Budgeting •

How to afford an apartment in college

Many students live in on-campus dorms, but having your own apartment can be freeing. Here’s how to afford an apartment in college.

College is a time of learning, exploration, and growth—and chances are, you’ll be spending a lot of time on campus. While most students live in dorm rooms, it can be a huge relief to have an off-campus apartment.

There’s a downside, though: Apartments typically cost significantly more than dorm rooms. If you’re wondering how to afford an apartment in college, you’re certainly not alone! Keep reading for our top tips to swing your own space.

Can I afford an apartment in college?

Before we get too far ahead of ourselves, let’s be realistic: Is an off-campus apartment actually affordable?

And what does “affordable” actually mean? There’s what seems affordable, what actually is affordable, and what your landlord considers affordable.

It’s time to do a bit of research. Here’s what to dig into—and what to ask yourself.

How much does an apartment cost compared to a dorm?

First things first: Look up dorm cost information at the school you plan to attend. It’s usually pretty easy to find this information—just Google “[your school] dorm room cost,” and you should find it!

Not sure where you’re going to school yet? You can look up average estimated prices in this report from the College Board.

Next, jot down the monthly cost for a dorm room. If the prices are only listed in terms, figure out the rough monthly cost by dividing the cost by the number of months per term. A semester is usually around 4 months long, while a quarter is usually around 2.5 months long.

Next, research average rent prices in your school’s area. You can use a search aggregator like Apartments.com or check sites like Craigslist. Jot down the average monthly rents in your area—and don’t forget to add the estimated costs of utility bills!

Utilities can easily add $100–$300—or more—to your monthly rent, depending on the area and which amenities are included in the price. Utilities are generally included in the price of a dorm room.

Now you’ll have the estimated costs for both a dorm room and an apartment, and you can compare the prices directly. An apartment will almost certainly be more expensive—but how much more expensive depends on many factors.

How much can I afford to spend?

This might seem like an obvious question, but it’s vital to consider. How much can you actually afford to spend on housing?

If you’re simply not sure, it’s a good time to start a budget for college. Begin with your total monthly income, and estimate all your monthly expenses. If you’re struggling to get started, use Mos’s handy college student budget templates.

Once you start adding up all your expenses, you may find that you don’t have as much for housing as you’d thought.

It’s also important to weigh your priorities. Would you rather have an apartment or more money for activities? Is having your own space worth the trade-off of having a tighter budget in other areas of your life?

It’s wise to give careful thought to these questions. What’s the point of having your own place if you can’t afford beer and tacos?

Can I meet rental income requirements?

