Student loans •

Everything you need to know about aggregate loan limits

Read this Mos.com guide to find out how aggregate loan limits work, what the current limits are, and what to do if you reach your limit.

Believe it or not, even lawmakers think that college can be unaffordable for a lot of students.

That’s why the US Department of Education offers a range of fairly generous subsidized loan programs designed to help you pay for college.

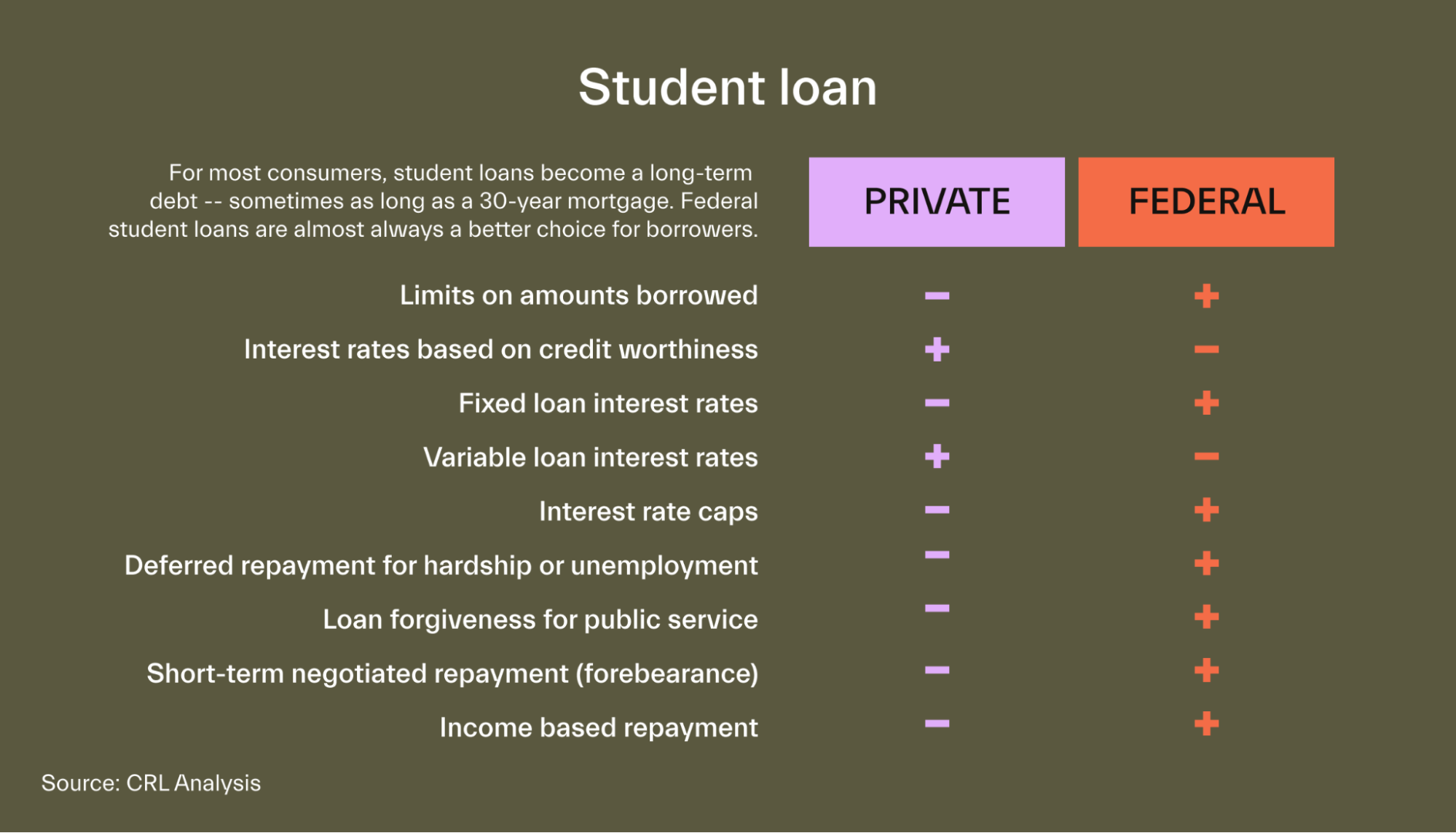

By choosing a federal student loan rather than a private loan, you’ll benefit from a number of protections like fixed interest rates, income-based repayment plans, and even loan forgiveness. But no matter how generous these loan schemes may be, there’s still a cap on the amount of money that you’re allowed to borrow—which is known as your “aggregate loan limit.”

