FAFSA •

February 28, 2023

What is Schedule 1 for the FAFSA?

Schedule 1 is an IRS tax form. You’ll need this information when you complete your FAFSA, and it helps determine your financial aid.

Financial aid has never been more important with the rising cost of college.

The first step to qualifying for financial aid is completing your FAFSA—the Free Application for Federal Student Aid.

The FAFSA is where you report your family’s income, which is used to determine what financial aid you might be eligible for.

One important piece of the income puzzle is Schedule 1—an IRS form where taxpayers report non-wage types, such as rental income and capital gains.

So, if you're getting ready to file your FAFSA, keep reading to learn what’s included on Schedule 1, how to report it on your FAFSA, and how it can affect your chance of getting the financial aid you need.

What is Schedule 1?

Americans file their tax returns with the Internal Revenue Service (IRS) each year.

Even if you’re still in school and haven’t filed taxes, there’s a good chance your parent or guardian has. And Form 1040 is the official IRS form they use to file their taxes.

While the most common types of income (wages, interest, dividends, and more) are reported on Form 1040, some aren’t.

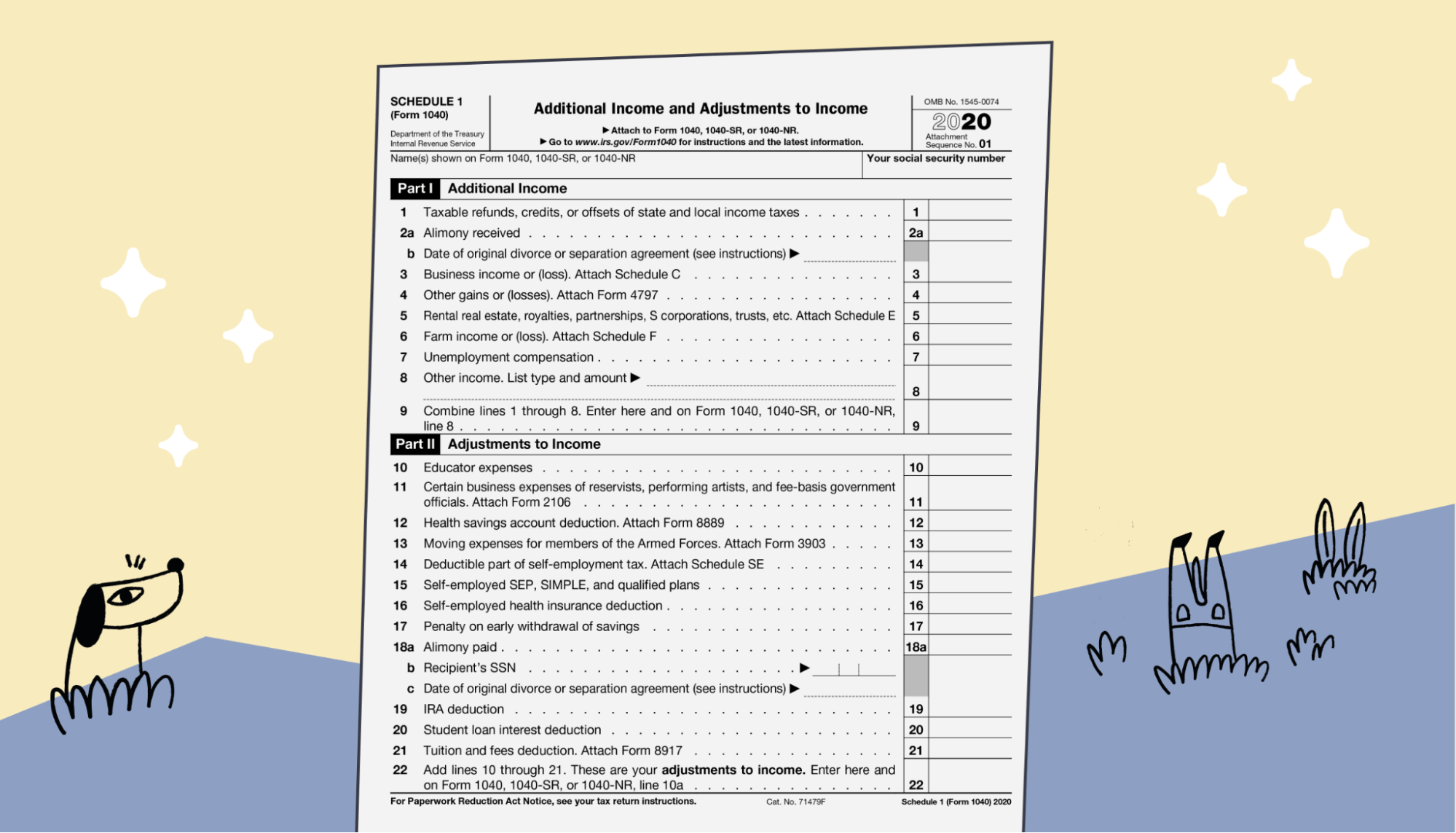

Schedule 1 is an additional form used to report certain types of income that aren’t included in Form 1040.

