FAFSA •

November 9, 2022

Tips for the FAFSA

The FAFSA can unlock grants, scholarships, and student loans to pay for college. Here are useful tips for the FAFSA to maximize your financial aid.

The Free Application for Federal Student Aid, or the FAFSA, is your ticket to all forms of financial aid. This includes federal student loans, grants, certain scholarships, and even work-study opportunities.

Filing the FAFSA is a must-do every year for students. While most students know that they need to file this application, many don’t understand (or even know) that they can optimize the amount of aid they receive.

In this guide, we’ll go over tips for the FAFSA that can help you get the most financial aid possible!

FAFSA basics

FAFSA stands for Free Application for Federal Student Aid. It’s one step all students should complete each and every academic year, as it’s their ticket to federal financial aid.

Filing the FAFSA is a requirement to receive the following:

Federal student loans

Federal grants

Work-study opportunities

Certain scholarships

Having the FAFSA filed is also a prerequisite for applying for many third-party scholarships.

The FAFSA needs to be completed every academic year. It uses information from you (the student) as well as from your parents, if you’re considered a dependent student.

The amount and type of aid you’ll receive depend on different factors. Most forms of federal financial aid are need-based, meaning that more aid is available to students from lower-income families.

Because of this, you can get more federal aid money by utilizing creative FAFSA tips, like minimizing base-year income (legally, of course!).

The financial aid formula is complex, but it takes into account both the income of and assets owned by the student and their family. This information is used to calculate the “expected family contribution” (EFC), or the amount that the government assumes the family will be able to contribute toward a student’s education.

The financial aid formula is complex, but it considers the income and assets that you and your family own. This information is used to calculate the Expected Family Contribution (EFC)—the amount that the government assumes a family will be able to contribute toward a student’s education. Colleges also look at the EFC to determine how much financial aid they can offer.

There are a few ways students and their families can minimize the EFC, thereby increasing a student’s financial aid eligibility.

Tips for the FAFSA: How to get the most financial aid possible

Optimizing how and when you file the FAFSA can help you get more financial aid!

Some tips are simple—filing early may get you first dibs on certain need-based grants. Other tips are a bit more complicated—by reducing the amount of reportable assets by either paying off debt or using other strategies, you might be able to qualify for more aid.

We’ll discuss all these tips for the FAFSA in greater detail below.

