Financial aid •

Princeton financial aid: a complete guide

Read all about financial aid at Princeton, including scholarships, loans, and grants.

Located in Princeton, New Jersey, Princeton is one of the oldest schools in the United States, having been founded in 1746 as the College of New Jersey. It’s a small school with just over 5,200 students enrolled in the undergraduate program and just under 3,000 graduate students.

With a 5:1 student to faculty ratio and 27 Nobel prize winners on the school’s faculty and staff, students can expect a strong learning experience at the school.

If you’re thinking about going to Princeton but want to know more about how you can pay for school, here’s what you need to know.

A snapshot look at Princeton

Princeton University is a member of the illustrious Ivy League, a group of the oldest and most respected universities in the United States. This status as one of the world’s top institutions for higher education has helped it become a leader in many different fields!

One thing that sets Princeton apart from many other schools, including other Ivies, is its unique financial aid policy. Princeton offers large grants that meet 100% of a student’s financial needs. This lets students spend more time focusing on their studies and less time worrying about finances.

Students at Princeton can choose from dozens of different areas of study, including architecture, the classics, chemistry, engineering, dance, economics, entrepreneurship, history, music, philosophy, politics, theater, and more.

Outside of their classes, Princeton students can get involved in a vibrant campus life. Princeton emphasizes the value of the connections that students make at school and maintains a strong alumni network.

Princeton has one of the largest athletic programs in the Ivy League, with roughly 18% of students participating in varsity sports across 37 teams. Students who don’t play sports can attend games and cheer on their classmates or get involved in the school’s more than 300 student organizations.

Ranking: 1st nationally

Size: 4,773 undergraduate students

Demographics: 50% male, 50% female

Tuition: $57,690

Acceptance rate: 6%

Average GPA of accepted student: 3.9

Key dates and deadlines (2022):

Application: January 1

Financial aid deadlines: February 1

A look at scholarships offered by Princeton

Applying for scholarships is one of the best things you can do to help you pay for college! Scholarships are essentially free money you can use to pay for your education. Unlike loans, you don’t have to worry about paying them back after you graduate.

Princeton is a bit different from other universities when it comes to awarding scholarships and other aid.

One important thing to note is that Princeton’s admissions process is need-blind for all students, including international students. What that means is that your level of financial need won’t have any impact on your chances of getting into the school!

When it comes to awarding aid, Princeton doesn’t offer any merit-based scholarships or grants. Instead, all aid is awarded based solely on the student’s financial need.

Princeton puts in significant effort to look at a student’s financial situation and considers unique circumstances to determine how much aid it offers. The school commits to meeting 100% of its students’ financial needs.

The school publishes average grant income to students based on their family income. Those whose families make less than $65,000 per year receive enough to cover full tuition, room, and board. Even students whose families make $200,000 or more receive an average of more than $37,000 in aid.

While Princeton’s financial aid for students is generous, you shouldn’t stop there when it comes to looking for scholarships to pay for school. There are many scholarship programs administered by local businesses, community organizations, and other groups. These scholarships can award hundreds or thousands of dollars that you can put toward your education.

If you look carefully, you can find scholarships for just about anything you can think of—from eating vegetarian to getting migraines!

Ready to get started applying for scholarships? Get started with Mos today to apply for a large batch of scholarships in one go, or get 1:1 assistance from a private advisor.

Quit leaving money behind.

Student loans

If you still need some help paying for school after you get your scholarship and grant aid, your next best bet is to get a student loan.

Student loans are a way to invest in yourself by paying for your education. However, you’ll have to be ready to pay back the money that you borrow, plus interest.

Princeton’s financial aid website has information about student loan options, including loans that it offers directly to students.

For most students, the best loan program available is the Federal Direct Loan Program. These loans come directly from the United States government. There are 2 types of Federal Direct loans: subsidized and unsubsidized.

Subsidized loans are the better of the two! The government subsidizes these loans by paying the interest on them while you’re still in school. That means interest won’t build up until after you leave college.

Unsubsidized loans start to build up interest immediately, meaning the loan balance will rise over time even while you’re still working on your degree.

