FAFSA •

March 2, 2022

Missed FAFSA deadline: what to do next

The FAFSA has a hard deadline of June 30, and many state and college deadlines are earlier than this. What happens if you miss the FAFSA deadline?

Financial aid can help you pay for college. Upwards of 86% of students receive some form of financial aid each academic year!

And when it comes to financial aid, there’s one “golden ticket:” The Free Application for Federal Student Aid, or FAFSA.

This all-important application is how you qualify for grants, work-study, federal student loans, and even some scholarships.

But what happens if you file the FAFSA late?

This article will explore what to do if you miss the FAFSA deadline. Don’t worry—you still have options!

When is the FAFSA deadline?

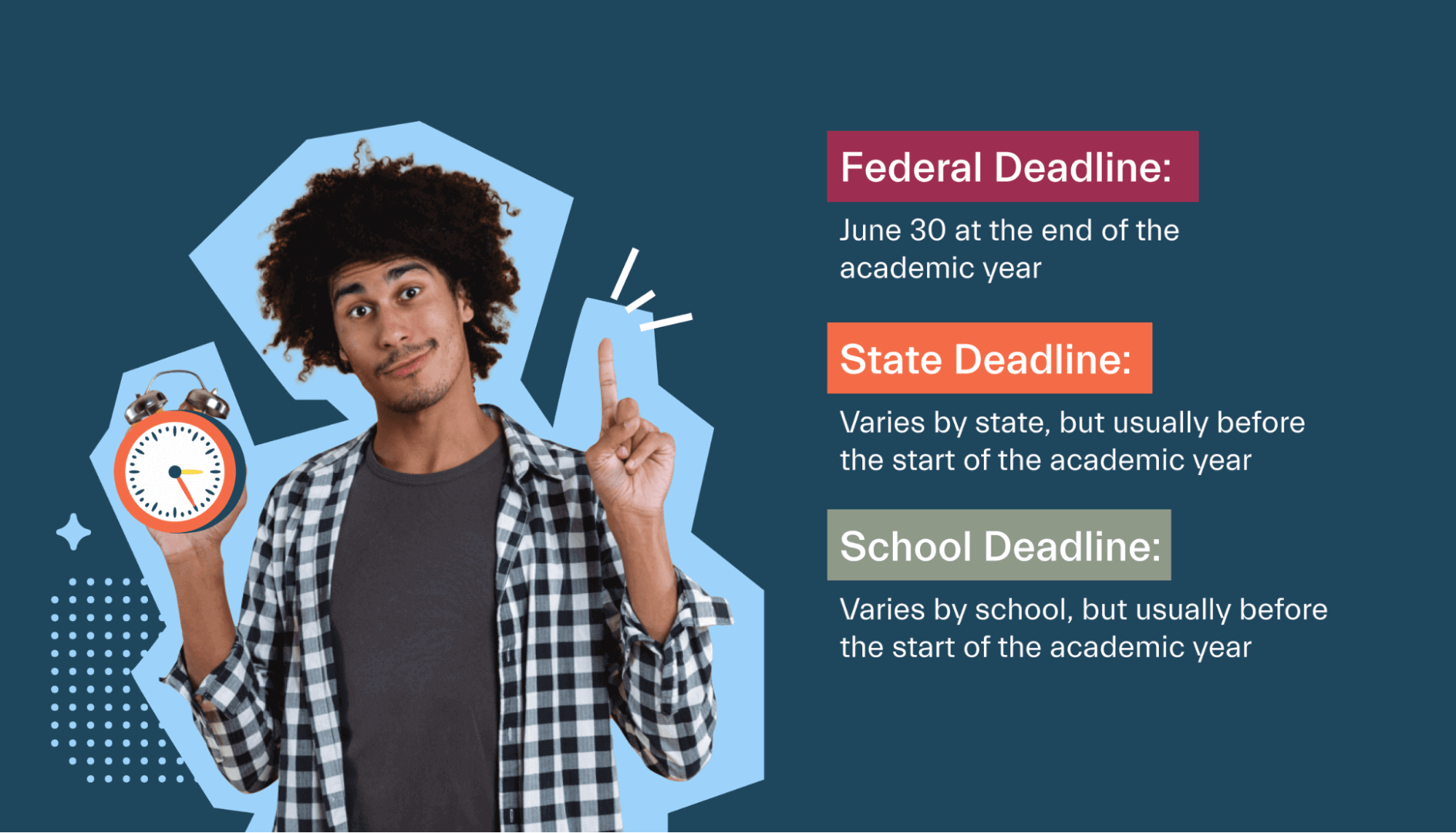

The federal FAFSA deadline is midnight on June 30 of the academic year that you’re submitting the FAFSA for.

