Budgeting •

November 2, 2022

A college student’s guide to recurring expenses

Some expenses last a long time, or even for life. These are recurring expenses. Discover how recurring expenses work and learn the major types.

College is one of the best times to learn money management. Your finances are simple, and there’s a good chance you don’t have a lot of responsibilities.

One of the first things that hits you when organizing your personal finances is the hard reality of bills. Rent, utilities, food, and other expenses never truly go away.

These are known as recurring expenses because they happen regularly, and most of them make up the core of your budget.

Below, we’ll explain recurring expenses in detail and discuss a few types you need to know.

What are recurring expenses?

Recurring expenses consist of any spending you have to do regularly. This can happen daily, weekly, monthly, or even yearly.

For example, do you have a Netflix subscription? That’s a recurring expense because you have to pay for it each month.

Food is another example. Your grocery bill may change at each store visit, but it’s recurring because you have to buy groceries regularly to eat and get other household essentials.

Recurring vs. non-recurring expenses

As we discussed, recurring expenses happen regularly. They can be fixed and automatically billed, but not always.

Non-recurring expenses are just the opposite. These are one-off expenses that you don’t expect to make regularly.

That doesn’t mean non-recurring expenses only happen once. It just means you don’t pay for them on a predictable basis.

For example, purchasing a new pair of pants is not necessarily a recurring expense. Yes, you might buy more pants in the future—but you don’t buy new pants at regular intervals like you would food.

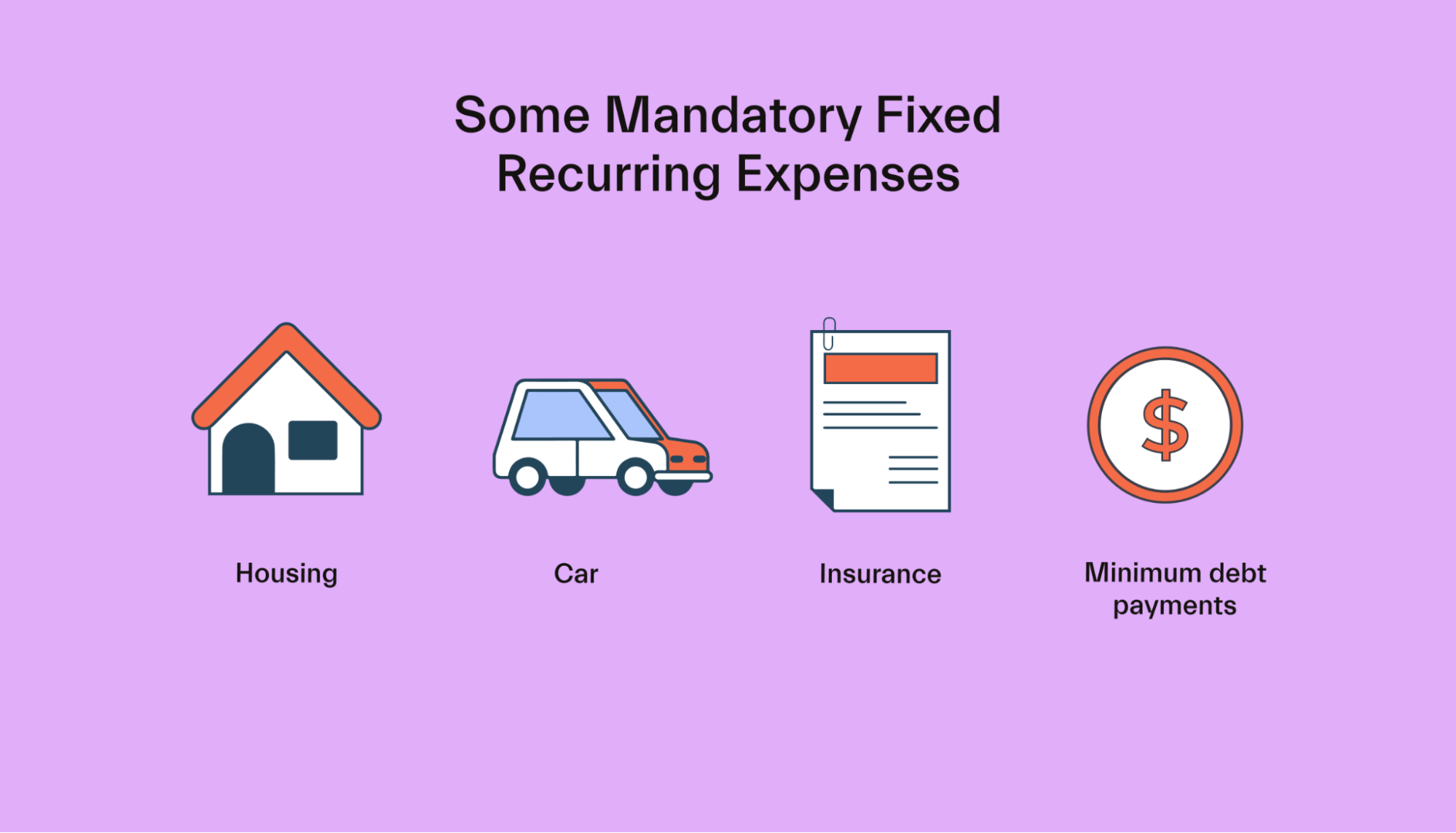

Mandatory fixed recurring expenses

A fixed expense is any expense that doesn’t change from month to month.

Mandatory fixed expenses are those that you have to pay to live. Without them, you’d be unable to survive, or you’d deal with a lot of hardship.

Below are several of the top mandatory fixed recurring expenses you might deal with as a college student and beyond.