Both types of loans are eligible for various government assistance programs. For example, federal student loan borrowers can choose to use an income-based repayment plan to determine their monthly payments based on how much money they make. These loans are also eligible for various loan forgiveness programs.

After you’ve maxed out your federal loans, you can turn to private student lenders if you still need money. These lenders are banks, credit unions, and other businesses that offer loans to college students.

The drawback of private loans is that they’re more expensive than Federal Direct loans. They have higher interest rates and fees, don’t have interest subsidies, and aren’t eligible for loan forgiveness.

Have more questions about student loans? Head over to our article on how student loans work.

FAFSA

When it comes to getting help with college costs, the most important thing for every student to do is fill out the Free Application for Federal Student Aid (FAFSA).

The FAFSA is a universal college aid application that is used by both the federal government and universities like Princeton. The information included on your FAFSA determines how much need-based financial aid you can receive.

When you complete the FAFSA, you’ll need to sit down with your parents and fill in some basic financial information. This includes things like your family’s income and how much money you’ve set aside for college.

The government uses your answers in a complicated formula to determine your family’s Expected Family Contribution (EFC) to the cost of your education. Your EFC determines the need-based aid and subsidized loans you receive.

Princeton aims to meet 100% of your financial need after accounting for things like federal Pell Grants and other aid, so filling out the FAFSA is essential! Princeton’s admissions process is need-blind, so filling out the FAFSA won’t hurt your chances of getting in even if you need a lot of aid.

