FAFSA •

March 24, 2023

FAFSA vs. CSS Profile: What's the difference?

The FAFSA and the CSS Profile help pay for college—but they have plenty of differences. Learn how these aid applications compare and which to fill out.

Whether in college or preparing to attend soon, you’ve probably heard of the Free Application for Federal Student Aid or the FAFSA.

The FAFSA is, after all, the primary way to get financial aid from the government to help you pay for school.

But did you know there’s another way to get financial aid?

That’s right! It’s called the College Scholarship Service (CSS) Profile and is run by the College Board.

While having two ways to get financial aid is better than one, it makes everything a little more confusing. Which should you apply for? How does each work? How much aid do they offer?

Below, we’ll answer these and other common questions about the FAFSA and the CSS.

What is the FAFSA, and how do I apply?

The FAFSA is a form you submit to qualify for federal financial aid, such as student loans, grants, and work-study aid.

It gives the government and your chosen schools information about you and your family’s finances to calculate your ability to pay for college. Then, they weigh that against each school’s cost of attendance to figure out how much your aid package will be.

The FAFSA is the most popular way to pay—at least partially—for college. According to the Education Data Initiative, 66% of submit a FAFSA.

Let’s explain how to fill out and send off yours.

Determine your dependency status

Dependency status impacts whether your parents get involved in the FAFSA process. Most undergrad students are considered dependent, meaning your parents have to fill out their financial information. As a result, your aid amounts will be based on your income and assets and theirs.

All grad students and undergrads who meet certain special circumstances, such as being a military veteran, married, or older than 24, qualify for independent student status.

Create your FSA ID

Your FSA ID is a combination of your username and password that helps you save your FAFSA information and quickly log into an in-progress FAFSA.

Once you make your FSA ID, you can renew your FAFSA much faster each subsequent year you fill it out. You can also review your FAFSA whenever you want—if you need to make corrections, for example.

Your parents must make a separate FAFSA ID if you’re an independent student.

