FAFSA •

April 6, 2023

What you need to know about the FAFSA and your federal tax return

When you submit the FAFSA, you’ll have to provide your tax information. And the aid you receive could also affect your taxes next year.

Taxes aren’t fun, but they’re an essential part of adulting. And as a student, your financial aid can affect your taxes—and vice versa!

Confused yet?

Don’t worry—we’ll break down everything you need to know about the relationship between the FAFSA and tax returns.

Note: This article is for informational purposes only and should not be considered tax advice. For expert help, speak with a tax professional.

What is the FAFSA?

FAFSA stands for Free Application for Federal Student Aid. It’s an application that students must submit to qualify for federal financial aid.

Financial aid includes:

Grants (free money for college)

Student loans (loaned money that you must pay back eventually)

Work-study (part-time jobs for students to earn money)

The FAFSA gathers relevant information about the student and their family. It focuses on financial information, which the government uses to calculate how much aid they can offer the student.

You can apply for all of these financial aid types via the FAFSA, which you submit online at studentaid.gov, or else fill out a paper application and mail it in.

Note: You must submit the FAFSA each academic year to qualify for federal aid. This is very important!

The FAFSA and tax returns: The basics

First, some helpful definitions:

A tax return is a form you submit to the IRS each year to file your taxes. Your “tax return” typically refers to everything you submit to the IRS, whether that’s 1 form or 10.

But don’t get tax returns confused with tax refunds. Tax returns are the documents you submit to the IRS. Tax refunds are the money you may get back after filing your return (note that we said “may” as a refund is not guaranteed–more on this later).

The FAFSA is the form you submit to apply for financial aid. It uses information from your federal income tax return to calculate aid amounts. The information you provide includes things like your income and how much money you have in your bank accounts. If you’re a dependent student (see below), you’ll also be asked to provide your parents’ financial information.

One of the primary purposes of the FAFSA is to provide the federal government with financial information that is then used to calculate students’ eligibility for financial aid.

This information is important because some types of aid are need-based. Need-based financial aid, as its name suggests, is awarded based on financial need. So lower-income students will typically qualify for more aid. In contrast, higher-income students may not be eligible to receive any aid at all.

Now here’s how the two are related:

The FAFSA will ask you for tax return information from a previous year in order to determine your income levels

You may need to report the financial aid you receive as a result of filing the FAFSA as taxable income on your tax return

Let’s get into the details of each.

Using tax information to fill out the FAFSA

The FAFSA tax return information you provide is important for calculating aid amounts.

In most cases, you’ll be able to use the IRS Data Retrieval Tool (DRT) system to electronically submit stored tax records. Essentially, this tool accesses the information the IRS already has on file for you from previously submitted tax returns, and shares it with Federal Student Aid.

Which tax return should I use?

The federal income tax return you should use is the return you filed 2 years before the current academic year.

For example, when applying for aid for the 2023-2024 academic year, you’ll be asked for your 2021 tax information. For the 2024–2025 academic year, you’ll be asked for your 2022 tax information. And so on.

Don’t worry, the FAFSA application will make this clear—and if you’re using the IRS direct transfer tool, it will automatically upload the correct tax year information.

If you’re not using the IRS DRT to retrieve your federal tax returns, double-check to be sure you’re submitting the correct year’s tax information.

What if my income has changed?

By default, financial aid eligibility is calculated based on your income from the required tax year (for instance, 2021 for the 2023–2024 academic year). But what if your income in 2022 or 2023 has changed significantly since the 2021 tax year?

If your income has increased, you’ll be in luck: The government will still consider your 2021 income when calculating your financial aid eligibility (for this academic year, anyway).

If your income has decreased, you should still submit the FAFSA as usual. Then, contact your school’s financial aid office. Explain that your income has dropped, and provide the necessary documentation to prove it. The financial aid office can then work with you to adjust your financial aid paperwork.

What if I haven’t filed taxes?

