Financial aid •

University of California, Irvine financial aid: a complete guide

Learn about University of California, Irvine financial aid, including information about scholarships, loans, and grants.

The University of California, Irvine (UCI) was founded in 1965 with “a mission to catalyze the community and enhance lives through rigorous academics, cutting-edge research, and dedicated public service.”

In the over 50 years since, UCI has made a name for itself, ranking as one of the top 10 public universities in the US and having an enrollment of more than 37,000 students!

Are you a prospective student interested in applying to UCI but want to know how to pay for your education? Here’s what you need to know.

A snapshot look at the University of California, Irvine

The University of California, Irvine, is one of the 10 University of California campuses. It is well-regarded, often named one of the “Public Ivies,” a select group of public universities that are known for their academic excellence.

The school is located in Irvine, California, and it enrolls more than 37,000 students. It offers bachelor’s degrees in 87 different subjects, master’s degrees in 84 subjects, and doctorates in 53 subjects!

Some of the courses of study available include the arts, biological sciences, business, education, engineering, humanities, information and computer sciences, and law.

UC Irvine offers many extracurricular programs, and the school is affiliated with NCAA Division I’s Big West Conference, meaning students can enjoy watching college sports while working on their degrees.

As a public school, UC Irvine is less expensive than other schools in the state for California residents, making it a great choice for Californians who want a high-quality education at a lower price.

Ranking: 36th nationally

Size: 37,103

Demographics: 53% female, 44% male

Tuition: $11,442 for in-state students, $41,196 for out-of-state students

Acceptance rate: 30%

Average GPA of accepted student: 3.91

Key dates and deadlines (2022):

Application: November 30

Financial aid deadlines: May 1

A look at scholarships offered by the University of California, Irvine

Scholarships are one of the best ways to pay for college. When you get a student loan, you have to repay that money. But scholarships are free money to use for school that you don’t usually have to pay back.

UCI’s Office of Financial Aid has a list of different scholarships that students may be eligible for. 72% of its students receive some amount of financial assistance, and 57% of its students pay no tuition! If you’re coming from a low-income family or fear that you won’t be able to afford tuition, it’s still worth applying to UCI. There’s a good chance that you could get a need-based award. Earning merit-based scholarships on top of that can make your education even cheaper.

There is a single form that each UCI student can fill out to apply for scholarships. The form asks for some information about you, your background, any employment and academic experience you have, and any outside scholarships you’ve earned.

You also have to answer some short-answer questions. These cover things like your education and professional goals and ask you to discuss challenges you’ve faced and other aspects of your life. Keep in mind that these essays are your best chance to get your personality across and connect with the people making scholarship decisions. Take the time to write down good responses to these short-answer and essay questions to boost your chances of getting an award.

Outside of UC Irvine, you can apply for scholarships from other organizations. Many community groups and local businesses have scholarship programs that students can apply for. There are scholarships for almost everything you can think of.

For more on which scholarships you can apply for and how Mos can help, check out our financial aid tips and tricks.

Student loans

If you can’t afford to pay for college out of pocket and the scholarships and grants you earn don’t cover the full cost of your education, your next best bet is to look for student loans. Borrowing money to pay for your education is one way to invest in yourself—just be ready to pay back the money, plus interest.

UC Irvine’s financial aid office has a webpage dedicated to the different loans available to students.

One of the best loan programs available is the Federal Direct Loan program. These loans come directly from the US government and can be either subsidized or unsubsidized.

Subsidized loans don't build up interest while you’re in school. Unsubsidized loans start building up interest right after you receive the loan. Both types of federal loans are eligible for federal loan programs like income-based repayment.

There are also special California resident loan programs, such as the California Dream loan. If you don’t receive enough funding from federal aid or state loan programs, there are many private student loan lenders out there. These banks and other lenders can help you cover the remaining cost of school.

However, before you work with a private lender, keep in mind that private student loans are generally more expensive than government student loans. They also don’t qualify for the same perks, like income-based repayment or loan forgiveness.

It’s usually a good idea to max out government loans before turning to private student loans. And before you take out any loans, Mos can help you get as much free money for college as possible by helping you apply for financial aid, grants, and scholarships—all in one place.

