Saving •

The 4 best ways to save for college

Looking for ways to pay for college? Check out this guide from Mos.com on the best way to save for college.

Everybody knows college isn’t cheap. But what you might not know is that there are lots of tried and tested ways you can save for college to soften the financial blow of getting your degree.

No 2 students are 100% alike, so the college savings strategy that works for you might not necessarily be right for your best friend.

But to help you get an idea of some of the savings options available to you, we’ll walk you through 4 of the top ways you can start saving for college now—trust us, you’ll be thanking yourself later.

This guide explains what expenses you should save for as a student and the 5 best ways to save for college.

What should I save for as a student?

Before we get into the best way to save for college, you must understand exactly what you’ve got to be saving for as a student.

A lot of families take a look at a school’s tuition fees and assume this is the figure they need to save for. Unfortunately, the cost of attending college is a whole lot more than just tuition fees alone.

To give you an idea, let’s walk through the key expenses you’ll need to save for as a student.

College tuition fees

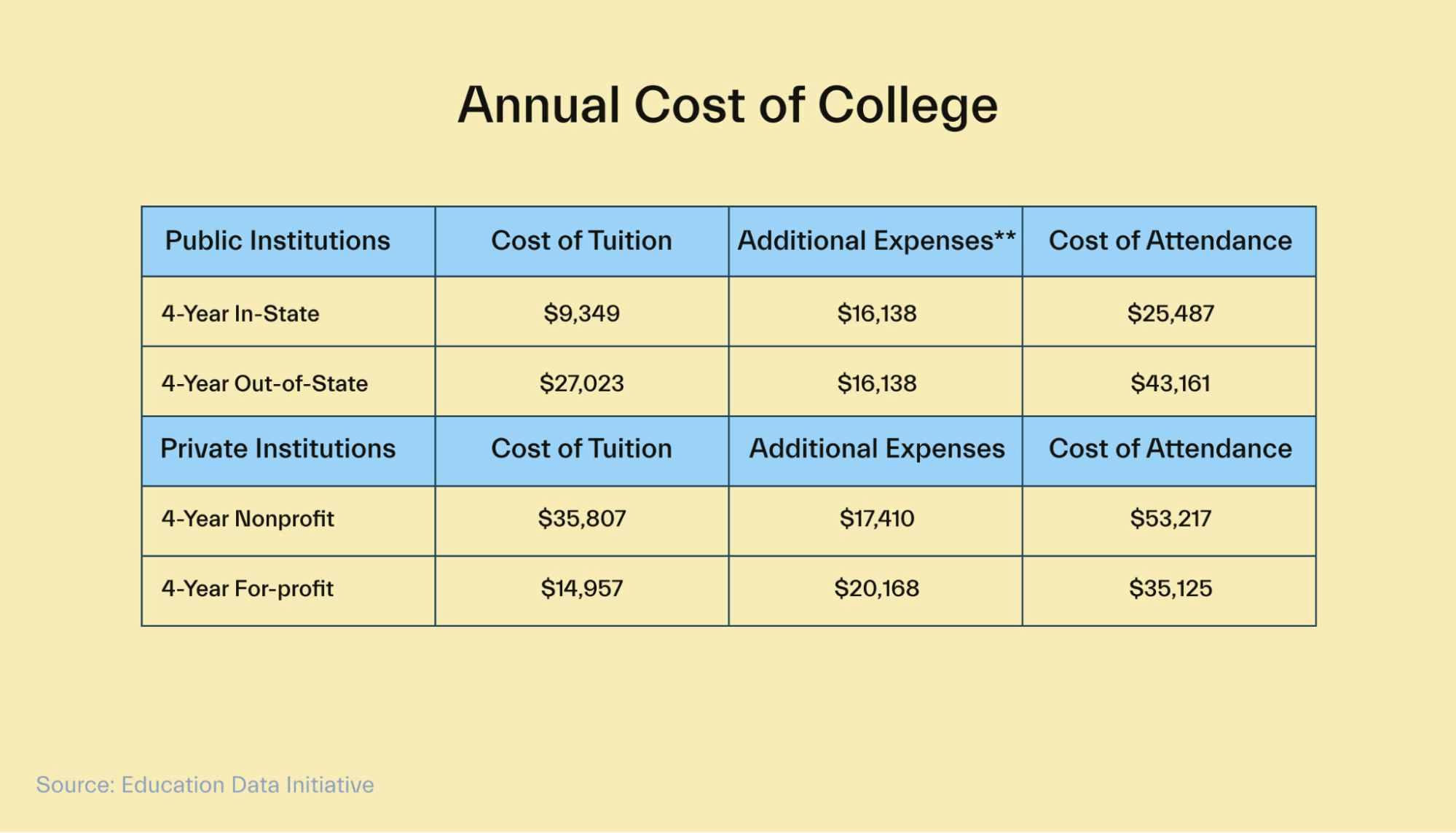

Tuition is the single greatest expense you’re going to need to save for when preparing for college—and the cost can vary pretty dramatically depending on where you decide to attend.

At a public college, the average in-state tuition fees sit at $9,377 per year. For out-of-state students, the average cost for a 4-year public institution is $27,279 per year.

But a private college can be a lot more expensive in terms of tuition fees. 4-year non-profit private schools cost an average of $37,641 per year.

Fortunately, large chunks of this particular expense can be covered by sources of federal student aid—but we’ll talk more about ways to pay for college in a minute. First, let’s keep working through the expenses you’ve got to save for.

Books and supplies

College textbooks are notoriously expensive. At the average public 4-year college, students can expect to pay an average of $1,230 per year on books and supplies. For reference, “supplies” covers stuff like lab materials or art materials if you’re taking those sorts of courses.

Again, it’s important to note this is just a ballpark average. Different schools and majors are going to have different textbook expenses—and various programs within each school will have their own unique costs for course materials.

Room and board