What if you don’t have a tax return from 2 years ago? Maybe you were in high school and didn’t earn enough money to need to file taxes.

If you weren’t required to file taxes, you don’t need tax information to submit the FAFSA and will simply be asked to manually enter your income information.

But, if you were required to file and simply didn’t, then you can’t submit the FAFSA without first submitting your tax return.

Do I need my parents’ tax information?

Although your tax information specifically may not be required, you may still need to submit your parent or guardians’ tax return instead.

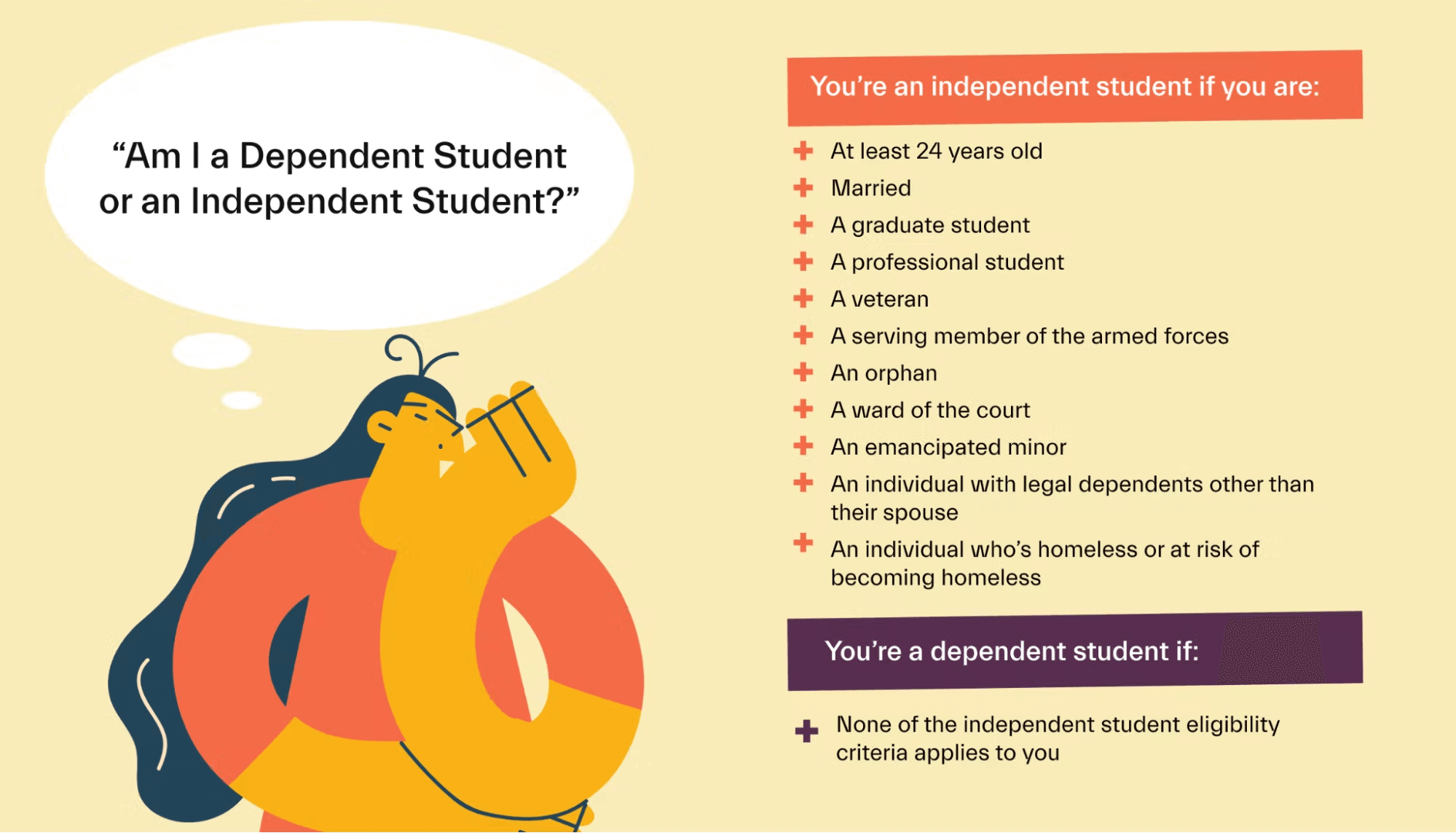

This is the case if you’re considered a dependent student. The image below explains what FAFSA dependency means.

