Budgeting •

Learn these budgeting skills in college to master your money

College is the best time to learn how to manage your money, and that includes budgeting. Master these budgeting skills to master your money.

College is the first time many people become responsible for managing their own money. And at the heart of doing that successfully is budgeting.

At its core, budgeting simply involves tracking where each of your dollars goes so you can live within your means and save money. It’s not as daunting as it may seem, but there are some skills you must learn to get it right—and there’s no better place to learn these skills than in college.

In this article, we’ll explain why you should make a budget in college before diving into a list of key budgeting skills to learn if you want to master personal budgeting.

Why should I make a budget while in college?

We get it—you’re busy. Making a student budget in college is yet another task to add to your plate. But once you get your budget going, the benefits are immense.

Here are a couple of reasons to make a budget in college.

It can stretch your college finances further

Plenty of college students know what financial stress is like—otherwise, the “broke college student” stereotype wouldn’t exist! Budgeting helps you stretch your money further and ease that stress.

By creating a budget, you’ll uncover just how much you really spend and potentially find some expenses you can cut (do you really need that Netflix subscription?).

Plus, by tracking your spending, you can reduce the chance that you’ll spend money on a whim—once again stretching each dollar a bit further.

It can help you minimize your debt

The Department of Education estimates that the average undergrad graduates from college with around $25,000 in student debt.

While it can be tough to graduate completely debt-free just by tracking your spending, budgeting certainly helps you avoid other debts, like excessive credit card debt and personal loan debt.

For some, it may help reduce your reliance—at least slightly—on student loans to pay for college, making it easier to get out of debt after graduation.