For example, the deadline for the 2022/2023 academic year will be June 30, 2023. If you start going to school in the Fall of 2022, you will have until late Spring of 2023 to submit the FAFSA.

However, submitting much earlier than the deadline is recommended.

The earlier you submit, the more likely you’ll be to receive certain types of aid. This is because many forms of aid have a limited amount of funding, and once funding runs out, it’s gone for the year. Even if you would have qualified for a specific program, you won’t receive an award if you apply too late.

Applications open on October 1. Students can submit the FAFSA throughout most of the year, from October 1 to June 30.

Keep in mind that June 30 is just the federal due date. Individual states may have their own due dates in order to qualify for state-funded grants. Many of these state-level due dates can be found on this PDF or this website.

Likewise, schools have their own due dates for when financial aid paperwork must be completed (more on this below).

To sum up: The June 30 deadline is the most important, as it is the cutoff for federal programs like the Pell Grant and student loans. But completing the FAFSA earlier in the year is very beneficial and may improve your odds of being eligible for state-funded grants and other programs.

College-level financial aid deadlines

It’s helpful for students to check with the school(s) they may attend to see if there are any school-specific deadlines.

Each school handles financial aid differently. Colleges have their own internal processes, paperwork requirements, and due dates.

Most schools have deadlines earlier than the federal deadline of June 30. Many schools have deadlines between January and March, but this varies. You should do your best to submit the FAFSA as early as possible.

Applying early has benefits, too! Many schools have a “priority deadline.” Applications received before the priority deadline are processed sooner and may be more likely to qualify for certain types of aid that have limited budgets.

Even if there is no hard deadline, early applications have a better chance of receiving more aid. Many state-level and college-level funding sources are quite limited and may be first come, first served.

Plus, you need to touch base with your school even after you submit the FAFSA.

Including a school on your FAFSA doesn’t necessarily mean that the school will prepare a financial aid offer for you—even if you qualify.

School financial aid departments are busy, so they focus their energy on serious applicants who are likely to attend that school.

To ensure you get all the aid that’s available to you, be sure to contact your school directly to find out what you need to tackle on your end.

What happens if you miss the FAFSA deadline?

The June 30 federal deadline is a hard deadline. If you don’t submit the FAFSA before this date, you can’t submit the FAFSA for that academic year—period. The FAFSA application is completely taken down from the Student Aid website after June 30.

If you miss the June 30 deadline, you’re out of luck for financial aid for the current academic year.

But if you just miss a state-level or school-level deadline, you still have some options.

In this case, you should still submit the FAFSA and do so as soon as possible. We’ll explore the next steps in the section below.

Can you submit the FAFSA late?

You cannot submit the FAFSA after the June 30 deadline.

However, you can submit the FAFSA up until June 30, even if that’s after a certain state or college-level deadline.

For example, your state may have scholarship and grant opportunities with a deadline of February 1. If you miss this deadline, you won’t qualify for those opportunities—but you should still submit the FAFSA.

As long as you file the FAFSA by June 30, you’ll be considered for student loans, work-study, and certain grants.

Next steps if you missed the FAFSA filing deadline

Mistakes happen. If you miss the FAFSA deadline, what should you do next?

1. Submit the FAFSA as soon as possible

If the FAFSA application is still live on the Federal Student Aid website, you should submit the application as soon as possible.

If the application has been removed, you cannot apply for the current academic year. You can apply for the next academic year starting on October 1.

2. Contact your school’s financial aid office

Next, contact your school’s financial aid department. Explain your situation, and ask if there are any options available to you.

Some schools are more lenient with deadlines than others. Again, most schools will have no options if you miss the June 30 federal deadline, but they may be more flexible with school-level deadlines.

