Financial aid •

April 1, 2022

Financial aid for international students: the ultimate guide

Learn what financial aid programs are available for international students in the US and what alternatives you have beyond state and school programs.

Many students come to the United States to attend the world-class colleges and universities in the country. Just like American students, if you’re coming from abroad, you need to think about how you’ll pay tuition, fees, and living expenses.

The financial aid available to international students differs from the aid available to students from the US. Understanding the unique situation that international students face and how to get the most financial aid possible is essential to being able to pay for college.

Let’s dive into the specifics.

Costs to consider

One of the first things to think about when trying to figure out how you’ll pay for school is how much your education will actually cost.

Tuition, supplies, housing, and student fees are common costs that every student has to think about. The schools you’re thinking about attending should publish a cost of attendance outlining the amount that students can expect to pay for different things.

As if that’s not expensive enough, you also have other costs to consider. On top of typical college expenses, international students must consider things like travel, language tests, and more.

For example, many American colleges require that students from non-English-speaking countries take the Test of English as a Foreign Language (TOEFL). This ensures that students understand the language enough to benefit from the education they’ll receive.

The TOEFL can cost 100s of dollars, and you may need to take it multiple times, so you’ll have to be ready to pay the testing fees.

International students also have to pay costs related to getting to the school they plan to attend. Overseas travel can be expensive, so this can be a hefty cost. You’ll also have to apply for a student visa so that you can remain in the United States for long enough to finish your schooling.

Once you’re in the United States, you’ll probably want to see more than just the city or town your college is located in. That means budgeting for travel around the US, whether it’s just for a weekend or if you choose to take advantage of longer vacations like Spring Break.

You also have to consider medical care and insurance. Many colleges offer medical insurance for students, but you have to pay the premiums to purchase the coverage. Many students from the US can avoid this cost by staying on their parents’ coverage, making this another cost that is relatively unique to international students.

