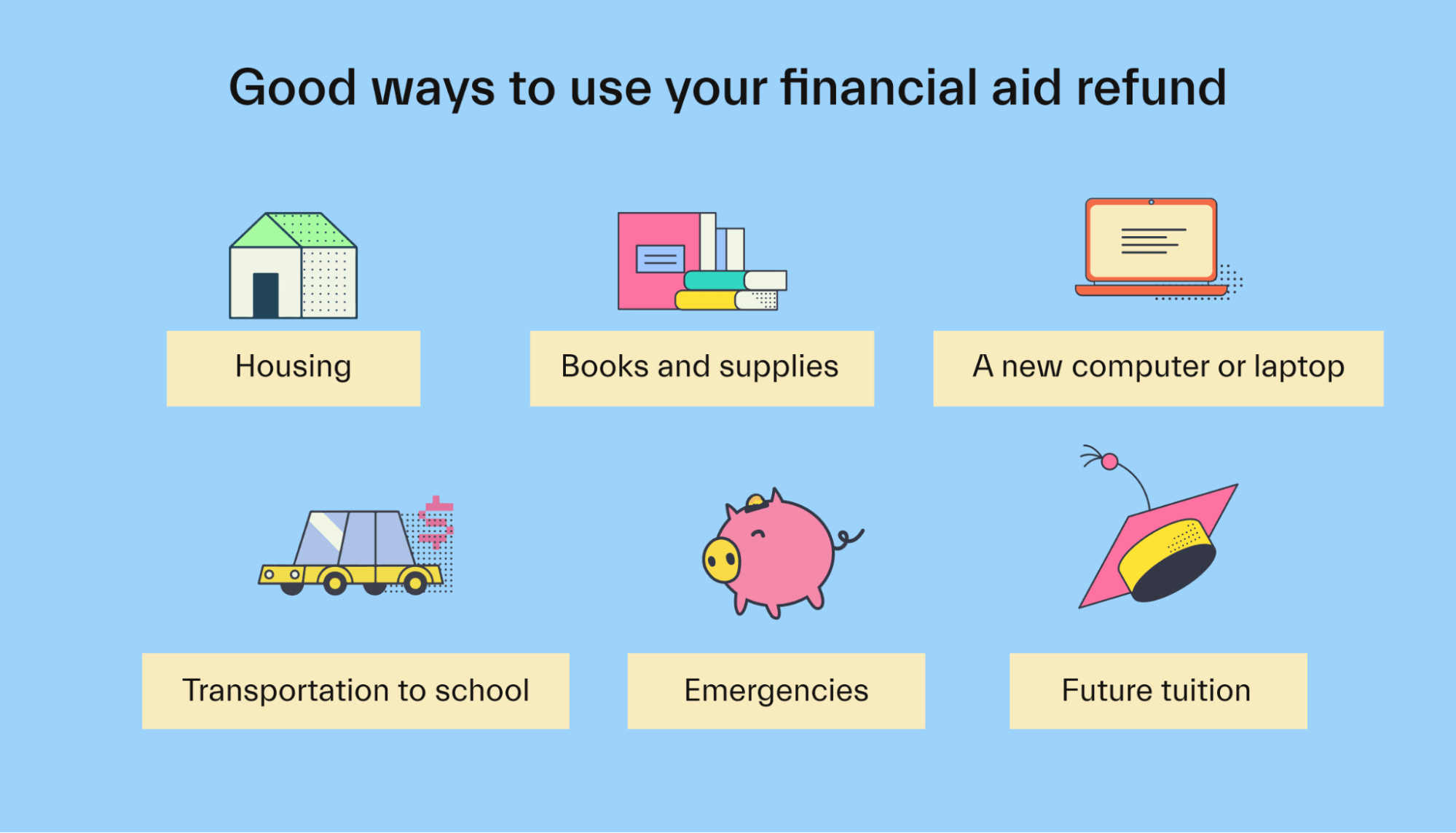

Here are some ways you can use that refund after tuition and fees:

Housing

If you live in an on-campus dorm, your school might apply your refund toward the cost of living there.

Using your refund to cover rent is a wise idea if you live off-campus. You could also put it towards utility payments if you have enough of your refund left over.

Books and supplies

In general, schools make students buy textbooks and school supplies separately from tuition. That makes your refund a natural fit for these expenses.

Remember: You don’t have to use your refund at the campus bookstore. Looking for used textbooks and shopping for supplies off campus can stretch that refund further and prevent you from dipping into your savings or taking on more debt.

Laptop/computer

For most college students, a desktop computer or laptop is necessary to succeed. Without it, you have to take notes by hand and do online assignments at a library or in a computer lab.

Computers are expensive, of course, but you can cover some or all of the cost with a refund.

But don’t panic, as there’s no need to get a high-end gaming computer. Instead, buy something that works well for taking notes, doing homework, completing projects, etc. Shop around a bit to get the best price on a solid computer.

Transportation to school

There’s little chance you’ll get enough of a refund to buy a new car. But you can put the money toward expenses involved in commuting to school.