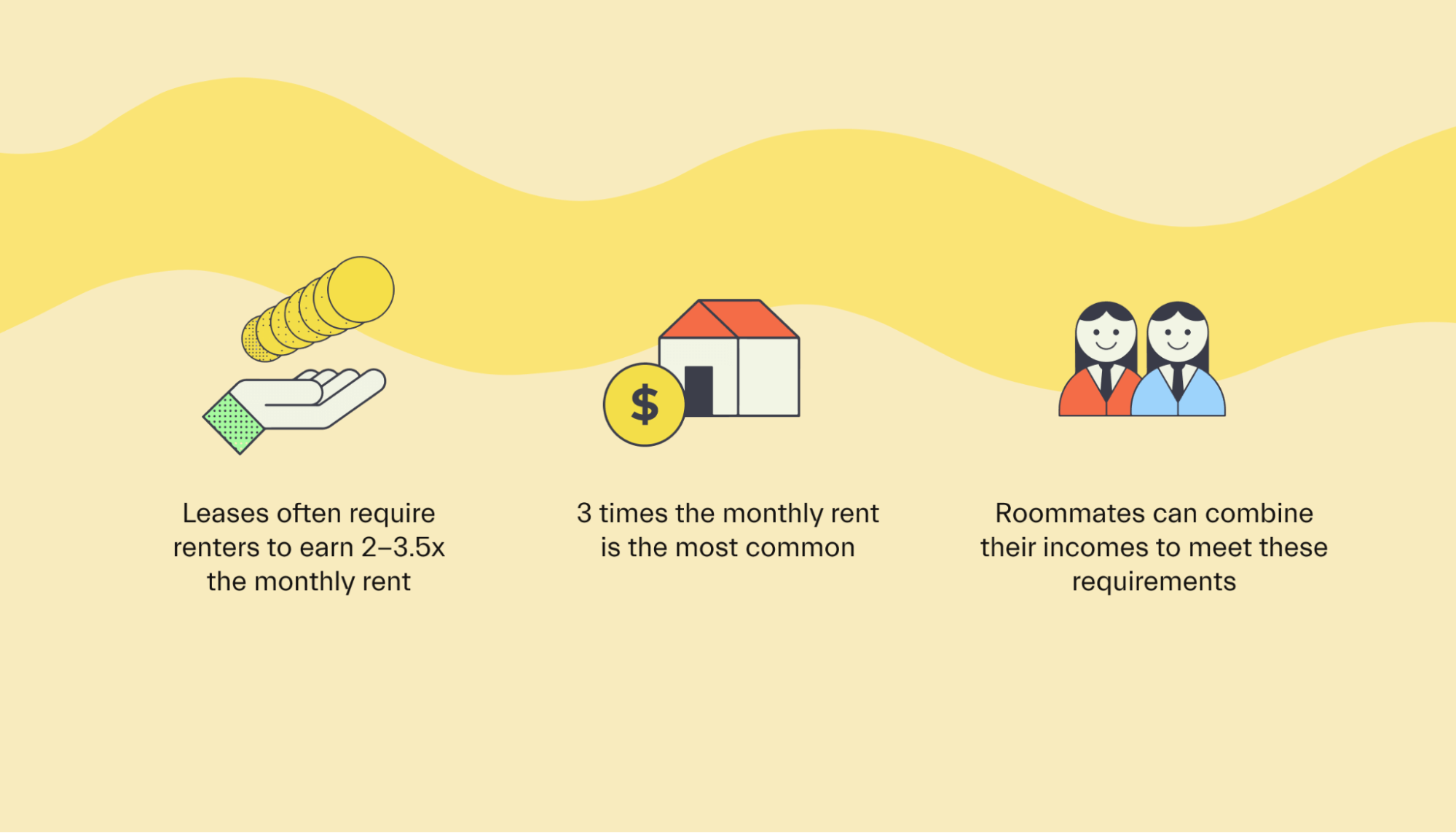

There’s a big gotcha when it comes to renting an apartment. To qualify, you’ll have to meet certain income-related requirements. The landlord will want to know that you can afford the rent based on the apartment’s internal requirements.

In most cases, landlords require that a tenant or tenants make 2–3.5x the monthly rent. 3x is the most common.

So, if an apartment rents for $1,200 a month, the landlord might require that you earn at least $3,600 per month.

For students, that can be a tough ask. Financial aid money is generally not considered income by landlords, although it might be if you have money left over after paying for school-related expenses.

Fortunately, roommates can combine their incomes to meet these requirements. So, if you earn $2,000 a month and your friend earns $1,600, your combined income will meet the $3,600 rental income requirement.

These requirements vary, but they are often included in the property rental listing. If not, you can look up the rental agency that manages the property to see their terms or contact the landlord for details.

In some cases, landlords might work with students who have limited income—as long as they can prove they can afford the rent. For instance, a landlord might be more flexible if you have a parent who is willing to co-sign the lease agreement.

How to afford an apartment in college

Alright, so you’ve done the math and considered the relevant factors. How do you actually afford an apartment as a college student? These tips will help.

1. Rent with roommates

Okay—Captain Obvious here, we know. But renting with roommates can dramatically reduce your housing costs. In fact, splitting an apartment with just 1 roommate can, in some cases, be cheaper than 2 people sharing a dorm room.