Schedule 1 is also used to report certain income adjustments which reduce a person's taxable income. Some of the income and adjustments on Schedule 1, along with the information on the rest of the tax return, can be used to determine if you (the applicant) are eligible for financial aid (and how much you’ll get).

When you fill out your FAFSA, you’ll find 2 questions related to Schedule 1. The first asks if your parents completed Schedule 1, while the other asks if you did.

Suppose you answer “yes” to either of these questions. In that case, you’ll need to provide additional information about your or your family’s income from sources other than the most common types. The information you offer will be used to adjust the income your school uses to calculate your expected family contribution to the cost of school.

Why does the FAFSA ask for Schedule 1?

In past years, the FAFSA asked families what income tax form they used to file their annual tax returns. But with the passage of the Tax Cuts and Jobs Act of 2017, Congress got rid of 2 of the tax return forms—Form 1040A and Form 1040EZ.

Since then, the FAFSA has used the questions within Schedule 1 to determine what income and deductions your family might have that are important for determining financial aid, but that wasn’t reported elsewhere on your tax return.

The FAFSA isn’t interested in all the income and deductions you might claim on Schedule 1. Therefore, the FAFSA questions clarify which types of income would require you to report your Schedule 1.

Now, it’s worth asking why the FAFSA can’t automatically pull your Schedule 1 with the rest of your tax return.

Why do you have to manually answer this question?

The answer is that only some of the information you might report on your Schedule 1 has to be reported for the FAFSA. So it’s possible that you completed Schedule 1 to report your student loan interest deduction. But the FAFSA excludes that adjustment for your FAFSA.

The FAFSA only needs to pull your Schedule 1 if you completed one of the fields that don’t have an exception. And if you completed a field that’s currently an exception for purposes of the FAFSA, those files will be masked when the FAFSA retrieves your IRS forms.

This question is also important because it helps the FAFSA determine if you’re eligible to skip certain questions later in the form.

What sections of Schedule 1 relate to the FAFSA?