For example, you might buy a campus parking pass with your refund. Saving a bit of that refund for gas and vehicle repairs isn’t a bad idea, either.

If you don’t have a vehicle, you could keep your refund for any paid transit, like a bus pass.

Emergencies

An emergency fund consists of money you set aside in a savings account for, well, emergencies—things like car crashes, emergency family travel, and hospital bills. An emergency fund can help you afford the emergency and cover your living expenses if the emergency prevents you from working for some time.

And speaking of working, saving up several months’ worth of living expenses is tough on a college paycheck. Putting your refund toward an emergency fund will give you a bit of a financial cushion for the time being.

Future tuition

Still have money left after all the other stuff we talked about? Save it for future tuition—unless, of course, this is your last semester or quarter.

If your school lets you leave your refund as a student account credit, then do that. Otherwise, open a student bank account and set it aside there. This account will earn monthly interest as a nice little bonus, giving you a few extra bucks for school next semester.

What NOT to use your refund for

Keep in mind that your refund money is designed for educational use. We strongly recommend only using it for expenses needed to go to class, live on or commute to campus, and so on.

If you want money you can spend, consider getting a job on or off campus—making sure it isn’t work-study—to earn some ”fun money.”

Meanwhile, you should avoid using your refund on the following kinds of expenses:

Shopping

There’s nothing like seeing a large amount of money hit your bank account.

But don’t go on a shopping spree with it. If it’s against the rules to use your refund for shopping and the aid provider finds out, you could face serious consequences.

Even if it’s not against the rules, you should still avoid using your refund for unnecessary shopping. College is expensive, so you should put every aid dollar—free money or debt—toward that.

Fun/entertainment

If you have a large refund, spending it on a spring break trip or blowing it on concerts can be tempting. But try not to do this—as, with shopping, it might be against the rules to use the money for these purposes.

And even if you aren’t tempted to do this, remember: You want to cut your college-related costs as much as possible. Every dollar of debt you avoid now means less financial stress once you graduate college and start earning a paycheck.

Helping out friends

Helping out your friends often seems like a more legit way of using extra refund money than shopping sprees or vacations. Sometimes, not helping them can seem almost cruel.

Although assisting a friend through a tough time feels good, it’s typically best to use your financial aid refund to help yourself first. Help yourself first to help others, as they say.

And, as unlikely as it may sound now, you never know if you and that friend will grow apart down the line.

Investing

Investing your student aid may not technically be illegal. But if you’re investing your student loan funds, you’re taking a big risk.

Remember: You have to repay those loans, and you can lose your money in the market. If the worst happens, you’ll be out of the money you borrowed and in college debt.

If you don’t return them, loan refunds are best kept in a savings account for future tuition or used for living expenses.

Scholarships and grants are inherently less risky to invest since they’re free money. But you have to make sure investing the funds isn’t against the scholarship or grant rules.

If it is, investing that money could cause the scholarship or grant organization to demand repayment—or worse.

Oh, and even if you make money in the market, selling it could mean you’ll owe taxes on the profits.

Ultimately, keeping the extra funds in a savings account is typically the best option.

Charity

Giving money to charity feels great, but doing this could put you in further debt. More debt leaves you with less monthly discretionary income once you graduate. That means less money that you can donate later on.

Here’s a better idea: Volunteer some of your time to a charitable organization instead. Not only will you still get to help a good cause, but you’ll also have something to put on your resume.

A better resume could help you land a better job. And a better job could help you earn more money—money you can donate to whatever charity you’d like.

Financial aid refund FAQs

Do you have more questions about your refund? Check out the following financial aid refund FAQs for some answers:

What should I do with the extra refund money?

This depends on whether the refund comes from a loan or a source of free money, like a grant or scholarship.

Loan refunds are extra debt, and you don’t want extra debt. Work with your school’s financial aid office to return the excess to minimize your student loan debt later.

Next time, plan out your total costs to minimize extra loan refunds. This will save you time and effort trying to return the money, and it’ll also cut down on your debt costs.

If your refund came from a grant or scholarship, set it aside for future college expenses or emergencies. Alternatively, you could put that extra money toward your student loans to cut down on your total loan balance once you graduate.

Extra grant or scholarship funds isn’t as big a deal since you won’t usually have to pay them back.

What should I do if I lose my refund check?

If you were mailed a physical refund check and lost it, contact your financial aid office immediately and let them know. Every school’s process for handling this may differ, but financial aid staff will be able to walk you through the process. You may have to submit a form as well.

You should also check your mailing address—and update it, if necessary—if you receive your refund as a check.

When will I receive my financial aid refund?

This varies by school. It’ll usually take between 1 week and 1 month after classes start, but it can take even longer.

You can check online or contact your financial aid office to see the status of your financial aid refund disbursement.

Use your financial aid refund wisely

Getting a big financial aid refund payout can feel great, but you should use it wisely. Spend it on textbooks, supplies, commuting to campus, housing—things like that. And if your refund involves loans, try to return any unused funds to keep your debt low.

We believe all students deserve their dream degree—without the debt. Mos helps students save on tuition, match with scholarships, and earn extra cash—all in one app. Explore memberships today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you