FAFSA

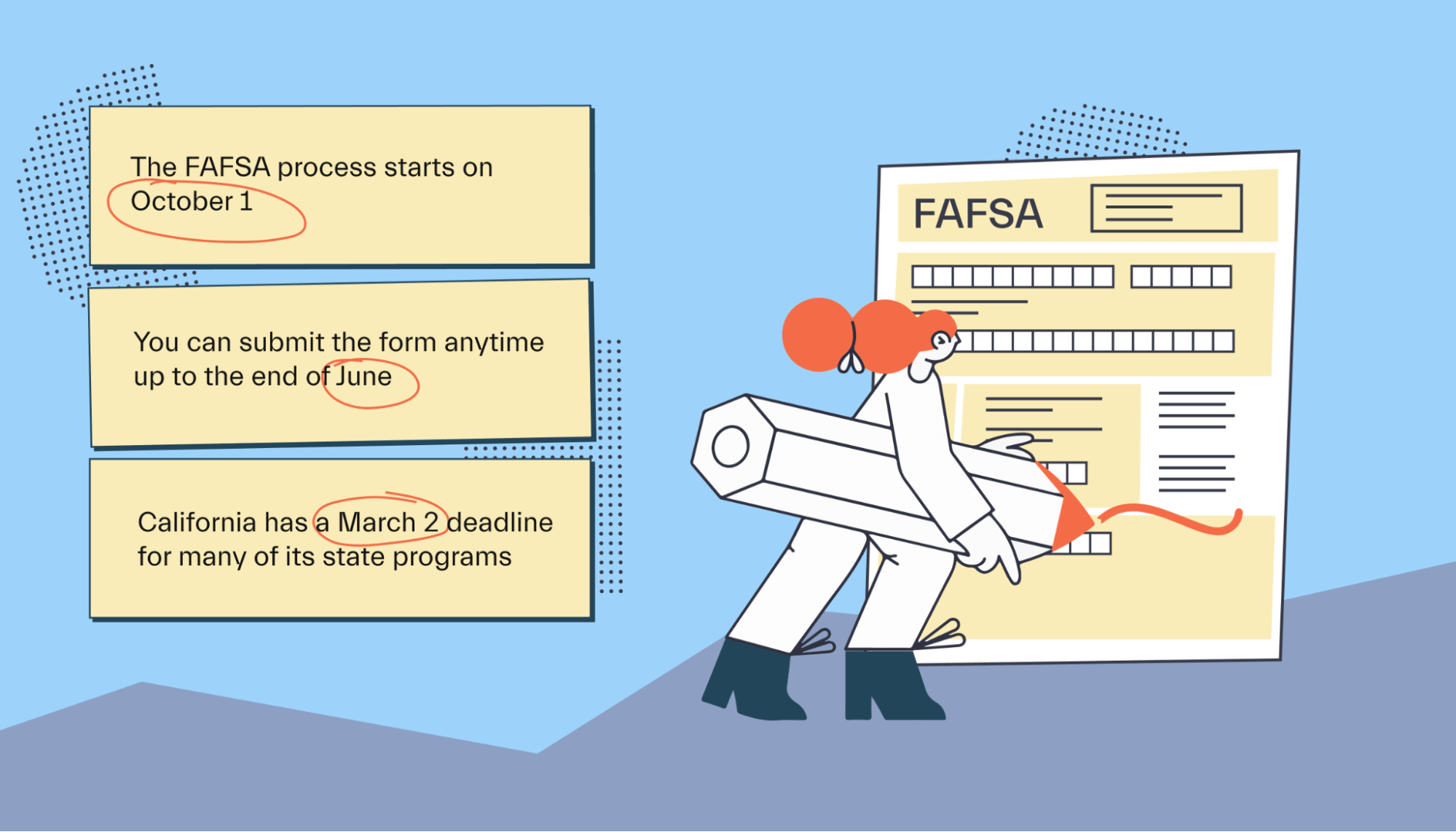

Every student should fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is a universal financial aid application that you use to qualify for federal grant programs, UCI scholarships, and other financial assistance programs.