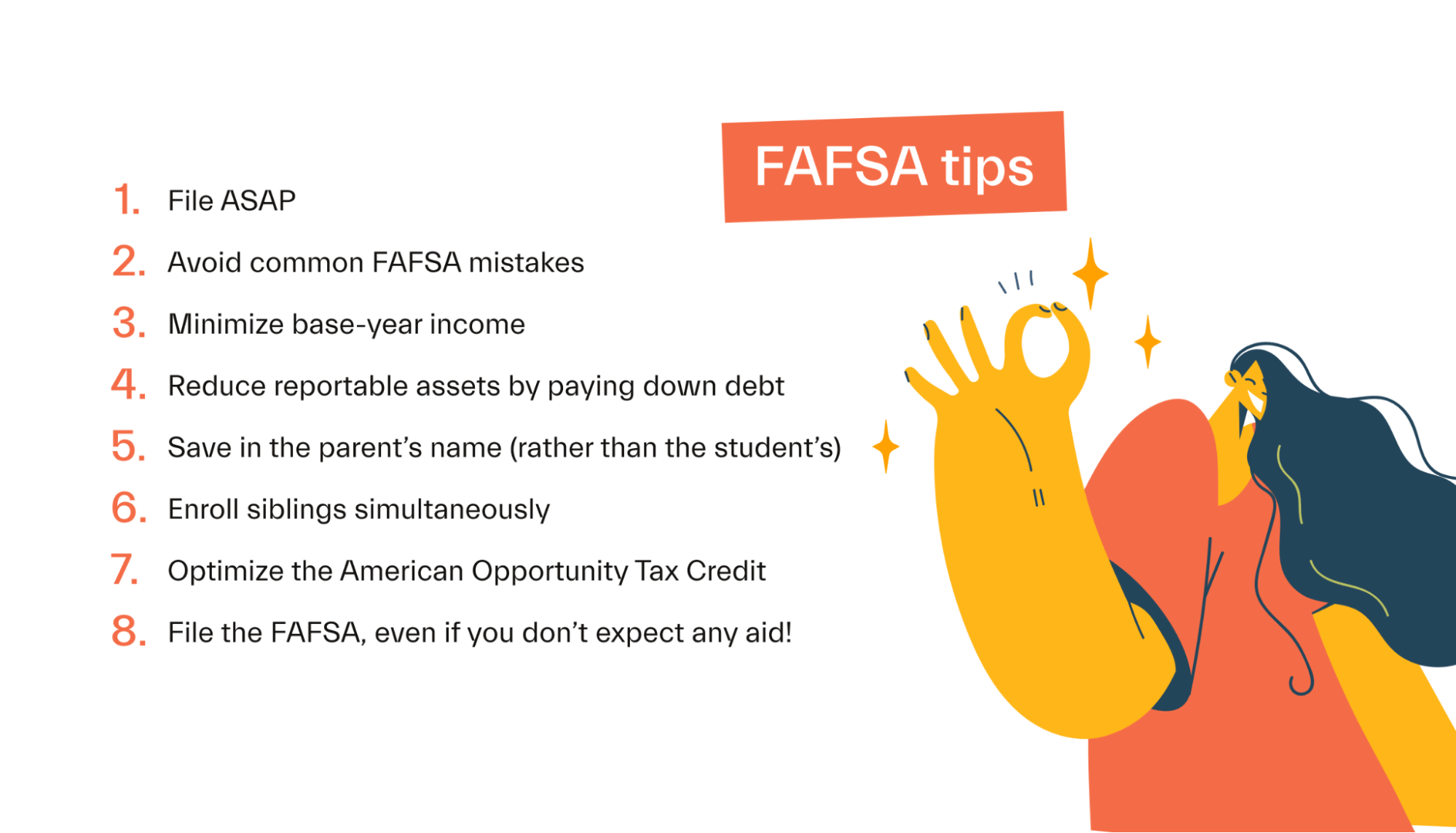

Here are 8 tips for filing the FAFSA.

1. File ASAP

First and foremost, make sure you file the FAFSA as soon as you can!