Accommodation is generally going to be your second-greatest expense after tuition fees. The deciding factor in terms of your total cost of room and board will be whether you decide to live on-campus or off-campus.

If you’re attending a 4-year institution, you can expect the cost of room and board to fall anywhere between $8,556 and $12,870 per year.

If you’re living on-campus, public university accommodation is generally a little bit more expensive. Room and board for on-campus students costs, on average, $11,557 per year. Meanwhile, off-campus students pay slightly less, at an average of $10,941 per year.

Additional expenses

Tuition, supplies, food, and accommodation are obviously going to be your essential expenses. But those are just the basics and don’t account for every single expense you’re going to have to pay while you’re at school.

On average, additional expenses at a 4-year college run from $2,774 to $5,294 per year. But what exactly are “additional expenses”?

The short answer is that it’s the fun stuff—things like travel, involvement in clubs and teams, nights out, entertainment, and everything in between.

What are the best ways to save money for college?

We’ve covered the various expenses you’ll need to save for to go to college. Actually saving up enough money to cover those expenses is a different matter entirely.

Fortunately, there are several tried-and-tested ways to get your finances under control and start saving enough to cover all your college expenses. Let’s explore 4 of the most popular ways to save for college and how you can get started saving now.

1. Start a 529 college savings plan

You’ll need the help of a parent or guardian for this one. But if your family can set up a 529 college savings plan a few years before graduating high school, this can be a tax-beneficial way to save and pay for college.

A 529 college savings plan is an education investment account that lets you invest cash or assets into a fund that can be used to pay for future college tuition and related expenses.

529 plans are managed by each individual state government. That means the exact rules and account types are going to vary from state to state. Generally speaking, the reason that a lot of families choose to set up a 529 plan is that it offers a couple of attractive tax benefits that can help you pay for college education later on.

With 529 prepaid plans, all of the money you invest is allowed to grow free from federal income tax and state income tax. When it comes time to withdraw, you won’t need to pay taxes on the money you take out of a 529 either—but only as long as those withdrawals are for a “qualified education expense.”

