Budgeting •

April 8, 2023

11 tactics to help you pay for college

College can feel like a full-time job. So why not get paid for it? Check out these 11 ways to get paid to go to college.

The average bachelor’s degree holder graduates with over $32,000 in student loan debt. That’s not a great way to start in the “real world.”

But lucky for you, there are plenty of ways to get paid to go to college.

Yes. Really!

This article will cover 11 ways you can get paid to go to college.

1. Fill out the FAFSA

The FAFSA is key to unlocking federal financial aid.

Now, student loans are the most common form of aid the FAFSA gives out. But they’re debt—you have to pay them back. And the whole point of reading this is to learn how to get paid.

So let’s go over some forms of “free” money—or money you don’t have to pay back—that the FAFSA can hand to you.

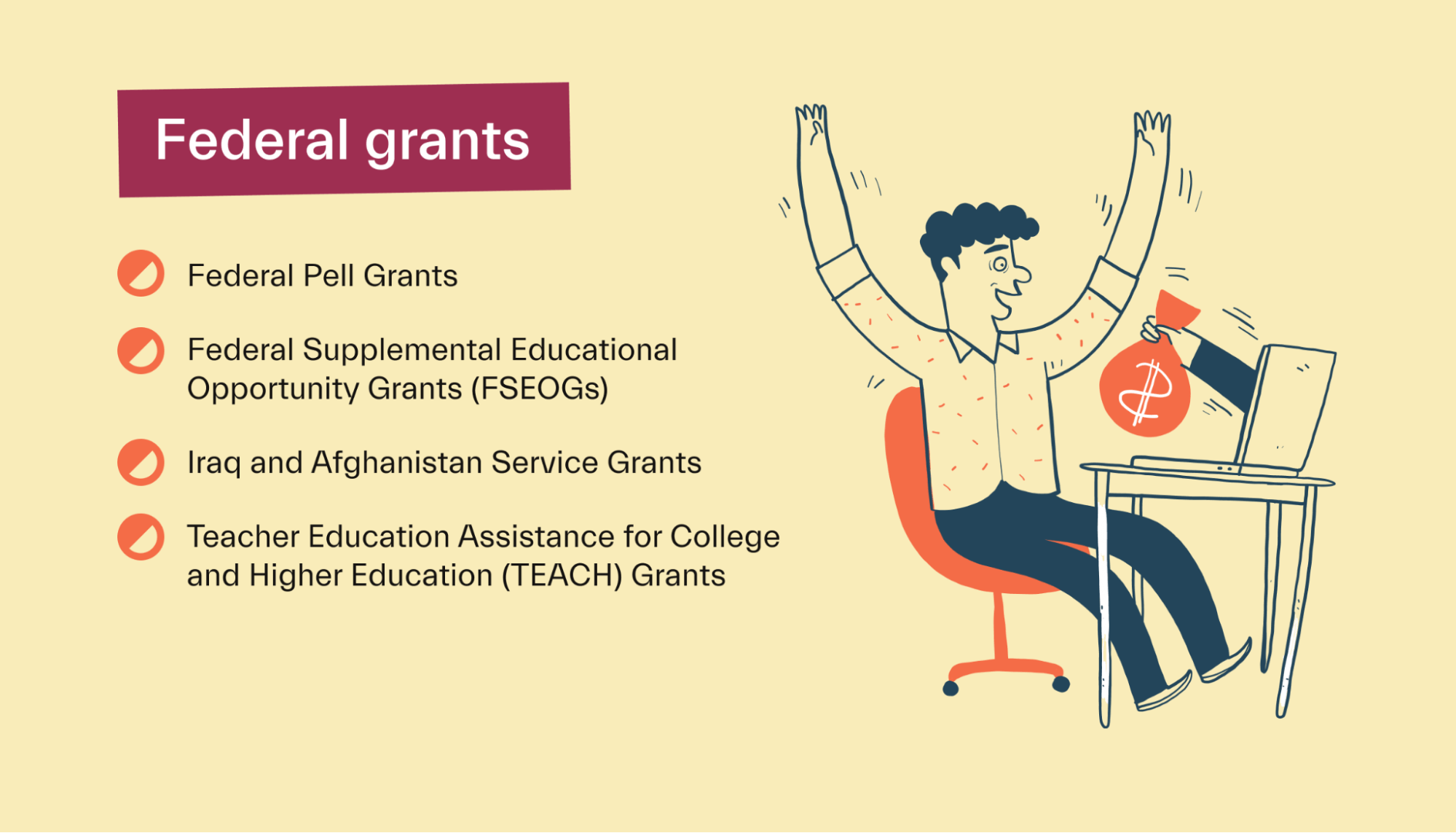

Federal grants

Federal grants are sources of money you don’t have to pay back except in rare circumstances, such as if you break a rule attached to them. They’re based on need, not merit, meaning the government hands them out based on your financial situation.