You can start saving and investing early

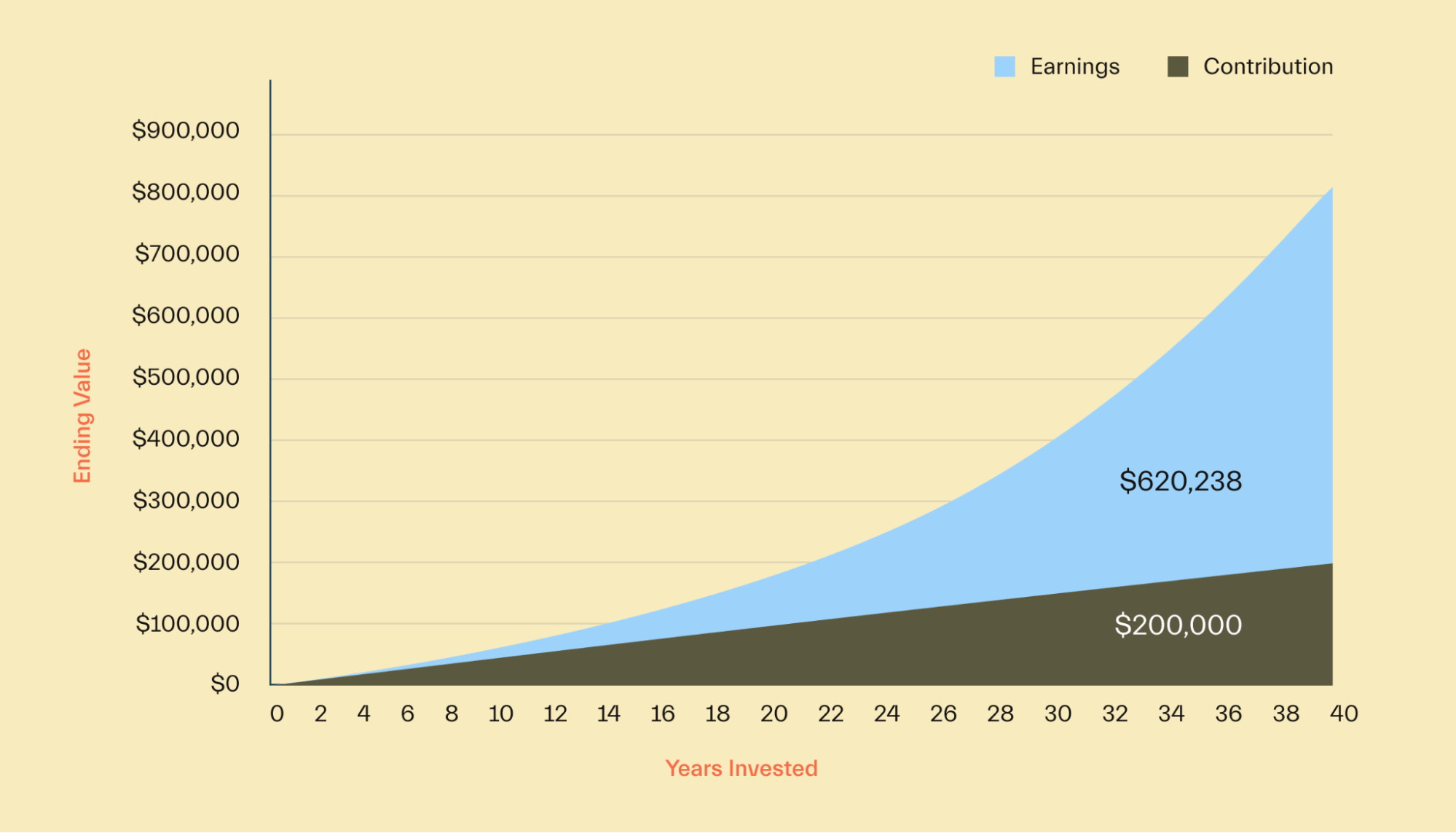

The earlier you start saving and investing your money, the earlier you can reach your financial goals. But more importantly, you can take advantage of compounding—where your money earns more money.

For example, if you invest $1,000 and earn 5% returns in a year, you’ll earn $50 for a total of $1,050. Next year, if you earn another 5%, you earn $52.50, putting your total at $1,102.50.

Repeat this over many decades, and you’ll have a lot more money.

As you can see, investing while still in college can be one of your smartest money moves. Budgeting helps you set aside a portion of your monthly income—even if it’s not a lot, consistent investments maintain the habit and offer you more time to compound your money.

It’s a vital life skill

Budgeting is arguably more important after college because, at that point, you’re fully in charge of managing your money and may have student loans to repay.

What’s more, your finances can get more complicated.

For example, if you buy a home and start a family, you’ll have to budget for a mortgage, property taxes, childcare costs, and a whole lot more. Also, you’ll have other humans depending on you to make sure those items are covered. It won’t be just you at that point.

Learn these 11 budgeting skills

Successful budgeting involves several skills, so it can take a bit of time to learn. But there’s no rush—you’re in college, so treat budgeting as a learning experience.

As you create and stick to your budget, make sure you develop the following budgeting skills.

Picking the right budgeting method

There isn’t just one way to budget. You have several options.

For example, the 50/30/20 method is great for beginners. Under this method, you budget 50% of your after-tax income for your needs, 30% for your wants, and 20% for your savings.

If you want to be more meticulous, you can try zero-based budgeting. This is a more traditional form of budgeting where you list all of your expenses and make sure your monthly income minus those expenses equals zero.

If you feel like you spend a bit too easily, you can try envelope-based budgeting. This involves setting aside cash in separate envelopes for each budget category. Once an envelope is empty, you can’t spend more in that category until next month.

These are just a few of the many methods out there. You may have to do more research and try a few techniques to see what works best for you.

