Financial aid •

Cornell financial aid: a complete guide

Learn more about the financial aid available if you want to study at Cornell, including loans, scholarships, and grants.

Cornell University is a privately endowed research university located in Ithaca, New York. Cornell is part of the well-known Ivy League, making it one of the most competitive and well-regarded universities in the United States.

The school was founded in 1865 and has grown to have a student population of more than 23,000.

If you’re a high school student considering applying for a spot at Cornell but are wondering how you’ll pay for college, here’s what you need to know.

A snapshot look at Cornell

Cornell University is a private research university that is partnered with the State University of New York. It is a member of the Ivy League and is also a land-grant institution, making it unique among other universities.

The school was founded in Ithaca, New York, in 1865 and today has more than 23,000 students and nearly 1,700 professors. It boasts more than 50 Nobel laureates among its alumni and other affiliates!

Cornell has 16 colleges and schools, including 9 undergraduate schools for students to choose from. Undergraduates can study topics such as agricultural sciences, economics, astronomy, the classics, history, government, math, philosophy, and more.

It also has multiple graduate school programs if you’re interested in attending an Ivy League grad school.

Outside of classes, students can get involved in NCAA or intramural sports and participate in one of the school’s many clubs or student groups. They can also grab a bite to eat at the Cornell Dairy Bar, which features ice cream and other dairy products made using milk from the cows that are part of the school’s agriculture program!

One thing that makes Cornell unique is that all of the financial aid it awards is on the basis of need rather than merit. It awarded more than $280 million in aid in 2020!

Ranking: 17th in national universities

Size: 23,620

Demographics: 46% male, 54% female

Acceptance rate: 11%

Average GPA of accepted student: 3.9

Key dates and deadlines (2022):

Application: January 2

Financial aid deadlines: February 15

A look at scholarships offered by Cornell

If you’re trying to figure out how you’ll pay for living expenses or tuition, one of the best things to do is look for scholarships. Scholarships are one of the best ways to pay for college. Unlike student loans, which you have to pay back eventually, scholarships are free money that you don’t usually have to repay.

One thing that makes the financial aid program at Cornell unique is that it doesn’t offer any merit-based financial aid. You won’t be able to get a scholarship because of your great athletic abilities or academic skills.

Instead, Cornell looks solely at students’ financial needs when making decisions about scholarships and grant aid to award to students.

Cornell states that there is no minimum or maximum amount of aid that it will award, and you are automatically considered for Cornell grants when you fill out a financial aid form. Need is based on things like your family size, income, and savings.

If you qualify for Cornell’s institutional grants, you may also qualify for a named scholarship program established by a Cornell donor. These programs may have additional eligibility requirements.

Outside of Cornell’s need-based aid, there are other scholarship opportunities out there. Many local community groups and businesses have scholarship programs that award money to students from their area.

There are also larger scholarship programs based on specific skills and interests. If you look, you can find scholarships for almost everything you can think of!

For more on which scholarships you can apply for and how Mos can help, check out our financial aid tips and tricks.

Student loans

If the grants and scholarship assistance that you receive aren’t enough to cover the cost of your education, you can turn to student loans.

Borrowing money to pay for your schooling is one way to invest in yourself. However, you need to keep the cost of that investment in mind. The drawback of this type of aid is that you’ll have to pay back the money that you borrowed, plus interest.

Because of that, student loans should be your last resort.

Cornell’s Office of Financial Aid and Student Employment offers information about aid options and loan programs that its students might be interested in. There’s also a financial aid calculator that first-year students and other incoming students can use to calculate the aid they might get.

The best loan program that most students have access to is the Federal Direct Loan program. These loans come directly from the government and can be subsidized or unsubsidized.

If you get a subsidized loan, interest won’t start building up on the balance while you’re still in school. Unsubsidized loans will start to build interest as soon as you receive them.

With either type of loan, payments aren’t due until after you leave school. Also, both types of government loans qualify for programs like income-based repayment and loan forgiveness.

If you still need more funding after your scholarship aid and federal loans, you can work with private student loan lenders. There are many banks and other businesses willing to lend money to students who need to pay for school.

Keep in mind that private loans tend to be much more expensive than government loans. They also aren’t eligible for programs like income-based repayment, so it’s usually a good idea to reach the limit on your federal loans before getting private student loans.