The most well-known federal grant is the Pell Grant. You can win up to $6,895 in Pell Grants for the 2022-2023 aid year. But that number can increase every year with inflation.

There are 3 other federal grants available to people in certain situations. They’re outlined in the table below.

Work-study

Work-study is an aid award that lets you work a job to pay for school. Your paycheck goes straight to college expenses, like tuition and fees.

These are usually on-campus jobs, and the program will try to give you something relevant to your major. However, you might also work off-campus for a non-profit or civic organization.

As a result, work-study positions often look great on a resume. They can be scheduled around your classes, too. The downside, though, is you can’t work more than 19 hours a week in a work-study program.

2. Find private aid

Need more free aid beyond the FAFSA? Look to private sources of free college money.

Below, we’ll look at scholarships, private grants, and fellowships.

Scholarships

Scholarships offer free money—often based on merit. That means the committee judges you on your grades, essays, extracurriculars, and so on.

Some scholarships are easy to apply for, requiring little more than a written application and maybe a personal statement. Others are more involved, asking for multiple essays, videos, and more.

Scholarships are available for students on campus and at online colleges. Some are even created specifically for online college students.

You can apply for scholarships all year, and you can win some of them multiple times. The free money never ends, and services like Mos can connect you to tons of scholarships you’re precisely cut out for.

Private grants

Like the federal government, private organizations hand out need-based money through grants.

Once again, you can apply for these year-round. However, your award from a private grant may shrink if you also get aid from somewhere else.

Fellowships

Fellowships, which often come from private organizations, give you a stipend to cover your living expenses while in school. While some fellowships are available for undergraduates, they’re generally designed for grad students.

Fellowships can last from a few months to a few years, generally based on professional pursuits or specific fields of study.

3. Get a job

On-campus jobs offer plenty of variety. For example, you could work in the dining hall, campus gym, bookstore, library, IT department, or academic department, to name a few.

Getting a job is the closest you can get to truly getting paid for being a college student.

On-campus jobs are often pretty flexible since the staff knows you’re a student. You can also get discounts on certain items. For example, bookstore employees might get cheaper books, or dining hall employees could score free meals.

Off-campus jobs are less flexible in some cases, but there are so many opportunities out there. Depending on where you work, you could also outearn an on-campus job if you work off campus.

Oh, and an off-campus job could help you get your foot in the door for a full-time role.

Regardless of where you work, a job while going to college will look good on a resume. Employers love to see initiative, and a job on your resume implies you’ve developed some valuable hard and soft skills.

4. Land an internship

Internships are similar to jobs but tend to be more formally connected to your field of study.

Oh, and many pay quite a bit, too. It’s not out of the question to earn an hourly rate in the high teens with an internship.

Many students lock down a full-time internship during the summer when they don’t have classes. However, some majors, like accounting, might have full-time opportunities during the school year. So if you’re willing to take classes during the summer, internship opportunities may open up.

Otherwise, part-time internships can be available during the year, too.

Like jobs, internships look great on a resume, and they can help get your foot in the door for a position after graduation.

Keep in mind that internships required by your major might cost money to secure college credit.

5. Become a resident assistant

Resident assistants, or RAs, are sophomore-level or higher students who live in the dorms on campus and serve as peer leaders for the student residents.

The RA ensures students follow campus and dorm rules, resolves roommate conflicts, helps residents transition to living away from home, creates fun activities for residents, and more.

In exchange, RAs get several perks. For example, most schools waive their room and board, and RAs can get a room without a roommate. They may also get laundry credits, meal stipends, and more.

This is quite a lucrative job if you’re willing to live in the dorms and be a leader among students.