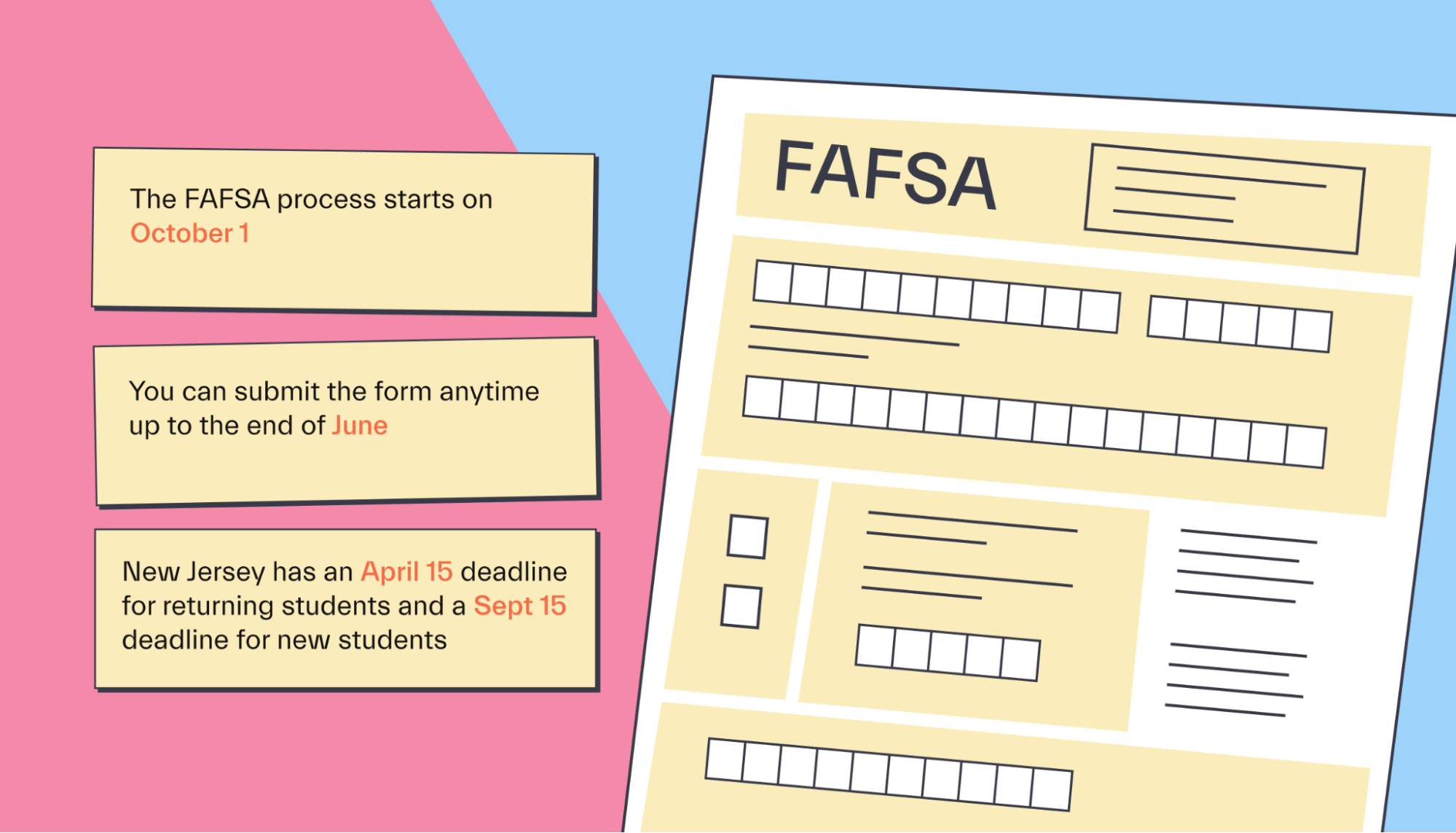

The FAFSA process begins on October 1 for aid awarded for the next academic year. But you can freely submit the form any time until the end of June the year you actually attend college.

For example, if you’re applying for aid for the 2022/20223 academic year, the first day you could have applied was October 1, 2021. The last day you can apply is June 1, 2023.

However, New Jersey has an April 15 deadline for some applicants, so you should submit the form as soon as you can!

For more about the FAFSA and when it’s due, check out our article that covers everything you need to know about the FAFSA.

Princeton financial aid FAQs

Let’s answer some of the most frequently asked questions about financial aid at Princeton.