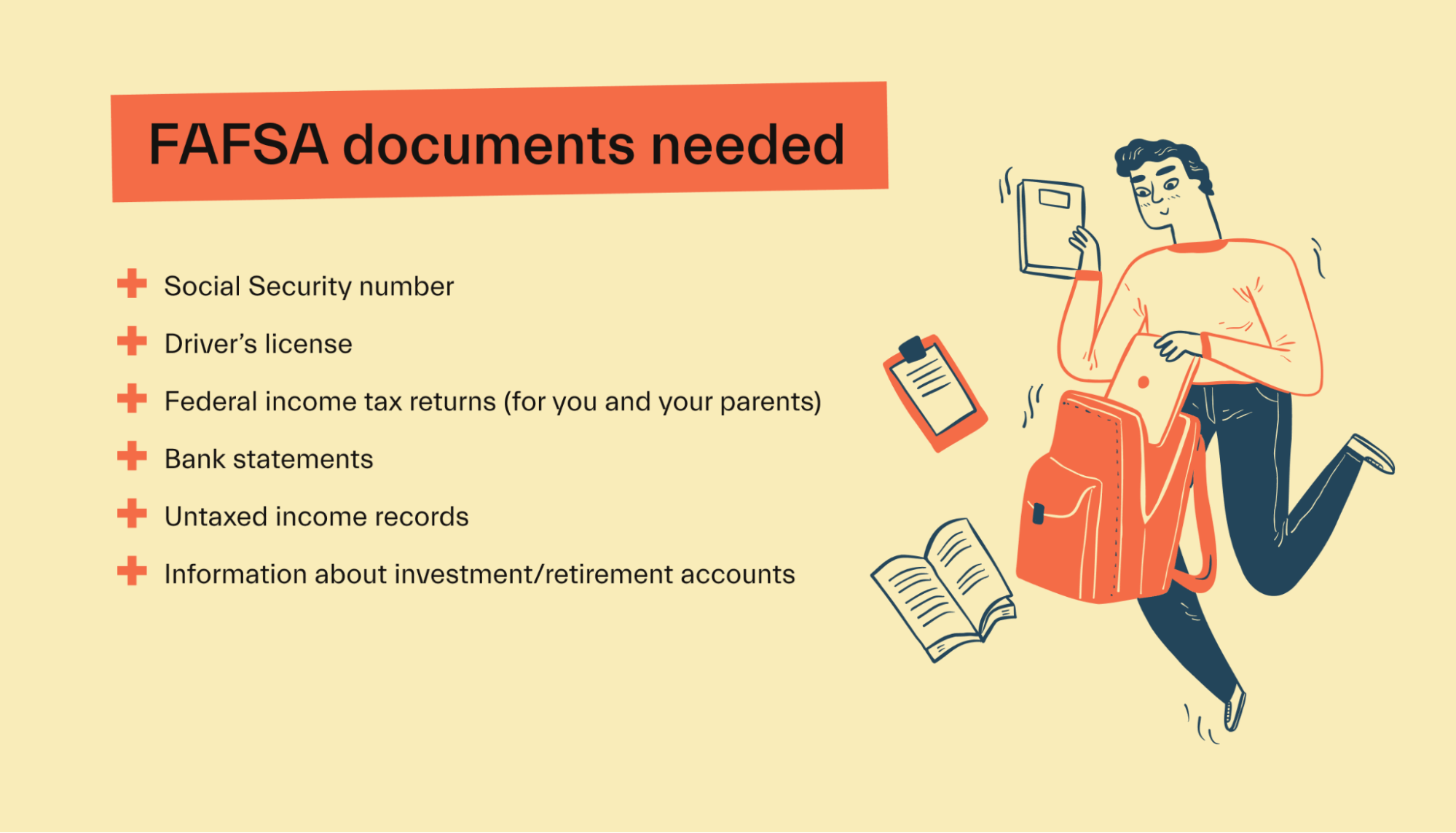

Gather your documents

The meat of the FAFSA is your personal and financial information—and your parents’ if you’re a dependent student.

Some documents you’ll need include:

Your Social Security number (SSN) or your alien registration number if you’re not a US citizen

Your driver’s license or another form of identification

Your own and your parents’ federal tax returns

Other income-related documents, such as your latest Form W-2

Records of any untaxed income, such as worker’s compensation—more information on this can be found on the Federal Student Aid website

Information about assets and accounts such as cash, bank account balances, and investments

Hold on to these documents somewhere safe, and keep them all together. This will make renewals faster since you won’t have to scramble to find them each year.

Fill out your personal and financial information

With your documents in front of you, you’ll fill out your information in the correct places. Answer each question, and take your time to avoid missing questions or selecting incorrect options.

Thanks to their separate FSA ID login, your parents can do their section separately, even if you’re already away at school.

This shouldn’t take you more than an hour.

Renewing the FAFSA next year should be even faster since it has several tools that pull in past years’ information.

Sign and submit the FAFSA

Give your FAFSA a once- or twice-over to ensure you didn’t make any errors or miss any boxes.

After that, sign and submit it. Signing electronically is the easiest—just use your FSA ID to add your signature. Then, submit it, and it’ll go to the government electronically.

You can also sign the FAFSA by hand and mail it in. However, this takes longer to get to the government than electronic submissions, and paper FAFSAs also take longer to process.

If you’re dependent, your parents will also need to sign your FAFSA separately.

What is the College Scholarship Service Profile, and how do I apply?

The College Board is a non-profit that aims to expand higher education access. It does this through the SAT program, advanced placement courses that can help students get credit for college classes in high school, and the College Scholarship Services Profile.

Speaking of, the CSS Profile is the College Board’s way of connecting students to billions of grant and scholarship dollars. It has brought over $9 billion in aid dollars to students since November 2021.

Like the FAFSA, the CSS Profile asks for your personal and financial information to determine your eligibility. When you fill out the CSS Profile, the College Board sends this profile to all the colleges and scholarship programs you selected.

Here’s how to do your CSS Profile:

Create an account with the College Board

First, you must create an account with the College Board. Head to the College Board’s account creation page to get started.

After that, you can start making your CSS Profile by signing into your account on this page.

If you already took the SAT or an AP test, you may already have a College Board account. In that case, log back into your account and start the CSS Profile.

Gather your documents

The CSS Profile requires lots of information about your finances. A lot of it is similar to the required information for the FAFSA, but the financial section is more in-depth.

Here are some documents to have handy:

Your Social Security number (SSN) or your alien registration number if you’re not a US citizen

Your driver’s license or another form of identification

Your own or your parent's federal tax returns

Other income-related documents, such as your latest Form W-2 or bank statements

Records of any untaxed income

Mortgage information

Information about assets and accounts such as cash, bank account balances, trusts, non-retirement annuities, education savings accounts, and investments

Fill out your information

The CSS should take 1-2 hours to knock out, and if you’re a dependent student, most of it will be your parents’ job information.