6. Work for a company with corporate tuition reimbursement

Smart companies understand the importance of investing in their employees, so they might pay you to go to school and learn skills valuable to both you and them.

Not only will college be easier to afford, but you’ll also come back with additional skills and possibly a degree—making you a more valuable employee. Yep—that means you might qualify for better jobs, promotions, and raises.

Usually, your employer will stipulate which classes or programs you must take to qualify, and you’ll also have grade requirements.

There’s no need to have a “full-time office job” or the like to score tuition reimbursement anymore. Companies like Starbucks and Chipotle offer tuition help to all their employees, from baristas and cashiers to management.

7. Earn rewards on your school purchases

Got a credit card or rewards debit card? That’s a great way to get paid a little bit on every purchase you make in college.

Both credit and debit cards offer rewards in the form of cash back or points redeemable for cash back. All you have to do is spend money on purchases in qualifying categories to rack up the points and then cash them out for money or spending.

8. Join the military

Serving in the military can save you a ton of money on college. Here’s how:

Military tuition assistance: Enlisted active duty military can get 100% of tuition and fees covered, up to a certain limit. Military.com provides more in-depth information on amounts.

GI Bill: The GI Bill provides anyone who meets the requirements with money to help pay for tuition, fees, books, and supplies. You can receive housing assistance if you enroll in school more than half-time. If you live in a rural area, as defined by the Department of Veterans Affairs, and meet other requirements, you can get financial help relocating to your school.

Military-specific scholarships and grants: We discussed these earlier, but you can get specific scholarships and grants if you or a parent serve or served in the US military.

From age 17, you can apply to join the Reserve Officer Training Corps. If accepted, you become eligible for scholarships that could pay for all your tuition and fees and give you a living stipend.

Plus, ROTC looks good on a resume and guarantees a military career after college. But remember that ROTC members must serve in the military after graduation for a certain number of years, as defined by their scholarship, career path, and degree program.

9. Catch a college tax break

The IRS gives you all sorts of tax breaks simply for spending money on college if you meet the requirements.

There are 2 college tax credits available to your parents or you if you’re considered independent:

The American Opportunity Tax Credit (AOC)

The Lifetime Learning Credit (LLC)

Since these are credits, they directly reduce the taxes you owe the government. This could save you or your parent's big bucks during tax season.

After that come deductions, these only reduce the income the IRS cares about for taxes, but they still offer some savings.

For example, if you have student loan debt, your payments aren’t tax-deductible—but you might be able to deduct your interest payments.

10. Do gig work around campus

Gig work means doing little jobs here and there to earn some cash. You can build most gigs around your schedule, so they won’t hurt your grades if you’re good at managing your time.

Gigs can be pretty fun, too.

Do you like dogs? Become a dog walker.

How about teaching and helping others? Sell your notes online or tutor your fellow students.

Or maybe you love to be on the road. Driving or delivering for rideshare or a delivery service could be a good gig for you.

As for where to find gigs, online marketplaces are an excellent place to start. For example, Mos’s gig marketplace gathers gigs specifically with college students in mind—in other words, the most flexible and fun gigs on your campus.

11. Freelance on the side

Freelancing is like gig work; you control your schedule, so you can work around your classes and homework.

While freelancing often requires more time than other jobs, you can make more money by charging more and offering particularly valuable services.

Here are some benefits to freelancing besides the money and flexibility:

It looks great on a resume, but freelancing stands out. You’re willing to take control of your career early and have an entrepreneurial drive. Employers love to see that stuff.

You can apply the skills and knowledge you learn at college: For example, a computer science major can apply their programming skills to freelance programming work. That can help them do better in class if they apply their knowledge to real-world problems.

You can learn new skills: Freelancing can teach you more skills in your field as you learn to solve problems and help clients on the fly. But, of course, you’ll also learn those soft skills we mentioned, like time management and communication.

Get paid to get an education

From scoring free money on the FAFSA to landing a paid internship to catching college tax breaks and everything in between, there are many ways to get paid to go to college.

And while the money you earn might not pay for all your tuition, textbooks, and living expenses, cutting that debt load down never hurts.

Speaking of, making money isn’t your only option. Knowing how to cut your spending and save up cash to stretch your dollars is also important.

Check out our guide to saving money in college to learn how to do this.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you