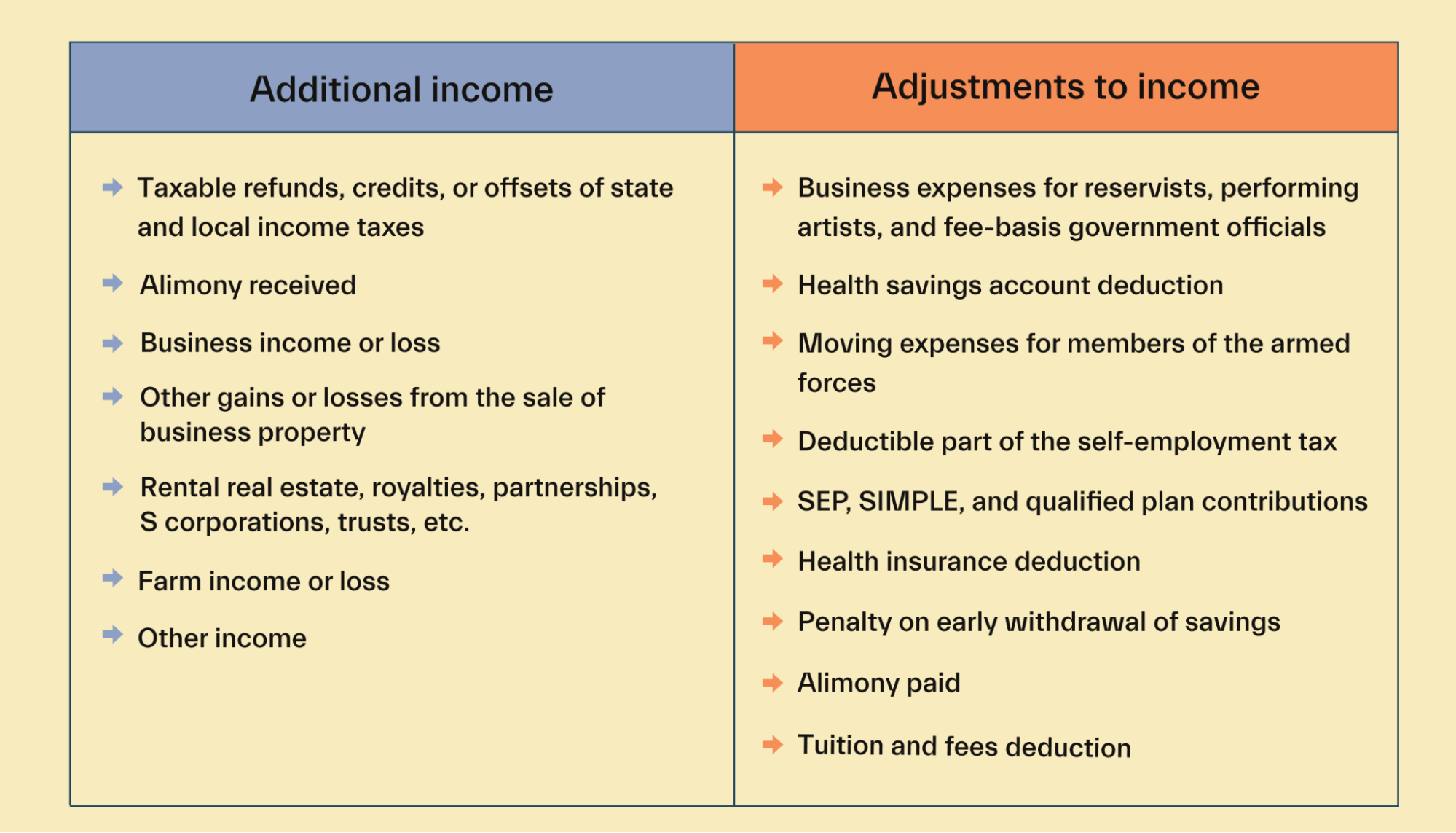

Schedule 1 allows taxpayers to report various types of income and adjustments to income that they don’t report on their federal income tax return form. There are 19 different types of income and adjustments that you might report on Schedule 1, but not all of them matter for the FAFSA.

Here are the types of income and adjustments that would require you to report your Schedule 1 on your FAFSA:

Line 1: Taxable refunds, credits, or offsets of state and local income taxes. If you or your family received this income, you would receive a 1099-G to report it.

Line 2a and 2b: Alimony received. The taxpayer must also include the date of their original divorce or separation agreement.

Line 3: Business income or loss. The taxpayer must complete and attach Schedule C for business income and losses.

Line 4: Other gains or losses from the sale of business property. Suppose the taxpayer has gains or losses to report on this line. In that case, they’ll also have to complete and attach any corresponding forms.

Line 5: Rental real estate, royalties, partnerships, S corporations, trusts, etc. If the taxpayer has any income to report on this line, they’ll also have to complete and attach Schedule E.

Line 6: Farm income or loss. If the taxpayer has the income to report on this line, they’ll also have to complete and attach Schedule F.

Line 8: Other income. The taxpayer will fill out this line if they have untaxed income that hasn’t been reported elsewhere. This income could include gambling winnings or other prizes and awards.

Line 11: Business expenses for reservists, performing artists, and fee-basis government officials. If taxpayers have adjustments to report on this line, they’ll also have to complete and attach Form 2106.

Line 12: Health savings account deduction. If taxpayers claim this adjustment, they’ll also have to complete and attach Form 8889.

Line 13: Moving expenses for members of the Armed Forces. If taxpayers claim this adjustment, they’ll also have to complete and attach Form 3903.

Line 14: Deductible part of the self-employment tax. Self-employed individuals can currently deduct half of this tax. If taxpayers claim this adjustment, they’ll also have to complete and attach Schedule SE.

Line 15: SEP, SIMPLE, and qualified plan contributions. These contributions are fully deductible if the taxpayer is self-employed.

Line 16: Health insurance deduction. If the taxpayer is self-employed, they can deduct 100% of these health, dental, and long-term care insurance premiums.

Line 17: Penalty on early withdrawal of savings. Suppose the taxpayer paid the penalty for early withdrawal of an account, like a certificate of deposit. In that case, they’d report it along with Form 1099-INT or Form 1099-OID.

Line 18a and 18b: Alimony paid. At this point, the taxpayer also includes the recipient’s Social Security number and the date of their original divorce or separation agreement.

Line 21: Tuition and fees deduction. Taxpayers can currently deduct up to $4,000, but they can’t deduct expenses for which they’ve claimed another higher education tax credit.

The types of income and adjustments that don’t need to be reported for the FAFSA are:

Capital gains

Unemployment compensation

Alaska Permanent Fund dividends

Educator expenses

IRA deduction

Student loan interest deduction

How do I answer questions 35 and 82 on the FAFSA?

Questions 35 and 82 on the FAFSA ask whether you or your parents have filed (or plan to file) Schedule 1 with your tax return. It’s important to read the instructions on these questions carefully because the answers may not be as clear as they seem.

For both questions, it’s possible that you filed Schedule 1 but would still answer no. This is because certain sections of the form are excluded for purposes of the FAFSA. If you completed those sections of the form and no others, you’d respond that you hadn’t completed the form at all.