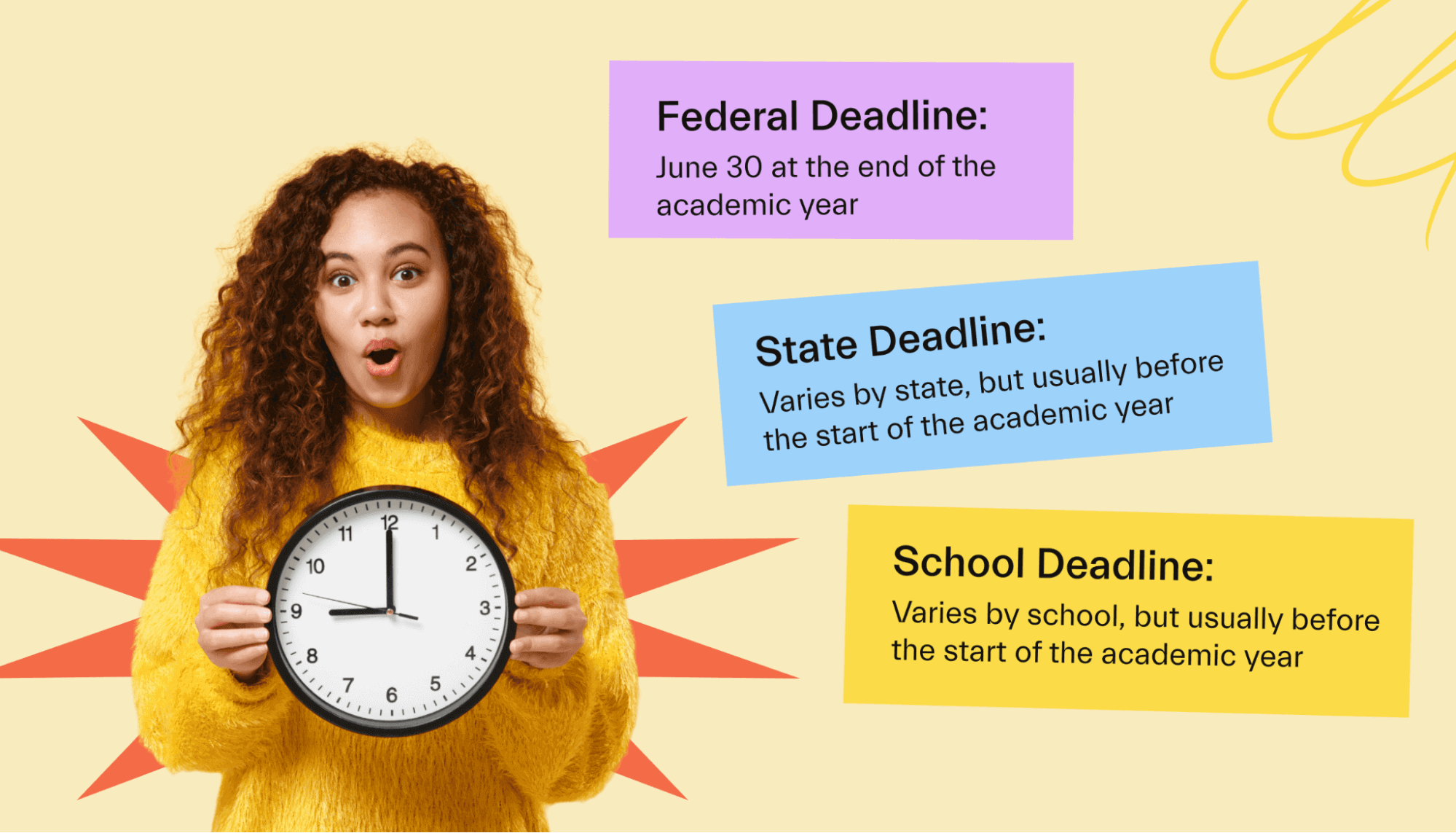

The FAFSA is due on June 30 at the end of the academic year. However, some state deadlines fall earlier than this, with some as early as January or February. Plus, some schools also have deadlines to watch out for.

You definitely want to get your application in before any applicable due dates. If you miss the FAFSA deadline, you’re out of luck for any sort of financial aid for that academic year.

But it’s not just about getting in before the deadline—there are also benefits to filing early.

Many grants and scholarships are offered on a first-come, first-served basis. This means that once a state or school runs out of funds for a certain grant, they’ll no longer be able to offer students money—even if those students would normally qualify.

For this reason, earlier applicants have a better chance of receiving more aid. This is particularly true of state-level and school-level grant opportunities.

And you don’t have to pay back grants, so it’s basically free money! Grants can provide a huge boost to your student finances.

2. Avoid common FAFSA mistakes

Avoiding mistakes that students commonly make on the FAFSA is another handy tip. Some of the most frequent mistakes include the following:

Filing late (see above)

Not filing at all

Incorrectly reporting income (Use the IRS data retrieval tool to make this easier)

Misunderstanding dependency status

Using incorrect information or making simple typos

Not reporting all required information

Not listing all the colleges that you might attend

Forgetting to digitally sign the FAFSA application

Read through this guide from StudentAid.gov for more on how to avoid these mistakes.

If you do make a mistake, you might need to submit a corrected FAFSA form. You might also need to resubmit if you need to update something (e.g., a change in income) or add schools to the FAFSA.

3. Minimize base-year income

Many types of financial aid are need-based. This means that the government considers the student and their family’s ability to pay for the former’s college when calculating how much aid is available to them.

Generally speaking, lower-income families will be eligible for more aid than higher-income families.

Income for FAFSA purposes is calculated using the “base year” income. This is generally the prior-prior year’s tax return. For instance, for the 2023/2024 academic year, the FAFSA will be due on June 30, 2024—and it will ask for income information for the 2022 tax year.

You must accurately report your income—as well as that of your family if you’re a dependent student—on your FAFSA. Don’t lie or try to mislead the government on this report—after all, they have access to your tax returns!

With that said, there are proactive steps that you can take to minimize reportable income in that base year. These could help you qualify for more aid.

Note: This is a proactive step that you must do in the base year. If it’s already 2023, you’re likely out of luck in optimizing this step for the 2022 tax year.

For instance, you or your parents could consider the following ways to reduce reportable income in the base year.

Avoid realizing capital gains in the base year. For example, avoiding selling profitable investments in the base year could reduce reportable income. If you simply hold onto the investment instead of selling it in the base year, the gain will not be realized and will not be reportable as income.

Offset capital gains in the base year. If the student or their family has sold investments for a profit in the base year, they can partially offset these gains by selling other investments at a loss. For instance, consider an example where someone sells stocks for a $5,000 profit but currently holds another stock that’s showing a $3,000 loss. By also selling the stock at a loss (and rebuying something similar), they can lower their profit on paper to $2,000.

Avoid retirement plan distributions in the base year. This one is parent-specific: If your parents are retired, they could consider avoiding making retirement plan distributions in the FAFSA base year, relying on other savings instead. Distributions from retirement accounts are considered reportable income for FAFSA purposes. Delaying or reducing these distributions can significantly lower reportable income, which may help a student qualify for additional aid.