Housing

Many people find housing to be their largest recurring expense, whether that’s room and board, rent, or a mortgage.

Other expenses may be involved. For example, renters may have small fees attached to their rent. Meanwhile, homeowners may owe mortgage insurance, property taxes, and homeowners association fees.

You must pay to keep a roof over your head, making these mandatory recurring expenses. Fortunately, they’re fixed—you know exactly how much you’ll pay each month.

Car payment

How do you get to class, club meetings, intramural games, and work? If it involves financing or leasing a vehicle, you’ll pay a fixed amount to keep driving that vehicle.

Your auto payment costs can blur the lines between mandatory and discretionary.

For example, buying a used economy car to keep your car payment low would most likely count as a mandatory expense. However, if you stepped up to something luxurious or sporty that goes beyond the basics of “Point A to Point B safely,” your automobile may fall partially into discretionary spending.

Insurance

Several forms of insurance are required either by law or necessity. For example, you generally need car insurance to operate your vehicle on the road legally.

Other insurance types, like health insurance, aren’t mandatory by law. But without health insurance, an illness or injury could indebt you for a long time.

Regardless, insurance premiums generally don’t change from month to month. Thus, insurance is a mandatory fixed recurring expense.

That said, optional insurance types, like life insurance, may also fall under this category once you sign up for them, because you have to keep up on payments to maintain the coverage and benefits.

Minimum debt payments

Credit cards and loans demand a minimum payment each month. You can pay as much as you want, but you only have to meet that minimum to avoid late fees and damage to your credit score.

Because of this, the minimum required payments on each of your debts are considered mandatory fixed recurring expenses.

For example, say you put a $500 balance on your credit score each month, and the card requires a $25 minimum payment. Your mandatory fixed recurring expense here would be that $25 payment.

Only paying the minimum amount will likely mean you’ll pay a lot in interest and it will take a long time to clear your balance. For this reason, anything beyond the bare minimum could be considered an “investment”, and you’ll learn why in the next section.

Mandatory variable recurring expenses

Some expenses are necessary to live but may change every month. These are called mandatory variable recurring expenses because, well, they vary.

Let’s look at a few of these below:

Utilities

Utilities are necessary to live, and the most prominent ones—gas, electricity, and water—fluctuate from month to month for many.

For example, your electric bill could be lower in the fall than in the summer because you need less air conditioning.

Even so, you can nail down relatively predictable utility bills after living somewhere for a while and getting used to how much of a specific utility you need.

Note that some utilities may be fixed. For example, many Internet plans charge a fixed amount every month. You may exclude this from utilities in your budget if that’s the case.

Groceries

You have to eat and get other household essentials. The amount of food and other items you buy can change each month, though, making your grocery bill a mandatory variable recurring expense.

Transportation

Your car loan or lease payment is fixed, but things like gas and routine maintenance can change. These expenses are mandatory and recurring but variable.

Some people may skip car ownership or leasing entirely and use public transit or ridesharing services. If you pay for either of these, you still have mandatory recurring transportation costs. These costs are variable as well.

Saving and investing

Ok, saving and investing are not technically expenses. But they kind of are — when you set aside some of the money you make for the future, you’re “spending money” to pay yourself.

Saving and investing provides reassurance for future you. For some students this might be an expense too far. They need to prioritize living expenses in the here and now rather than taking care of their future self.

For others, saving a little each month is possible. The recurring expense then becomes a small deposit into a savings or investment account from your checking account.

Any debt payments over and above the minimum can also be considered an investment.

If you have debt, like credit card or student debt, you’re likely paying interest on the balance each month. Making larger payments than the minimum means you get out of debt faster. Getting out of debt faster means you pay less interest.

Instead of earning a return on your investment, you’re saving money on your debt. They’re two sides of the same coin. And both mean you end up with more in your pocket.

For example, say you owe at least $300 per month to stay on track with your college debt payments. But you got an excellent salary out of college, so you can pay $400 per month comfortably.

The first $300 is the minimum, a mandatory fixed recurring expense. The extra $100 could be considered “savings/investing.”

Discretionary recurring expenses

Most of your recurring expenses are needs. They’re the expenses you need to keep paying to survive.

But some of your recurring expenses are discretionary. Or, in other words, they’re wants.

Like your mandatory expenses, they can be fixed or variable.

Here are a few types of discretionary recurring expenses:

Subscription services

Subscription services are generally discretionary expenses. You don’t need that Netflix account or skincare subscription box—these are wants.

And yet, you pay for them on a monthly basis. So they are recurring expenses.

These are generally fixed since you’re buying a set level of goods or services every month.

Memberships

Memberships are recurring expenses. If you fail to pay, you lose your membership.

As a student, your memberships likely include club or fraternity/sorority dues. You might also have a gym membership if there is no gym on campus or if it isn’t free for students.

Outside of that, you could hold membership in networking and professional groups that require a fee.

Regular “fun” purchases

Any other fun purchases that happen on a regular basis can be recurring expenses, although this can vary between people.It

If you love to ski, then maybe your regular “fun” purchase is your annual lift pass. Football fan? Maybe season tickets for your school’s games is your recurring “fun” expense instead. These are obviously different for each individual, so won’t appear in every budget.

Recurring expenses are vital but never-ending

Recurring expenses are central to your budget because you need to make sure you can pay them every month.

Some are mandatory, like housing. But many are flexible, and with some planning, you can cut back on those expenses without making life miserable.

Learning how to manage recurring expenses early on will pay off later in life when you have more to deal with—like, you know, student loans.

Want more tips for managing your money as a student? Check out these tips for creating a college budget.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you