If your parents are divorced or separated, your custodial parent—the one you’ve lived with for the majority of the last 12 months—should use their information.

If you’ve lived with both parents equally, the one who provided most of your financial support over the last 12 months should fill it out.

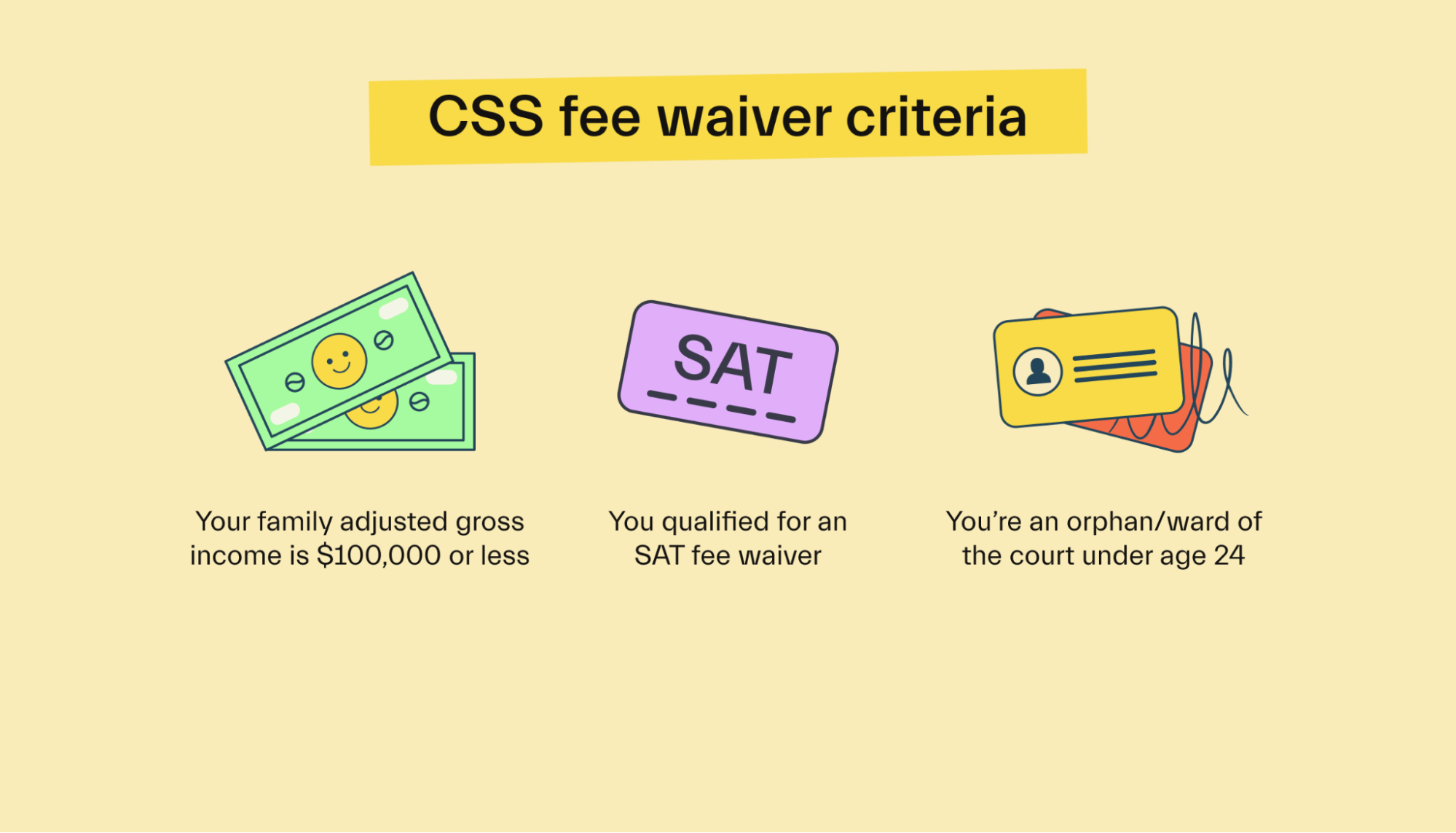

Pay the fee or get a waiver

The CSS Profile charges a $25 fee to apply to one school and another $16 per additional school you send it to. That can add up if you’re submitting to many schools, so budget accordingly.