4. Reduce reportable assets by paying down debt

The FAFSA looks at both income and reportable assets when calculating financial aid eligibility. While income is the most important factor, the assets owned by a student and their family will also contribute to that student’s financial aid awards.

The FAFSA looks at investments, savings, checking account balances, and more when determining a family’s reportable assets.

For many households, there is a simple way to reduce reportable assets: Pay down debt!

For example, consider a scenario where a family has $20,000 in cash savings and $15,000 in credit card debt. By paying off the $15,000 debt, they can reduce their reportable assets by $15,000. This could result in the win-win of saving money on interest while also potentially qualifying the student for additional financial aid.

5. Save in the parent’s (rather than the student’s) name

As mentioned, the FAFSA considers assets that the student and their parents own when calculating award amounts.

But savings owned by the student count for more than savings owned by the parent. Student-owned assets are assessed at 20%, while parent-owned assets are assessed at up to 5.64%.

What does this mean in simple terms? $10,000 owned by a student will reduce aid eligibility by $2,000. That same $10,000 owned by a parent will only reduce eligibility by up to $564.

In other words, a situation in which a student has $10,000 in their bank account will negatively affect their financial aid eligibility more than a situation in which the parent has $10,000 in their bank account.

With this in mind, students and their families can plan ahead to optimize their savings strategy. Instead of a parent giving money to the child to save for college, for instance, it might make sense for the parent to save on their own and help make tuition payments directly when they are required.

6. Enroll siblings simultaneously

The FAFSA calculates the expected family contribution (EFC) and then divides that number by the number of students in the family currently enrolled in college. For this reason, having siblings enrolled at the same time can halve the EFC, potentially qualifying both students for more aid.

For instance, say the EFC is calculated at $20,000. If there’s 1 student enrolled, the reportable EFC will be $20,000. If 2 students are enrolled, the EFC will be cut in half to $10,000.

7. Optimize the American Opportunity Tax Credit (AOTC)

Here’s a tip that’s separate from the FAFSA but equally important to optimizing financial assistance from the government.

The American Opportunity Tax Credit (AOTC) is a generous tax credit that can result in up to $2,500 of tax credits per student. Essentially, it reimburses students or their parents for paying for certain education costs, like tuition.

Eligible taxpayers who qualify should ensure that they are utilizing this tax credit. And for best results, it’s important to balance this tax credit with other tax-advantaged strategies.

For instance, many families pay for college using a 529 account, which offers tax perks for saving for college. However, IRS rules prevent double-dipping on 529 tax perks and the AOTC.

Essentially, if a family pays for a student’s education using a 529 account and takes advantage of the 529 tax deduction, they can’t also take the AOTC credit on the same contribution.

To maximize the AOTC credit, students and their families should aim to have $4,000 of qualified expenses paid for via cash (not from a 529 account) or via a student loan.

Confused yet? These rules can get pretty complex, so you may want to talk with a tax advisor to cover your bases. But for another straightforward explanation, let’s look at it this way:

The AOTC is valuable credit that can be maximized by having at least $4,000 of qualified expenses paid for with cash or student loans. If you’re also using a 529 account, you can’t double-dip on the tax benefits of the 529 and the tax credit of the AOTC. For maximum tax benefits, students and their families should craft a payment plan that can utilize the benefits of both a 529 and the AOTC.

8. File the FAFSA—even if you don’t expect any financial aid

Students from wealthy families may not qualify for any grants or federal scholarships—but they should still file the FAFSA. In fact, every student should file the FAFSA, even if they don’t expect to qualify for any aid.

Here’s why:

Filing the FAFSA is required for low-cost federal student loans. The majority of students use federal student loans to help pay for school. These are typically lower-cost than private loan options, and filing the FAFSA is required to qualify for federal loans.

Filing the FAFSA is a prerequisite for many scholarships. If you plan to apply for scholarships (which you should!), you’ll find that many opportunities require you to have already filed the FAFSA.

You might be surprised by what you qualify for. Finally, you may simply be pleasantly surprised by what financial aid options you qualify for. Plus, it typically takes less than an hour to file the FAFSA, so it’s well worth submitting even if you’re not sure what you’ll qualify for.

Bottom line

Financial aid amounts are based on a combination of factors, including income, assets, time of filing, and more. Students and their families can take various steps—like reducing their reportable assets—to maximize students’ financial aid.

Want more tips for maximizing your money in your college years? Check out the rest of the Mos blog for details on paying for college, budgeting as a student, and much more!

Better yet, sign up for Mos today to enjoy student-friendly features and perks. Mos is a free debit card and money app for students. It provides access to cash back rewards, side gig opportunities, expert advice on paying for school, and more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you