Choosing the right budget categories

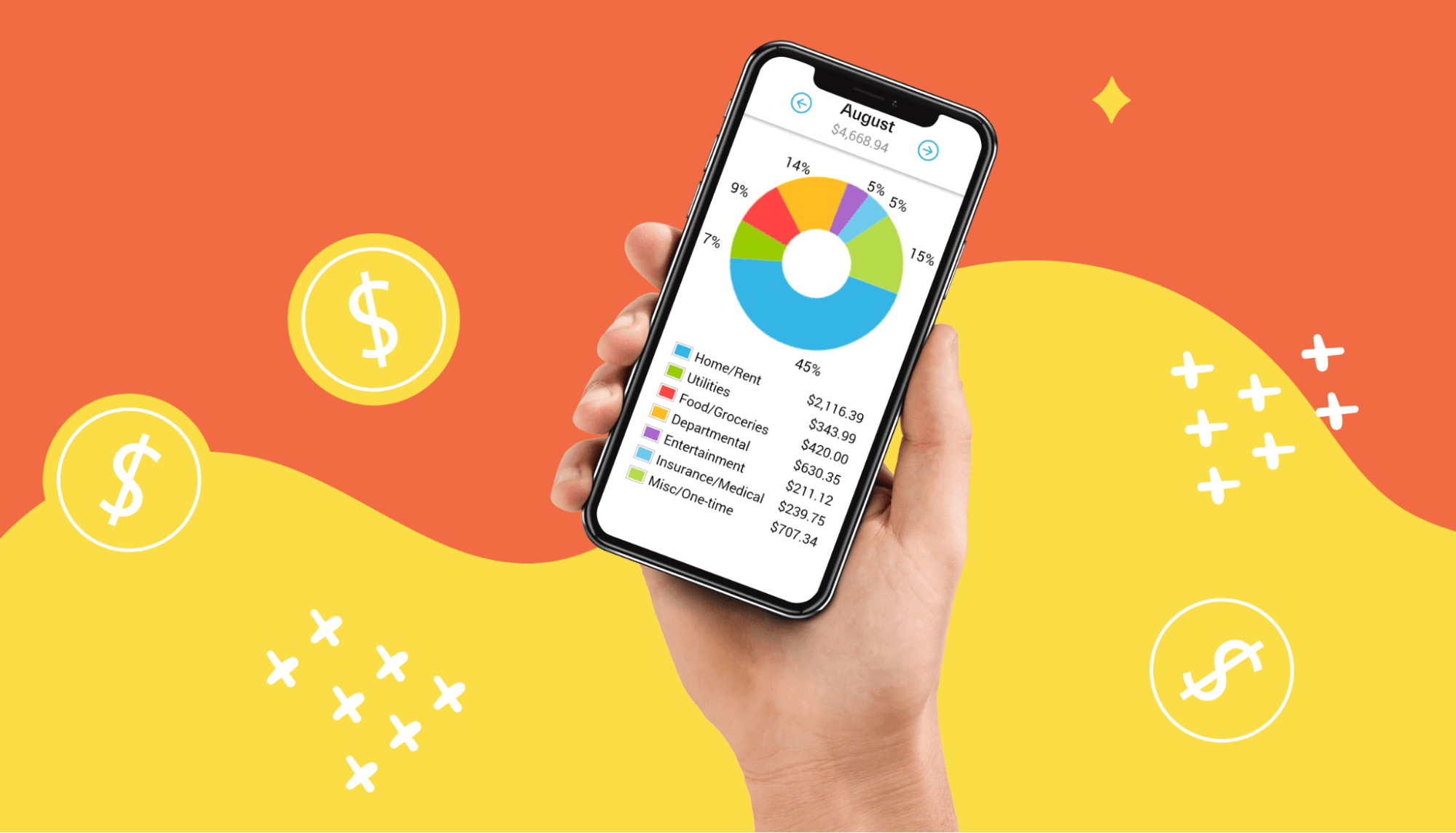

Regardless of your budgeting method, you’ll need at least some idea of what you spend money on. Choosing the right personal budget categories ensures that you won’t fail to account for any spending in your budget.

If you’re doing your budget by hand or in a spreadsheet, you may have to track your expenses for a month to get a better picture of your spending habits.

Budgeting apps come preloaded with categories. You can simply link your financial accounts, pick categories that fit your financial habits, and let the app track your transactions—saving you a lot of time (and money when you use them properly).

Some of these apps also let you create custom categories if they don’t contain a preset category you need.

Accounting for all of your income

Many budgeters have a paycheck as their only source of income. But as a student, you might have more. You’ll need to include all your income sources to get a better picture of the money you have available for spending and saving.

Sources of income for college budgeters can include:

Part-time work

Freelance work

Parental help—your parents sending you money

Some income sources are recurring, whereas others are one-offs.

Create separate subcategories in your income section to allocate your total income across these sources. Doing so will help you make sure you aren’t, for example, listing your student loans every single month when they’re a one-time payout.

Saving a portion of your money

Budgeting is used mainly for tracking your monthly expenses, sure, but you track those expenses so that you’ll have money left over to save.