You can usually retrieve this information using the IRS DRT tool—just like with your own tax return. But if you can’t use the IRS DRT system, you’ll need to ask for your parents’ information directly.

On the other hand, if you’re an independent student, you won’t need to submit your parents’ or guardian’s tax information.

What other information do I need to file the FAFSA?

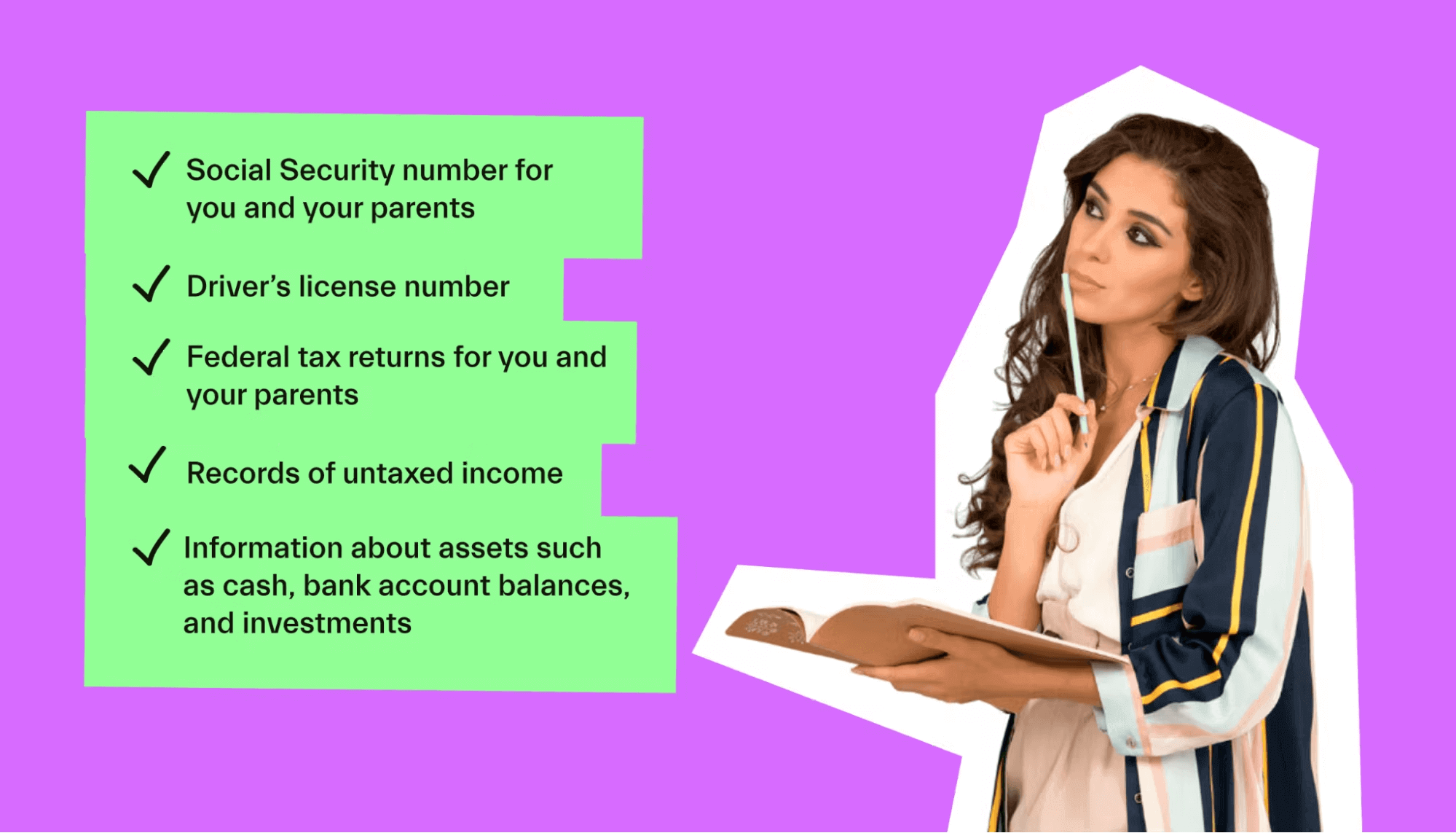

Your tax returns aren’t the only thing you’ll need to include when you submit the FAFSA! During the application process, you’ll be asked for other information, too.

If you’re an independent student, you’ll be asked for the following information:

Your Social Security number

Your driver’s license number

Records of any untaxed income

Information about your assets

Your FSA ID (you can create this during the FAFSA process if you don’t already have one)

A list of the schools you may attend

If you’re a dependent student, you’ll be asked for all of this information—for yourself and your parents.

This can seem like a lot, but if you have your information ready to go, filing the FAFSA only takes about an hour each year.

Using FAFSA information to file your taxes

We’ve talked about how your past years’ taxes can affect your financial aid situation. But what about the other way around? Is financial aid taxable?

The answer to this is a bit complicated. Fortunately, most financial aid isn’t taxable and doesn’t usually need to be reported on your tax return. But the details vary, as they often do with taxes!

Do I need to report financial aid money when I file my taxes?

Work-study is a form of financial aid for which your earnings should be reported on your tax return. You should receive a tax form from your employer that summarizes what you earned during the year. So the amount to include on your tax return should be pretty straightforward.

If you receive student loans, grants, or scholarships, this money is typically not taxable and doesn’t need to be reported. However, there is an important exception: If you use financial aid for non-qualifying expenses, it could be considered taxable income.