When you fill out the FAFSA, you and your parents will all have to provide some financial information, such as how much you have saved for college and your family income. The government uses the information you provide to determine your expected family contribution (EFC) to the cost of your college education.

The government and most schools, including UC Irvine, use this information to decide how much need-based financial aid you’ll receive. This includes scholarship programs and grant aid like the Pell Grant. Your eligibility for federal financial aid, like subsidized and unsubsidized loans, also depends on your FAFSA.

Schools don’t use the information in the FAFSA against applicants, so you won’t hurt your chances of admission by filling it out.

The FAFSA process starts on October 1 for financial aid awarded during the next academic year. You can submit the form anytime up to the end of June of the year you actually attend school.

However, California has a March 2 deadline for many of its state programs. You should generally aim to fill out the FAFSA as soon as you can.

For more on applying for FAFSA, including important dates and how to make sure your application is successful, get help from a Mos advisor.

University of California, Irvine financial aid FAQs

These are some of the most frequently asked questions about financial aid at UCI.

What is the University of California, Irvine’s cost of attendance?

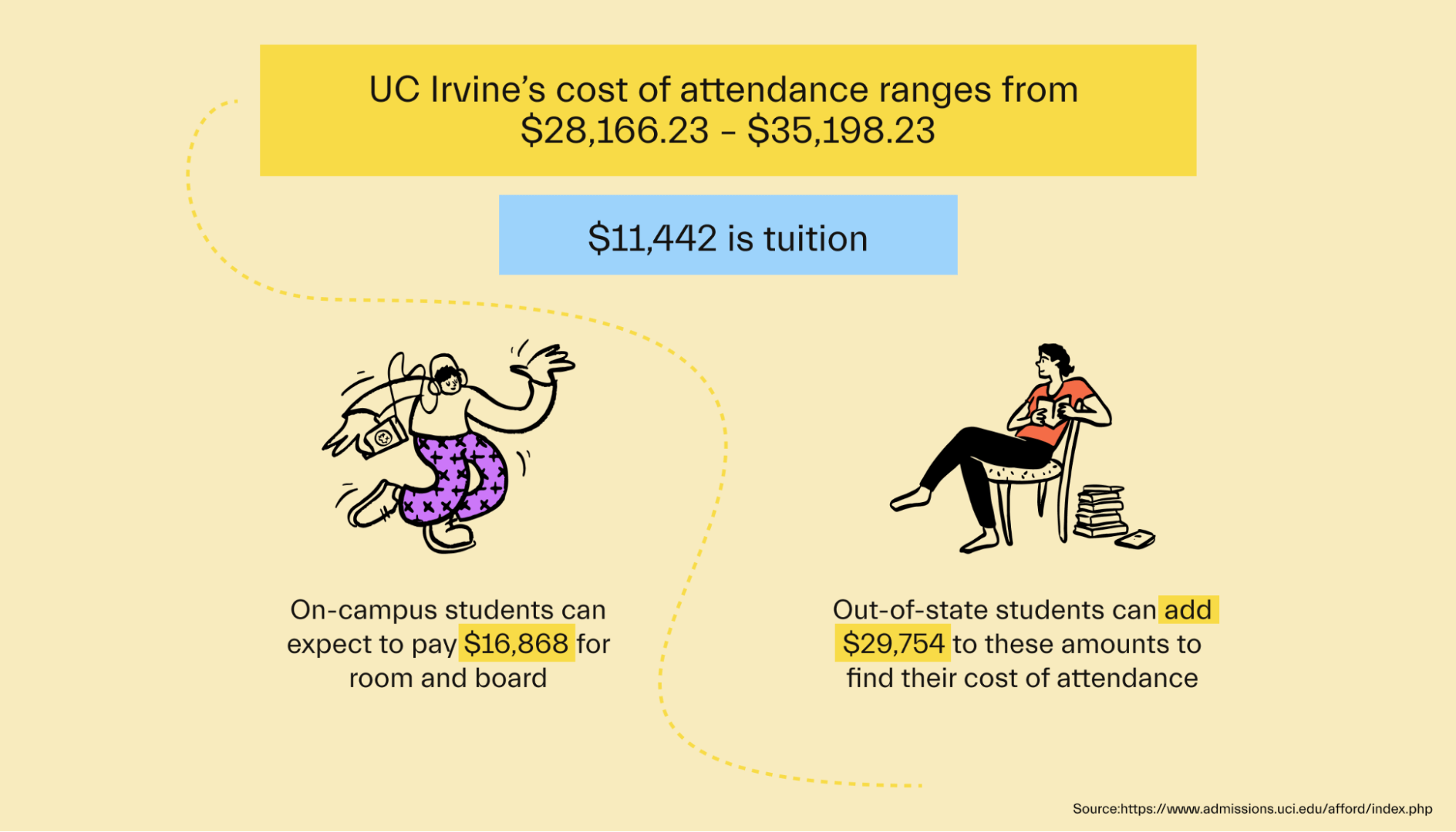

UC Irvine’s cost of attendance ranges from $28,166.23–$35,198.23, depending on whether you live at home or choose to live on campus.

Of this cost of attendance, $11,442 is tuition. On-campus students can expect to pay $16,868 for room and board.

Out-of-state students can add $29,754 to these amounts to find their cost of attendance.

How many students pay no tuition at UCI?

UC Irvine claims that 57% of its students qualify for enough aid to cover their full cost of tuition.

Can out-of-state students receive financial aid?

UC Irvine is a California state school, but out-of-state students can still qualify for financial aid. However, they won’t be eligible for state-specific programs like the California Dream loan program.

Are there financial aid eligibility requirements?

Eligibility requirements vary by financial aid program. For example, to qualify for Cal Grants, applicants must display financial need. The UCI Middle Class Scholarship requires a family income and assets of less than $184,000.

Can international students receive financial aid funds from UCI?

International students won’t be eligible for some forms of financial aid, particularly US government aid like grants and loans. However, UC Irvine’s financial aid office notes that you may qualify for other types of aid and that all graduate students can receive fellowship funding.

When will I know my financial aid award amount?