This guide explains what aggregate loan limits are, the current aggregate loan limits for federal student loans, and what to do if you reach your annual or aggregate loan limits.

What is an aggregate loan limit?

When you apply for federal student aid, the college or university you’ve been accepted at will decide the type of loan you’re eligible for.

More important still, your school will decide the actual loan amount that you’re going to be eligible to receive for each academic year you’re in school.

Whenever you choose to borrow money as part of a student loan, it’s important to note that there are going to be limits on the amount of money you’re able to get. Generally speaking, there are 2 types of loan limits that are going to affect student borrowers: annual loan limits and aggregate loan limits.

Both limits depend on what school you’re going to and your dependency status.

Dependency status just means whether you're a dependent student or an independent student from a financial point of view. But we’ll break down the details on these factors and actual loan limits in just a minute.

The amount of money you’re able to borrow each academic year is known as your “annual loan limit.” This applies to both undergraduate and graduate studies. But it’s important to know that your annual loan limit might be different from the actual amount you’re able to borrow each academic year.

For example, you might be given an annual loan limit of $9,350 per academic year. But your school might decide that you should only receive $6,750 per year—which could be based on a number of different factors, such as the tuition fees associated with your degree program.

By contrast, the total amount of money that you’re allowed to borrow over the entire course of your studies is referred to as your “aggregate loan limit.”

The important takeaway here is that if the total loan amount you’ve received over the course of your education reaches your aggregate loan limit, you won’t be allowed to receive any more federal loans.

That being said, there’s one exception to the rule. If you’re able to pay back some of your outstanding loan debts so that you owe less than the aggregate loan limit, you may be able to start borrowing again.

But you’ll only be able to borrow up to the amount within your remaining aggregate loan eligibility.