How to get aid for college

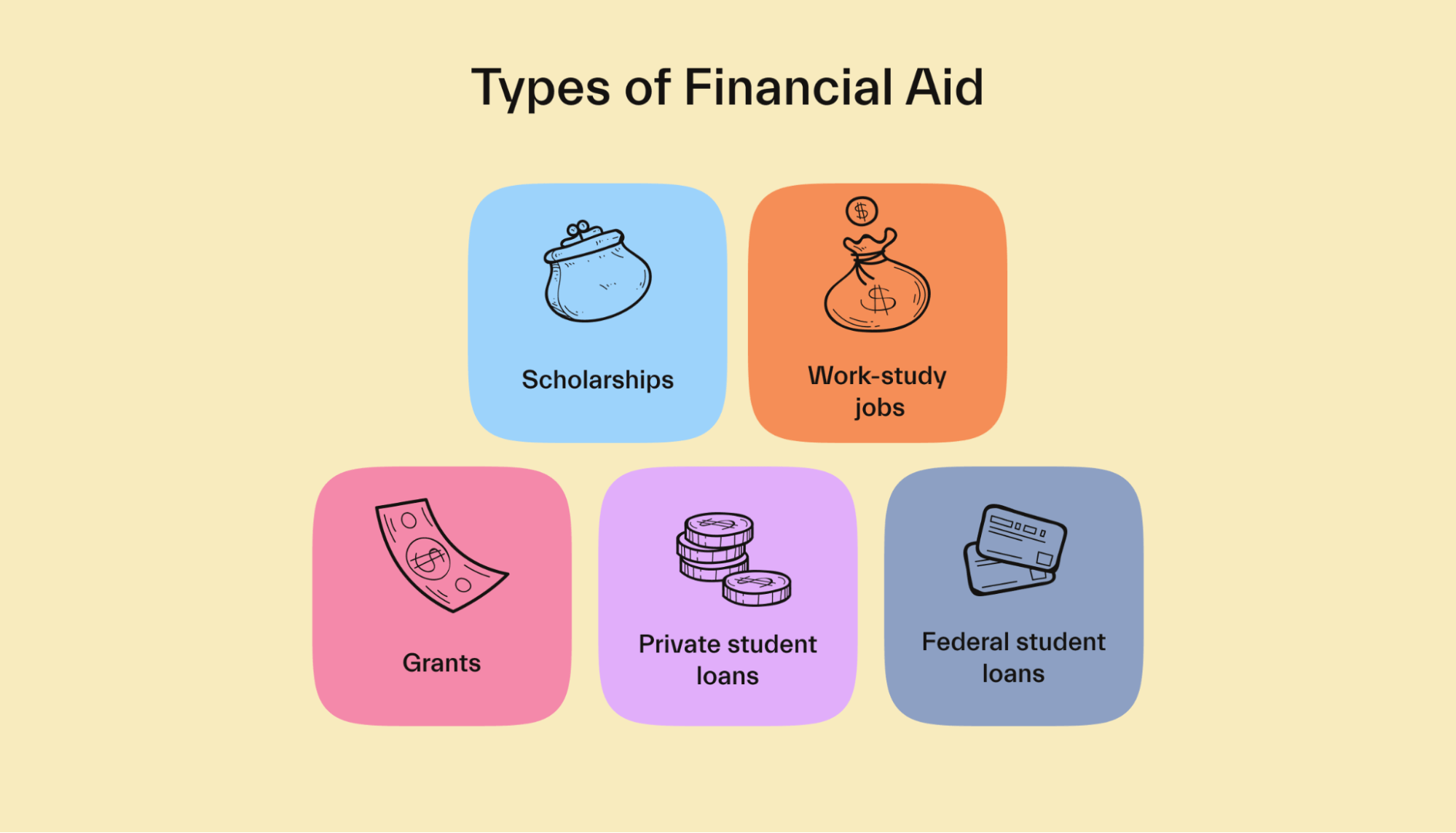

There’s no question that college is expensive. Many students rely on financial aid to help them pay for their education. International students don’t have all of the same options as American students when it comes to getting aid, but that doesn’t mean you’ll be left on your own.