Returning undergraduate students will receive information about their financial aid offers in mid-July, 2 months before the deadline to pay their tuition bill. This will give them time to accept their financial aid and find a way to pay the remaining balance.

Are education loans a good idea?

Getting an education loan, especially from the federal government, can be a good way to invest in yourself. Federal loans offer many protections, such as income-based repayment plans, which can make them easier to deal with after school.

However, before turning to education loans, try to earn scholarships and other forms of aid that you don’t have to repay.

Universities like the University of California, Irvine that you might be interested in

If you’re not sure whether the University of California, Irvine is right for you, these other schools might fit the bill.

California State University

If you like the idea of attending a state school but don’t think UC Irvine is right for you, there are plenty of other public schools in the state.

The California State University system has almost 500,000 students pursuing degrees in dozens of subjects. CSU has campuses located in cities like San Jose, Chico, San Francisco, Sacramento, Long Beach, and Los Angeles.

California Institute of Technology

If you’re a high achiever, you might be interested in the California Institute of Technology, also known as Caltech. Caltech is a private research school in Pasadena.

Caltech has 1,000 undergraduate students and 1,300 graduate students working alongside 300 faculty members. The school emphasizes engineering and science, and it boasts more than 76 Nobel laureates who have been connected to the school.

Cal Poly Pomona

Cal Poly Pomona is one of the world’s top polytechnic universities. The school has almost 24,000 students who are studying applied sciences such as civil engineering, electrical engineering, and mechanical engineering.

It has built a reputation as one of the top technical schools in the western US and one of the most innovative schools in the country!

Conclusion

University of California, Irvine is one of the best-known schools in California.

It provides a world-class education, and many students are able to graduate without being burdened by expensive student debt. If you can qualify for assistance, there’s a chance you might not have to pay any tuition at all.

If you’re looking for the best way to pay for higher education, Mos can help.

If you’re looking for the best way to pay for higher education, Mos can help.

With Mos, you can get help negotiating for more financial aid, applying for hundreds of scholarships and grants with ease, and writing scholarship essays to help you earn extra funding to pay for tuition.

To get started, check out Mos.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you