Do your best to be humble and understanding. After all, you missed the deadline. If there’s no aid available, you shouldn’t get frustrated at the person trying to help you.

If there are no financial aid options available, your school may still be able to counsel you on other alternatives. They may be aware of private scholarships that are still available, or they may give you some information on private student loan providers.

3. Contact your state’s education agency

If you miss a state-level deadline, you may be taken out of consideration for state-funded programs, including grants and scholarships.

Many states have hard deadlines, meaning if a deadline is missed, there’s no option to still apply.

But other states have some more wiggle room. If you were hoping to qualify for a specific state-level grant or scholarship but missed the deadline, it’s worthwhile to contact your state’s education department.

4. Explore other funding options

There are many ways to pay for college, with or without financial aid.

If you find you cannot get financial aid or don’t receive enough aid to pay for your education, these are the other college funding options you should explore.

External scholarships and grants

There are many scholarships and some grants available outside of the FAFSA.

For instance, many businesses, school foundations, nonprofits, and religious organizations sponsor scholarships for students.

You can apply to these scholarships directly. Applications usually involve filling out a form, submitting an answer to a question, or writing a scholarship essay.

Note: Many scholarships require that you submit the FAFSA first in order to apply for the scholarship. Be sure to check the eligibility requirements.

For more information, read through our guide on how to get a scholarship.

External grants (meaning grants applied for outside of the FAFSA) are less common, but a handful exist. For instance, there may be industry-specific grants available for students going into a certain field of study.

Private student loans

Most students get federal student loans, but loans are also available from private banks and businesses.

Private student loans are more flexible in the amount you can borrow—as long as you have a good credit score and a decent source of income to repay the loans.

But private loans are also much more difficult to get approved for. Loan providers will consider your income, credit score, and loan repayment history. If you don’t meet their requirements, you won’t be approved for a loan. Or you may be approved for a small loan at a very high interest rate.

With federal loans, almost everyone is eligible. As long as you submit the FAFSA on time, you should qualify for federal loans. But if you miss the FAFSA deadline, your only option may be to seek out private loans.

Private student loan interest rates are different from federal loans, as well. For most borrowers, they will be higher than federal loans—but rates vary depending on the borrower’s creditworthiness.

Part-time jobs

Getting a part-time job (or a full-time job, if your schedule allows) is a good way to cover a portion of your college expenses.

Many students prefer jobs that have flexible hours and/or schedules that typically fit in well with class schedules. These could include:

Barista jobs

Bartending jobs

Foodservice jobs

On-campus jobs

When looking for work, be sure to keep in mind that your class schedule will change regularly. It’s wise to look for employment with flexible hours.

You can search online job boards for employment opportunities. Some colleges also have their own job boards to help students connect with local employers.

Read our full guide on how to make money in college for more information.

Note: Work-study is a form of financial aid that offers paid employment for students. But if you don’t file the FAFSA, you can’t get work-study opportunities. In this case, getting a standard part-time job is the best option.

Side hustles

Side hustles are another flexible way to make money while in school and can be a good way to supplement financial aid.

Some popular options include:

Driving for ridesharing companies

Delivering food or groceries

Tutoring

Freelancing

Reselling used items

Side hustles can be a good way to make a few bucks, but they won’t be sufficient to pay for school for the most part. However, the big advantage is that they are usually very flexible with when you put in the time.

5. Plan ahead for next year

The FAFSA is due every academic year. If you missed the deadline this year, be sure to plan ahead for next year!

FAFSA applications open in early October of each year and close by June of the following year. The sooner you can submit your FAFSA, the better!

Consider setting a reminder in your calendar to file the FAFSA so that you don’t miss another deadline.

Conclusion

If you miss the FAFSA deadline, you may be out of luck for certain types of financial aid—at least for this academic year.

But you still have some options, including private student loans and external scholarships and grants.

Want help finding scholarship opportunities? Check out Mos.

Mos is a money app that helps students lower their tuition, match with top scholarships, and earn extra cash in college. Explore memberships here.

And finally, remember to be prepared for next year! The FAFSA opens to new applicants starting on October 1. The earlier you apply, the more opportunities for financial aid you’ll have.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you