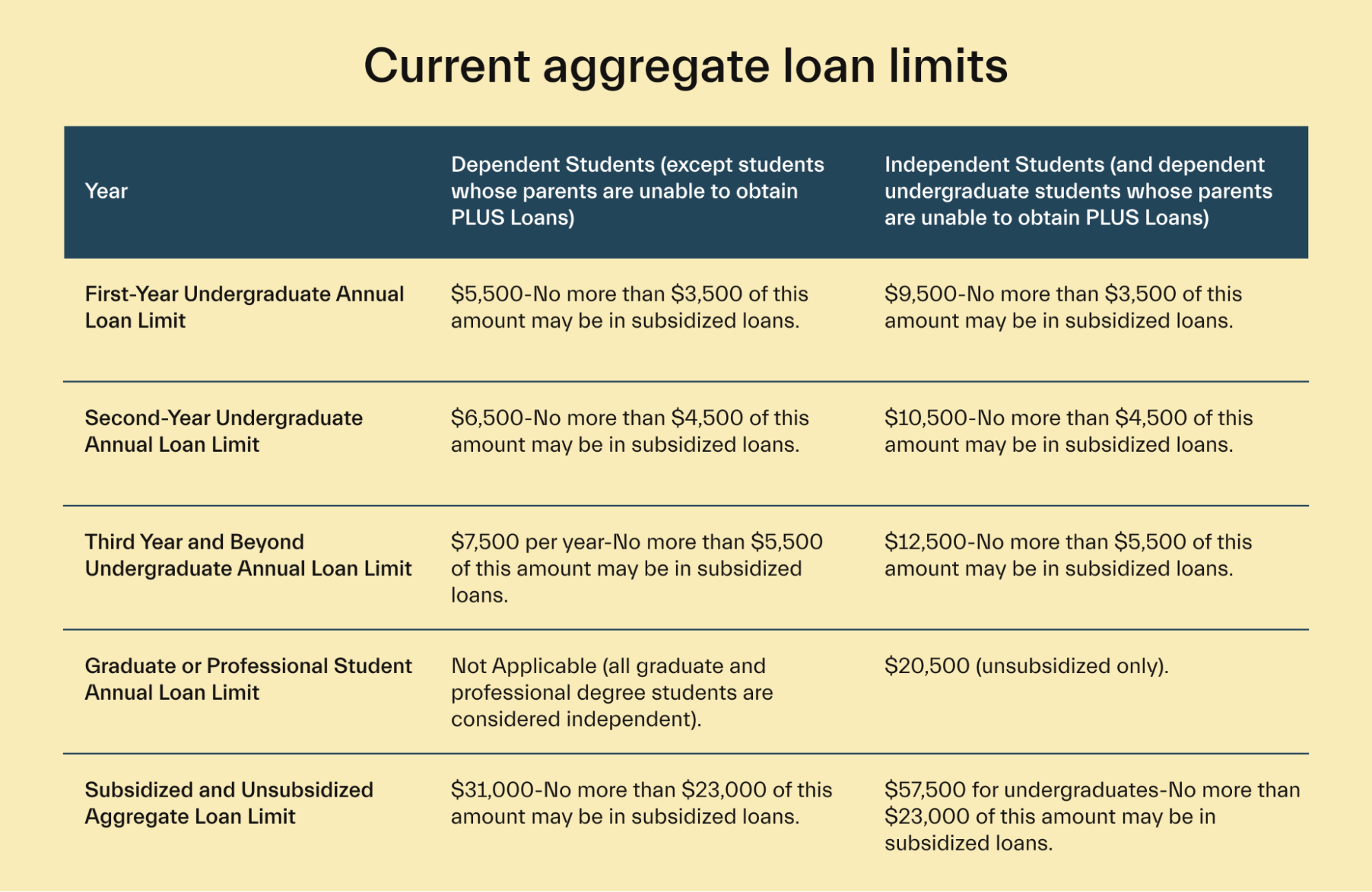

What are the current aggregate loan limits?

For the 2021/22 academic year, both federal subsidized and unsubsidized loans have the same aggregate loan limits.

If you’re a dependent undergraduate student (which means you rely on your parents or guardians as your primary source of income), the aggregate loan limit for 2021/22 is $31,000.

The only exception to this rule is that you’ll likely qualify for a higher aggregate loan limit if you’re a dependent student and your parents are unable to secure a Direct PLUS loan from the federal government.

If you’re a dependent student, no more than $23,000 of your available $31,000 aggregate loan limit can come from subsidized loans.

Undergraduates who count as independent students (which means they’re financially independent of their parents) have an aggregate student loan limit of $57,500. As we’ve just mentioned, this higher cap also applies to dependent students whose parents couldn’t get hold of a Direct Plus loan.

Just like dependent students, an independent undergraduate student with aggregate loan limits of $57,700 can only count $23,000 worth of federal subsidized loans towards this maximum amount.

But these amounts all apply to undergraduate students. If you’re a grad student or a professional student, the aggregate loan limit for 2021/22 is $138,500. Only $65,500 of this amount can come from subsidized federal loans.

This $65,500 subsidized aggregate loan limit for graduate students and professional students also includes all of the money you’ve received from subsidized loans for periods of enrollment that occurred before July 2012. Likewise, loan amounts previously received for undergraduate study apply to this loan limit, too.

Translation: if you’ve received a subsidized federal loan to get a bachelor's degree and now want to get a loan for a master’s degree, the amount you borrowed as an undergraduate will count against your aggregate limit as a master’s student.

But there’s also an exception to this rule. If you’re a grad school student or a professional student who’s enrolled in programs for certain health professions, you might qualify for extra Direct Unsubsidized Loan amounts—no matter how much you borrowed as an undergrad.

Med students may also be eligible to get higher aggregate loan limits on Direct Unsubsidized Loans. This is something you’ll need to take up with your school’s financial aid office.

Finally, it’s worth pointing out that no matter what level you’re studying at, the aggregate loan limits we’ve just listed include any Subsidized Federal Stafford Loans. They also include any Unsubsidized Federal Stafford Loans you may have been awarded as part of the Federal Family Education Loan (FFEL) program.

This is because of some government legislation that was passed in July 2010, which said that no additional loans would be made to students under the FFEL Program.

Similarly, any grad school students who enrolled after 2012 are no longer eligible to get a Direct Subsidized Loan. Instead, they have to apply for unsubsidized loans.

What to do if you reach your aggregate loan limit

Despite the best planning, it’s possible for your tuition fee costs to stack up pretty high. That means you could hit your aggregate loan limit a lot faster than you’d like to—ultimately affecting your ability to secure a degree.

But if you do find yourself in a situation where you reach your aggregate loan limit, don’t panic! There are still a few solutions and opportunities available to you that are worth exploring.

To help get you started, we’ll quickly break down a few potential avenues you should try if you hit your aggregate loan limit before getting all of the degrees you’d like to earn.

Contact your financial aid office

This one is a no-brainer. If you ever end up hitting your aggregate loan limit, the first thing you should always do is to get in touch with your school’s financial aid office. Give them a call, and explain what has happened.

Your school’s finance team might have additional questions about your particular loan awards and your financial situation, so be prepared to talk numbers and provide evidence of your finances.