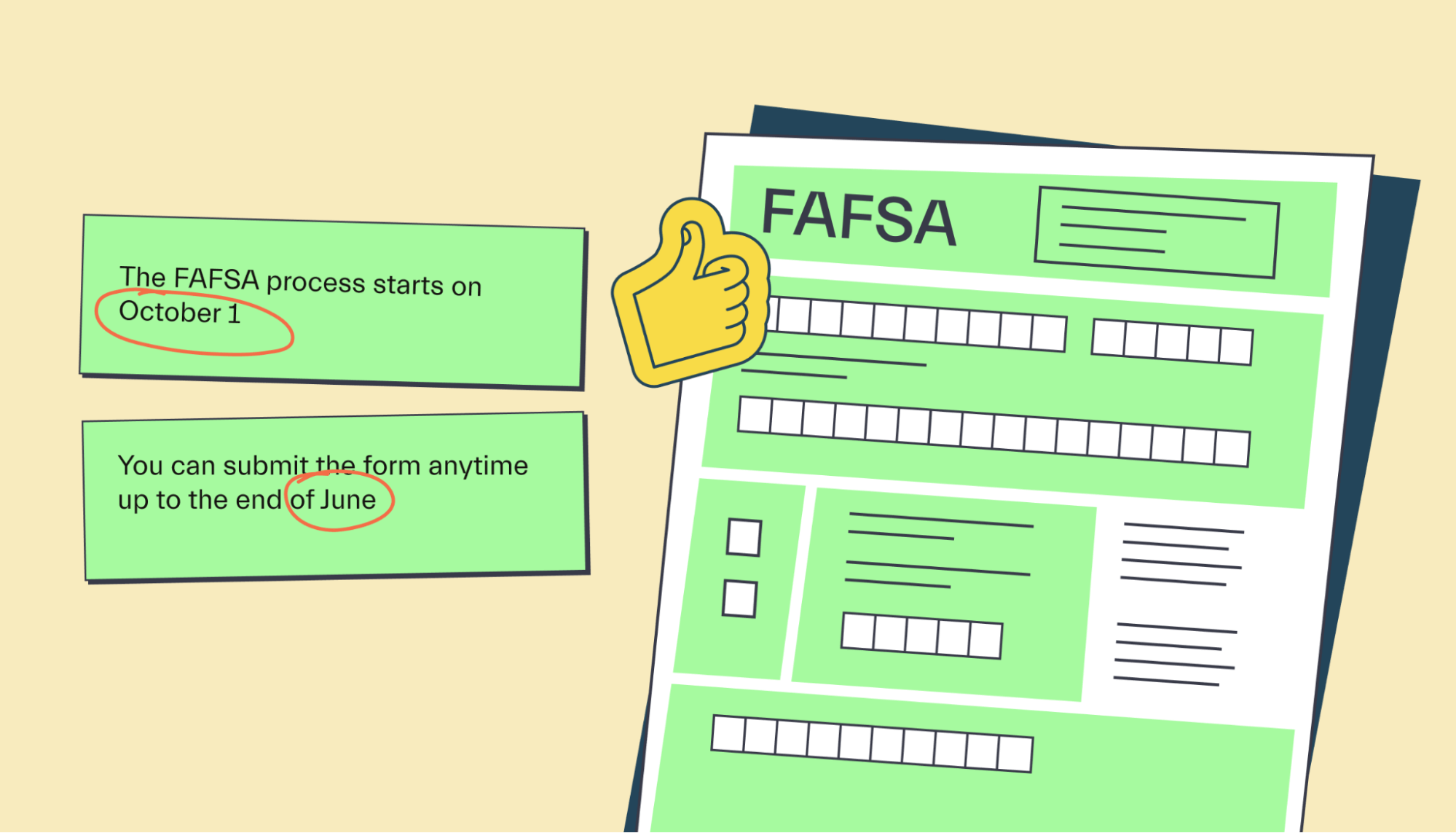

FAFSA

The Free Application for Federal Student Aid (FAFSA) is a universal financial aid application used by states, the federal government, and schools to make decisions about how much financial aid to award to students.

To get the bad news out of the way, international students are not eligible for federal financial aid. That means that filing the FAFSA won’t help you get federal grant money or subsidized student loans.

The good news is that just because you won’t receive federal aid doesn’t mean that you won’t get anything from filing the FAFSA—some schools require it to check your eligibility for school or state scholarships.

Because you won’t have a Social Security number, you’ll have to print the form and file it by mail instead of filing it online. It’s worth the effort because international students can still receive other forms of aid by filing the form.

You can also fill out the International Student Financial Aid Application (ISFAA), a special form for international students. You can check with your school to see which forms it prefers.

The deadline to submit the FAFSA is June 30 of the summer after the school year ends. So, if you’re applying for aid for the 2022-2023 school year, you can submit the form anytime through June 30, 2023.

However, you’ll want to submit the FAFSA as soon as you possibly can. Many state and school aid programs have earlier deadlines and provide aid on a first-come, first-served basis. That means filing sooner increases your chances of getting money!

Aid from colleges

Another major source of financial aid is the school that you choose to attend. Many colleges and universities offer scholarships and grants based on need, academic merit, and athletic merit.

The bad news for international students is that many schools reserve most of their aid for American students, offering only limited aid to international students. However, that doesn’t mean you won’t get any support.

One of the best places to look for funding opportunities is your school’s financial aid website. Many schools maintain lists of scholarship and grant opportunities. Some even have a convenient online portal. There, you can search for programs you’re eligible for and submit an application quickly and easily.

You can also reach out to the financial aid office directly to ask about funding opportunities for international students. You might have more luck if you can demonstrate a financial need or have a strong academic record or other unique skills.

Another potential source of aid is your department at your college. For example, if you choose to study chemistry in college, you can reach out to the chemistry department or College of Science at your school directly. They may have some funds available to offer assistance if you can demonstrate a need.

Graduate student financial aid

If you’re planning to attend graduate school in the United States, your options for financial aid are better than they are for undergraduate students. Many schools reserve a significant amount of their aid for international students for those in grad school.

This aid typically comes in the form of assistantships and fellowships. These can be simple monetary awards like scholarships or a form of compensation for work that you do helping professors in their undergraduate classes.

These forms of aid can cover your tuition and fees and help with other costs like covering rent and food. That makes them an essential source of funding for international graduate students.