If you withdraw money for anything other than qualified educational expenses, you’ll need to pay a withdrawal penalty (10% + income taxes).

2. Get scholarships

Scholarships are one of the best ways to save for college.

If you’re unfamiliar with scholarships, they’re just financial gifts awarded for educational purposes that you don’t have to pay back. Translation: a scholarship is free money to help students pay for college—and if you can bank a few of them before you graduate high school, you’re going to be well on your way toward paying for school.

Fortunately for students in need of some financial support, there are a lot of scholarships available. Right now, 1,700,000+ private scholarships are being awarded by schools, employers, private companies, charities, nonprofits, communities, social organizations, religious groups, and even individuals.

Bearing in mind how many scholarships are out there, it’s hardly surprising that 60% of American families relied on at least one scholarship in the 2021/2022 academic year to help pay for school.

Unfortunately, sifting through 1000s of scholarships to find the ones you can apply for can be time-consuming and incredibly mind-numbing. That’s where Mos comes to the rescue.

When you set up an account with Mos, we automatically match you with 100s of scholarships that are perfect for you—and our expert advisors are on-hand to help guide you through the application process.

3. Start a Coverdell ESA

A Coverdell education savings (ESA) account is an alternative to the 529 plan. The Coverdell ESA is almost the same as a 529 plan in terms of being used to cover education expenses, but it’s a lot more lenient than 529 providers around what counts as a “qualified expense.”

In addition to your tuition fees and administrative fees, Coverdell ESAs are also able to cover other expenses like your tutors, any uniforms you might need, special needs services, and much more.

That being said, there are a couple of drawbacks to the Coverdell ESA you should consider. It’s got much lower limits on contributions at just $2,000 a year—and if you’re going to Harvard from out-of-state, that’s not going to put a huge dent in your tuition. There’s also a rule which dictates you have to withdraw all funds by the time the student beneficiary hits age 30.

But apart from that, the Coverdell ESA is a tax-beneficial way to save for college you might want to explore.

4. Apply for grants

Like scholarships, grants are an amazing way to save for college because they count as “gift aid.”

Gift aid is financial aid that you don’t need to repay. That means grants are literally free money—which makes them preferable to taking out massive federal student loans that you’ll need to repay with interest.

There are plenty of federal, state, and school-specific grants available. The most common federal grant by far is the Federal Pell Grant. Pell grants are designed for undergraduate students who can demonstrate exceptional financial need.

But just because you’re unable to demonstrate financial need and qualify for a Pell Grant doesn’t mean you’re unable to qualify for any grant.

Contrary to common belief, you don’t need to live in a low-income family to receive a grant. You just need to show you have a financial need. By “financial need,” the US Department of Education is specifically looking to see if your Expected Family Contribution (EFC) is lower than the cost of attendance (COA) at your school.

Your expected family contribution is the number that you get after submitting your Free Application for Federal Student Aid (FAFSA) and is how much the government thinks your family can cover for your education. Even if you’ve got a high EFC, you may still be able to demonstrate a financial need if you’re applying to a really expensive college.

That’s why it’s worth completing your FAFSA as soon as possible, no matter what your financial circumstances may be. By getting your EFC early, you’ll have more time to complete extra applications for any state grants or school-specific grants you might be able to get from your school.

Conclusion

College is expensive—but you shouldn’t let that prevent you from going to school or enjoying a quality student life while you’re studying. That’s why it’s important you start saving for college as soon as you can.

If you want to be able to save money for college, you’ve got to have a ballpark figure in mind to understand your overall expenses. That means doing some research on the type of school you’d like to go to, what sort of degree program you’re going to pursue and whether you plan to live on-campus or off-campus.

Once you’ve got a ballpark figure for your college savings goal, it’s worth using some of these tried-and-tested methods to start saving for college.

If you’re ready, download the Mos app and get started today. Mos is all about helping you save and earn in college. Get help matching with scholarships, maximizing your financial aid, finding student-approved side hustles, and more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you