That said, the College Board offers fee waivers, and they recently loosened the requirements quite a bit. The waiver criteria are as follows:

Your family-adjusted gross income is $100,000 or less

You qualified for an SAT fee waiver

You’re an orphan/ward of the court under the age of 24

Double-check and submit your CSS Profile

Before you send off your profile, double- or triple-check your info to ensure you haven’t missed anything. Once it looks good, submit it, and you’re done.

Now, you’ll be able to check your profile periodically for messages regarding your profile in case any errors are detected or any colleges reach out.

You must update and renew your CSS Profile each year to qualify for aid. Renewing is faster, luckily, since some parts autofill.

If you need to add new schools after submitting your CSS Profile, just log into your account and click “Add a College or Program.”

How are the FAFSA and CSS different?

Both forms serve a similar purpose. But they differ in many ways, including the information needed, aid types, and deadlines.

Let’s cover their differences.

Who needs to submit them?

Any student that meets FAFSA’s residency requirements should submit the FAFSA to get federal aid for college.

Students that don’t meet those requirements, such as international students, should submit the CSS Profile—although they should remember that not all schools accept the CSS.

Students who need aid beyond the FAFSA should also submit a CSS Profile.

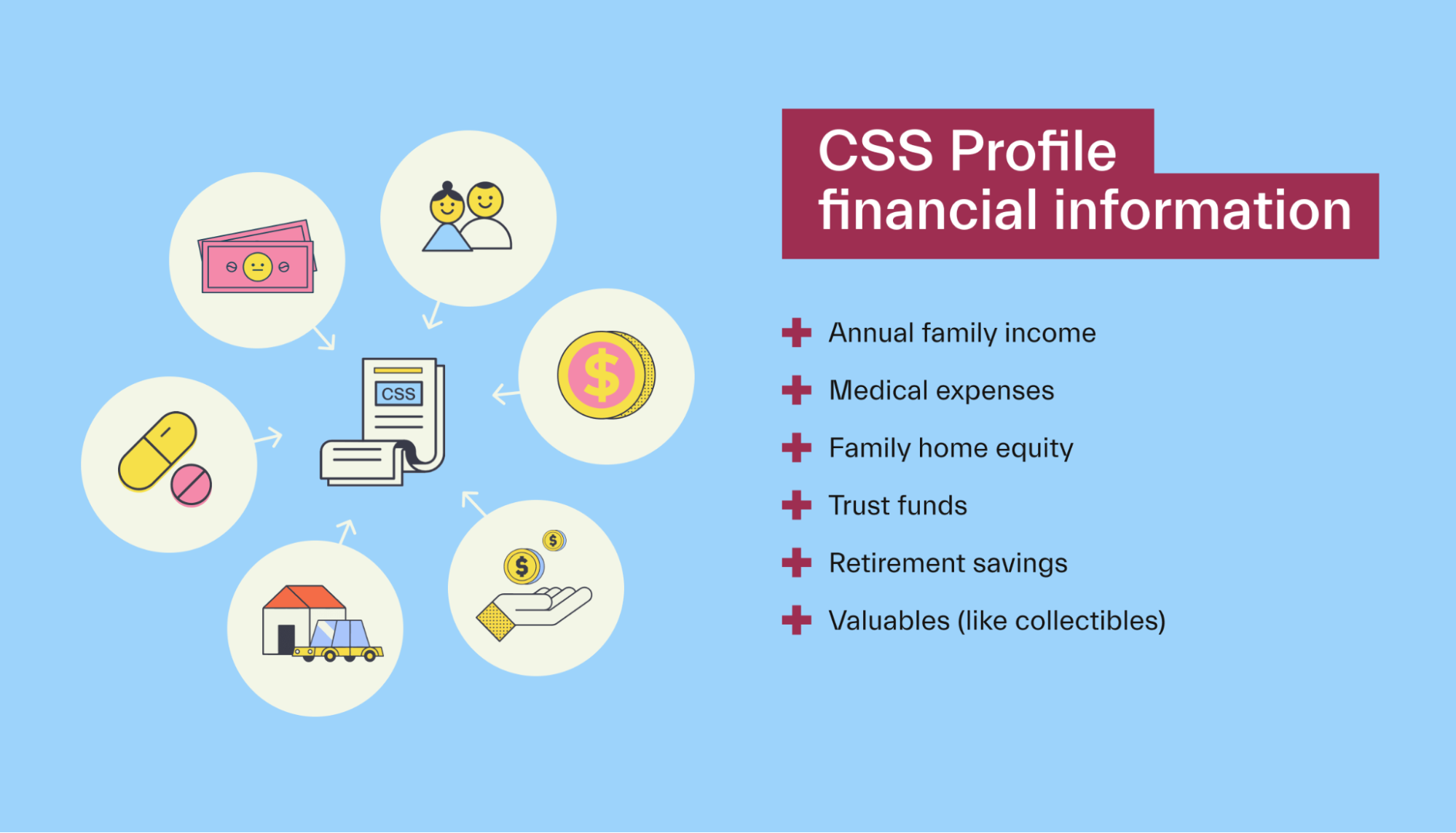

What information do you need to fill out the forms?

The FAFSA asks for information about your and your parents’ incomes, bank accounts, and educational savings accounts. It also needs information about your parents’ liquid investments, real estate investment properties, tax-deferred retirement contributions, and family businesses.

The CSS Profile wants all this, plus items including, but not limited to:

Medical expenses

Family home equity

Trust funds

Total retirement savings

Valuables, like collectibles

More information can be found in the CSS Profile tutorial on the College Board’s website.

When are the FAFSA and CSS Profile due?

The FAFSA is due June 30 at 11:59 pm Central Time of the year you want aid for. For example, you must submit your FAFSA by June 30, 2023, to get 2022-2023 aid year money. Some aid types, like work-study, can run out. So apply as early as possible.

The CSS Profile comes out on October 1 of the year you want aid for, but schools set their own CSS deadlines. The earlier you fill it out, the better. You’ll get yours in before colleges slam their doors on the CSS.

What aid types do you qualify for?