Learn how to make a separate category for your savings and give those savings a name to encourage yourself to stick to a plan—especially if you’re saving for multiple items.

For instance, you might create a savings category and subcategories for your emergency fund and a spring break vacation.

Saving itself is a skill, too, because you need the discipline to stick to the plan. Setting up auto transfers to a savings account can make this easier.

Recording debt correctly

Debt payments are weird in budgeting.

Minimum payments are considered expenses since they’re the smallest amounts you must pay to avoid late fees and credit damage.

Paying anything beyond the minimum on loans—and credit cards, if you carry a balance on them—can be considered investments.

Here’s why:

Interest is like a negative “investment return.” If you have a $1,000 loan at 5% interest, you’re earning a -5% return.

Therefore, putting extra toward debt reduces the interest you pay, effectively “earning” a return.

With that said, place your debt minimum payments somewhere in the expenses section. Create a “debt payments” or “debt payoff” category in your investments section.

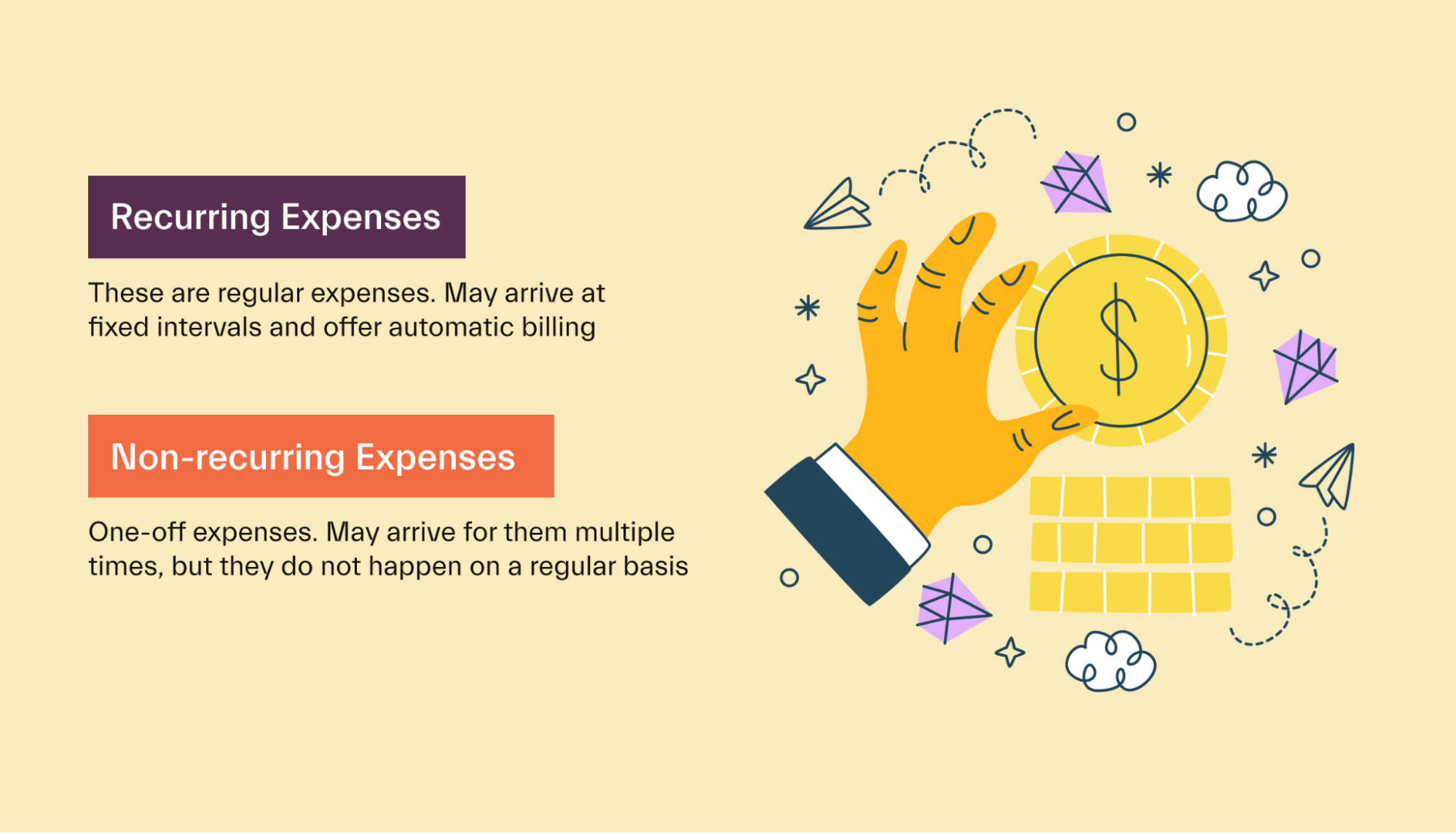

Knowing your fixed vs. variable and recurring vs. non-recurring expenses

Fixed expenses, such as rent, don’t change from month to month.

Variable expenses, however, can change. Groceries are a great example—you need to eat, but your grocery bill changes a bit with every visit to the store.

There are recurring and non-recurring versions of both fixed and variable expenses.

Learning the differences between fixed and variable expenses and between recurring and non-recurring expenses will help you better understand your budget categories. This will make it easier to track how much money will go to specific categories each month.

Forecasting your future finances

A key to succeeding with money is shifting your focus from the present to the future.

Part of this is learning how to forecast your finances. This is a lot like budgeting for the future, but you also have to think about what your life will look like at that point. Forecasting your finances helps you plan for changes in income and expenses so that when the time comes, you aren’t stressed out. You’re prepared.

For example, say you just signed a new lease for an off-campus apartment after living in a dorm. You might want to forecast what your budget will look like when you move in.

That forecast might include a different rent amount than what you paid at the dorm, utilities, groceries if you didn’t get a meal plan, and so on.

Cutting unnecessary expenses

We talked earlier about how budgeting helps stretch your money further. It means looking over and cutting expenses you don’t need.

For example, maybe you don’t use Netflix all that much. You could downgrade your plan or cut the subscription and save a few bucks every month.