Scholarships

The best way for any student to cover the cost of college is with a scholarship. Scholarships are “free money” you can use to pay tuition and fees that you don’t have to pay back.

There are many merit-based scholarships out there that give promising students or people with skills in athletics and other fields financial aid for school. There are also more unique scholarships out there that focus on special interests or helping specific groups of people, like first-generation college students, afford school.

International students might have more limited scholarship options than American students, but there are still plenty of opportunities out there. You can qualify based on your grades, sports, hobbies, volunteering, and more.

Most scholarships require that you fill out an application and send it in. You might also have to attach additional material like an essay, questionnaire, or video. This takes a bit of time but is well worth the effort.

Even small scholarships are worth applying for. Even if an opportunity only offers $100 or $200 for school, if you win a few of those awards, it can put a big dent in your college tuition bill.

Unfortunately, because there are so many people looking for help with paying for school, that means that scammers have targeted scholarship hunters. When you’re applying for scholarships, make sure to be on the lookout for scams. You should never have to pay an application fee to try to win a scholarship. Do your due diligence to make sure scholarship opportunities are legit.

Or if you want to apply to 1000s of scholarships with one application and complete peace of mind that they’re all legit, try the Mos app. It gives you access to the largest scholarship pool in North America, including many aid opportunities for international students.

Another good source for finding good scholarship opportunities is IEFA.org. This site has a list of scholarship and loan opportunities that you can filter to find opportunities you’re eligible for.

Aid from your home country

Some of the top-rated schools in the world are located in the United States. An education from a school like Harvard, Stanford, MIT, or Caltech holds cachet in any country!

A highly educated populace is important for countries that want to succeed in the future. That leads many governments to offer financial aid to students who want to pursue higher education. In the US, that takes the form of federal grants and loans for American students. Depending on where you’re from, your local government may offer financial aid, even if you’re choosing to travel to the United States for your education.

The available aid will vary significantly based on your home country. For example, the United Kingdom offers loans to some students who pursue higher education. Saudi Arabia offers full scholarships to some students who choose to attend American universities.

Keep in mind that some of these programs come with additional requirements. Your home government is making an investment in you as a student, so it may expect you to repay some of the costs after you graduate or might mandate that you return home for a minimum period after earning your degree.

The best way to learn about these kinds of funding opportunities is to check your local government’s website. Many countries have student aid websites that outline the different programs that exist. They will cover which, if any, assistance is available for students who choose to travel abroad for their degree.

Student loans

One of the most common sources of funding for students in the United States is student loans. These loans can come from the state or federal government as well as private lenders. By the time the average student graduates, they have more than $37,000 in student debt.

International students aren’t eligible for federal student loan programs and generally won’t be able to get loans from state governments either. That means that you’ll have to turn to private student loans if you want to borrow money to pay for school.

Borrowing money can be a bit more difficult if you aren’t an American student. The majority of private student lenders only offer loans to American citizens and residents. Students visiting on a student visa aren’t eligible.

To get around this restriction, you could try applying with an eligible cosigner. Cosigning on a loan means taking responsibility for the loan if the borrower fails to make payments, which means you’ll need a cosigner that has significant trust in you. If you have family in the US, this can work, but finding a cosigner is otherwise hard.

Some lenders will allow international students to apply without a cosigner, but these lenders may charge higher fees and interest rates.

You can also look for lenders in your home country who offer student loans. It’ll likely be easier to qualify for a loan in your home country, but the rates and terms of these loans will be different from loans in the United States.

Before you apply for student loans, consider the long-term impact of borrowing money to pay for school. You’ll have to pay back whatever you borrow, plus interest. Some loans let you defer payments until you leave school, but others demand partial payments immediately, meaning you’ll need a plan to start making those payments.

You also have to consider whether the debt burden is worth the education you’re receiving. If you’re attending a top school in the US, going into debt could be worth it. Otherwise, you might wind up with significant debt that you have trouble repaying.

Conclusion

International students don’t get access to all of the same financial aid that American students can receive. However, that doesn’t mean that help isn’t out there! Scholarships, grants, student loans, and other sources of funding can help you afford the cost of higher education in the United States.

With Mos, you get access to the largest scholarship pool in America. Read more about how we can help make your financial life easier on our website.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you