The FAFSA qualifies you for federal financial aid. That includes:

Federal student loans

Federal grants, such as the Pell Grant

Work-study

The FAFSA may also be required for certain state-based aid programs. For example, New York’s TAP program application is available once you complete the FAFSA.

Virtually every school takes the FAFSA.

The CSS Profile helps you find scholarships. Many—but not all—colleges and universities accept the CSS Profile.

How much does it cost to apply?

The FAFSA is always free. The CSS charges 2 fees:

$25 per application

$16 per additional report

However, the CSS offers fee waivers for students who qualified for SAT fee waivers and whose families’ AGIs are under $100,000. Students under 24 who are orphans or wards of the court can also get this waiver.

Where can you apply?

To apply for the FAFSA, go to Federal Student Aid’s FAFSA application web page and select “Start Here” for a new FAFSA or “Log In” using your FSA ID to renew your FAFSA.

To apply for the CSS page, you’ll have to create a College Board account or log into your existing account. Then, you can use this web page to choose which academic year you’d like to apply for, check participating schools, and more.

Should I submit the FAFSA or the CSS?

The FAFSA mainly qualifies you for need-based aid, like loans, grants, and work-study. That means you’ll only get a certain amount based on your family finances.

Meanwhile, the CSS is all about merit aid—in other words, scholarships. So there’s technically no limit to how much you can win.

So if you are eligible for the FAFSA, submit both.

Max out the FAFSA aid you don’t have to pay back, like grants. Then, score some scholarships with the CSS before filling in the gaps with FAFSA loans.

It shouldn’t take more than 2-3 hours to knock out the CSS Profile and FAFSA.

And even if the fee is a bit of a stretch, consider that the scholarships you earn will most likely outweigh that fee many times over.

So if you’re not FAFSA eligible, go for the CSS.

The only time you shouldn’t do the CSS is if your school doesn’t take it.

2 excellent ways to find the money for college

If you’re eligible to submit the FAFSA, you should always fill it out. It’s free and doesn’t take all that long, but it qualifies you for all sorts of help.

On the other hand, if your school uses the CSS Profile, that’s an excellent option for people who can’t fill out the FAFSA or don’t get enough FAFSA aid.

But what if you still need more aid after filling out the FAFSA and the CSS Profile? The Mos app has tools to find additional funding through grants, scholarships, side hustles, and more. Explore Mos memberships to learn more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you