In many cases, the more roommates you live with, the more you’ll save. For instance, renting a 4-bedroom house with 3 other roommates will often be cheaper per person than the 4 of you renting 2 apartments.

Don’t have specific roommates in mind? Plenty of students advertise “Roommate Wanted” ads on Craigslist, Facebook Marketplace, and other platforms. Finding someone you click with is always hit-or-miss, but the savings can be worth it.

Roommates help to both bring down housing costs and meet those pesky rental income requirements (see above). They’re a win-win!

2. Explore alternative living situations

For most folks, wanting an apartment in college really just means not wanting to live in a college dorm. So how about a tiny house, an above-garage apartment, or a mother-in-law unit?

Not weird enough for you? Try the hippie commune down the street, or live on a goat farm!

All jokes aside, there are plenty of alternative living situations that can be more affordable than apartments. Even renting a private room in someone else’s house can be more private than living in a dorm. You can check out Craigslist and other sites for opportunities in your area. And don’t be afraid to ask for student discounts!

3. Make room in your budget

Back to that budget we were talking about.

There’s not often a lot of wiggle room in a student’s monthly budget. But if you’re trying to afford an apartment, it’s time to find some.

This could mean cutting back on optional spending, like entertainment and eating out. Or it could mean looking for “big wins,” like eliminating car payments and other costly expenses. Can you go car-free and use public transit? Or can you take other steps to free up space in your budget?

As with so many things in life, affording an apartment in college often involves some trade-offs. The specifics are up to you.

4. Look for work exchange opportunities

You might be able to trade some labor for reduced—or even free—rent, depending on the situation. Here are some ideas:

Many apartment complexes hire live-in managers who help to fix minor problems, collect rents, and keep an eye on things.

Farms often hire seasonal laborers and provide them with free housing.

Some households might be willing to provide housing in exchange for childcare or other help around the house.

WWOOF is a platform that lets you work on an organic farm in exchange for free housing and food.

Workaway is a platform that lets you trade labor in various forms for free housing and (sometimes) food.

The possibilities are endless! If you don’t see advertised opportunities, it never hurts to ask. If you can prove you’re responsible and a hard worker, you can luck into some great situations.

5. Take on a side gig

Boosting your income is another way to afford an apartment. That could mean getting a part-time job or working more hours at your current gig—or it might mean looking for a side gig.

Side gigs are generally perfect for students because the required hours are often flexible. Jobs in the gig economy are ideal, as you can usually pick up “shifts” whenever you find yourself with free time.

Driving for Uber or Lyft is a classic example, but there are dozens of other great side gig opportunities. A few ideas include:

Dog walking

Tutoring fellow students

Delivering food with Doordash or UberEats

Being a rideshare driver

Freelance writing or designing

Doing odd jobs for neighbors or fellow students

Catering on weekends

You can research side gigs online or stop by your campus resource office to see if they have any ideas.

6. Use student loans to pay for rent

Student loans are designed to pay for school—including your housing. In some cases, it might be feasible to take out a bit more in loans to afford an apartment of your own.

This approach is totally above-board and legal, but it’s not without its downsides. The most obvious is that you’ll be taking on more debt than you need to, which is never ideal.

There’s also the long-term effect of interest, which is important to grasp ahead of time. If you’re renting for $1,200 per month but using loans to pay for it, you’ll end up paying significantly more in the long run.

In most cases, if you need to rely on loans to pay for rent, it’s best to stick to the cheapest possible option (read: a dorm room).

If you’ve maxed out the financial aid you qualified for, private student loans may also be an option. These, too, can be used for living expenses—but they tend to have higher APRs than federal loans. Plus, you’ll usually need a solid income and a good credit score to qualify for them.

Optimize your student finances

If you’re springing for an off-campus apartment, you’ll likely need to streamline the rest of your finances to make ends meet.

This might mean ensuring you’re applying for as many scholarships as possible, or it might mean reducing your spending in other categories.

Need a hand with the financial aid stuff? Mos gets you an expert’s help with FAFSA, grants, scholarships, and more. Connect with your advisor today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you