For instance, if you get a $10,000 scholarship and only have $8,000 of tuition and fees to pay, you may pocket $2,000. That $2,000 would be taxable and should be reported to the IRS. The same is true for grants that exceed the money you need to pay for school.

Student loans don’t fall into this category, however. Student loans are never considered taxable, even if they’re used for non-school expenses. This is because loans eventually need to be repaid, making them “debt” rather than “income.”

Trying to figure out if you need to report anything can be a bit confusing. Your financial aid office can help you navigate the process and find out whether you have any financial aid money that may be taxable.

Will financial aid money affect the size of my tax refund?

You may get a tax refund after you file your taxes.

The amount is determined based on how much tax you paid throughout the year vs. how much you owe. If you paid more than you owe, you get a refund (cha-ching!). But if you owe more than you paid, you must pay the IRS the remainder.

To sum this point up, in most cases, receiving financial aid won’t affect your refund. However, the section above offers some examples in which financial aid money might be considered taxable—and could affect your refund as a result.

Note: If you work for someone else they should automatically withhold taxes from your paycheck and submit them to the government on your behalf.

But, if you’re self-employed (for example, you run a lawn mowing business), you’re directly responsible for sending your taxes to the IRS–so be sure to do so throughout the year, or else you may need to send a big chunk of change to the IRS when you file your taxes.

Conclusion

The Free Application for Federal Student Aid (FAFSA) must be filed each year and requires information from a previous year’s tax return. Fortunately, the IRS Data Retrieval Tool makes it simple to upload tax information while filing the FAFSA.

Want to master your student finances? Download the Mos app today to match with top scholarships, find side hustles, and receive personalized advice from an expert financial aid advisor.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you