Just keep calm and be honest. Your college will want to do everything it can to help you because it’ll want you to succeed as a student (and keep paying tuition for the remainder of your degree).

After chatting with the financial aid office, you might be able to appeal your financial aid offer in certain situations in order to get more money.

Common scenarios in which your school might be willing to offer you additional financial aid include if you’re a dependent student and your family has experienced a sizable loss in income. For example, if your dad loses his job and he’s the primary earner in your family.

You may also be able to appeal your financial aid offer if you’ve experienced a major life event like the death of a family member or there’s been a costly emergency like an unexpected medical expense.

Finally, you may hit your aggregate loan limit prematurely, and be able to appeal it, if the information you included on your Free Application for Federal Student Aid (FAFSA) was incorrect.

After all—we all make mistakes. If this is the case, let your financial aid office know. It could ultimately change the amount you’ve been cleared to borrow as part of your aggregate limit.

Even if you’re unable to appeal your financial aid offer, you might still be able to apply for other forms of financial aid.

For example, your school might offer low-interest loans on an institutional basis, or you might be able to enroll in a work-study program that’ll help you bridge the gap to fund the rest of your degree.

Apply for scholarships and grants

If you’ve reached your aggregate loan limit, another solution is to apply for scholarships or grants.

Grants and scholarships are what’s known as “gift aid.” Unlike loans, grants and scholarships are financial awards that don’t have to be repaid. That means they’re essentially free cash to help you pay for college!

Better yet, there are literally thousands of college scholarships and grants out there for both undergraduates and postgraduates. You can also often apply for multiple awards simultaneously.

For example, you could apply for a grant your school offers based on financial need alongside a merit-based scholarship because of your satisfactory academic progress.

By adding those two together, alongside what you’ve already covered using federal student loans, you might be able to reach your target amount pretty easily.

To be honest, the trickiest part about applying for scholarships is simply finding the right ones for you. But if you need a hand getting started, we’re here to help. By joining Mos.com, you can be instantly connected with loads of scholarships that are perfect for you!

Apply for PLUS Loans

Have you hit your aggregate loan limits with the Federal Stafford Loan? We’ve got some good news—not all federal student loans have aggregate limits.

By taking out a Direct PLUS Loans, you’ll be allowed to borrow any amount up to the school-certified cost of your attendance. There’s no annual loan limit or aggregate loan limit to worry about with these loans.

The only trick is that Direct PLUS Loans are designed specifically for parents of undergraduate students and graduate students. That means if you’re an undergraduate student who’s reached your aggregate loan limit, you won’t be able to apply for a Parent PLUS Loan on your own.

You’ll need to chat with your parents or guardians and ask them if they’d be willing to take out a PLUS loan on your behalf.

If you’re a grad school student, you don’t have to ask your parents anything. Postgraduates and professional students are allowed to apply directly for a Grad PLUS Loan.

Whether your parent is applying for a Parent PLUS Loan or you’re applying for your own Grad PLUS Loan, you’ll need to undergo a credit history check.

It’s also important to note that both types of Plus loans do carry slightly higher interest rates than other federal direct loan types such as Stafford Loans.

Apply for private student loans

Another possible solution if you’ve reached your aggregate loan limit is to apply for a private student loan—but you should only consider this as a last resort.

Private student loans don’t come with the same benefits as federal loans.

Federal student loans tend to offer fixed interest rates, which means the cost of repayment will stay the same on your loan until it’s paid off.

When you go to a private lender like a bank, you may get charged a variable interest rate. This means your monthly payments could go up in the future at fairly short notice.

Likewise, with a federal student loan, you may benefit from income-based repayment options in which the amount you’re paying back to the government each month can be lowered based on how much money you’re making and your personal financial situation.

With most private lenders, you aren’t going to get that.

Private lenders will also usually check your credit score. So, if you don’t have any credit history yet or your score is pretty low, you may need to get a cosigner.

But if you’re genuinely in a pickle, applying for private loans can be a solution. Most lenders will let you borrow up to the cost of attendance—which means you can borrow money for accommodation, food, textbooks, travel, and other stuff!

Conclusion

At the end of the day, the federal government will only let you borrow so much to fund your studies. That’s where aggregate loan limits come into the frame.

But if you reach your annual or aggregate limits, don’t panic. There are other ways to source funding for your education, and one of the best ways to pay for college is to apply for grants and scholarships.

Fortunately, matching students with free cash for college is what we do best. So, what are you waiting for? Join Mos.com now.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you