How to answer question 35

Question 35 of the 2021 FAFSA asks: “Did (or will) you file a Schedule 1 with your 2021 tax return?”

As we said earlier, answering this question is more complicated than whether you completed the form.

You should answer “No” to question 35 if you didn’t file Schedule 1. But you should also answer “No” if you filed Schedule 1, but only to report any of the following income and adjustments:

Capital gains

Unemployment compensation

Alaska Permanent Fund dividends

Educator expenses

IRA deduction

Student loan interest deduction

If you filed Schedule 1 and reported income or adjustments above and beyond the 6 exceptions, you should answer ‘Yes’ to question 35.

If you’re married, you must also report your spouse’s Schedule 1. The rules for whether you have to report your spouse’s Schedule 1 are the same as the rules for whether to report yours.

If you aren’t sure if you filed (or are planning to file) a Schedule with your tax returns, then you can answer ‘Don’t know”.

How to answer questions 82

Question 82 of the FAFSA reads: “Did (or will) your parents file a Schedule 1 with their 2021 tax return?”

The rules for answering question 82 are the same as answering question 35. You should answer ‘No’ if your parents didn’t file Schedule 1 or filed it but only reported the excluded income and adjustments.

You should answer ‘Yes’ if your parents filed Schedule 1 and reported income and adjustments above and beyond the 6 exceptions.

It’s worth noting that question 82 won’t apply to everyone. For example, suppose you’re an independent student. In that case, you won’t report any of your parents’ tax or financial information with your FAFSA.

What happens if I click ‘Don’t Know’?

If you don’t know if you or your parents filed or plan to file Schedule 1, then the FAFSA allows you to answer ‘Don’t know’ questions 35 and 82.

It’s important to note that any missing information in your FAFSA, including whether you or your parents filed Schedule 1, could hold up your financial aid offer. It doesn’t mean you won’t be eligible for financial aid, but it does mean that it could take longer to receive your offer letter.

If you answered ‘Don’t know’ to question 35 or 82, then the schools you’ve applied to will have to do some extra digging. For example, they might reach out to ask you a few more questions. Or they’ll pull your tax return to see whether you filed Schedule 1 and completed any of the relevant sections.

If you’re worried about whether your answer to questions 35 and 82 will hold up your financial aid offer, reach out to your school’s financial aid office.

Do I need to fill out Schedule 1 every year?

It depends.

Every year when you fill out the FAFSA, the form will ask whether you or your parents submitted Schedule 1 with your tax returns. If you did, you’d have to fill out Schedule 1 for that year.

Some people have to submit Schedule 1 with their taxes every year. For example, people who own farms likely have farm incomes or losses yearly, meaning they have to fill it out every year. On the other hand, someone who filled out Schedule 1 once due to winning a cash prize won’t have to fill it out on the FAFSA again unless they have another reason to file Schedule 1.

Why is Schedule 1 of the FAFSA so important?

Filling out Schedule 1 of the FAFSA is important for a few reasons.

The FAFSA is the most important document you can fill out to determine the amount of financial aid you’ll receive. On top of determining your eligibility for grants and federal student loans, colleges and universities use it to decide on your need-based financial aid.

Schedule 1 lets you adjust your family’s income based on things that might not appear on income tax returns. This is beneficial because your income on Schedule 1 of the FAFSA could be noticeably lower than that on your income tax returns.

For example, if you’re self-employed, Schedule 1 lets you deduct income for the self-employment tax, which could increase the amount of money your college financial aid office awards.

On the other hand, if you don’t report your income on Schedule 1 of your FAFSA, you might underreport your actual income. That can lead to legal trouble, especially if it’s discovered that you underreported intentionally to try to get more financial aid.

What is the IRS Data Retrieval Tool?

If you’ve already filed your tax return, when you fill out the FAFSA online or through the myStudentAid mobile app, you can use the IRS Data Retrieval Tool (DRT).

The IRS Data Retrieval Tool will automatically retrieve your tax information from the IRS database and populate that information in the relevant fields of the FAFSA, making it easier to complete the form.

For instance, the DRT will automatically answer the questions about whether you or your parents filed a Schedule 1 with your tax returns. It will also automatically fill in the relevant fields on the FAFSA Schedule 1 to make it easy to provide accurate information on the form.

Conclusion

As you prepare to file your FAFSA and figure out how you’ll pay for college, it’s important to understand how your family’s income affects your financial aid. That includes the income you and/or your parents report on Form 1040 Schedule 1. Don’t worry—filing a Schedule 1 doesn’t necessarily mean you won’t be eligible for financial aid. It’s just a tiny piece of the puzzle.

Got a financial aid question? Explore Mos memberships for unlimited help from an expert.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you