For more on finding the right student loan for you, check out Mos, and work with a human advisor that can help you find the best loans.

FAFSA

One of the most important things for any student to do is fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is a universal student financial aid application that will let you qualify for federal aid programs and Cornell’s need-based scholarships.

Filling out the FAFSA means sitting down with your family and providing some basic financial information, such as your family income and how much you’ve saved for school.

Based on the information you provide, the government will calculate your expected family contribution (EFC) to your college education. This is how much money they think your family can afford to pay.

The government and Cornell will use your FAFSA to decide on the financial aid offer you’ll get. This includes scholarships, work-study programs, and grants such as the Pell Grant. Your eligibility for subsidized and unsubsidized federal loans also depends on the information in your FAFSA.

Schools don’t use the information in the FAFSA during the application process, so you won’t hurt your chances of admission by filling it out.

You can fill out the FAFSA starting on October 1, the academic year before you plan on attending. So, if you plan to attend college right after high school, you can fill it out beginning in October of your senior year.

The deadline is the end of June of the year you actually attend. But some aid programs award money on a first-come, first-served basis, so you’ll want to fill out the form as early as possible.

For more on applying for FAFSA, including important dates and how to make sure your application is successful, learn about our Mos application. It turns the FAFSA into an even simpler application that also makes you eligible for additional scholarships and grants.

Cornell financial aid FAQs

These are some of the most frequently asked questions about financial aid at Cornell.

What is Cornell’s cost of attendance?