Or perhaps you’re dining out 4 nights a week. Maybe that could be cut to 2 or 3 nights to save on restaurant bills.

Learning to say “no”

There will be temptations to spend beyond your means both in college and beyond. Credit cards can worsen this temptation because it’s easier to swipe a piece of plastic than it is hand over dollar bills.

So one of the hardest but most vital budgeting skills can be learning to say “no” to spending you can’t afford. This is a matter of developing willpower and discipline, and you may slip up at first.

But sticking to a budget builds good money habits, eventually making it easier to turn down spending that’s outside your budget.

Budgeting for “fun money” and occasionally splurging, within reason

While you’re budgeting, don’t get caught up on saving every penny for necessities. It’s totally fine to have some “fun money” and to even splurge occasionally.

You just have to make sure you plan for the fun things in life.

That means making sure your needs and savings are covered first. Anything left over is discretionary income for you to use on hobbies, interests, travel, and so on. You can get narrow with this by defining separate categories for every fun expense, or you can have a general “fun money” category and spend it on whatever you want each month.

And remember: You don’t have to spend this amount if you don’t do anything requiring your “fun” fund. Feel free to add it to your savings account to get ahead on your savings goals. Future you will thank you.

Reviewing your budget regularly

Budgeting isn’t a one-and-done task, especially at the start. Review your budget regularly to make sure you’re on pace to stay within your budget.

That said, don’t sweat it if you go a little over your monthly budget the first few months. After all, life isn’t static and unexpected expenses happen. It’s hard to nail your exact spending habits in one try.

What’s important is that you take a look at why you went over budget and adjust the category amounts as needed. Over time, sticking to your budget will change your spending habits. And eventually, staying on budget will become almost second nature.

Master these skills to master your budgeting

Budgeting continues well beyond college. Learning how to stick to a budget and mastering all the skills discussed above early in life will set you up for less financial stress and more money success down the road.

You might make mistakes at first, but hey, that’s part of the learning process. It’s better to knock those mistakes out now instead of later.

That said, budgeting is one part of your overall financial picture. For more help getting comfortable with managing your money, check out our guide to personal finance for college students.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you