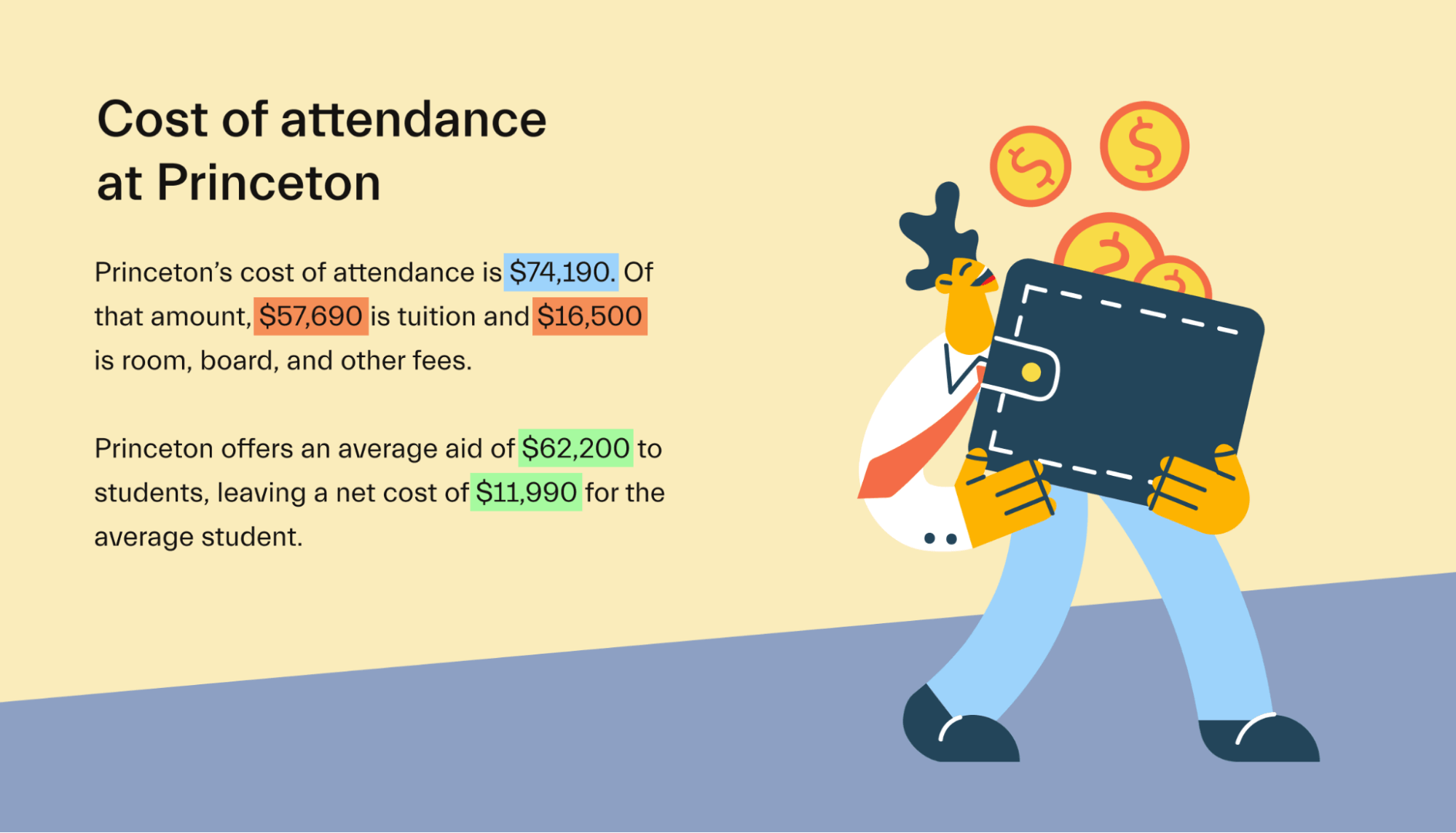

What is Princeton’s cost of attendance?

Princeton’s cost of attendance is $74,190. Of that amount, $57,690 is tuition, and $16,500 is room, board, and other fees. Princeton offers an average aid of $62,200 to students, leaving a net cost of $11,990 for the average student.

How many students pay no tuition at Princeton?

Princeton offers generous amounts of financial aid to its students. Students whose families make $65,000 or less qualify for enough aid to cover their entire tuition, room, and board costs. Even students whose families make up to $160,000 can receive enough aid to cover tuition, leaving them only to pay for a portion of room and board.

Can out-of-state students receive financial aid?

Yes, students from outside New Jersey can receive financial aid at Princeton. In fact, so can international students!

What is the cheapest Ivy League school?

Princeton is often considered the cheapest Ivy League school because of its generous financial aid. Harvard University also often proves to be quite affordable due to its financial assistance programs.

Universities like Princeton that you might be interested in

If you’re thinking about attending Princeton but aren’t completely sure it’s the right school for you, consider these alternatives.

Yale

Founded in 1701, Yale is another member of the Ivy League.

Yale is smaller than other Ivies, with just under 4,700 undergraduate students. If the relatively small size of Princeton’s student body appeals to you, Yale could be a good alternative!

Harvard University

Located in Cambridge, Massachusetts, Harvard University is one of the oldest members of the Ivy League and one of the oldest universities in the entire United States.

Harvard is well-known and respected across the globe and is home to more than 23,000 students. It boasts many important and influential people among its alumni network, including multiple presidents, senators, and Supreme Court justices.

Brown University

Founded in 1764, Brown is a world-renowned research university with a reputation for innovation and creativity. The school’s open curriculum lets students skip the core requirements required by many other schools and set their own course of study, making them the architect of their own education.

If you’re looking for an Ivy League school with a unique take on the college experience, Brown may be a good fit.

Conclusion

As a member of the prestigious Ivy League, Princeton provides a top-notch education with some of the most impressive faculty and facilities out there. If you can make it through the incredibly selective application process, the generous financial aid will help you earn a degree at a reasonable price.

Need help with all this financial aid stuff?

Connect with a private advisor today to find every dollar you qualify for. From scholarships to grants to loans, we’ll fight to lower your tuition.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you