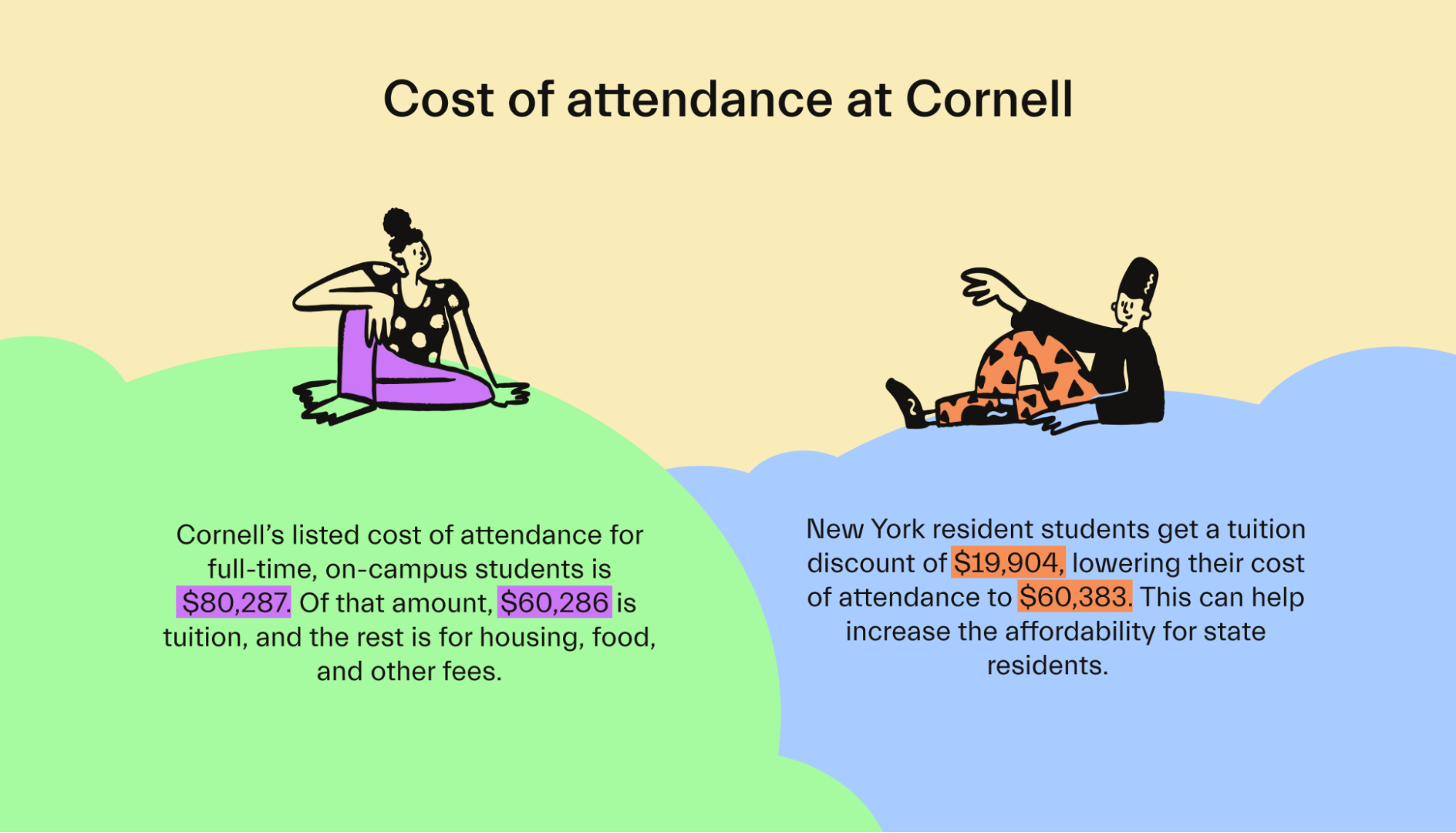

Cornell’s listed cost of attendance for full-time, on-campus students is $80,287. Of that amount, $60,286 is tuition, and the rest is for housing, food, and other fees.

New York resident students get a tuition discount of $19,904, lowering their cost of attendance to $60,383. This can help increase the affordability for state residents.

How many students pay no tuition at Cornell?

Cornell doesn’t share exact numbers for how many students get a full-ride scholarship at the school. However, the school does list limits for how much loan aid will be in each student’s financial aid package each year.

Students whose families make less than $60,000 per year and have assets under $100,000 won’t need to take out any loans, and the school won’t expect their families to contribute any money. Cornell will give these students enough money so that they don’t need to borrow any.

Can out-of-state students receive financial aid?

Yes, out-of-state students, and even international students, can qualify for financial aid at Cornell. Like aid awarded to New York residents, out-of-state students will get aid based on financial need.

Does Cornell’s financial aid office have any useful resources?

Cornell’s financial aid office has a web page outlining all of the deadlines and opportunities available to students. You can sign in to your account and view a to-do list of financial aid applications, making it easy to track your progress.

When does Cornell announce a financial aid decision?

For incoming students, early decision applicants receive their aid decision in mid-December. Regular decision students receive their decisions in early April.

For returning students, financial aid decisions are posted from May through August.

Why doesn’t Cornell offer merit-based financial assistance?

Cornell doesn’t explicitly state why it only offers need-based financial assistance instead of merit-based scholarships. However, this can benefit lower-income students who are guaranteed full-tuition awards or partial scholarships regardless of their academic performance or extracurriculars.

Do you have to be a citizen or permanent resident to get aid?

Cornell offers financial aid to all students. Permanent residents, international students, and undocumented students are all eligible. However, some students may not be able to receive certain types of aid, such as federal student loans.

Universities like Cornell that you might be interested in

If you’re not sure that Cornell is the right school for you, these other schools might be appealing.

Harvard University

Located in Cambridge, Massachusetts, Harvard is one of the oldest members of the Ivy League and one of the oldest institutions of higher education in the US.

Harvard is home to more than 23,000 students and boasts many well-known alumni, including many presidents, senators, and Supreme Court justices.

Yale University

Founded in 1701, Yale is another Ivy League school. It is smaller than many other Ivies, enrolling just 4,664 undergraduate students. That may make it appealing for students who want to attend a school with a smaller student body.

Columbia University

Columbia University is another school based in New York. However, instead of being upstate, Columbia is located in New York City! Students who want access to the largest city in the US while getting an Ivy League education may find that Columbia meets their needs.

Conclusion

As a member of the Ivy League, Cornell is one of the most selective universities in the country. If you get in, you can be assured you’ll get a strong education and a large alumni network that you can take advantage of.

If you’re looking for the best way to pay for higher education, Mos can help.

With Mos, you can get help negotiating for more financial aid, applying for hundreds of scholarships and grants with ease, and writing scholarship essays to help you earn extra funding to pay for tuition. Why not get started today?

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you